St. Francis, Wisconsin (WI 53235) profile: population, maps, real estate, averages, homes, statistics, relocation, travel, jobs, hospitals, schools, crime, moving, houses, news, sex offenders (original) (raw)

Submit your own pictures of this city and show them to the world

OSM Map

General Map

Google Map

MSN Map

OSM Map

General Map

Google Map

MSN Map

OSM Map

General Map

Google Map

MSN Map

OSM Map

General Map

Google Map

MSN Map

Please wait while loading the map...

Current weather forecast for St. Francis, WI

Population in 2022: 9,422 (100% urban, 0% rural).

Population change since 2000: +8.8%

| Median resident age: | 53.7 years |

|---|---|

| Wisconsin median age: | 40.4 years |

Zip codes: 53235.

Estimated median household income in 2022: 50,785(∗∗itwas∗∗50,785 (it was 50,785(∗∗itwas∗∗36,721 in 2000)

| St. Francis: | $50,785 |

|---|---|

| WI: | $70,996 |

Estimated per capita income in 2022: 39,480(∗∗itwas∗∗39,480 (it was 39,480(∗∗itwas∗∗21,837 in 2000)

St. Francis city income, earnings, and wages data

Estimated median house or condo value in 2022: 212,779(∗∗itwas∗∗212,779 (it was 212,779(∗∗itwas∗∗95,500 in 2000)

| St. Francis: | $212,779 |

|---|---|

| WI: | $252,800 |

Mean prices in 2022: all housing units: 216,862;∗∗detachedhouses:∗∗216,862; detached houses: 216,862;∗∗detachedhouses:∗∗214,049; townhouses or other attached units: 381,413;∗∗in2−unitstructures:∗∗381,413; in 2-unit structures: 381,413;∗∗in2−unitstructures:∗∗151,396; in 3-to-4-unit structures: 231,224;∗∗in5−or−more−unitstructures:∗∗231,224; in 5-or-more-unit structures: 231,224;∗∗in5−or−more−unitstructures:∗∗277,371

Median gross rent in 2022: $882.

March 2022 cost of living index in St. Francis: 97.8 (near average, U.S. average is 100)

St. Francis, WI residents, houses, and apartments details

Percentage of residents living in poverty in 2022: 16.5%

(15.8% for White Non-Hispanic residents, 52.8% for Black residents, 1.9% for Hispanic or Latino residents, 1.3% for other race residents)

Detailed information about poverty and poor residents in St. Francis, WI

Business Search - 14 Million verified businesses

- 6,99976.5%White alone

- 1,16212.7%Hispanic

- 6497.1%Black alone

- 1451.6%Asian alone

- 390.4%American Indian alone

- 320.3%Other race alone

- 260.3%Two or more races

Races in St. Francis detailed stats: ancestries, foreign born residents, place of birth

According to our research of Wisconsin and other state lists, there were 11 registered sex offenders living in St. Francis, Wisconsin as of November 17, 2024.

The ratio of all residents to sex offenders in St. Francis is 862 to 1.

The ratio of registered sex offenders to all residents in this city is lower than the state average.

Crime rates in St. Francis by year

| Type | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Murders(per 100,000) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) |

| Rapes(per 100,000) | 1(10.1) | 1(10.7) | 2(21.3) | 2(21.2) | 1(10.4) | 1(10.4) | 2(20.9) | 4(41.8) | 1(10.5) | 1(10.6) | 3(31.5) | 3(30.8) | 2(20.3) | 3(30.7) |

| Robberies(per 100,000) | 3(30.4) | 4(42.7) | 6(63.8) | 5(53.0) | 2(20.8) | 2(20.9) | 8(83.4) | 6(62.6) | 3(31.6) | 3(31.7) | 4(42.0) | 1(10.3) | 1(10.2) | 1(10.2) |

| Assaults(per 100,000) | 10(101.4) | 4(42.7) | 8(85.1) | 8(84.8) | 7(72.9) | 7(73.0) | 6(62.6) | 3(31.3) | 5(52.7) | 10(105.7) | 7(73.5) | 4(41.1) | 4(40.6) | 16(164.0) |

| Burglaries(per 100,000) | 33(334.6) | 32(341.7) | 34(361.5) | 21(222.6) | 24(250.1) | 24(250.3) | 21(219.0) | 25(261.0) | 31(326.8) | 15(158.6) | 26(272.9) | 40(411.0) | 9(91.4) | 2(20.5) |

| Thefts(per 100,000) | 227(2,302) | 240(2,563) | 262(2,785) | 200(2,120) | 147(1,532) | 175(1,825) | 151(1,575) | 148(1,545) | 129(1,360) | 94(993.8) | 83(871.3) | 86(883.6) | 109(1,107) | 79(809.6) |

| Auto thefts(per 100,000) | 11(111.5) | 12(128.1) | 7(74.4) | 3(31.8) | 4(41.7) | 12(125.1) | 14(146.0) | 13(135.7) | 6(63.2) | 6(63.4) | 9(94.5) | 11(113.0) | 23(233.6) | 16(164.0) |

| Arson(per 100,000) | 3(30.4) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 1(10.4) | 1(10.4) | 2(21.1) | 0(0.0) | 0(0.0) | 0(0.0) | 0(0.0) | 1(10.2) |

| City-Data.com crime index | 161.9 | 166.6 | 195.8 | 152.7 | 111.3 | 129.7 | 144.3 | 149.4 | 110.8 | 95.0 | 114.0 | 109.1 | 96.8 | 107.4 |

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Click on a table row to update graph

Full-time law enforcement employees in 2021, including police officers: 22 (21 officers - 20 male; 1 female).

| Officers per 1,000 residents here: | 2.13 |

|---|---|

| Wisconsin average: | 2.07 |

Latest news from St. Francis, WI collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: German (21.2%), Polish (15.1%), American (5.9%), Irish (5.4%), Palestinian (3.0%), French (2.4%).

Current Local Time: CST time zone

Incorporated in 1951

Elevation: 682 feet

Land area: 2.53 square miles.

Population density: 3,722 people per square mile (average).

456 residents are foreign born (2.2% Asia, 1.3% Europe, 0.8% Latin America).

| This city: | 5.0% |

|---|---|

| Wisconsin: | 5.0% |

Median real estate property taxes paid for housing units with mortgages in 2022: $4,182 (2.0%)

Median real estate property taxes paid for housing units with no mortgage in 2022: $3,975 (1.9%)

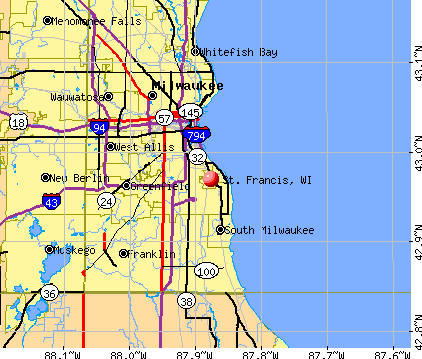

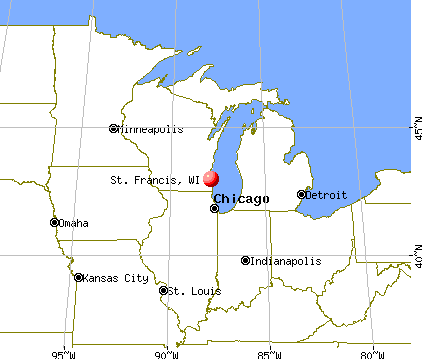

Nearest city with pop. 50,000+: Milwaukee, WI (7.0 miles , pop. 596,974).

Nearest city with pop. 1,000,000+: Chicago, IL (78.7 miles , pop. 2,896,016).

Nearest cities:

Latitude: 42.97 N**, Longitude:** 87.88 W

Daytime population change due to commuting: -1,497 (-16.4%)

Workers who live and work in this city: 959 (21.0%)

Property values in St. Francis, WI

St. Francis, Wisconsin accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2021: 2 buildings , average cost: $445,000

- 2020: 2 buildings , average cost: $460,400

- 2019: 2 buildings , average cost: $240,400

- 2018: 3 buildings , average cost: $425,200

- 2017: 1 building , cost: $125,000

- 2016: 4 buildings , average cost: $327,000

- 2015: 1 building , cost: $60,000

- 2014: 7 buildings , average cost: $228,500

- 2013: 5 buildings , average cost: $269,000

- 2012: 1 building , cost: $340,000

- 2009: 3 buildings , average cost: $272,100

- 2008: 3 buildings , average cost: $248,300

- 2006: 5 buildings , average cost: $86,000

- 2005: 31 buildings , average cost: $140,000

- 2004: 27 buildings , average cost: $169,700

- 2003: 48 buildings , average cost: $119,100

- 2002: 6 buildings , average cost: $236,300

- 1999: 1 building , cost: $77,000

- 1998: 2 buildings , average cost: $147,500

- 1997: 2 buildings , average cost: $68,500

Unemployment in December 2023:

Most common industries in St. Francis, WI (%)

- Health care (9.8%)

- Finance & insurance (7.2%)

- Construction (6.0%)

- Accommodation & food services (5.2%)

- Metal & metal products (4.8%)

- Educational services (4.6%)

- Professional, scientific, technical services (4.5%)

Most common occupations in St. Francis, WI (%)

- Other office and administrative support workers, including supervisors (6.0%)

- Other production occupations, including supervisors (5.4%)

- Metal workers and plastic workers (4.7%)

- Electrical equipment mechanics and other installation, maintenance, and repair workers, including supervisors (4.1%)

- Driver/sales workers and truck drivers (4.0%)

- Other sales and related occupations, including supervisors (3.7%)

- Secretaries and administrative assistants (3.3%)

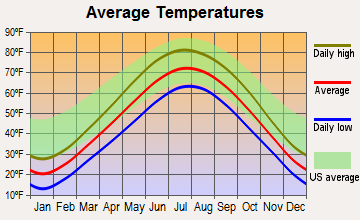

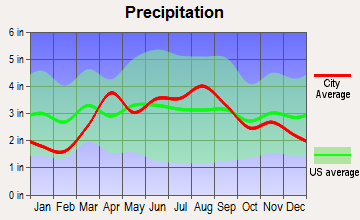

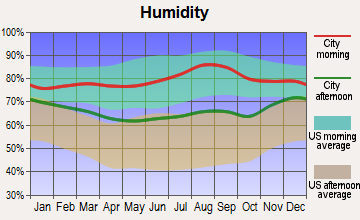

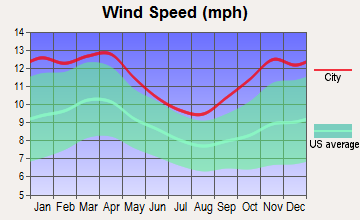

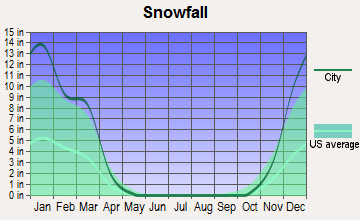

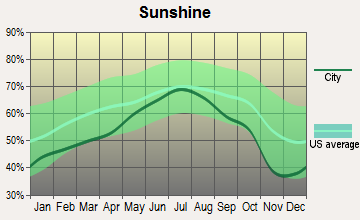

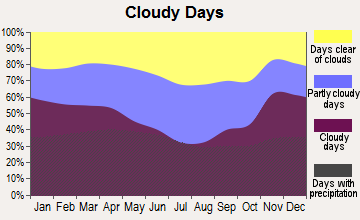

Average climate in St. Francis, Wisconsin

Based on data reported by over 4,000 weather stations

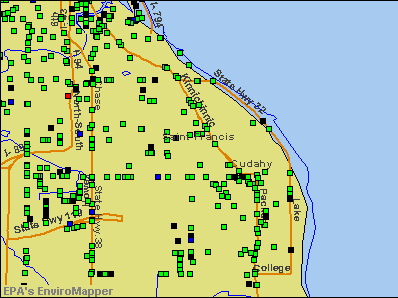

Air pollution and air quality trends (lower is better)

AQI CO NO2 SO2 Ozone PM10 PM2.5 Pb

Air Quality Index (AQI) level in 2022 was 59.0**. This is better than average.**

Tornado activity:

St. Francis-area historical tornado activity is near Wisconsin state average. It is 12% greater than the overall U.S. average.

On 4/27/1984**, a** category F4 (max. wind speeds 207-260 mph) tornado 18.0 miles away from the St. Francis city center killed one person and injured 14 people and caused between 500,000∗∗and∗∗500,000 and 500,000∗∗and∗∗5,000,000 in damages.

On 8/22/1964**, a** category F4 tornado 28.5 miles away from the city center injured 30 people and caused between 500,000∗∗and∗∗500,000 and 500,000∗∗and∗∗5,000,000 in damages.

Earthquake activity:

St. Francis-area historical earthquake activity is significantly above Wisconsin state average. It is 10% greater than the overall U.S. average.

On 4/18/2008 at 09:36:59**, a magnitude** 5.4 (5.1 MB**,** 4.8 MS**,** 5.4 MW**,** 5.2 MW**, Class:** Moderate**, Intensity:** VI - VII) earthquake occurred 312.5 miles away from St. Francis center

On 6/10/1987 at 23:48:54**, a magnitude** 5.1 (4.9 MB**,** 4.4 MS**,** 4.6 MS**,** 5.1 LG) earthquake occurred 286.9 miles away from St. Francis center

On 6/28/2004 at 06:10:52**, a magnitude** 4.2 (4.2 MW**, Depth:** 6.2 mi**, Class:** Light**, Intensity:** IV - V) earthquake occurred 116.8 miles away from St. Francis center

On 4/18/2008 at 09:36:59**, a magnitude** 5.2 (5.2 MW**, Depth:** 8.9 mi) earthquake occurred 312.5 miles away from the city center

On 5/2/2015 at 16:23:07**, a magnitude** 4.2 (4.2 MW**, Depth:** 2.8 mi) earthquake occurred 134.6 miles away from the city center

On 2/10/2010 at 09:59:35**, a magnitude** 3.8 (3.8 MW**, Depth:** 6.2 mi**, Class:** Light**, Intensity:** II - III) earthquake occurred 76.1 miles away from St. Francis center

Magnitude types: regional Lg-wave magnitude (LG), body-wave magnitude (MB), surface-wave magnitude (MS), moment magnitude (MW)

Natural disasters:

The number of natural disasters in Milwaukee County (19) is greater than the US average (15).

Major Disasters (Presidential) Declared: 15

Emergencies Declared: 4

Causes of natural disasters: Floods: 12**, Storms:** 12**, Tornadoes:** 4**, Winter Storms:** 3**, Snowstorms:** 2**, Blizzard:** 1**, Hurricane:** 1**, Snow:** 1**, Wind:** 1**, Other:** 1 (Note: some incidents may be assigned to more than one category).

Hospitals and medical centers near St. Francis:

- GOLDEN LIVINGCENTER-SOUTH SHORE (Nursing Home, about 1 miles away; SAINT FRANCIS, WI)

- MIDWEST DIALYSIS - LAKESHORE (Dialysis Facility, about 1 miles away; SAINT FRANCIS, WI)

- TRINITY HOME CARE (Home Health Center, about 3 miles away; CUDAHY, WI)

- ST LUKES MEDICAL CTR INC (Hospital, about 3 miles away; CUDAHY, WI)

- DEPAUL HOSPITAL INC (Hospital, about 3 miles away; MILWAUKEE, WI)

- N O S HEALTHCARE INC (Home Health Center, about 3 miles away; SOUTH MILWAUKEE, WI)

- MIDWEST DIALYSIS - SOUTH (Dialysis Facility, about 4 miles away; MILWAUKEE, WI)

Amtrak stations near St. Francis:

- 5 miles: MILWAUKEE (433 W. ST. PAUL AVE.) . Services: ticket office, fully wheelchair accessible, enclosed waiting area, public restrooms, public payphones, full-service food facilities, paid short-term parking, paid long-term parking, call for car rental service, taxi stand, public transit connection.

- 19 miles: STURTEVANT (2904 WISCONSIN ST.) . Services: enclosed waiting area, public restrooms, public payphones, free short-term parking, free long-term parking, call for taxi service, public transit connection.

Colleges/universities with over 2000 students nearest to St. Francis:

- Marquette University (about 6 miles; Milwaukee, WI; Full-time enrollment: 9,844)

- Milwaukee School of Engineering (about 6 miles; Milwaukee, WI; FT enrollment: 2,386)

- Milwaukee Area Technical College (about 6 miles; Milwaukee, WI; FT enrollment: 13,156)

- University of Wisconsin-Milwaukee (about 8 miles; Milwaukee, WI; FT enrollment: 24,196)

- Cardinal Stritch University (about 12 miles; Milwaukee, WI; FT enrollment: 3,595)

- Carroll University (about 18 miles; Waukesha, WI; FT enrollment: 3,313)

- Concordia University-Wisconsin (about 20 miles; Mequon, WI; FT enrollment: 5,253)

Public high school in St. Francis:

- SAINT FRANCIS HIGH (Students: 593, Location: 4225 S LAKE DR, Grades: 9-12)

See full list of schools located in St. Francis

Library in St. Francis:

- ST. FRANCIS PUBLIC LIBRARY (Operating income: $549,974; Location: 4230 S. NICHOLSON AVE.; 52,892 books; 11,942 e-books; 7,077 audio materials; 6,714 video materials; 9 local licensed databases; 28 state licensed databases; 124 print serial subscriptions)

User-submitted facts and corrections:

- You can add an Amtrak station at the Airport. Thank You

Points of interest:

Click to draw/clear city borders

Notable locations in St. Francis: Lakeside Power Station (A), Saint Francis Fire Department (B), Salsmann Library (C), Saint Francis Municipal Building (D), Heiss Residential Hall (E). Display/hide their locations on the map

Shopping Centers: Whitnall Square Shopping Center (1), Layton Mart Shopping Center (2). Display/hide their locations on the map

Churches in St. Francis include: Sacred Heart Roman Catholic Church (A), Sacred Heart of Jesus Convent (B). Display/hide their locations on the map

Parks in St. Francis include: Saint Francis Memorial Park (1), Greene Park (2). Display/hide their locations on the map

Birthplace of: Leo Joseph Brust - Catholic bishop**,** Jose Valdez (American football) - Football player.

Milwaukee County has a predicted average indoor radon screening level between 2 and 4 pCi/L (pico curies per liter) - Moderate Potential

Average household size:

| This city: | 2.0 people |

|---|---|

| Wisconsin: | 2.4 people |

Percentage of family households:

| This city: | 49.2% |

|---|---|

| Whole state: | 64.4% |

Percentage of households with unmarried partners:

| This city: | 7.9% |

|---|---|

| Whole state: | 7.3% |

Likely homosexual households (counted as self-reported same-sex unmarried-partner households)

- Lesbian couples: 0.4% of all households

- Gay men: 0.5% of all households

People in group quarters in St. Francis in 2010:

- 140 people in nursing facilities/skilled-nursing facilities

- 109 people in other noninstitutional facilities

- 30 people in college/university student housing

- 23 people in group homes intended for adults

People in group quarters in St. Francis in 2000:

- 81 people in religious group quarters

- 35 people in nursing homes

- 9 people in other noninstitutional group quarters

- 7 people in homes for the mentally retarded

Banks with branches in St. Francis (2011 data):

- Tri City National Bank: Whitnall Convenience Center Branch at 4968 South Whitnall Avenue**, branch established on** 1995/11/20**. Info updated** 2009/10/26: Bank assets: 1,214.5mil∗∗,Deposits:∗∗1,214.5 mil**, Deposits:** 1,214.5mil∗∗,Deposits:∗∗1,073.7 mil**, headquarters in** Oak Creek, WI**, positive income**, Commercial Lending Specialization**,** 44 total offices , Holding Company: Tri City Bankshares Corporation

For population 15 years and over in St. Francis:

- Never married: 34.5%

- Now married: 38.1%

- Separated: 2.3%

- Widowed: 9.8%

- Divorced: 15.2%

For population 25 years and over in St. Francis:

- High school or higher: 93.7%

- Bachelor's degree or higher: 27.2%

- Graduate or professional degree: 7.2%

- Unemployed: 4.7%

- Mean travel time to work (commute): 18.2 minutes

Education Gini index (Inequality in education)

| Here: | 9.0 |

|---|---|

| Wisconsin average: | 10.4 |

Graphs represent county-level data. Detailed 2008 Election Results

Political contributions by individuals in St. Francis, WI

Religion statistics for St. Francis, WI (based on Milwaukee County data)

| Religion | Adherents | Congregations |

|---|---|---|

| Catholic | 199,153 | 83 |

| Evangelical Protestant | 116,298 | 346 |

| Mainline Protestant | 51,652 | 148 |

| Black Protestant | 38,583 | 96 |

| Other | 24,760 | 62 |

| Orthodox | 9,080 | 9 |

| None | 508,209 | - |

Source: Clifford Grammich, Kirk Hadaway, Richard Houseal, Dale E.Jones, Alexei Krindatch, Richie Stanley and Richard H.Taylor. 2012. 2010 U.S.Religion Census: Religious Congregations & Membership Study. Association of Statisticians of American Religious Bodies. Jones, Dale E., et al. 2002. Congregations and Membership in the United States 2000. Nashville, TN: Glenmary Research Center. Graphs represent county-level data

Food Environment Statistics:

**Number of grocery stores: 203

| Here: | 2.13 / 10,000 pop. |

|---|---|

| Wisconsin: | 1.86 / 10,000 pop. |

**Number of supercenters and club stores: 3

| Here: | 0.03 / 10,000 pop. |

|---|---|

| Wisconsin: | 0.11 / 10,000 pop. |

**Number of convenience stores (no gas): 67

| Milwaukee County: | 0.70 / 10,000 pop. |

|---|---|

| Wisconsin: | 0.38 / 10,000 pop. |

**Number of convenience stores (with gas): 262

| Milwaukee County: | 2.75 / 10,000 pop. |

|---|---|

| Wisconsin: | 4.12 / 10,000 pop. |

**Number of full-service restaurants: 605

| This county: | 6.36 / 10,000 pop. |

|---|---|

| Wisconsin: | 8.64 / 10,000 pop. |

**Adult obesity rate:

| Milwaukee County: | 29.6% |

|---|---|

| State: | 27.5% |

**Low-income preschool obesity rate:

| This county: | 13.7% |

|---|---|

| Wisconsin: | 13.0% |

Health and Nutrition:

**Healthy diet rate:

| St. Francis: | 50.4% |

|---|---|

| Wisconsin: | 49.5% |

**Average overall health of teeth and gums:

| St. Francis: | 47.5% |

|---|---|

| State: | 46.6% |

**Average BMI:

| St. Francis: | 28.6 |

|---|---|

| State: | 28.7 |

**People feeling badly about themselves:

| St. Francis: | 21.5% |

|---|---|

| Wisconsin: | 21.4% |

**People not drinking alcohol at all:

| St. Francis: | 10.7% |

|---|---|

| Wisconsin: | 10.2% |

**Average hours sleeping at night:

| St. Francis: | 6.9 |

|---|---|

| Wisconsin: | 6.8 |

**Overweight people:

| St. Francis: | 33.8% |

|---|---|

| State: | 34.0% |

**General health condition:

| Here: | 56.8% |

|---|---|

| Wisconsin: | 56.3% |

**Average condition of hearing:

| St. Francis: | 77.8% |

|---|---|

| State: | 78.5% |

More about Health and Nutrition of St. Francis, WI Residents

St. Francis government finances - Expenditure in 2017 (per resident):

- Construction - Regular Highways: 388,000(388,000 (388,000(41.18)

General - Other: 199,000(199,000 (199,000(21.12)

General Public Buildings: 93,000(93,000 (93,000(9.87)

Parks and Recreation: 42,000(42,000 (42,000(4.46)

Libraries: 4,000(4,000 (4,000(0.42)

Natural Resources - Other: 4,000(4,000 (4,000(0.42)

Sewerage: 1,000(1,000 (1,000(0.11) - Current Operations - Police Protection: 3,173,000(3,173,000 (3,173,000(336.77)

Local Fire Protection: 1,952,000(1,952,000 (1,952,000(207.17)

Regular Highways: 1,395,000(1,395,000 (1,395,000(148.06)

Sewerage: 781,000(781,000 (781,000(82.89)

Central Staff Services: 576,000(576,000 (576,000(61.13)

Libraries: 565,000(565,000 (565,000(59.97)

Solid Waste Management: 478,000(478,000 (478,000(50.73)

General - Other: 258,000(258,000 (258,000(27.38)

Judicial and Legal Services: 190,000(190,000 (190,000(20.17)

Health - Other: 190,000(190,000 (190,000(20.17)

Protective Inspection and Regulation - Other: 112,000(112,000 (112,000(11.89)

General Public Buildings: 102,000(102,000 (102,000(10.83)

Financial Administration: 78,000(78,000 (78,000(8.28)

Natural Resources - Other: 54,000(54,000 (54,000(5.73)

Parks and Recreation: 25,000(25,000 (25,000(2.65) - General - Interest on Debt: 640,000(640,000 (640,000(67.93)

- Other Capital Outlay - Regular Highways: 156,000(156,000 (156,000(16.56)

Police Protection: 109,000(109,000 (109,000(11.57)

Local Fire Protection: 67,000(67,000 (67,000(7.11)

Central Staff Services: 18,000(18,000 (18,000(1.91) - Total Salaries and Wages: 3,546,000(3,546,000 (3,546,000(376.35)

St. Francis government finances - Revenue in 2017 (per resident):

- Charges - Sewerage: 821,000(821,000 (821,000(87.14)

Regular Highways: 315,000(315,000 (315,000(33.43)

Other: 278,000(278,000 (278,000(29.51)

Solid Waste Management: 166,000(166,000 (166,000(17.62)

Parks and Recreation: 5,000(5,000 (5,000(0.53) - Local Intergovernmental - Other: 63,000(63,000 (63,000(6.69)

- Miscellaneous - Special Assessments: 479,000(479,000 (479,000(50.84)

Fines and Forfeits: 258,000(258,000 (258,000(27.38)

Interest Earnings: 114,000(114,000 (114,000(12.10)

General Revenue - Other: 64,000(64,000 (64,000(6.79)

Rents: 29,000(29,000 (29,000(3.08)

Donations From Private Sources: 28,000(28,000 (28,000(2.97)

Sale of Property: 13,000(13,000 (13,000(1.38) - State Intergovernmental - General Local Government Support: 2,206,000(2,206,000 (2,206,000(234.13)

Highways: 755,000(755,000 (755,000(80.13)

Education: 222,000(222,000 (222,000(23.56)

Transit Utilities: 172,000(172,000 (172,000(18.26)

Other: 170,000(170,000 (170,000(18.04) - Tax - Property: 5,541,000(5,541,000 (5,541,000(588.09)

Occupation and Business License - Other: 156,000(156,000 (156,000(16.56)

Other License: 135,000(135,000 (135,000(14.33)

Other: 20,000(20,000 (20,000(2.12)

St. Francis government finances - Debt in 2017 (per resident):

- Long Term Debt - Outstanding Unspecified Public Purpose: 14,436,000(14,436,000 (14,436,000(1532.16)

Beginning Outstanding - Unspecified Public Purpose: 11,905,000(11,905,000 (11,905,000(1263.53)

Issue, Unspecified Public Purpose: 3,120,000(3,120,000 (3,120,000(331.14)

Retired Unspecified Public Purpose: 589,000(589,000 (589,000(62.51)

St. Francis government finances - Cash and Securities in 2017 (per resident):

- Bond Funds - Cash and Securities: 4,020,000(4,020,000 (4,020,000(426.66)

- Other Funds - Cash and Securities: 13,242,000(13,242,000 (13,242,000(1405.43)

- Sinking Funds - Cash and Securities: 619,000(619,000 (619,000(65.70)

4.52% of this county's 2021 resident taxpayers lived in other counties in 2020 ($59,601 average adjusted gross income)

| Here: | 4.52% |

|---|---|

| Wisconsin average: | 6.07% |

0.01% of residents moved from foreign countries ($97 average AGI)

Milwaukee County: 0.01% Wisconsin average: 0.00%

Top counties from which taxpayers relocated into this county between 2020 and 2021:

6.14% of this county's 2020 resident taxpayers moved to other counties in 2021 ($69,652 average adjusted gross income)

| Here: | 6.14% |

|---|---|

| Wisconsin average: | 6.10% |

0.01% of residents moved to foreign countries ($47 average AGI)

Milwaukee County: 0.01% Wisconsin average: 0.00%

Top counties to which taxpayers relocated from this county between 2020 and 2021:

Businesses in St. Francis, WI

- Advance Auto Parts: 1

- Blockbuster: 1

- Cricket Wireless: 1

Strongest AM radio stations in St. Francis:

- WTMJ (620 AM; 50 kW; MILWAUKEE, WI; Owner: JOURNAL BROADCAST CORPORATION)

- WISN (1130 AM; 50 kW; MILWAUKEE, WI; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WMCS (1290 AM; 5 kW; GREENFIELD, WI; Owner: MILWAUKEE RADIO ALLIANCE, LLC)

- WOKY (920 AM; 5 kW; MILWAUKEE, WI; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WEMP (1250 AM; 5 kW; MILWAUKEE, WI; Owner: ENTERCOM MILWAUKEE LICENSE, LLC)

- WAUK (1510 AM; daytime; 10 kW; WAUKESHA, WI; Owner: WALT-WEST WISCONSIN, INC.)

- WKSH (1640 AM; 10 kW; SUSSEX, WI; Owner: ABC, INC.)

- WGN (720 AM; 50 kW; CHICAGO, IL; Owner: WGN CONTINENTAL BROADCASTING CO.)

- WSCR (670 AM; 50 kW; CHICAGO, IL; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WJYI (1340 AM; 1 kW; MILWAUKEE, WI; Owner: LAKEFRONT COMMUNICATIONS, LLC)

- WBBM (780 AM; 50 kW; CHICAGO, IL; Owner: INFINITY BROADCASTING OPERATIONS, INC.)

- WMVP (1000 AM; 50 kW; CHICAGO, IL; Owner: ABC, INC.)

- WLS (890 AM; 50 kW; CHICAGO, IL; Owner: WLS, INC.)

Strongest FM radio stations in St. Francis:

- WJZI (93.3 FM; MILWAUKEE, WI; Owner: MILWAUKEE RADIO ALLIANCE, LLC)

- WKTI-FM (94.5 FM; MILWAUKEE, WI; Owner: JOURNAL BROADCAST CORPORATION)

- WMIL-FM (106.1 FM; WAUKESHA, WI; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WUWM (89.7 FM; MILWAUKEE, WI; Owner: BOARD OF REGENTS, UNIVERSITY OF WISCONSIN SYSTEM)

- WMWK (88.1 FM; MILWAUKEE, WI; Owner: FAMILY STATIONS, INC.)

- WXSS (103.7 FM; WAUWATOSA, WI; Owner: ENTERCOM MILWAUKEE LICENSE, LLC)

- WKLH (96.5 FM; MILWAUKEE, WI; Owner: LAKEFRONT COMMUNICATIONS, LLC)

- WLTQ (97.3 FM; MILWAUKEE, WI; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- WLUM-FM (102.1 FM; MILWAUKEE, WI; Owner: MILWAUKEE RADIO ALLIANCE, LLC)

- WRIT-FM (95.7 FM; MILWAUKEE, WI; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WLZR (102.9 FM; MILWAUKEE, WI; Owner: LAKEFRONT COMMUNICATIONS, LLC)

- WJMR-FM (98.3 FM; MENOMONEE FALLS, WI; Owner: LAKEFRONT COMMUNICATIONS, LLC)

- WVCY-FM (107.7 FM; MILWAUKEE, WI; Owner: VCY AMERICA, INC.)

- WMYX-FM (99.1 FM; MILWAUKEE, WI; Owner: ENTERCOM MILWAUKEE LICENSE, LLC)

- WFZH (105.3 FM; MUKWONAGO, WI; Owner: CARON BROADCASTING, INC.)

- WKKV-FM (100.7 FM; RACINE, WI; Owner: CLEAR CHANNEL BROADCASTING LICENSES, INC.)

- WYMS (88.9 FM; MILWAUKEE, WI; Owner: MILWAUKEE BOARD OF SCHOOL DIRECTORS)

- WMSE (91.7 FM; MILWAUKEE, WI; Owner: MILWAUKEE SCHOOL OF ENGINEERING)

- WEXT (104.7 FM; STURTEVANT, WI; Owner: NM LICENSING, LLC)

- WEZY (92.1 FM; RACINE, WI; Owner: RACINE BROADCASTING, L.L.C.)

TV broadcast stations around St. Francis:

- WMKE-CA (Channel 7; MILWAUKEE, WI; Owner: KM LPTV OF MILWAUKEE, L.L.C.)

- WCGV-TV (Channel 24; MILWAUKEE, WI; Owner: WCGV LICENSEE, LLC)

- WPXE (Channel 55; KENOSHA, WI; Owner: PAXSON MILWAUKEE LICENSE, INC.)

- WMVS (Channel 10; MILWAUKEE, WI; Owner: MILWAUKEE AREA TECHNICAL COLLEGE DISTRICT BOARD)

- WMVT (Channel 36; MILWAUKEE, WI; Owner: MILWAUKEE AREA TECHNICAL COLLEGE DISTRICT BOARD)

- WJJA (Channel 49; RACINE, WI; Owner: TV-49, INC.)

- WTMJ-TV (Channel 4; MILWAUKEE, WI; Owner: JOURNAL BROADCAST CORPORATION)

- WVTV (Channel 18; MILWAUKEE, WI; Owner: WVTV LICENSEE, INC.)

- WVCY-TV (Channel 30; MILWAUKEE, WI; Owner: VCY AMERICA, INC.)

- WISN-TV (Channel 12; MILWAUKEE, WI; Owner: WISN HEARST-ARGYLE TV, INC. (CA CORP.))

- WDJT-TV (Channel 58; MILWAUKEE, WI; Owner: WDJT-TV LIMITED PARTNERSHIP)

- WMLW-CA (Channel 46; MILWAUKEE, WI; Owner: CHANNEL 41 AND 63 LIMITED PARTNERSHIP)

- W63CU (Channel 63; MILWAUKEE, WI; Owner: CHANNEL 41 AND 63 LIMITED PARTNERSHIP)

- WITI (Channel 6; MILWAUKEE, WI; Owner: WITI LICENSE,INC.)

- WTAS-LP (Channel 43; WAUKESHA, WI; Owner: WAUKESHA TOWER ASSOCIATES)

- W64CQ (Channel 64; ARLINGTON HEIGHTS, IL; Owner: TRINITY BROADCASTING NETWORK)

- WWRS-TV (Channel 52; MAYVILLE, WI; Owner: NATIONAL MINORITY T.V., INC.)

St. Francis fatal accident statistics for 1975 - 2021

St. Francis fatal accident list:

May 2, 2018 06:20 PM, S Pennsylvania Ave, Lat: 42.975081, Lon: -87.879706, Vehicles: 2, Persons: 1, Fatalities: 1, Drunk persons involved: 1

May 27, 2017 05:00 PM, Pensylvania Ave S, Whitnall Ave S, Lat: 42.960169, Lon: -87.879786, Vehicles: 2, Persons: 4, Fatalities: 1

Jun 29, 2009 01:48 AM, Sr-32, Lat: 42.968153, Lon: -87.851872, Vehicles: 1, Persons: 1, Fatalities: 1, Drunk persons involved: 1

FCC Registered Antenna Towers:

28 (See the full list of FCC Registered Antenna Towers in St. Francis)

FCC Registered Broadcast Land Mobile Towers:

3

- 4235 S. Nicholson Ave (Lat: 42.967500 Lon: -87.873056), Type: Mtower, Structure height: 30.5 m, Call Sign: KXM280, Licensee ID: L00096515,

Assigned Frequencies: 155.100 MHz, Grant Date: 03/20/2023, Expiration Date: 03/17/2033, Registrant: City Of St. Francis - 1390 E. Bolivar Ave. (Lat: 42.966389 Lon: -87.892500), Call Sign: WPWV266,

Assigned Frequencies: 462.862 MHz, 462.787 MHz, 462.937 MHz, 462.437 MHz, 462.337 MHz, 462.262 MHz, Grant Date: 01/24/2003, Expiration Date: 01/24/2013, Cancellation Date: 03/30/2013, Certifier: John E Warnock, Registrant: Radio Communication Co., Inc., 12323 W. Fairview Ave., Milwaukee, WI 53226, Phone: (414) 771-6900, Fax: (414) 771-4980 - Lat: 42.967639 Lon: -87.877806, Call Sign: WPZE307,

Assigned Frequencies: 72.4400 MHz, Grant Date: 11/23/2023, Expiration Date: 12/31/2033, Certifier: Ronda Ewald, Registrant: St. Francis School District, 4225 S. Lake Dr., St. Francis, WI 53235, Phone: (414) 747-3985, Fax: (262) 248-0061, Email:

FCC Registered Microwave Towers:

4

- Kansas SS, 4130 S. Kansas Ave (Lat: 42.969583 Lon: -87.950194), Type: Nntann, Structure height: 14 m, Call Sign: WPTY406,

Assigned Frequencies: 957.150 MHz, Grant Date: 01/11/2002, Expiration Date: 01/11/2012, Cancellation Date: 03/17/2012, Certifier: Michael J Kelley, Registrant: Wisconsin Electric Power Company, 333 W. Everett St., Milwaukee, WI 53201, Phone: (414) 221-2226, Fax: (414) 221-3198, Email: - St. Francis WI 6, 4168 S. Packard Avenue (Lat: 42.968500 Lon: -87.857000), Type: Pole, Structure height: 47.2 m, Call Sign: WQIH859,

Assigned Frequencies: 11035.0 MHz, Grant Date: 02/15/2008, Expiration Date: 02/15/2018, Cancellation Date: 08/15/2009, Certifier: William Chastain, Registrant: Radio Dynamics Corporation, 774 Mays Blvd., #10-465, Silver Spring, MD 20914, Phone: (301) 493-5171, Fax: (301) 576-4553, Email: - N080, Int Of S Iowa Ave & E Morgan Ave (Lat: 42.980889 Lon: -87.883611), Type: Tower, Structure height: 18.3 m, Call Sign: WQMM766,

Assigned Frequencies: 934.912 MHz, Grant Date: 08/25/2020, Expiration Date: 09/27/2030, Certifier: Brad G Zielie, Registrant: Prokarma, 222 So 15th St., Suite 505n, Omaha, NE 68102, Phone: (402) 522-5068, Fax: (402) 346-6676, Email: - MIL41K, 4120 S. Kansas Ave. (Lat: 42.969444 Lon: -87.885750), Type: Mast, Structure height: 8 m, Overall height: 10 m, Call Sign: WRDG434, Licensee ID: L01166198,

Assigned Frequencies: 17965.0 MHz, Grant Date: 04/23/2019, Expiration Date: 04/23/2029, Certifier: Brian Corman, Registrant: Business Only Broadband, LLC, 999 Oak Creek Drive, Lombard, IL 60148, Phone: (630) 590-6006, Email:

FCC Registered Amateur Radio Licenses:

4

- Call Sign: KB9MMD, Licensee ID: L01136260, Grant Date: 04/03/2006, Expiration Date: 04/03/2016, Cancellation Date: 04/04/2018, Certifier: Edwin J Zieroth, Registrant: Edwin J Zieroth, 2502 E. Whittaker Ave., St. Francis, WI 53235

- Call Sign: N9OFB, Licensee ID: L00092980, Grant Date: 01/21/2023, Expiration Date: 03/21/2032, Certifier: Jeffrey R Sharrow, Registrant: Jeffrey R Sharrow, 2917 E Koenig Ave., St. Francis, WI 53235

- Call Sign: N9VMP, Licensee ID: L01472493, Grant Date: 03/10/2009, Expiration Date: 05/06/2019, Cancellation Date: 05/07/2021, Registrant: Timothy K Cieszki, 4314 S. Nicholson Ave. Apt. 44, St. Francis, WI 53235

- Call Sign: KD9WMA, Licensee ID: L02634258, Grant Date: 01/31/2023, Expiration Date: 01/31/2033, Certifier: James T Schlosser, Registrant: James T Schlosser, 1813 E Norwich Ave, St. Francis, WI 53235

| Home Mortgage Disclosure Act Aggregated Statistics For Year 2009_(Based on 2 full tracts)_ | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A) FHA, FSA/RHS & VAHome Purchase Loans | B) ConventionalHome Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 34 | 133,689∣38∣133,689 | 38 | 133,689∣38∣128,990 | 246 | 132,057∣10∣132,057 | 10 | 132,057∣10∣58,593 | 5 | 1,606,656∣15∣1,606,656 | 15 | 1,606,656∣15∣172,262 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 2 | 128,990∣2∣128,990 | 2 | 128,990∣2∣85,995 | 26 | 143,754∣4∣143,754 | 4 | 143,754∣4∣7,500 | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

| APPLICATIONS DENIED | 3 | 125,990∣11∣125,990 | 11 | 125,990∣11∣155,722 | 100 | 146,369∣3∣146,369 | 3 | 146,369∣3∣18,663 | 0 | 0∣7∣0 | 7 | 0∣7∣114,991 |

| APPLICATIONS WITHDRAWN | 5 | 142,576∣5∣142,576 | 5 | 142,576∣5∣117,388 | 60 | 142,154∣3∣142,154 | 3 | 142,154∣3∣93,333 | 1 | 899,820∣6∣899,820 | 6 | 899,820∣6∣102,833 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣1∣0 | 1 | 0∣1∣240,000 | 15 | 154,849∣0∣154,849 | 0 | 154,849∣0∣0 | 0 | 0∣1∣0 | 1 | 0∣1∣127,000 |

| Aggregated Statistics For Year 2008_(Based on 2 full tracts)_ | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A) FHA, FSA/RHS & VAHome Purchase Loans | B) ConventionalHome Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On ManufacturedHome Dwelling (A B C & D) | ||||||||

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 16 | 146,671∣61∣146,671 | 61 | 146,671∣61∣141,791 | 155 | 134,556∣19∣134,556 | 19 | 134,556∣19∣54,839 | 7 | 547,087∣15∣547,087 | 15 | 547,087∣15∣121,853 | 1 | $83,000 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | 0∣3∣0 | 3 | 0∣3∣139,333 | 16 | 147,611∣4∣147,611 | 4 | 147,611∣4∣59,738 | 1 | 352,000∣1∣352,000 | 1 | 352,000∣1∣106,980 | 0 | $0 |

| APPLICATIONS DENIED | 0 | 0∣9∣0 | 9 | 0∣9∣182,872 | 78 | 156,073∣17∣156,073 | 17 | 156,073∣17∣62,349 | 0 | 0∣8∣0 | 8 | 0∣8∣193,619 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 1 | 127,970∣3∣127,970 | 3 | 127,970∣3∣114,333 | 41 | 130,274∣4∣130,274 | 4 | 130,274∣4∣53,992 | 0 | 0∣3∣0 | 3 | 0∣3∣123,663 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣2∣0 | 2 | 0∣2∣130,490 | 11 | 192,088∣0∣192,088 | 0 | 192,088∣0∣0 | 0 | 0∣3∣0 | 3 | 0∣3∣182,327 | 0 | $0 |

| Aggregated Statistics For Year 2007_(Based on 2 full tracts)_ | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A) FHA, FSA/RHS & VAHome Purchase Loans | B) ConventionalHome Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 5 | 162,768∣120∣162,768 | 120 | 162,768∣120∣133,447 | 132 | 121,738∣29∣121,738 | 29 | 121,738∣29∣35,684 | 2 | 1,361,420∣13∣1,361,420 | 13 | 1,361,420∣13∣162,299 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | 0∣14∣0 | 14 | 0∣14∣123,916 | 24 | 122,321∣9∣122,321 | 9 | 122,321∣9∣37,108 | 0 | 0∣1∣0 | 1 | 0∣1∣95,000 |

| APPLICATIONS DENIED | 2 | 152,485∣13∣152,485 | 13 | 152,485∣13∣104,292 | 96 | 135,613∣14∣135,613 | 14 | 135,613∣14∣27,209 | 1 | 27,000∣5∣27,000 | 5 | 27,000∣5∣138,190 |

| APPLICATIONS WITHDRAWN | 0 | 0∣8∣0 | 8 | 0∣8∣102,855 | 34 | 132,991∣1∣132,991 | 1 | 132,991∣1∣12,000 | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣2∣0 | 2 | 0∣2∣162,965 | 11 | 142,716∣0∣142,716 | 0 | 142,716∣0∣0 | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

| Aggregated Statistics For Year 2006_(Based on 2 full tracts)_ | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A) FHA, FSA/RHS & VAHome Purchase Loans | B) ConventionalHome Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On ManufacturedHome Dwelling (A B C & D) | ||||||||

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 6 | 145,647∣220∣145,647 | 220 | 145,647∣220∣137,495 | 170 | 114,928∣32∣114,928 | 32 | 114,928∣32∣48,118 | 1 | 1,559,690∣36∣1,559,690 | 36 | 1,559,690∣36∣133,022 | 1 | $131,970 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | 0∣34∣0 | 34 | 0∣34∣175,434 | 36 | 114,851∣6∣114,851 | 6 | 114,851∣6∣26,997 | 0 | 0∣3∣0 | 3 | 0∣3∣130,990 | 0 | $0 |

| APPLICATIONS DENIED | 0 | 0∣27∣0 | 27 | 0∣27∣133,690 | 103 | 134,424∣8∣134,424 | 8 | 134,424∣8∣49,495 | 0 | 0∣2∣0 | 2 | 0∣2∣148,500 | 1 | $34,990 |

| APPLICATIONS WITHDRAWN | 1 | 109,980∣33∣109,980 | 33 | 109,980∣33∣146,906 | 57 | 116,161∣4∣116,161 | 4 | 116,161∣4∣102,242 | 0 | 0∣4∣0 | 4 | 0∣4∣186,995 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣3∣0 | 3 | 0∣3∣101,667 | 32 | 145,895∣0∣145,895 | 0 | 145,895∣0∣0 | 0 | 0∣1∣0 | 1 | 0∣1∣149,970 | 0 | $0 |

| Aggregated Statistics For Year 2005_(Based on 2 full tracts)_ | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A) FHA, FSA/RHS & VAHome Purchase Loans | B) ConventionalHome Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On ManufacturedHome Dwelling (A B C & D) | ||||||||

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 9 | 159,982∣227∣159,982 | 227 | 159,982∣227∣125,711 | 233 | 109,239∣36∣109,239 | 36 | 109,239∣36∣50,384 | 6 | 1,310,777∣41∣1,310,777 | 41 | 1,310,777∣41∣133,164 | 2 | $44,500 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | 0∣20∣0 | 20 | 0∣20∣139,242 | 35 | 99,105∣5∣99,105 | 5 | 99,105∣5∣43,600 | 0 | 0∣2∣0 | 2 | 0∣2∣214,485 | 1 | $127,000 |

| APPLICATIONS DENIED | 1 | 158,970∣43∣158,970 | 43 | 158,970∣43∣131,598 | 90 | 127,410∣8∣127,410 | 8 | 127,410∣8∣47,749 | 0 | 0∣13∣0 | 13 | 0∣13∣142,766 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 0 | 0∣40∣0 | 40 | 0∣40∣152,371 | 68 | 124,429∣9∣124,429 | 9 | 124,429∣9∣67,104 | 0 | 0∣12∣0 | 12 | 0∣12∣227,148 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣10∣0 | 10 | 0∣10∣104,785 | 40 | 126,588∣1∣126,588 | 1 | 126,588∣1∣69,990 | 0 | 0∣0∣0 | 0 | 0∣0∣0 | 0 | $0 |

| Aggregated Statistics For Year 2004_(Based on 2 full tracts)_ | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A) FHA, FSA/RHS & VAHome Purchase Loans | B) ConventionalHome Purchase Loans | C) Refinancings | D) Home Improvement Loans | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | G) Loans On ManufacturedHome Dwelling (A B C & D) | |||||||

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 20 | 126,634∣168∣126,634 | 168 | 126,634∣168∣130,420 | 213 | 102,462∣26∣102,462 | 26 | 102,462∣26∣41,224 | 16 | 130,802∣0∣130,802 | 0 | 130,802∣0∣0 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 1 | 130,970∣11∣130,970 | 11 | 130,970∣11∣109,989 | 41 | 100,476∣4∣100,476 | 4 | 100,476∣4∣71,000 | 1 | 109,980∣0∣109,980 | 0 | 109,980∣0∣0 |

| APPLICATIONS DENIED | 2 | 115,990∣20∣115,990 | 20 | 115,990∣20∣131,089 | 89 | 102,966∣14∣102,966 | 14 | 102,966∣14∣42,779 | 9 | 100,661∣2∣100,661 | 2 | 100,661∣2∣38,500 |

| APPLICATIONS WITHDRAWN | 3 | 111,983∣38∣111,983 | 38 | 111,983∣38∣174,359 | 35 | 106,899∣2∣106,899 | 2 | 106,899∣2∣49,995 | 2 | 157,000∣0∣157,000 | 0 | 157,000∣0∣0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | 145,000∣6∣145,000 | 6 | 145,000∣6∣91,995 | 36 | 112,490∣1∣112,490 | 1 | 112,490∣1∣94,980 | 1 | 170,000∣0∣170,000 | 0 | 170,000∣0∣0 |

| Aggregated Statistics For Year 2003_(Based on 2 full tracts)_ | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A) FHA, FSA/RHS & VAHome Purchase Loans | B) ConventionalHome Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 7 | 139,833∣89∣139,833 | 89 | 139,833∣89∣110,123 | 437 | 84,983∣22∣84,983 | 22 | 84,983∣22∣18,952 | 5 | 698,706∣32∣698,706 | 32 | 698,706∣32∣99,644 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | 0∣10∣0 | 10 | 0∣10∣71,298 | 36 | 89,154∣1∣89,154 | 1 | 89,154∣1∣64,990 | 0 | 0∣9∣0 | 9 | 0∣9∣80,773 |

| APPLICATIONS DENIED | 1 | 133,970∣17∣133,970 | 17 | 133,970∣17∣104,166 | 113 | 99,421∣13∣99,421 | 13 | 99,421∣13∣19,844 | 0 | 0∣10∣0 | 10 | 0∣10∣93,687 |

| APPLICATIONS WITHDRAWN | 1 | 124,980∣7∣124,980 | 7 | 124,980∣7∣93,140 | 53 | 99,552∣1∣99,552 | 1 | 99,552∣1∣6,000 | 0 | 0∣2∣0 | 2 | 0∣2∣106,990 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣1∣0 | 1 | 0∣1∣98,000 | 13 | 89,916∣0∣89,916 | 0 | 89,916∣0∣0 | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

| Aggregated Statistics For Year 2002_(Based on 2 full tracts)_ | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A) FHA, FSA/RHS & VAHome Purchase Loans | B) ConventionalHome Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 16 | 108,610∣86∣108,610 | 86 | 108,610∣86∣88,653 | 267 | 81,155∣25∣81,155 | 25 | 81,155∣25∣13,279 | 2 | 325,945∣13∣325,945 | 13 | 325,945∣13∣77,447 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | 0∣7∣0 | 7 | 0∣7∣97,271 | 28 | 81,990∣1∣81,990 | 1 | 81,990∣1∣25,000 | 0 | 0∣1∣0 | 1 | 0∣1∣109,980 |

| APPLICATIONS DENIED | 0 | 0∣11∣0 | 11 | 0∣11∣75,630 | 61 | 93,302∣16∣93,302 | 16 | 93,302∣16∣8,562 | 0 | 0∣2∣0 | 2 | 0∣2∣70,990 |

| APPLICATIONS WITHDRAWN | 0 | 0∣13∣0 | 13 | 0∣13∣91,377 | 49 | 90,952∣3∣90,952 | 3 | 90,952∣3∣43,660 | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣2∣0 | 2 | 0∣2∣65,500 | 4 | 111,482∣0∣111,482 | 0 | 111,482∣0∣0 | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

| Aggregated Statistics For Year 2001_(Based on 2 full tracts)_ | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A) FHA, FSA/RHS & VAHome Purchase Loans | B) ConventionalHome Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 21 | 107,801∣82∣107,801 | 82 | 107,801∣82∣86,807 | 249 | 78,034∣23∣78,034 | 23 | 78,034∣23∣20,432 | 2 | 533,400∣15∣533,400 | 15 | 533,400∣15∣72,991 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 2 | 96,990∣5∣96,990 | 5 | 96,990∣5∣71,792 | 28 | 79,276∣4∣79,276 | 4 | 79,276∣4∣4,500 | 0 | 0∣2∣0 | 2 | 0∣2∣88,000 |

| APPLICATIONS DENIED | 4 | 97,990∣24∣97,990 | 24 | 97,990∣24∣63,450 | 60 | 70,974∣14∣70,974 | 14 | 70,974∣14∣11,213 | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

| APPLICATIONS WITHDRAWN | 0 | 0∣5∣0 | 5 | 0∣5∣74,596 | 38 | 92,618∣3∣92,618 | 3 | 92,618∣3∣13,000 | 0 | 0∣1∣0 | 1 | 0∣1∣94,000 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣5∣0 | 5 | 0∣5∣74,586 | 8 | 98,861∣1∣98,861 | 1 | 98,861∣1∣109,980 | 0 | 0∣1∣0 | 1 | 0∣1∣42,990 |

| Aggregated Statistics For Year 2000_(Based on 2 full tracts)_ | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A) FHA, FSA/RHS & VAHome Purchase Loans | B) ConventionalHome Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 15 | 88,385∣65∣88,385 | 65 | 88,385∣65∣80,284 | 72 | 59,439∣32∣59,439 | 32 | 59,439∣32∣14,998 | 3 | 785,333∣13∣785,333 | 13 | 785,333∣13∣82,915 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | 0∣10∣0 | 10 | 0∣10∣66,692 | 21 | 59,374∣3∣59,374 | 3 | 59,374∣3∣11,330 | 0 | 0∣1∣0 | 1 | 0∣1∣58,990 |

| APPLICATIONS DENIED | 0 | 0∣14∣0 | 14 | 0∣14∣65,131 | 38 | 46,784∣18∣46,784 | 18 | 46,784∣18∣18,219 | 1 | 1,652,000∣1∣1,652,000 | 1 | 1,652,000∣1∣10,000 |

| APPLICATIONS WITHDRAWN | 1 | 85,980∣3∣85,980 | 3 | 85,980∣3∣92,660 | 11 | 48,719∣3∣48,719 | 3 | 48,719∣3∣26,997 | 0 | 0∣2∣0 | 2 | 0∣2∣51,000 |

| FILES CLOSED FOR INCOMPLETENESS | 2 | 66,490∣7∣66,490 | 7 | 66,490∣7∣64,990 | 8 | 76,866∣0∣76,866 | 0 | 76,866∣0∣0 | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

| Aggregated Statistics For Year 1999_(Based on 2 full tracts)_ | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A) FHA, FSA/RHS & VAHome Purchase Loans | B) ConventionalHome Purchase Loans | C) Refinancings | D) Home Improvement Loans | E) Loans on Dwellings For 5+ Families | F) Non-occupant Loans on < 5 Family Dwellings (A B C & D) | |||||||

| Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 21 | 90,476∣75∣90,476 | 75 | 90,476∣75∣79,067 | 117 | 65,260∣36∣65,260 | 36 | 65,260∣36∣15,151 | 6 | 330,047∣9∣330,047 | 9 | 330,047∣9∣64,703 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | 0∣4∣0 | 4 | 0∣4∣60,215 | 34 | 72,740∣7∣72,740 | 7 | 72,740∣7∣15,560 | 0 | 0∣3∣0 | 3 | 0∣3∣58,237 |

| APPLICATIONS DENIED | 1 | 89,280∣5∣89,280 | 5 | 89,280∣5∣66,208 | 51 | 69,225∣10∣69,225 | 10 | 69,225∣10∣15,061 | 0 | 0∣3∣0 | 3 | 0∣3∣49,167 |

| APPLICATIONS WITHDRAWN | 1 | 65,910∣7∣65,910 | 7 | 65,910∣7∣73,621 | 35 | 72,377∣12∣72,377 | 12 | 72,377∣12∣63,737 | 2 | 455,265∣2∣455,265 | 2 | 455,265∣2∣30,430 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣2∣0 | 2 | 0∣2∣93,810 | 7 | 97,130∣0∣97,130 | 0 | 97,130∣0∣0 | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

Detailed HMDA statistics for the following Tracts: 1851.00, 1852.00

| Private Mortgage Insurance Companies Aggregated Statistics For Year 2009_(Based on 2 full tracts)_ | ||||

|---|---|---|---|---|

| A) ConventionalHome Purchase Loans | B) Refinancings | |||

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 13 | 134,142∣11∣134,142 | 11 | 134,142∣11∣147,979 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 0 | 0∣4∣0 | 4 | 0∣4∣142,728 |

| APPLICATIONS DENIED | 7 | 155,969∣6∣155,969 | 6 | 155,969∣6∣208,652 |

| APPLICATIONS WITHDRAWN | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣2∣0 | 2 | 0∣2∣276,485 |

| Aggregated Statistics For Year 2008_(Based on 2 full tracts)_ | ||||||

|---|---|---|---|---|---|---|

| A) ConventionalHome Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 40 | 150,009∣16∣150,009 | 16 | 150,009∣16∣189,356 | 3 | $160,653 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 3 | 160,647∣5∣160,647 | 5 | 160,647∣5∣176,988 | 1 | $278,000 |

| APPLICATIONS DENIED | 4 | 153,235∣2∣153,235 | 2 | 153,235∣2∣398,000 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 1 | 102,980∣2∣102,980 | 2 | 102,980∣2∣135,490 | 1 | $102,980 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣2∣0 | 2 | 0∣2∣134,475 | 1 | $127,970 |

| Aggregated Statistics For Year 2007_(Based on 2 full tracts)_ | ||||||

|---|---|---|---|---|---|---|

| A) ConventionalHome Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 53 | 145,075∣13∣145,075 | 13 | 145,075∣13∣167,359 | 1 | $100,980 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 10 | 158,574∣7∣158,574 | 7 | 158,574∣7∣177,399 | 0 | $0 |

| APPLICATIONS DENIED | 2 | 149,970∣0∣149,970 | 0 | 149,970∣0∣0 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 2 | 109,980∣0∣109,980 | 0 | 109,980∣0∣0 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣0∣0 | 0 | 0∣0∣0 | 0 | $0 |

| Aggregated Statistics For Year 2006_(Based on 2 full tracts)_ | ||||||

|---|---|---|---|---|---|---|

| A) ConventionalHome Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 45 | 158,189∣15∣158,189 | 15 | 158,189∣15∣149,584 | 2 | $179,990 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 7 | 138,131∣0∣138,131 | 0 | 138,131∣0∣0 | 1 | $35,990 |

| APPLICATIONS DENIED | 1 | 160,000∣1∣160,000 | 1 | 160,000∣1∣208,000 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 2 | 166,000∣1∣166,000 | 1 | 166,000∣1∣152,970 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣1∣0 | 1 | 0∣1∣177,960 | 0 | $0 |

| Aggregated Statistics For Year 2005_(Based on 2 full tracts)_ | ||||||

|---|---|---|---|---|---|---|

| A) ConventionalHome Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 53 | 151,210∣16∣151,210 | 16 | 151,210∣16∣140,300 | 1 | $213,000 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 6 | 160,483∣0∣160,483 | 0 | 160,483∣0∣0 | 0 | $0 |

| APPLICATIONS DENIED | 0 | 0∣1∣0 | 1 | 0∣1∣135,000 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 1 | 125,000∣0∣125,000 | 0 | 125,000∣0∣0 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣1∣0 | 1 | 0∣1∣157,000 | 0 | $0 |

| Aggregated Statistics For Year 2004_(Based on 2 full tracts)_ | ||||||

|---|---|---|---|---|---|---|

| A) ConventionalHome Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 38 | 140,197∣13∣140,197 | 13 | 140,197∣13∣124,368 | 4 | $128,990 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 5 | 146,784∣4∣146,784 | 4 | 146,784∣4∣119,982 | 0 | $0 |

| APPLICATIONS DENIED | 0 | 0∣0∣0 | 0 | 0∣0∣0 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 1 | 170,000∣1∣170,000 | 1 | 170,000∣1∣123,980 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣1∣0 | 1 | 0∣1∣128,000 | 0 | $0 |

| Aggregated Statistics For Year 2003_(Based on 2 full tracts)_ | ||||||

|---|---|---|---|---|---|---|

| A) ConventionalHome Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 38 | 118,701∣49∣118,701 | 49 | 118,701∣49∣112,395 | 1 | $137,970 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 1 | 115,980∣7∣115,980 | 7 | 115,980∣7∣115,419 | 0 | $0 |

| APPLICATIONS DENIED | 1 | 153,000∣0∣153,000 | 0 | 153,000∣0∣0 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 1 | 119,980∣1∣119,980 | 1 | 119,980∣1∣110,000 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣0∣0 | 0 | 0∣0∣0 | 0 | $0 |

| Aggregated Statistics For Year 2002_(Based on 2 full tracts)_ | ||||

|---|---|---|---|---|

| A) ConventionalHome Purchase Loans | B) Refinancings | |||

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 39 | 110,935∣32∣110,935 | 32 | 110,935∣32∣108,894 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 2 | 124,990∣8∣124,990 | 8 | 124,990∣8∣107,986 |

| APPLICATIONS DENIED | 1 | 95,980∣0∣95,980 | 0 | 95,980∣0∣0 |

| APPLICATIONS WITHDRAWN | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | 109,000∣0∣109,000 | 0 | 109,000∣0∣0 |

| Aggregated Statistics For Year 2001_(Based on 2 full tracts)_ | ||||||

|---|---|---|---|---|---|---|

| A) ConventionalHome Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 30 | 104,254∣34∣104,254 | 34 | 104,254∣34∣103,458 | 2 | $97,000 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 3 | 90,983∣7∣90,983 | 7 | 90,983∣7∣109,987 | 0 | $0 |

| APPLICATIONS DENIED | 3 | 134,990∣0∣134,990 | 0 | 134,990∣0∣0 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 0 | 0∣1∣0 | 1 | 0∣1∣105,980 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | 75,980∣1∣75,980 | 1 | 75,980∣1∣78,000 | 0 | $0 |

| Aggregated Statistics For Year 2000_(Based on 2 full tracts)_ | ||||||

|---|---|---|---|---|---|---|

| A) ConventionalHome Purchase Loans | B) Refinancings | C) Non-occupant Loans on < 5 Family Dwellings (A & B) | ||||

| Number | Average Value | Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 31 | 97,667∣11∣97,667 | 11 | 97,667∣11∣107,263 | 2 | $87,000 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 3 | 105,333∣3∣105,333 | 3 | 105,333∣3∣85,993 | 0 | $0 |

| APPLICATIONS DENIED | 0 | 0∣0∣0 | 0 | 0∣0∣0 | 0 | $0 |

| APPLICATIONS WITHDRAWN | 0 | 0∣1∣0 | 1 | 0∣1∣79,000 | 0 | $0 |

| FILES CLOSED FOR INCOMPLETENESS | 1 | 86,000∣0∣86,000 | 0 | 86,000∣0∣0 | 0 | $0 |

| Aggregated Statistics For Year 1999_(Based on 2 full tracts)_ | ||||

|---|---|---|---|---|

| A) ConventionalHome Purchase Loans | B) Refinancings | |||

| Number | Average Value | Number | Average Value | |

| LOANS ORIGINATED | 36 | 91,131∣9∣91,131 | 9 | 91,131∣9∣84,633 |

| APPLICATIONS APPROVED, NOT ACCEPTED | 4 | 93,898∣1∣93,898 | 1 | 93,898∣1∣80,540 |

| APPLICATIONS DENIED | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

| APPLICATIONS WITHDRAWN | 1 | 144,600∣0∣144,600 | 0 | 144,600∣0∣0 |

| FILES CLOSED FOR INCOMPLETENESS | 0 | 0∣0∣0 | 0 | 0∣0∣0 |

Detailed PMIC statistics for the following Tracts: 1851.00, 1852.00

- 88.4%Utility gas

- 10.0%Electricity

- 0.6%Solar energy

- 0.5%Bottled, tank, or LP gas

- 0.5%Fuel oil, kerosene, etc.

St. Francis compared to Wisconsin state average:

- Unemployed percentage below state average.

- Hispanic race population percentage above state average.

- Renting percentage above state average.

- Length of stay since moving in significantly above state average.

- Number of rooms per house below state average.

St. Francis on our top lists:

- #70 on the list of "Top 101 cities with the largest percentage of people in religious group quarters (population 1,000+)"

- #76 on the list of "Top 101 cities with the smallest house values disparities (population 5,000+)"

- #6 on the list of "Top 101 counties with the highest average weight of females"

- #17 on the list of "Top 101 counties with the most Black Protestant congregations"

- #20 on the list of "Top 101 counties with the most Black Protestant adherents"

- #22 on the list of "Top 101 counties with the highest number of infant deaths per 1000 residents 2007-2013 (pop. 50,000+)"

- #23 on the list of "Top 101 counties with the most Catholic congregations (pop. 50,000+)"

Top Patent Applicants

| Benjamin T. Jones (6) Kevin Bastyr (3) Vivian Marie Roe (2) John Baeten (2) Scott B. Stevens (2) | Kevin J. Bastyr (2) Aleksey Y. Lubimov (1) Dustin John Mack (1) Gerois Di Marco (1) Luther E. Esselstrom (1) |

|---|

Total of 26 patent applications in 2008-2024.