What kind of MVNO are you? A guide to operational models. (original) (raw)

What are the types of MVNO models – and why is it important? MVNO types are defined by which of the operational components the MVNO manages and which one the host network operator manages – indicating the depth of the individual MVNO’s market participation.

Mobile Virtual Network Operators (MVNO), are companies that provide mobile phone services but do not own the wireless network infrastructure over which they operate. Instead, they lease network capacity at wholesale rates from a Mobile Network Operator (MNO) and sell it to their customers.

While all MVNOs follow this core business model, they aren’t all the same. The various types of MVNOs are defined by a crucial factor: the degree of control they have over their operational components. This ranges from simply reselling airtime to managing their own core network.

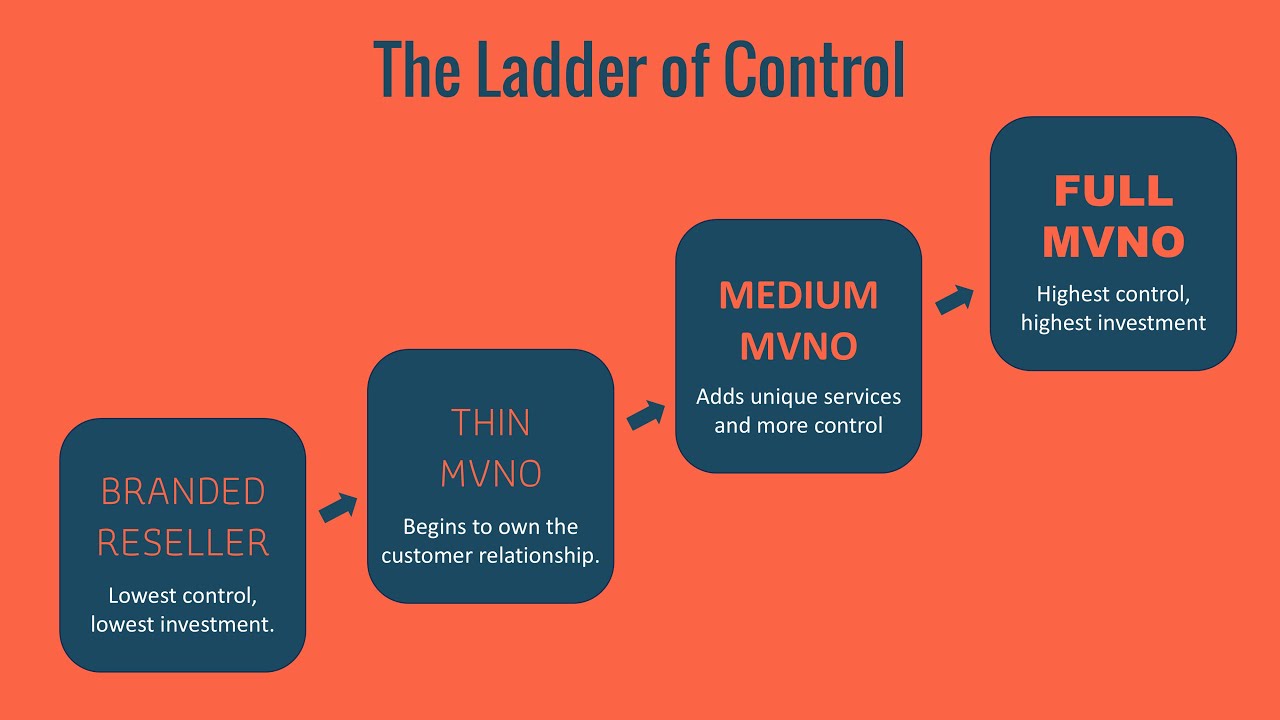

The Ladder of Control

If you ever tried to figure this out, you may have come across this wall of jargon: Airtime Reseller, Basic MVNO, Branded Reseller, Digital virtual network operators (DVNOs), Enhanced Service Provider (ESP), Extended MVNO, IMSI MVNO, Full MVNO, Hybrid MVNO, IN MVNO, Medium MVNO, On-brand MVNO, Reseller MVNO, Service Provider MVNO, Thick MVNO, Thin MVNO, etc. – it is an absolute alphabet soup.

However, we can boil all that complexity down to just four simple steps up a ladder, and use the most common terms for the type of MVNO:

You Can Read the Full Video Transcript Here

Hi, and welcome to Yozzo’s podcast dedicated to empowering mobile virtual network operators with the insights they need to succeed.

This is the place where we break down the complexities of the MVNO ecosystem.

Let’s get started.

So, if you’ve ever used one of those smaller, maybe more niche mobile carriers, you’ve actually been a customer of an MVNO.

That’s a mobile virtual network operator. Now, these are the companies that sell you mobile service, but here’s the kicker. They don’t own a single cell tower. So, how on earth do they do that?

Well, that’s what we’re going to break down.

And you know, if you’ve ever tried to figure this stuff out on your own, you get hit with this just this wall of jargon, right?

Airtime reseller, thick MVNO, thin MVNO, enhanced service provider. It’s an absolute alphabet soup. And honestly, it makes it feel impossible to figure out who’s who and what’s what.

But what if you could boil all that complexity down? What if it was really just four simple steps up a ladder?

That’s exactly what we’re going to do. We’re going to cut through all that noise and give you one simple framework to see how a company goes from just being a brand to a real honest to goodness mobile operator.

And here it is. We’re calling it the ladder of control. It’s pretty straightforward. We’re going to start at the bottom on the first rung with the basic reseller and we’re going to climb all the way to the top to the full MVNO.

And as you’ll see, every step up that ladder means more money. Yeah. But it also means way more control. All right, so let’s get started.

We’re on the very first rung of the ladder, the reseller MVNO. Think of this as the easiest, most common way for a new brand to dip its toes in the mobile world.

A reseller, well, it’s pretty much exactly what it sounds like. Their whole job is to focus on the flashy stuff, the branding, the marketing, the sales. They bring the customers in the door, but everything else, all the technical stuff, the heavy lifting, that’s all handled by the big guy, the host network, what we call the MNO or mobile network operator. So, you can see the appeal, right?

The huge advantage here is that it’s super cheap and incredibly fast to get started. You can launch a mobile brand almost overnight. But, and this is a big butt, the downside is massive. You have basically zero control. The host network owns your customer. They own the SIM card. They own all the user data, and they set the prices. You’re really just a sales front.

I mean, just look at how this breaks down. The reseller, their only job is marketing and sales. That’s it. Everything else you’d associate with a mobile company, billing, customer service, the actual SIM cards, the network itself, that’s all on the host MNO.

It’s a partnership for sure, but it’s a very, very one-sided one.

Okay, time to climb a little higher. We’re moving up to the middle rungs of the ladder. Now, this is where things get interesting. Companies start taking on more responsibility, a little more risk, but in return, they get a whole lot more say in their own future.

We’re talking about thin and medium MVNOs now. And this is where a brand starts to get really serious. You’re not just a sales agent anymore. Now you actually start to own the relationship with your customer.

You manage your own billing and you can even start creating your own unique services that make you stand out from the crowd. And the key word here is control. The MVNO now runs its own CRM. That’s the customer relationship management system. They have their own BSS or billing support system. Having that control is a gamechanger. It means they can set their own prices, create their own data bundles, and maybe most importantly issue their own branded SIM cards.

That’s a huge leap from being a simple reseller. But you know how it goes. With more control comes more responsibility and more cost. The upside is fantastic. You finally own your own customers.

You can build a real brand for a specific community. The downside though, your IT cost just shot way up, both for day-to-day operations and initial investment. And at the end of the day, you’re still relying on the big M for the actual network connection. All right, we’ve climbed all the way to the top. This is the final rung on the ladder.

We’re talking about the full MVNO, the most powerful, most independent a virtual operator can possibly be. Here’s the easiest way to picture this. A full MVNO is basically a traditional mobile network in every single way except one. They don’t own the radio towers. That’s it. They lease access to the towers, but pretty much everything else they own and operate it themselves.

And the perks of being at the top, they are huge. We’re talking complete ownership of the customer, your own blocks of phone numbers, and your own network switching gear. That last one is key.

It means you can negotiate your own roaming deals with other carriers. You get total flexibility and direct access to all that rich, valuable user data. I mean, the technical complexity here is just on another level.

A full MVNO might own and operate more than 15 separate pieces of the core network. all those complicated bits and pieces that make a mobile service actually work.

So, let’s just zoom in on two of the most important ones to really get what that control means. First up, you have the HLR, the home location register. Think of this as the master brain, the central database that keeps track of every single one of your subscribers.

When you own the HLR, you control your own SIM cards and you get to decide exactly what services each customer can access. Another critical piece of the puzzle is the GGSN. Okay, that’s a mouthful, but it’s basically the gateway to the internet for your customers.

It’s the on-ramp. And if you own that gateway, you can see, manage, and control all the data your customers are using. And in today’s world, that is an absolutely critical power to have.

Okay, so we’ve climbed the whole ladder from bottom to top. But you might be wondering, why does this whole system even exist? Why does any of this matter? Well, it turns out this isn’t just a business model.

This ladder is actually a core part of telecom policy around the globe. Yeah, this isn’t just about business plans. Governments are involved. Regulators all over from Europe to Singapore look at MVNOs and see a way to crank up the competition in the mobile market. They actually make rules to encourage new players.

Some places like Canada even give companies a push up the ladder, saying you have to own your own core network to even be considered an MVNO. So, it’s pretty obvious that getting to the top of this ladder gives you a ton of power.

But let’s be real, it’s also insanely expensive and technically complicated. That’s a huge barrier for most companies. But what if there was a kind of cheat code, a shortcut? Well, it turns out there is.

And it’s all thanks to another player in this ecosystem called an MVNE. That stands for Mobile Virtual Network Enabler. And these companies offer a partnership that, to put it simply, completely changes the game. It’s a B2B company and their whole business is basically selling a full MVNO in a box.

They build out all that complex expensive network stuff and then they rent it out to new companies. It lets an MVNO launch with all the power of being at the top of the ladder, but without having to build it all from scratch.

You could say they’re the ones who build the ladder for everyone else.

So, when you put it all together, what you have is this really clear path for new ideas in the mobile world. You’ve got this ladder of control where a company can pick exactly how much they want to invest and how much risk they want to take. And now with these enablers making that climb easier than it’s ever been, it really makes you wonder who’s going to be the next one to use this system to completely shake things up.

And that wraps up another episode of Yozzo’s podcast. If you want to dive deeper into today’s topic, you can find much more resources at yozzo.com. We’ll be back next time with more insights. Until then, keep innovating.

Understanding the MVNO Types and Models

1. Branded Reseller

A Branded Reseller is the most basic and least complex type of MVNO. They focus on sales, marketing, and customer relationships, often leveraging a well-known brand to sell the mobile services. This model requires a low initial investment and has a short time-to-market.

What they do: They acquire pre-defined services and bundles from a host MNO or another provider and resell them under their own brand.

Key characteristic: They have no technical control over the network. They rely entirely on the host provider for billing, customer support, and all network services.

Example: Walmart Family Mobile (U.S.)

2. Thin MVNO (Service Provider)

A Thin MVNO has slightly more control than a Branded Reseller, typically managing its own customer-facing operations. This model allows for more flexibility in defining services and customer plans.

What they do: They manage their own customer service and marketing, but still rely on the host MNO for the core network, radio access, billing, and rating.

Key characteristic: They own the Customer Relationship Management (CRM) but delegate most of the other technical and backend network functions to the MNO or a Mobile Virtual Network Enabler (MVNE).

Example: Google Fi (U.S.)

3. Medium MVNO (Enhanced Service Provider)

The Medium MVNO model strikes a balance between flexibility and cost. While they still do not own all the core network elements, they take control of their business operations. This allows them to create more customized offerings than a Thin MVNO.

What they do: They own their Business Support Systems (BSS) and Operational Support Systems (OSS), including billing, rating, and customer care. They still purchase core network and radio access from the host network, or via a Mobile Virtual Network Aggregator (MVNA).

Key characteristic: They have full control over their business operations, allowing them to define their own pricing, bundles, and services.

Example: FNB Connect (South Africa).

4. Full MVNO

A Full MVNO is the most sophisticated and independent type of MVNO. It operates with a high degree of control over its services and subscriber base.

What they do: A Full MVNO maintains its own core network and infrastructure, including essential elements like the Home Location Register (HLR), Packet Data Network Gateway (PWG), and Subscriber Data Management (SDM). They only lease radio access from a host MNO (or a via an MVNA).

Key characteristic: Full control over SIM cards (or eSIMs) and all network flows (voice, SMS, and data). This allows them to build custom services and have complete control over their customer experience.

Example: PosteMobile (Italy).

MVNO Operational Models

As mentioned, the MVNO type (Reseller, Thin, Medium or Full MVNO), is defined by which of the operational components, network elements, or facilities the MVNO manages, and which one the mobile network operator (or MVNE) manages.

This table summarizes the key operational differences between the four MVNO types and the host MNO.

Responsive MVNO Table

| Network Function / Component | MNO | Reseller | Thin MVNO | Medium MVNO | Full MVNO |

|---|---|---|---|---|---|

| Network Infrastructure | |||||

| Radio Network (RAN) & Spectrum(4G LTE, 5G NR) | Owns & Manages | Uses MNO’s | Uses MNO’s | Uses MNO’s | Uses MNO’s |

| Core Network(4G EPC, 5G Core) | Owns & Manages | Uses MNO’s | Uses MNO’s or MVNE’s | Partially owns(e.g., HLR, HSS) | Owns & Manages(including new 5G Core elements like UPF, AMF, SMF) |

| Subscriber Management | |||||

| SIM Card & Provisioning | Owns & Manages | Uses MNO’s | Uses MNO’s or MVNE’s | Owns & Manages(Can issue own SIMs and eSIMs) | Owns & Manages(Can issue own SIMs and eSIMs) |

| Business Operations | |||||

| Billing & Charging | Owns & Manages | Uses MNO’s | Owns & Manages | Owns & Manages | Owns & Manages |

| Customer Relationship Management (CRM) | Owns & Manages | Uses MNO’s | Owns & Manages | Owns & Manages | Owns & Manages |

| Value-Added Services (VAS) | Owns & Manages | N/A | Limited Control(Can add some) | Full Control | Full Control(Can create custom 5G services like network slicing) |

| Sales & Marketing | Owns & Manages | Owns & Manages | Owns & Manages | Owns & Manages | Owns & Manages |

| Key 5G Impact | Provides Accessto 5G Standalone (SA) and Non-Standalone (NSA) core. | Relies on MNO’s 5G services and pricing. | Can offer 5G plans but with limited ability to customize. | Gains ability to offer more tailored plans on 5G. | **Full Control over 5G services,**including the ability to offer network slicing, IoT, and low-latency applications. |

Why the MVNO Model is Important

The choice of MVNO operational model is a strategic decision that has two major implications for a the MVNO business: Licensing Requirements and Profitability.

1. Regulatory and Licensing Importance

In some countries, the national regulatory authority grant licenses to operate telecommunication services. The type of license an MVNO needs, and the application process for it, is often determined by the MVNO’s operational model.

- Higher control, more regulation: As an MVNO takes on more responsibility for core network functions (moving from a Reseller to a Full MVNO), the regulatory oversight increases. A Full MVNO, for example, must often apply for a specific telecom license that gives it its own numbering range and allows it to manage subscriber data.

- Lower barriers for entry: A Branded Reseller, on the other hand, often requires no special telecom license because all core services are managed by the host operator. This makes it the easiest and fastest model for a company to enter the mobile market, as it relies on the host’s existing regulatory compliance.

- Legal Compliance: The level of control also determines an MVNO’s legal obligations for things like lawful interception and data retention, which are crucial for security and law enforcement. A Full MVNO must have its own systems in place to handle these legal requirements, while a Reseller defers to the host MNO.

2. Margin and Business Control

The MVNO model directly impacts the profit margin on each subscriber. The more control and components an MVNO owns and manages, the better its bargaining power and potential for higher margins.

- Reseller (Branded Reseller): This model operates on the lowest profit margin because the MVNO has little to no control over the wholesale price. The host operator provides a near-complete service, leaving only a small slice of profit for the reseller’s branding and marketing efforts.

- Full MVNO: In contrast, a Full MVNO has the highest potential for profit. By owning core network elements like its billing and subscriber management systems, the MVNO effectively pays a lower, bulk rate for network access and can manage its own costs. This gives the MVNO the flexibility to create custom, value-added services and pricing plans that increase revenue per user. The host MNO’s costs are also lower since it is providing a less-managed service, which can lead to more favorable wholesale agreements.

- Negotiating Power: The components an MVNO brings to the partnership act as leverage during wholesale agreement negotiations with MNOs. A company that can show it will handle all the billing, customer support, and value-added services is a more attractive partner for an MNO and can secure a better per-unit rate for network access, directly improving its bottom line.

This breakdown provides a balanced view of the global market by operational model, acknowledging the varying data points from different research firms:

Full MVNO: This segment holds the largest market share in terms of revenue globally.

Revenue Share: Over half (50.5%) of the total MVNO market revenue in 2024.

Reasoning: Although fewer in number, Full MVNOs generate higher revenue because they have greater control over their services. They can develop their own specialized products, set their own pricing, and manage the entire customer experience, which often leads to higher average revenue per user (ARPU) and larger market capture in specific high-value segments.

Medium MVNO holds a significant, but smaller, share of the total market revenue compared to Full MVNOs. Its share varies widely by region, but it is a substantial contributor to global revenue, especially in markets where companies want control over their brand and customer experience without the cost of a Full MVNO.

Revenue Share: Reports suggest the Medium MVNO (Service Operator MVNO) holds approximately 37.5% of the total market.

Reasoning: These models are more numerous but generate less revenue per customer. Their business model is based on low-cost entry and high volume. They rely heavily on the host Mobile Network Operator (MNO) and their lack of control over the core network limits their ability to offer high-value, differentiated services.

Thin MVNO: This model is the most common in terms of the sheer number of MVNOs, but it has the smallest revenue share.

Revenue Share: Reports suggest Thin MVNOs holds approximately 12% of the total market.

Reasoning: Its low barriers to entry and minimal infrastructure requirements make it popular, but its low-margin business model means it contributes a smaller percentage to total global revenue.

Reseller, Thin, Medium, Full MVNO - Key Data Points

Revenue Dominance: Full MVNOs consistently lead in revenue share, with figures often cited at 41% to 60% of the total market in various reports.

Number of MVNOs: The vast majority of the approximately 2,000 active MVNOs globally are of the “Thin” or “Reseller” variety. These models are popular because of their lower barrier to entry.

Medium MVNO is often defined as a Service Operator MVNO in market reports, and its market share is often a significant portion of the non-Full MVNO segment.

Regional Variation: The popularity of each model can differ by region. For example, some reports show the Service Operator (Medium MVNO) model holding a 42.2% share in the fast-growing Asia-Pacific market, highlighting its importance in that region.

What are sub-brands?

Sub-brands (also: secondary brands or flanker brands) are secondary brands, owned and controlled by the network operators.

They are economically dependent on the network operators and try to differentiate offers and target groups.

However, in a competitive context, “sub-brand MVNOs” are not be viewed as relevant players because they have no independence from the network operators, and are not in any price or innovation competition with the network operators.

MVNO Types & Models - Frequently Asked Questions

What capabilities does a Medium MVNO gain over a Thin MVNO?

A Medium MVNO (Enhanced Service Provider MVNO) builds upon the capabilities of a Thin MVNO by gaining a few key advantages:

Own Numbering Range/Mobile Network Code: A Medium MVNO can obtain its own numbering range, giving it greater brand presence and potentially more direct control over how its services are identified.

Value-Added Services (VAS) Platform: This type of MVNO can add its own value-added services platform. This allows for greater differentiation from competitors by offering unique applications, data, and content services, which can be used to upsell or enhance the customer experience.

While a Medium MVNO still relies on the MNO for interconnect and IMSI and cannot negotiate its own wholesale interconnection agreements, these added capabilities provide it with more tools for market differentiation and revenue generation compared to a Thin MVNO.

What defines a Full MVNO, and what are its most significant advantages and disadvantages?

A Full MVNO represents the highest level of independence and control for a virtual operator. It is responsible for the entire operation, including customers and data, giving it complete authority over the services and products it offers. While it still leases access to the radio access network (RAN) and spectrum from a host MNO, it owns and operates its own core network infrastructure.

Significant Advantages:

Complete Control: Full MVNOs have full control over their own SIM cards, numbering ranges, Home Location Register (HLR), Gateway GPRS Support Node (GGSN), Short Message Service Centre (SMSC), Multimedia Messaging Service Centre (MMSC), and Gateway Mobile Switching Centre (GMSC).

Independent Roaming and Interconnect: They can negotiate their own roaming and interconnect agreements with other mobile network operators.

Customer Ownership and Customization: Full MVNOs have complete customer ownership and relationship management, allowing them to set their own tariff bundles and packages independently and gain deep insights into customer data for tailored services.

Differentiation and Flexibility: This level of integration provides greater flexibility in designing and deploying new services, offering significant opportunities for differentiation, segmentation, and fostering customer loyalty.

Significant Disadvantages:

High Costs: There are heavy OPEX and CAPEX costs associated with the extensive IT platforms and core network elements required.

Telecom Expertise: Operating as a Full MVNO demands a significant level of telecommunications know-how and understanding.

What core network elements can a Full MVNO own and operate, and why is this advantageous?

A Full MVNO can own and operate a wide range of core network elements, which provides significant advantages in terms of control, flexibility, and service differentiation. These elements include:

Mobile Switching Center (MSC): Controls call routing and generates usage information, allowing for independent wholesale relationships for voice/SMS routing.

Serving GPRS Support Node (SGSN): Handles packet-switched data, mobility management, authentication, and charging functions.

Gateway GPRS Support Node (GGSN): Manages subscriber access to the internet network, enables mapping and internet gateways, and allows for monitoring/controlling data usage.

Home Location Register (HLR): Registers SIM cards, stores subscriber information and privileges, maps internet access points, and enables management of dedicated IMSI series, special number allocation, and activation/deactivation of various services.

5G Core / User Plane Function (5GC/UPF): Separates user data from control data, handles high-bandwidth traffic, enables network slicing, and supports use cases like IoT and VR/AR.

Policy and Charging Rules Function (PCRF): Enforces policies related to data usage and quality of service (QoS), manages service access and billing, and enables granular control over data plans and flexible billing models.

User Data Management (UDM): Stores and manages subscriber data, provides a single source of truth, simplifies subscriber management, and enhances security and privacy.

Operations & Business Support Systems (OSS/BSS): Manages the business side of the network (billing, CRM, service fulfillment), automates operational processes, improves customer service, and provides a unified view of the customer.

Short/Multimedia Message Service Center (SMSC/MMSC): Manages the store-and-forwarding of text and multimedia messages, ensuring reliable delivery and allowing independent control and customization of messaging services and pricing.

Owning these elements grants the Full MVNO the ability to customize services, gain deep customer insights, establish its own roaming and interconnect agreements, and truly differentiate its offerings in the market, providing a level of independence similar to an MNO, albeit without owning the radio access network.

What are the key advantages and disadvantages of a Reseller MVNO model?

Advantages:

Low Startup Costs: Reseller MVNOs require minimal initial investment and have a quick time to market because they don’t need to invest in network infrastructure. The MNO handles most technical aspects.

Core Business Uplift: The MVNO can be leveraged to boost the reseller’s primary business by offering bundled services.

Disadvantages:

Lack of Control: The MNO retains ownership of customers, user data, post-sale interaction, SIMs, and infrastructure. The MNO also sets tariffs and receives revenues from incoming traffic.

Brand Translation Challenges: An existing brand might not translate effectively into the mobile sector.

Limited Industry Expertise: Branded resellers often lack the necessary telecom experience, making it difficult to gain market share without a deep understanding of the mobile industry.

How does a Thin MVNO differ from a Reseller MVNO in terms of ownership and control?

A Thin MVNO (Service Provider MVNO) offers significantly more ownership and control compared to a Reseller MVNO (Branded Reseller).

Customer and SIM Ownership: A Thin MVNO can own its own SIMs and customer relationships, which is not the case for a Reseller MVNO where the MNO retains customer ownership.

Tariff Setting: Thin MVNOs have some ability to set their own tariff bundles and packages, independent of the host network operator’s retail prices. Reseller MVNOs, on the other hand, have tariffs primarily set by the MNO.

Operational Responsibility: Thin MVNOs are responsible for customer care processes, including CRM, support, billing, tariffs, and associated IT platforms (BSS/OSS), incurring their own OPEX and CAPEX. Reseller MVNOs have fewer operational responsibilities, with the MNO handling most core processes.

Despite these differences, a Thin MVNO still does not own the International Mobile Subscriber Identity (IMSI) and has limited control over network routing capabilities, distinguishing it from Medium and Full MVNOs.

Can an MVNO (Thin, Medium, or Full) operate without investing in and owning its own equipment?

Yes, an MVNO, regardless of whether it is a Thin, Medium, or Full MVNO, does not necessarily need to invest in and own all of its own equipment or network elements.

It can partner with an MVNE (Mobile Virtual Network Enabler) to utilize the MVNE’s infrastructure and services. This partnership model allows MVNOs to reduce their capital expenditure (CAPEX) and operational complexity, as the MVNE provides the necessary technical platforms and support systems.

This flexibility is particularly beneficial for MVNOs looking to enter the market with lower upfront investment or those that prefer to focus their resources on marketing, customer acquisition, and service innovation rather than network management.

What is a sub-brand in telecommunications, and how does it differ from other MVNO types?

Sub-brands, also known as secondary or flanker brands, are telecommunications brands that are entirely owned and controlled by network operators. They are economically dependent on these operators and aim to differentiate offers and target specific customer groups.

However, from a competitive standpoint, sub-brand MVNOs are not considered significant players because they lack independence from their network operators and do not engage in price or innovation competition with them.

In contrast, other MVNO types (Reseller, Thin, Medium, and Full) generally operate with a greater degree of independence, even if they still rely on a host network operator for core network access.

While sub-brands are extensions of the network operator’s own offerings, other MVNOs strive to establish their own brand identity, customer base, and service differentiation, sometimes even owning significant portions of their operational infrastructure.

Additional Information on Types of MVNO and Operational Models

Check out our podcast: “Thin • Medium • Full – MVNO Types & Operational Models” – on Spotify or SoundCloud

Allan is a MVNA/MVNE/MVNO specialist with hands-on experience from more than 60 projects in both competitive and greenfield markets. His expertise includes business case development, execution, launch and growth strategies. Advisor and consultant to mobile network operators, MVNA, MVNE, MVNO, National Regulatory Authorities, Government Agencies, Broadcast Companies, TMT Industry Associations, Innovation and Investment Banks.