Briefing: Tax - Legalised robbery (March 1994) (original) (raw)

Socialist Review, March 1994

Legalised robbery

From Socialist Review, No. 173, March 1994.

Copyright © Socialist Review.

Copied with thanks from the Socialist Review Archive.

Marked up by Einde O’Callaghan for ETOL.

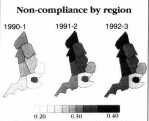

Proportion of poll tax

unpaid at end of year

- The Tories say that reducing taxes on the rich means there is less tax evasion. Between 1979 and 1990 the amount of tax uncollected at the end of the year rose from £847 million to £4,323 million. In 1979 the amount of tax written off as uncollectable was £60 million. Ten years later it was £531 million.

- Between 1990 and 1992 (the most recent figures) the amount of tax ‘written off’ was £3,147 million. Over the next two years the Tories plan to raise £3,250 million by imposing VAT on fuel bills.

- In 1978 the basic rate of tax was 33 percent and the top rate was 83 percent. Now the standard rate is 25 percent – but the top rate is 40 percent, less than half what it was.

- As a direct result of Tory tax changes over the past 15 years higher rate taxpayers have been given an extra £14,800 million. A full £9,000 million of this tax handout was shared by just 190,000 people – that’s £47,368 each.

- In 1988 the Tories cut tax for the rich by up to £200 a week for someone on £90,000 a year. Company directors on £250,000 received a handout worth £650 a week.

- When the Tories changed inheritance tax in 1988 it meant that someone inheriting an estate worth £2 million was instantly given an extra £343,000.

- The means test on social security benefits means that low paid workers pay tax at a higher rate than the rich. In 1993 there were more than half a million full time workers taxed at 50 percent or more on part of their income, compared to the top rate of 40 percent for the rich.

- Income tax in 1994 will raise about £65 billion. Workers contribute about £49 billion of this. We will pay a further £43 billion in VAT and more than £8 billion council tax. By contrast taxes which fall exclusively on the rich – capital gains tax and inheritance tax – come to £2.7 billion.

- In 1994 the amount paid by workers in National Insurance contributions – £17.6 billion – will be exactly the same as the total tax on company profits.

- Tax collected from company profits (corporation tax) has fallen from 20.7 percent in 1989 to less than 15 percent. In 1991 the Tories cut the rate of corporation tax and changed the rules to allow companies to offset losses against tax for up to six years. In the same period dividend payments to shareholders increased by more than 21 percent. Between 1980 and 1992 the amount paid out by companies in dividends was just under £150 billion.

- Tax evasion is illegal. Tax ‘avoidance’ is legal. Simple measures of tax avoidance available to the rich include offshore funds (sending money abroad), using ‘business reliefs’, setting yourself up as a company, and setting up trusts for children. Until last November it was legal to pay company executives in gold bars or coffee beans – closing this one tax loophole was worth £270 million.

- According to the Tories, the growth of self employment proves the success of the ‘enterprise culture’. There are currently about 3.4 million self employed. Of these 870,000 paid no tax at all last year, because they had declared earnings of less than £10,000. In 1994 it is estimated that 9.9 million workers earning less than £10,000 will have to pay tax.

- Executive share option schemes allow directors to buy their own company’s shares at a future date but at today’s price. By speculating in this way directors can avoid income tax on shares which are worth up to four times their salary. In the last quarter of 1993 the average profit made in this way was £102,221.

- According to one estimate (by American Express) as much as £60 billion is spent each year on ‘business expenses’. But only £40 million a year – less than 0.1 percent – is reported to the Inland Revenue as taxable expenditure on entertainment.

- Eight out of every ten households will lose income as a result of tax changes this year. The average loss will be nearly £10 a week. A family with one earner and two children will be paying an extra £22.32 a week in tax from April 1995.

- According to government expenditure surveys, VAT costs the richest households about 6 percent or their income. It costs the poorest households nearly 12 percent.

- The poorest households pay more than £8 a week in fuel bills – 14 percent of income. The richest pay about £20 – 2.5 percent. As a proportion of income VAT on fuel will cost the poorest five times more than the richest.

- Tax changes this year mean that 400,000 low paid workers will have to pay tax for the first time. On average it will cost them an extra £5.28 a week.

| Some state spending plansover the next 3 yearsInterest on government debtArmaments,militaryHome office: prisons, police etc.Government legal departmentsForeign Office: embassies, diplomats | £ million £74,000£69,000£19,120 £8,590 £3,700 |

|---|---|

| Taxes, National Insurance etc.as percentage of output1965197519851995 (planned)1998 (planned) | **%**31.736.737.237.038.5 |

Socialist Review Index | ETOL Main Page

Last updated: 8 March 2017