State Enterprises from Oracles to Apprentices (original) (raw)

State Enterprises from Oracles to Apprentices

Brook wants to trade 'all-knowing' swagger for an 'all-learning' reality check

Charged with transforming colossal state-owned enterprises into modern and competitive powerhouses, the sovereign wealth manager, Ethiopian Investment Holdings (EIH), is at a defining moment. At the helm is Brook Taye (PhD), its third CEO since its founding in 2020, whose vision departs from conventional public-sector oversight. He characterises EIH not as a regulator but as an active owner prepared to intervene, invest, and usher in fresh governance standards, offering the vitality of a private enterprise backed by public interest.

EIH’s approach stands out for its insistence on robust corporate oversight. Brook pledges transparent financial reporting and boards staffed with professionals of international calibre, appearing to domestic and foreign investors. He acknowledged that politics inevitably creeps into decisions; yet, by drafting clear policies on public service obligations and urging ministries to provide extra funding for non-commercial mandates, EIH hopes to shield enterprises from the crippling effects of political meddling.

Brook speaks candidly about learning from past failures, and ensuring leadership teams embrace innovation. The message is one of pragmatic adaptation. He believes EIH can build global competitiveness and boost public coffers, all while avoiding the bureaucratic inertia that has dogged state-owned enterprises for decades. In an exclusive interview with our outgoing Editor-in-Chief, TIZITA SHEWAFERAW, he shared insights into EIH’s priorities, the fine line of balancing control with management autonomy, and the strategies behind Ethiopia’s push for IPOs and foreign investments.

FORTUNE: State-owned enterprises under Ethiopian Investment Holdings (EIH) have a history of underperformance. What reforms are you implementing to turn them around, and how can you guarantee these changes will lead to long-term sustainability rather than temporary fixes?

Brook Taye: The right way to put it would be, “used to be known for underperformance.” Their performance in the past five years is phenomenal. The credit goes to the management of most SOEs. With one brilliant CEO, Ethio telecom has transformed into the continent's second-largest telecom operator. It pays a substantial dividend and tax, and makes us a recipient of services of superior quality and value.

This is promising. I am not saying all of it is being resolved or these companies are where we want them to be. We still have a lot to do. But except for one company, all of our companies are profitable. Every SOE class under our management, except for two companies, has their externally audited financials for the year 2022/23. This is unheard of. Some of them used to have a backlog of five and six years.

Others, such as the Federal Housing Corporation and Ethiopian Toll Road Enterprise, have also made strides, achieving clean, externally audited financial reports for the first time in years. These are companies that did not even know how many houses they had. Now, Federal Housing not only knows how many houses it has but is investing, building, and its finances are clean. We need to capitalise on this and provide all our SOEs with a guideline for our new five-year strategy.

Q: With a few years on its belt and limited experience, are EIH's capabilities overstretched at the risk of mismanagement?

Brook: We need to unpack this suggestion. We are a new institution, and although it can be a disadvantage, it also provides a fresh perspective. Rather than supervising state-owned enterprises (SOEs), we see ourselves as owners who actively make decisions and intervene when necessary. This new mindset, coupled with our leadership team's extensive experience in private and public sectors, brings dynamism that was missing in traditional public bodies. Our people understand corporate practices that drive better outcomes and push for efficiency, transparency, and accountability.

Of course, managing a vast and diverse portfolio of massive enterprises comes with inherent risks. The antidote is corporate governance that prioritises transparency, autonomy, and accountability. We assemble independent boards and demand open financial reporting to EIH and the public. We mitigate the danger of mismanagement and demonstrate our commitment to professionalism by setting these safeguards.

Q: With such a vast portfolio, how do you justify prioritising investments? Are there sectors you are deliberately avoiding?

Brook: We do not have the luxury of picking and choosing investments. Everything is a priority in theory at this point. Ethiopia is a growing economy with huge demand, so we need to invest across a wide range of sectors, including bakeries and other essential industries. However, we are very deliberate in our approach.

We focus on areas where private sector participation is limited or where there is some market failure and a broader definition of a market failure. For example, we do not establish new banks, as the private sector is already well-represented with over 30 banks, and we have the Commercial Bank of Ethiopia (CBE). Instead, we focus on strengthening existing state enterprises. We also prioritise investments with regional implications, quick returns, and substantive return on investment (ROI) while avoiding investments that could cause socio-economic harm. We are very conscious as a result of that.

Q: How do you define its success?

Brook: EIH's success will be defined in the future. So far, we think we are doing good. We have set a five-year strategic plan, and our definition of success involves ensuring that the state-owned enterprises learn from the successes of Ethio telecom and Ethiopian Airlines and contribute their part to the economy. We measure our performance annually based on several key financial and performance indicators (KPIs), the number of investments closed in a given year, and their role in creating new jobs. The amount of new investment we generate, whether through joint ventures or 100pc investments, will also define our success.

Q: Have you found the right balance between centralised control in management and granting autonomy to subsidiaries, or is excessive control stifling innovation and efficiency within the companies?

Brook: The debate on splitting management from control has long been settled in the corporate world. It is a matter of executing it successfully. Owners seek a good return on investment, while managers want to be rewarded for their results. However, this does not mean that they should have complete autonomy.

We encourage state-owned enterprises to have maximum decision-making latitude, with appropriate checks and balances. This is achieved through the board structure. We rely heavily on independent and qualified boards to guide CEOs and management teams in the company's and EIH's best interests. As owners, we intervene when necessary, especially when actions could harm our capital or returns. We also learn from other sovereign-owned funds globally to find the right balance and execute it effectively.

Q: How do you insulate the decisions from political interference?

Brook: These are government-owned state enterprises, on behalf of the public. There is always a political component to it. But, this can be defined or construed through a principle of public service obligation. There is no political decision that purposefully aims to damage a state-owned enterprise. What usually used to happen is various ministries or officials would try to utilise the state-owned enterprises to achieve a policy objective that does not necessarily match the commercial purpose.

If a state enterprise like the Ethiopian Electric Utility (EEU) is tasked with rural electrification, it cannot fund this from its own resources. The Ministry of Finance allocates a budget to bridge the gap. The policy objective is essential, but it interferes with the commercial purpose or would force the company to perform below par. We are finalising a public service obligation policy to ensure that public service objectives are met without compromising commercial viability.

Q: The Prime Minister announced plans for more state-owned enterprises to issue IPOs, following Ethio telecom's lead. Which other state-owned companies do you see taking a cue?

Brook: We have announced companies undergoing IPO readiness, including the Ethiopian Insurance Corporation (EIC), the Shipping Lines, and Berhan Ena Selam Printing Enterprise. However, this does not necessarily mean they will go public immediately. The process takes time as we need to clearly define why we are taking these companies to market. Is it to raise capital for expansion, or is it because the government no longer wishes to remain in that sector and plans to divest through the capital market?

Currently, we have a major IPO in progress. Once it is completed, we will analyse the outcomes — successes, challenges, and areas for improvement — and use those insights to guide the next steps for other companies.

Q: Without aligning these enterprises to international standards, aren't they set up for failure in the marketplace?

Brook: That is exactly what we are assessing now. Our focus is less on how ready they are and more on understanding how unprepared they might be. These companies are mostly state-owned and have never had the incentive to meet the requirements necessary to operate as public companies. This is understandable, given their history.

Our role is to evaluate their readiness and develop an equity story that aligns with their strengths and market potential. Once that foundation is in place, we help them meet the obligations outlined in the Capital Market Proclamation and the Directive for Public Offer. We have gone through this process with Ethio telecom; we are confident we can replicate it successfully with other companies. Capacity is not an issue; it is a matter of following the process systematically.

Q: Are you in a position to say something about how the Ethio telecom IPO is going?

Brook: The process is very active and ongoing. I hope that people will view this as an exciting opportunity, not only to become part-owners of one of the oldest companies in the country, with a history spanning 130 years. It is also one of the most profitable businesses in Ethiopia, a wonderful opportunity for individuals to hold a stake in a company that makes us proud.

Q: Ethiopia's capital markets are still in their infancy. Isn't relying on them to raise funds or divest assets a risky bet that could backfire on EIH and the economy?

Brook: There is always a risk when using market instruments to divest assets, whether through strategic sales, capital markets, or other mechanisms. However, EIH maintains a dynamic approach. We adjust and adapt if a process does not yield the desired results.

The risk is if you are not pragmatic, if you are stubborn and say, "This is the transaction that I have to do; I do not care if I have a collapse." But we do not have that mindset. It is a very pragmatic administration. We make decisions based on current priorities and implement changes as needed.

Q: Are there plans to attract foreign investors to participate in these IPOs?

Brook: Yes, under the National Bank of Ethiopia's (NBE) directive, portfolio companies can now invest in Ethiopia with up to a 30pc stake. However, the Capital Market Authority and the National Bank still need to finalise the directive, and we are eagerly awaiting its issuance. Once that happens, I am confident that portfolio investors will be drawn to Ethiopia.

One unique advantage is an asset class, uncorrelated mainly with global macroeconomic turbulence. Unlike many markets where economic shocks in one region ripple across others, Ethiopia’s assets are somewhat insulated. This makes them attractive to portfolio investors seeking diversification, as our market dynamics are not directly tied to those of advanced economies.

Q: Public-private partnerships can be beneficial but also have problems. How will EIH ensure these collaborations genuinely serve the public interest and not enrich vulture capitalists?

Brook: The public interest is defined by ensuring that state-owned enterprises are properly managed and operate profitably. The dividends they pay contribute to the national budget and our investment fund, growing wealth for both current and future generations. Our investment strategy aligns with this goal, incorporating rigorous due diligence, clear commercial terms, and extensive feasibility studies. We are putting public money as part of our equity.

Metrics such as Internal Rate of Return (IRR), payback period, job creation, and foreign exchange generation are integral to decision-making. There is a robust investment framework where decisions are made internally, by our investment committee, and then our board, depending on the volume and scale of the investment. Transparency is another cornerstone of our operations. Whenever we sign an MOU or joint venture, we make it public to invite feedback and ensure accountability.

Q: What are your top priorities for the next five years?

Brook: Our five-year strategy focuses on three core principles: diversification, driving economic growth, and delivering value.

Diversification involves expanding services, products, and geographical reach. Ethiopian Construction Works Corporation is one of the largest construction companies in the continent. Why is it not in 20 or 30 different African countries? Ethiopian Airlines does it. We also want the enterprises to drive the economic growth in our country. Tax contributions, foreign currency generation, and technology adoption support them. Last quarter, we generated over three billion dollars of foreign currency through our state-owned enterprises. We are one of the largest employers in this country.

They also need to deliver to the public, the owner. Increased revenue, higher tax contributions, and dividends are measures and deliveries that should be the core principles we will introduce in the next few years. We are sure that most of our SOEs will make us proud.

Q: What lessons have you learned from the past performances, both the success and failure of the companies?

Brook: We find both how to manage an SOE successfully and how not to manage it in Ethiopia. Ethiopian Airlines is a model of how SOEs should be managed. Its diversification and strong governance are examples of success. Conversely, failures of projects, past misalignments and governance failures offer lessons on what to avoid. We use these insights to recruit capable CEOs, encourage new talent, and design a strategy that builds on strengths while addressing weaknesses.

Q: Does the bureaucratic inertia not prevent you from adapting to shifting consumer behaviours and technological advancements?

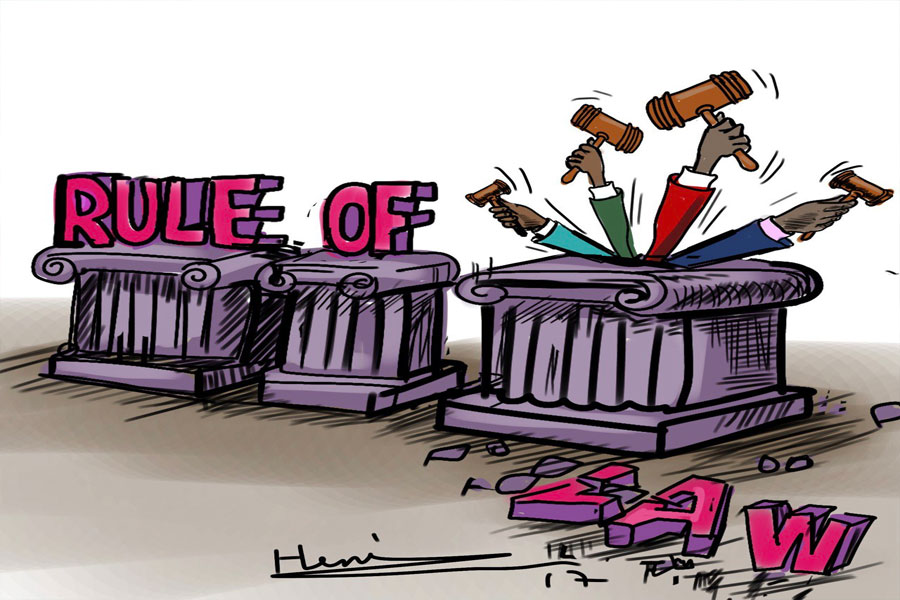

Brook: So far, I have not seen any resistance. People are actually anxious and restless. They want to reform. Most of the time, they are spearheading changes in many of our projects. What was missing before was a clear vision and collaborative leadership. We have shifted from “all-knowing” to “all-learning” leadership between management and stakeholders. This approach has created an environment where people are eager to reform and innovate.

Most of the complaints we receive are about the bureaucracy that private sector companies face. Our issue is also based on taxes, customs, and other matters. That is the frustration that they have and not resistance to change.

Q: Markets are increasingly volatile, especially in sectors like energy and logistics. Is the economy vulnerable to potential shocks? Is EIH adequately equipped to manage these risks?

Brook: Absolutely. Our five-year strategy prioritises driving economic change and ensuring efficient service delivery. We want to be part and parcel of the change. From telecom to energy to transportation, agriculture or access to finance, our SOEs are deeply embedded in daily life. This positions SOEs as key players in Ethiopia’s economic transformation. They are ready; we are ready and very confident that they will be at the forefront of any economic change introduced to this country.

Q: Are you pursuing any initiatives or investments to stay ahead in the digital economy?

Brook: Yes, we are exploring investments in the business process outsourcing (BPO) sector to ensure we have investments that allow private sector participants to come and invest. There are also other areas in the process of identifying and developing the investment framework that I will not be able to talk about right now. But, it will focus on technology we think we can align with.

Q: What role do investment holdings play in Ethiopia's integration into regional and global trade networks?

Brook: Diversification is key. There is no reason why CBE or Ethio telecom should not compete in other African markets. We envision Ethiopian SOEs becoming as prominent internationally as Chinese state-owned enterprises. In the same way, we see the 'C' companies from China, and there will be 'E' companies in many parts of the continent. We have the capacity and know-how; other companies have done it, and we should be able to learn from them. This strategy motivates our companies to think globally.

Q: What would you advise potential investors?

Brook: We offer de-risking, equity partnership, and a sounding board in investment decisions. But, in general, Ethiopia’s ongoing economic reforms, including opening the banking sector and launching a capital market, present tremendous opportunities. The next couple of years will be interesting. We are ready to partner with investors who identify synergies between our SOEs and strategically approach investment decisions.

PUBLISHED ON Dec 22,2024 [ VOL 25 , NO 1286]

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit "Cookie Settings" to provide a controlled consent.

Manage consent

State Enterprises from Oracles to Apprentices Dec 22 , 2024 . By TIZITA SHEWAFERAW Charged with transforming colossal state-owned enterprises into modern and competitiv...

State Enterprises from Oracles to Apprentices Dec 22 , 2024 . By TIZITA SHEWAFERAW Charged with transforming colossal state-owned enterprises into modern and competitiv...  Rising Costs, Inflation Threaten Insurance Industry Aug 18 , 2024 . By AKSAH ITALO Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Rising Costs, Inflation Threaten Insurance Industry Aug 18 , 2024 . By AKSAH ITALO Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...  BREWING DISCONTENT Jul 28 , 2024 . By TIZITA SHEWAFERAW Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

BREWING DISCONTENT Jul 28 , 2024 . By TIZITA SHEWAFERAW Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...  Electric Vehicle Push Leaves Investors in the Lurch Jul 13 , 2024 . By AKSAH ITALO Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Electric Vehicle Push Leaves Investors in the Lurch Jul 13 , 2024 . By AKSAH ITALO Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...  Banks Struggle to Lend as Branches Bloom, Coffers Wither A severe cash shortage squeezes the economy, and the deposit-to-loan ratio has slumpe...

Banks Struggle to Lend as Branches Bloom, Coffers Wither A severe cash shortage squeezes the economy, and the deposit-to-loan ratio has slumpe...  The Year That Falls Short in Lofty Ambitions, Brittle Realities Jan 4 , 2025 Time seldom passes without prompting reflection, and the dawn of 2025 should nudge Et...

The Year That Falls Short in Lofty Ambitions, Brittle Realities Jan 4 , 2025 Time seldom passes without prompting reflection, and the dawn of 2025 should nudge Et...  The Bureaucrats Turn to Masters of Misrule, Architects of Uncertainty Dec 28 , 2024 On a flight between Juba and Addis Abeba, Stefan Dercon, a professor of economic poli...

The Bureaucrats Turn to Masters of Misrule, Architects of Uncertainty Dec 28 , 2024 On a flight between Juba and Addis Abeba, Stefan Dercon, a professor of economic poli...  Addis Abeba's Gleaming Facade Masks a Parched Metropolis Dec 21 , 2024 The main avenues and thoroughfares of Addis Abeba have undergone an impressive faceli...

Addis Abeba's Gleaming Facade Masks a Parched Metropolis Dec 21 , 2024 The main avenues and thoroughfares of Addis Abeba have undergone an impressive faceli...