Nikola founder abruptly resigns amid fraud allegations (original) (raw)

Pursuing other opportunities

Nikola is reportedly under investigation by the SEC and Department of Justice.

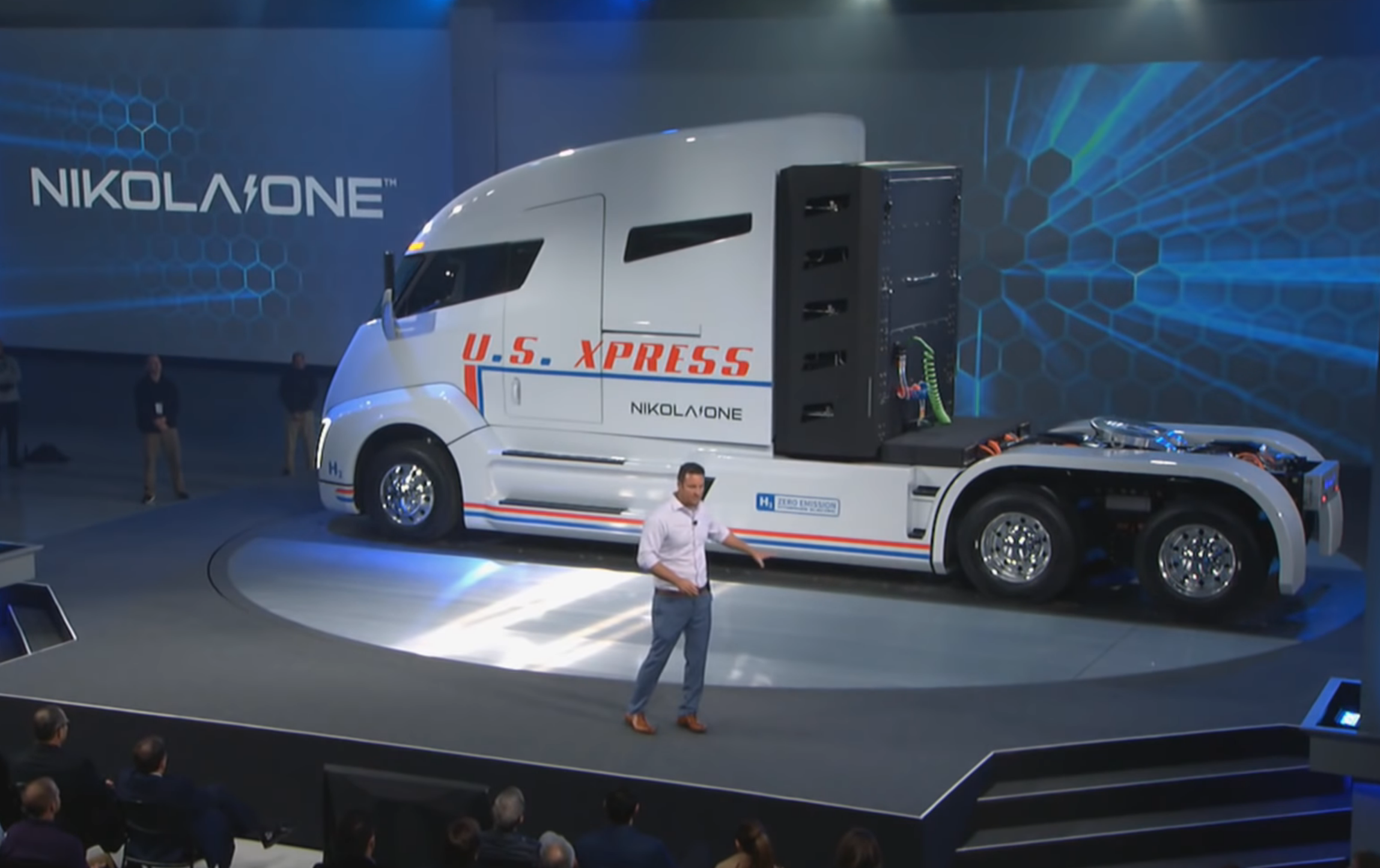

Nikola Chairman Trevor Milton unveils the Nikola One truck in December 2016. Credit: Nikola

Nikola Chairman Trevor Milton unveils the Nikola One truck in December 2016. Credit: Nikola

Trevor Milton, founder of electric truck startup Nikola, resigned his job as executive chairman of the company on Sunday—effective immediately. Nikola's stock plunged after the news and is currently trading at around $28 per share, which is down 18 percent.

Milton's resignation came just 10 days after a bombshell research report revealed that Milton wasn't telling the truth in 2016 when he unveiled the company's first product, the Nikola One, and claimed that it "fully functions." The report from short-selling firm Hindenburg Research also revealed that a Nikola One truck that appeared to be driving down a highway under its own power in a 2018 promotional video was actually rolling down a hill. Nikola acknowledged last week that it never got the Nikola One working.

The Hindenburg revelations put Nikola's management under immense pressure. Both the Securities and Exchange Commission and the Department of Justice have reportedly opened investigations into possible fraud by the company. Over the weekend, Milton offered (voluntarily, he says) to resign as executive chairman, and Nikola's board accepted his offer. Milton will also relinquish his seat on Nikola's board.

Nikola has selected former GM executive Stephen Girsky as its new chairman. Mark Russell will stay on as CEO. Until now, Russell has had a lower profile than a typical CEO, with Milton acting as the face of the company. It's unclear whether Russell or Girsky will take over Milton's role as Nikola's de facto leader.

An SEC filing says that Milton is relinquishing his claim to 4.9 million unvested shares in Nikola worth around 130million.However,hewillgetacceleratedvestingforanother600,000shareswortharound130 million. However, he will get accelerated vesting for another 600,000 shares worth around 130million.However,hewillgetacceleratedvestingforanother600,000shareswortharound16 million. Milton owns more than 90 million Nikola shares worth $2.5 billion at current prices, so these are small figures compared to his existing stake in the company.

Milton's exit contract stipulates that he will give up claim to a 20millionconsultingcontractandwillinsteadadviseNikolagratisthroughtheendoftheyear.Nikolawillalsopay20 million consulting contract and will instead advise Nikola gratis through the end of the year. Nikola will also pay 20millionconsultingcontractandwillinsteadadviseNikolagratisthroughtheendoftheyear.Nikolawillalsopay100,000 for a personal security detail for Milton over the next three months.

Nikola’s struggles aren’t over

Nikola's defenders argue that the deceptions revealed by Hindenburg are old news because Nikola long ago abandoned plans to commercialize the Nikola One. In recent years, Nikola has focused its energies on new products: the Nikola Two and Nikola Tre semi trucks and the Nikola Badger pickup.

Nikola does have a functioning prototype of at least the Nikola Two. Moreover, the company now has partnerships with established truck makers like Bosch, Iveco, and GM to design and build its newer trucks. So we don't need to worry that Nikola's new trucks are literally vaporware like the Nikola One turned out to be.

The key question, however, is whether Nikola will have any particular advantage over established truck makers—either in the trucks' capabilities or in the ability to bring them to market profitably. With the Nikola Badger, for example, Nikola is not only outsourcing manufacturing of the truck, it's also outsourcing much of the truck's design and its powertrain.

It's not clear what Nikola is bringing to the table other than a sack of cash and a brand name. And merely selling rebadged versions of other companies' trucks doesn't seem like a recipe for long-term profitability.

Could hydrogen save Nikola?

Nikola boosters point to the company's unique hydrogen-based business model as the key to Nikola's success. Instead of selling hydrogen-powered semi trucks to customers outright, Nikola is planning to lease trucks to customers bundled with hydrogen fuel and a maintenance contract.

This seems like a potentially clever business model. From the customer's perspective, leasing a truck and getting a preset price for hydrogen reduces the risks of switching to hydrogen technology—especially from an unproven startup.

From Nikola's perspective, the leasing model provides a guaranteed customer base for the network of hydrogen fueling stations it plans to build along major highways. Also, this kind of bundled service could eventually allow Nikola to earn higher profits on each truck it sells.

But here, too, the big question is whether Nikola actually has any unique capabilities to pull off its ambitious vision. The planned network of hydrogen fuel stations doesn't exist yet, and it's not clear that Nikola has the capacity to build it. Milton has claimed that Nikola has pushed the cost of producing hydrogen down from 16to16 to 16to4 per kilogram (in some interviews, he has mentioned even lower figures). But he hasn't offered much evidence to back up these claims.

Of course, you could make a similar critique of any startup touting a new, unproven technology or business model. But this is where the credibility of a startup's founders is essential. A history of past deception makes it harder for investors to believe a company's new promises.

But so far, Nikola seems to be retaining a core of true believers in its vision. Nikola's current stock price of around 28isdownsubstantiallyfromthehighof28 is down substantially from the high of 28isdownsubstantiallyfromthehighof50 achieved when Nikola announced its deal with GM earlier this month. But the stock price still values Nikola around $10 billion—an astonishing figure for a company that has yet to deliver a single truck to customers.

Timothy is a senior reporter covering tech policy and the future of transportation. He lives in Washington DC.