Introduction to Artificial Intelligence - Responsible AI Lab (original) (raw)

By Lusine Petrosyan

08/18/2024

Artificial Intelligence (AI) can perpetuate or exacerbate discrimination and segregation in housing, underscoring the need for safe, secure, and trustworthy development, deployment, and adoption of AI in housing and lending. This blog post will establish the meaning of and implications of AI in housing and lending.

Understanding AI

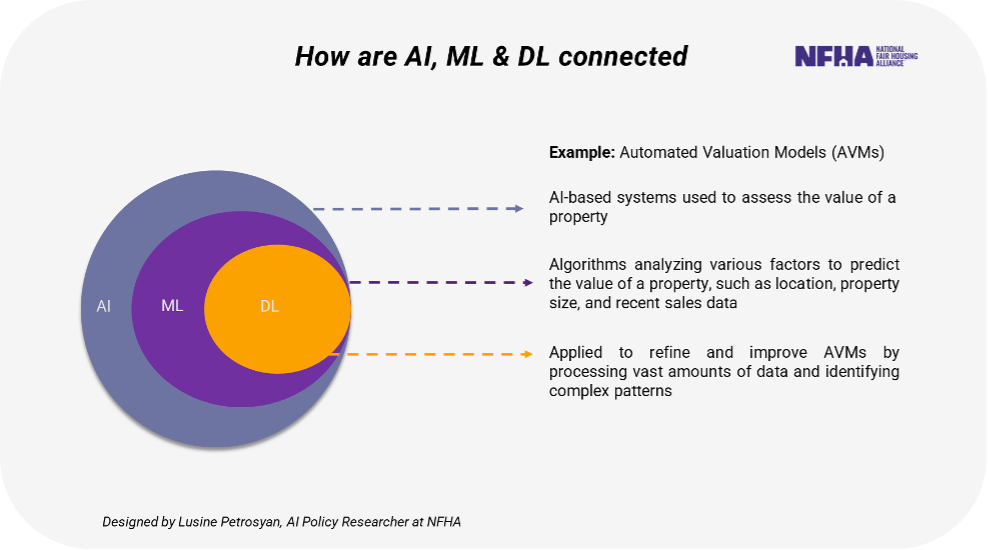

Between academia, industry, and regulatory bodies, there are numerous definitions of AI that also vary geographically and are often used interchangeably with machine learning (ML) and deep learning (DL). However, these terms are intrinsically different and hold different meanings.

Using the National Association of Insurance Commissioners’ definition as a guide, AI can be defined as “a branch of computer science that uses data processing systems that perform functions normally associated with human intelligence, such as reasoning, learning, and self-improvement.”[1] The data processing systems of AI rely on algorithms. An algorithm can be defined as a “clearly specified mathematical process for computation; a set of rules that, if followed, will give a prescribed result.”[2]

AI is a broad term that is comprised of multple subfields such as machine learning (ML) and deep learning (DL). ML is a subset of AI, referring to “any type of application for predictive or advanced analytics, which is used to identify patterns in datasets as a basis for making predictions.”[3] Whereas DL is a subset of ML that “simulates the functioning of neurons in the human brain”[4] using a mathematical construct with parameters whose values can be learned with an algorithm. These distinctions are crucial, especially when considering their applications in real-world contexts.

Numerous AI applications significantly influence how people inquire about, purchase, or sell homes, as well as who has access to housing. As digitization has transformed all industries, AI has also become embedded in housing-related processes, such as:

1. Advertisements:

AI is increasingly shaping how housing is advertised and discovered. Advanced personalization algorithms can be used to tailor property recommendations to potential buyers or renters based on their preferences, search history, and other relevant data. These systems analyze vast amounts of data to predict which properties a user is likely to be interested in.

2. Mortgage Underwriting or Tenant Screenings:

AI can play a significant role in the application process for loans or tenancies. Automated underwriting systems utilize algorithms to analyze financial and personal data, making the process faster and more accurate. Similarly, AI-driven tenant screening systems rely on factors such as credit history, employment status, and rental history to assess the risk associated with potential tenants.

3. Home Appraisal:

Automated Valuation Models (AVMs) are computerized algorithms that attempt to estimate the value of real estate properties. These models utilize various data points, such as property characteristics, comparable sales, and market trends, to generate property valuations. AVMs offer an efficient alternative to human appraisers and can provide estimates in a fraction of the time.

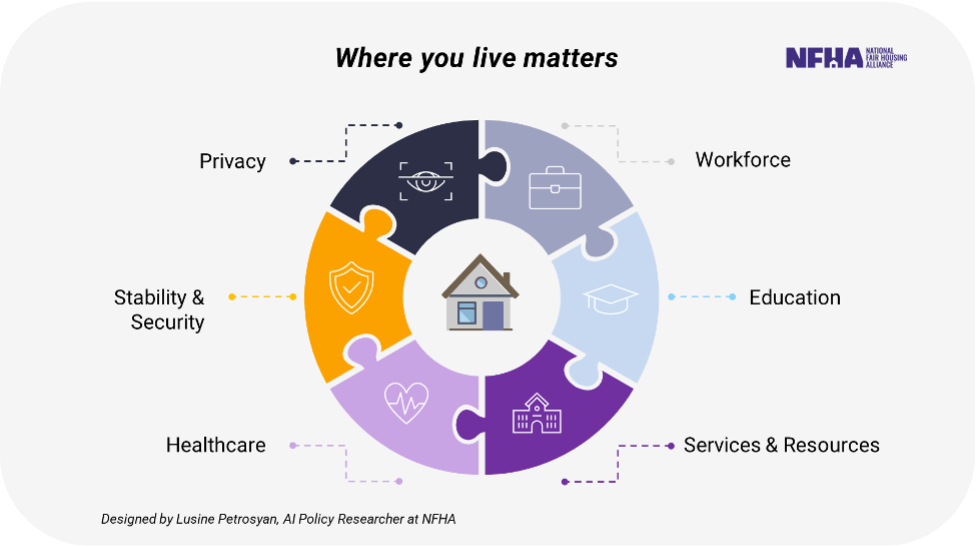

Where You Live Matters and so is AI in Housing

Housing is not just a means of shelter; it plays a central role in an individual’s quality life and in their ability to access opportunities. Well-resourced communities foster greater chances for societal success and protect civil and human liberties. This is why we must pay close attention to the implications of AI development and use in housing to make sure that this technology does not become yet another roadblock to equitable housing.

The housing industry is a sector with embedded historical, structural, and systemic discriminations that are now reflected in digital solutions in the industry. The underlying data behind AI solutions in housing can be problematic, and so can the learned patterns and inferred policies extracted from the solutions.

Consider a group of individuals who are qualified for homes that they never get to discover or pursue, those who are qualified to purchase homes and increase their equity but don’t get to, and those who are suitable to be great tenants but cannot secure a home. Beyond the obvious stressors and insecurities involved with not having the security of a home and well-resourced communities, what about the financial, social, and psychological damages that individuals and families may face? AI systems used to determine the state of housing opportunities for people hold significant social and ethical implications. These technologies do not function in isolation; their outcomes become deterministic artifacts in our realities.

The Significance of Responsible AI

It’s imperative to establish and implement governance and practical mechanisms to ensure the responsible design, development, and use of AI in housing. Based on NFHA’s PPM framework[5] and its pillars of responsible AI,[6] the development and use of AI in housing and lending should be non-discriminatory, privacy-preserving, reliable, transparent, and controllable by humans.

Expect a sequel post that explains the role of safe, secure, and trustworthy frameworks for managing AI risks and advancing its benefits in housing and lending.

Conclusion

Safe, secure, and trustworthy development and use of AI in housing is paramount to creating well-resourced communities. By prioritizing principles such as privacy preservation, reliability, non-discrimination, and explainability, we can mitigate the risks of bias and discrimination in the housing sector.

References

[1] NAIC Model Bulletin on the Use of Artificial Intelligence Systems by Insurers (2023): https://content.naic.org/sites/default/files/inline-files/2023-12-4%20Model%20Bulletin\_Adopted\_0.pdf

2 Id.

3 Sheikh, H., Prins, C., & Schrijvers, E. (2023). Mission AI: the new system technology (p. 410). Springer Nature.

4 Id.

5 NFHA’s Purpose, Process, and Monitoring Framework (PPM): https://nationalfairhousing.org/issue/purpose-process-and-monitoring-framework-ppm/

6 NFHA’s RAI Pillers: https://nationalfairhousing.org/program/responsible-ai/