Optimising shadow accounting activities in middle-office operations (original) (raw)

Published on September 23, 2024 by

Shadow accounting, which refers to setting up ledgers and accounts parallel to those of an organisation in order to corroborate the official accounts, is central to middle-office activities. Thus, it is imperative that improved forecasting and reorganised shadow accounting be adopted in line with the growing complexities in financial markets.

Challenges in shadow accounting

Data inconsistencies

Data inconsistencies pose a significant challenge in shadow accounting, often stemming from multiple sources:

- Multiple data sources: In shadow accounting, financial institutions work with data from systems other than those of administrators and custodians. These sources can be diverse and create inconsistencies in transactions in terms of values or classifications.

- Data-quality issues: Shadow accounting books may differ significantly from the official records due to the imperfection of the information entered into the system for processing.

- Timing differences: Categorised by when they occur, some are temporary while others easily create confusion; this likely explains why different systems record transactions at different times.

- Format inconsistencies: When compiling data, discrepancies in the structure of the information in terms of format lead to disagreement in the interpretation of the information.

Manual processes

Despite technological advancements, many organisations still rely heavily on manual processes:

- Data entry: Keying in transactions and adjustments manually leads to increased risk of error

- Spreadsheets: Despite the convenience of using spreadsheets to perform calculations and checking-account reconciliations, it can also have its disadvantages such as issues with version control and errors in formulas

- Manual reconciliation: Transferring entries between different systems and comparing them is a tedious process, and some information could be omitted

- Ad hoc reporting: Presenting different reports for the different stakeholders can be time-consuming and produce different results

Time constraints

The financial sector operates under significant time pressures:

- Reporting deadlines: Middle-office workers are pressured by tight deadlines for daily, monthly or quarterly reporting

- Market volatility: Market fluctuations call for updating shadow books rapidly, providing limited time for checking

- Increasing transaction volumes: The increasing number of transactions reduces the time available to perform and review each entry

- Expecting results in real time: This puts pressure on analysts to present real-time results instead of the usual end-of-day analysis

Key areas for optimisation

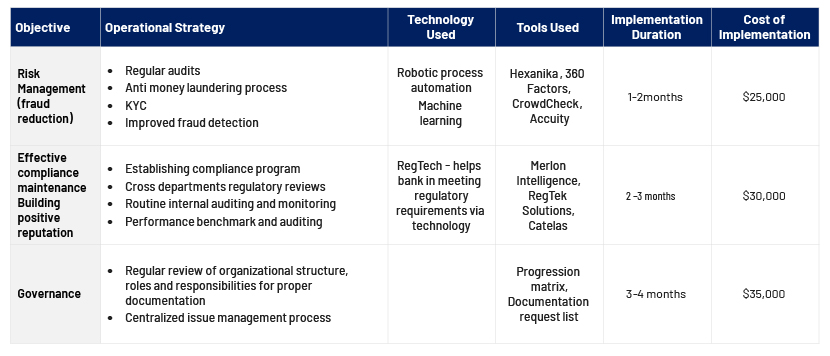

Middle-office operations can be transformed by focusing on managing regulatory compliance and governance such as risk management, that will lead to reducing fraud and building a strong reputation by means of regular audits and reviews.

Data management

Effective data management is crucial for accurate shadow accounting:

- Data governance: While setting up a big-data environment, it is essential to compile policies relating to ownership and quality of the data collected and measures to ensure its security

- Master data management: Standardise the repository of crucial data characteristics

- Data standardisation: Use formats commonly used in the market such as SWIFT and trading formats such as FIX

- Data cleansing: The data must be audited and cleaned as often as possible to prevent inaccuracy

Process automation

Automating manual tasks can significantly improve efficiency and reduce errors:

- Workflow automation: Put processes in place that allow automation of some of the repetitive work and approvals

- Straight-through processing (STP): Support fully automated processing end to end at the property

- Exception handling: Automate the process of flagging those cases that need to be reviewed by a specialist and their subsequent redirection

- Robotic process automation (RPA): Should be used to perform routine activities that have set rules

Reconciliation procedures

Streamlining reconciliation is key to timely and accurate shadow accounting:

- Automated matching: Be able to reconcile at least some of the transactions contained in at least one of the abovementioned information sources; implement systems that can automatically cross-reference the transaction

- Exception-based reconciliation: Concentrate activity on discovering and addressing conflicts

- Continuous reconciliation: Advance the process towards real-time or near real-time reconciliation procedures

- Multi-level reconciliation: Establish hierarchy reconciliation procedures for other complex structures in the financial statements

Reporting and analytics

Enhanced reporting capabilities provide valuable insights on shadow accounting:

- Customisable dashboards: Provide a reformist dashboard, which could be customised to the kind of user or the position they hold in the organisation

- Ad hoc reporting tools: Allow users to generate their own reports using an end-user tool that does not require help from the IT department

- Predictive analytics: Discuss past trends and potential problems to understand the future state

- Regulatory reporting: Establish production of regulatory reports required based on strategies outlined

Benefits of accounting in-house and outsourcing the task

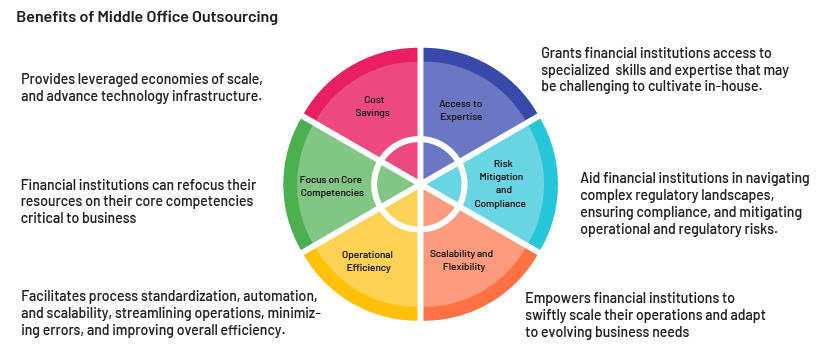

Shadow accounting in-house provides an organisation with more control over financial data and operations. It also has a positive impact, as it avoids interference of outside companies in its accounting processes. With no reliance on external parties, communication and decision-making processes could be more efficient.

On the other hand, outsourcing shadow accounting to specialists would enable the use of tools and the knowledge required, which may not always be available to an organisation. Third-party suppliers have a wider view and can introduce better methods and improvements as a result of having to implement solutions across organisations in different sectors.

Technological solutions for shadow accounting

Advanced reconciliation software

Modern reconciliation software offers powerful features:

- Multi-source matching: The opportunity to balance information from internal and external sources relevant to the organisation

- Rule-based engines: Scalability of rules for matching and exceptions

- Integration of machine learning: Self-learning matchmakers

- Audit trail: Documentation of all reconciliation-related activities

AI and machine-learning (ML) applications

AI and ML can transform shadow accounting processes:

- Anomaly detection: The software should also be able to point our unusual patterns in transactions, which may highlight errors or even cases of fraud

- Natural language processing: Identify relevant information from repositories of information such as emails, documents, folders and photos

- Intelligent automation: Use RPA in combination with AI for tasks that are decision-intensive

Cloud-based platforms

Cloud solutions offer numerous advantages:

- Scalability: Resources can be easily increased or decreased depending on the workload at a particular period of time

- Accessibility: Ensure secured access from any location, to enable working from home

- Automatic updates: To secure data and prevent unexpected problems, make sure that all users of any application use the most recently updated version

- Disaster recovery: Ensure redundancy and backup options are already included

Data-visualisation tools

Visualisation enhances data comprehension and analysis:

- Interactive charts and graphs: These enable users to interact with data in the application in a way in which they can manipulate it

- Heat maps: These quickly narrow down a problem or area of interest

- Network diagrams: These enable users to understand relationships between data points and their work

- Real-time visualisations: These show current data feeds for obtaining real-time figures

Conclusion

Optimising shadow accounting activities is no longer optional for middle-office operations. By addressing current challenges, leveraging technological solutions and implementing best practices, organisations can transform their shadow accounting function from a necessary cost centre to a valuable strategic asset. As the financial landscape continues to evolve, those who invest in optimising their shadow accounting capabilities would be best positioned to navigate future challenges and opportunities.

How Acuity Knowledge Partners can help

With our bespoke research, analytics and technology solutions, we are at the forefront of supporting the financial services sector, ranging from asset managers and investment banks to private equity firms, through this significant change.

Our global network of over 6,000 analysts and industry experts, operating from 10 locations worldwide, is dedicated to ensuring that our clients not only meet the challenges but also excel in the evolving regulatory and market landscape.

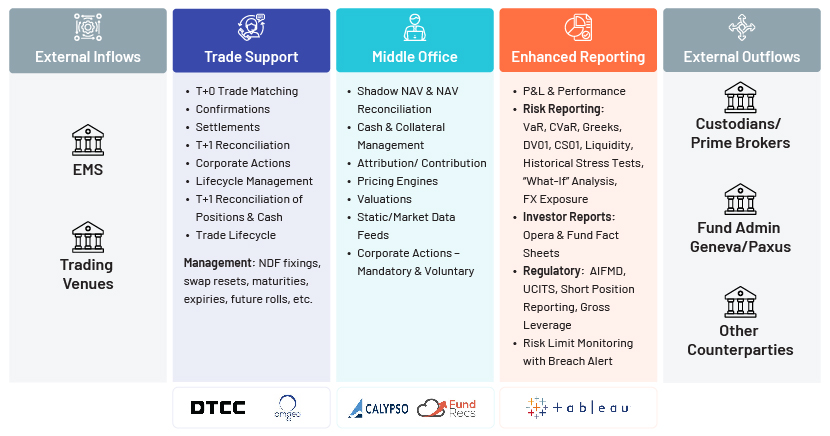

We offer a range of services including trade processing, reconciliation, corporate action NAV calculation, valuations, portfolio management and financial reporting. We offer businesses greater flexibility when it comes to fund/shadow accounting requirements, increased cost efficiency and real-time support.

References:

- https://www.ivp.in/resources/articles/why-do-hedge-funds-need-a-shadow-accounting-solution/

- https://www.ibntech.com/blog/navigating-the-shadows-an-introduction-to-shadow-fund-accounting/

- https://www.finservconsulting.com/2023/08/managed-services-2023-01-09-1-1/

- https://www.ivp.in/resources/blogs/how-hedge-funds-can-improve-performance-with-shadow-accounting/

- https://www.ibntech.com/blog/shadow-fund-accounting-outsourcing/

- https://www.fundtec.in/middle-office-services

- https://www.linedata.com/shadow-accounting-time-your-game

What's your view?

Thank you for sharing your Comments

Share this on

About the Author

Working in the Investment banking sector having 10+ years of work experience in various organizations like BNY Mellon, BNP Paribas, Wipro and in different roles. Has worked on various products like performance portfolio, client management, risk, compliance, attributions, CLO, CDO,CBO,ABS and syndicate loans. Has strong people management skill and enjoys indulging in playing outdoor activities.