IDW- "If Things Had Panned Out, Everybody Would Be On A Yacht" (original) (raw)

Posted in: Comics, Comics Publishers, Current News, IDW | Tagged: Davidi Jonas, yacht

Current CEO and new Publisher of IDW, Davidi Jonas of the Jonas family took an investment call while in the car about the comics publisher.

Published Tue, 17 Sep 2024 10:57:12 -0500

|

Last updated Wed, 18 Sep 2024 18:32:26 -0500

|

Article Summary

- Davidi Jonas discusses IDW's rocky financial history and its pivot from publishing to entertainment in 2013.

- Jonas highlights major layoffs and tough decisions that helped IDW move back towards profitability.

- Despite past challenges, Jonas emphasizes a positive outlook with new investments and strategic plans.

- IDW's potential return to the stock exchange is on the table to balance cost-saving vs. market visibility.

Current CEO and new Publisher of IDW, Davidi Jonas of the Jonas family took an investment call while in the car as as part of his duties of being a publically traded independent comic book publisher. As he pointed out, the only such comic book publishers of a comparable size, Marvel, DC, Image, Dark Horse, Boom, Dynamite, etc, that you can directly buy shares in. As well as talking about the history and the current status of the publisher and what they put out, he included a few notable newsworthy items that Bleeding Cool was keen to scoop up. We have been reporting on the turbulent employment conditions, including a new EIC that they still haven't announced, even though their competitors have. And there has been plenty of gossip to fill in the gaps. Might Jonas put some flesh on those bones?

Davidi Jonas investment call screencap

We previously covered his mention of a new George Takei book, a pivot to horror, and IDW's own superhero, Bible, crime, mafia and serial killer comics. But what of the company as a whole? As this is an investment call, he had to be pretty blunt.

Davidi Jonas began by stating that " IDW had a pretty rocky last five to seven years. The company went public in around 2009 and it was just a publishing company that really didn't do entertainment or entertainment exploitation. And as a publishing company the business was quite profitable. It was a small company, entrepreneurial; every dollar that was made went back into reinvesting into the business, but there were real cash reserves for the company."

"If Things Had Panned Out, Everybody Would Be On A Yacht"

So what changed, Davidi? "Around 2013, the company made the decision to make a foray into entertainment and decided to become something of a studio and a producer. While we now are reaping some of the benefits with Wynonna Earp as an example, those were costly investments and frankly did not pay off. It ended up causing IDW significant financial stress towards the end of 2019 and 2020. The company just had to pay off loans for the productions as well as investments into entertainment as an asset class doing scripts and development and building a studio. If those things had panned out, I think everybody would be on a yacht clinking glasses and saying how brilliant that idea was. In retrospect, it didn't work out and those investments didn't pay off."

No yacht for Davidi. Could this be the new "if wishes were horses, beggars would ride"? So what happened with IDW more recently? "When I came into IDW about 16 months ago, the company was in a pretty precarious spot. They had gotten back down to a place where they were pretty low on cash. By the time we were able to staunch the bleeding, the company had gone from the start of the year at about ten and a half million in cash to about three and a half million."

"We've confidently turned things around and feel that we're on a path of profitability, we are already profitable and believe we will be sustainably profitable. As well as the engine for future growth that required a lot of hard decisions and reduction in force and other cuts to the company's budget."

Otherwise known as firing 40% of your staff of course, with all the fallout then and more recent departures with all the gossip one might expect. So what is next? "We're doing more with less and feel that we're in the strongest position to be able to execute on our long-term goals. At this point, the company did a round of financing or fundraising where we did a rights offering to the shareholders of IDW. There was pretty anaemic participation from the shareholder base. I think, over time, the IDW shareholder base has gotten less invested in the company and the story, which is understandable. And so by the time we did the rights offering, most of the participation came from a core group of of investors who believe in the future of the company, namely that's me and my family, and a few other small shareholders. The company is a controlled company, and I'm the controlling shareholder of the company. The Jonas family collectively owns and controls about two-thirds of the outstanding equity in IDW, and the rest is held by independent investors."

Well, looks like IDW really is a family business now. He continued, "That round of financing wasn't to pay off debt or anything like that. It was meant for strategic purposes for investing in the future of the company and having additional cash reserves. When we got to the bottom, we were at about three and a half million, we expect that we'll end the year over seven million in cash with the three million that we raised. We're on a path of profitability, and we're expecting 2025 – when our fiscal year starts, November 1st of 2024 that starts our fiscal 25 – we expect it to be an even better year than the turnaround, We're going to be profitable this year is our expectation but when you consider the swing from losing about $7 million to where we are now, it's not just the profitability, it was the ability to to make that swing in such a short period of time. We've retained top talent, and we are investing in our talent, we believe that the future of our company is the people and their ability to deliver, to create, and to collaborate, and that's where we're investing our resources."

The Stock Exchange

The ones that are left, of course. IDW also de-listed themselves from the New York Stock Exchange and Davidi was asked if he would consider relisting the company. "We did delist from the New York Stock Exchange when I came on as a cost-cutting measure, so we've saved a lot on public company fees, which probably contributes to some of the lack of liquidity and trading in the company, and lack of interest. It's something that we're discussing if the benefit would outweigh the cost. Whatever cost we saved by going off of the New York Stock Exchange, we'd have to take back on if we relist, so we're sort of enjoying not having the burden of those costs. It's just a question of whether that trade-off makes sense but it is something that we're we're considering."

Look for a rebranding and relaunch of IDW at New York Comic Con for their 26th year. This article is suddenly getting a lot more attention as well.

Enjoyed this? Please share on social media!

![]() Stay up-to-date and support the site by following Bleeding Cool on Google News today!

Stay up-to-date and support the site by following Bleeding Cool on Google News today!

About Rich Johnston

Founder of Bleeding Cool. The longest-serving digital news reporter in the world, since 1992. Author of The Flying Friar, Holed Up, The Avengefuls, Doctor Who: Room With A Deja Vu, The Many Murders Of Miss Cranbourne, Chase Variant. Lives in South-West London, works from The Union Club on Greek Street, shops at Gosh, Piranha and FP. Father of two daughters. Political cartoonist.

Latest by Rich Johnston

All The Absolute Batman #2 Previews Pages And Leaks We Can Find

This week sees the publication of Absolute Batman #2 by Scott Snyder and Nick Dragotta, the first Absolute comic to put out a second issue.

Peebles Comics in Scotland Wins Image Comics' Fall 2024 Retailer Award

Peebles Comics And Games in Scotland Wins the Image Comics’ Fall 2024 Image Select Retailer Award at Lunar Summit

The Return Of Atlas Comics, 50 Years On With Paramount, Walmart & Mego

The Return of Atlas Comics, 50 Years on, with Paramount, Walmart and Mego, for comics, films, toys, merchandise and the like.

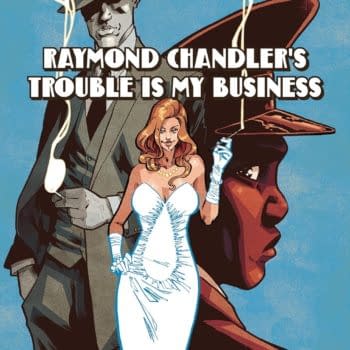

Raymond Chandler's Trouble Is My Business To Be A Graphic Novel

Dirk Gently's Holistic Detective Agency's Arvind Ethan David & Ilias Kyriazis turn Raymond Chandler’s Trouble Is My Business into Graphic Novel

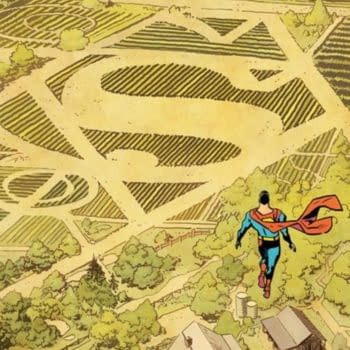

Absolute Superman #1 Smashes The Bleeding Cool Weekly Bestseller List

Absolute Superman #1 by Jason Aaron and Rafa Sandoval absolutely smashes the Bleeding Cool Weekly Bestseller List

A Horrific Future For Superman in The Daily LITG 9th November 2024

Horrific future spoilers for Superman topped the traffic on Bleeding Cool. Welcome to Lying In The Gutters...