HDFC Bank Millennia Credit Card - Apply Online (original) (raw)

HDFC Millennia Credit Card Features and Benefits

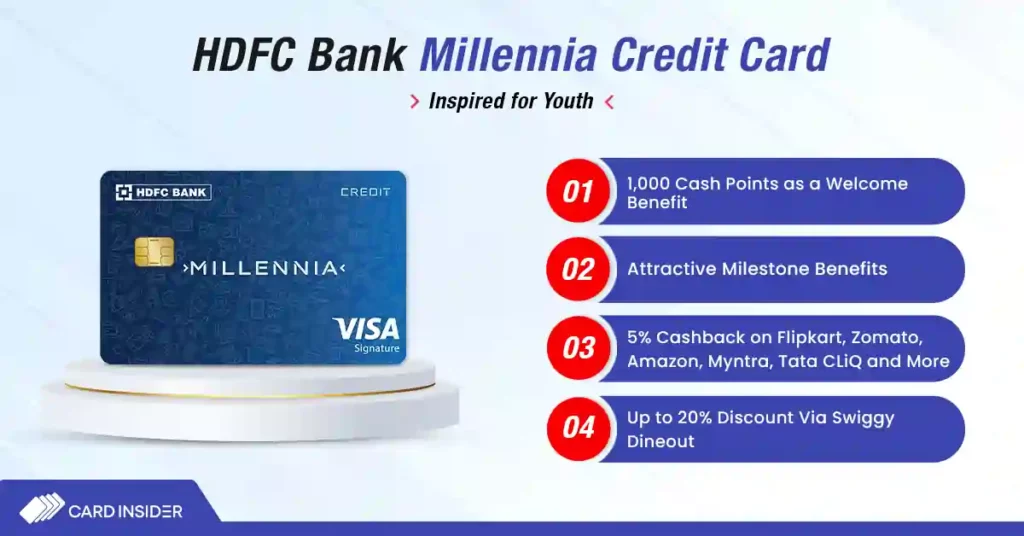

Apart from the cashback benefit, the HDFC Millennia Credit Card also offers many other benefits to the cardholders. The benefits include bonus CashPoints as a welcome gift, complimentary airport lounge access, dining discounts, and many more.

Welcome Benefits

In the form of welcome benefits, the cardholders will receive 1,000 bonus CashPoints on the successful realization of the joining fee.

Dining Benefits

Up to 20% discount at partner restaurants with Swiggy Dineout. This shall only be applicable to payments made via the Swiggy app.

Quarterly Spend Benefit

On spends of ₹1 lakh or more each quarter, you shall be eligible to receive gift vouchers worth ₹1,000. Through this offer, you can earn ₹4,000 each year as gift vouchers while spending ₹4 lakh; this would also waive your annual fee.

Fuel Surcharge Waiver

1% of the fuel surcharge is waived on a minimum payment of ₹400 at all petrol stations across India (the waiver amount is capped at a maximum of ₹250 per payment cycle).

Renewal Fee Waiver

This credit card comes with an annual fee of ₹1,000, which is eligible for a waiver if the cardholder is able to spend an amount exceeding ₹1,00,000 in an anniversary year.

Interest-Free Credit Period

You can get around 50 days of interest-free credit period on the credit card from the day of purchase. This depends on when the merchant submits the charge.

HDFC Millennia Credit Card Cashback

The cashback that you get by transacting through the HDFC Millennia Credit Card is posted as CashPoints to the card account. You can redeem these CashPoints against a variety of options (details below), including cashback (adjustment against the due balance on the card). HDFC Millennia Card earns you-

- A cashback of 5% on 10 partner online merchants- Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber, and Zomato.

- A cashback of 1% on all eligible other online and offline spends.

- The CashPoints earned under the 5% and 1% categories are capped at 1,000 CashPoints per statement cycle each (a maximum of 2,000 CashPoints can be earned in a given statement cycle).

HDFC Millennia Credit Card Reward Point Redemption

- As mentioned, the cashback earned on the HDFC Millennia Credit Card is credited as CashPoints to the card account at the end of the statement cycle. The CashPoints that you receive can be redeemed for a variety of options, which include cashback (i.e., adjusting them against the statement balance of the credit card), flight/hotel bookings via SmartBuy, product purchases from the bank’s catalog of products and partner airlines’ AirMiles.

| Value of CashPoints on Redemption | |||

|---|---|---|---|

| Product Catalog | Flights/Hotels on Smartbuy | Cashback | Airmiles |

| ₹0.30 | ₹0.30 | ₹1 | 0.30 AirMiles |

- A minimum of 500 CashPoints are required for redemption against the card’s statement balance.

- CashPoints are valid only for 2 years and will expire thereafter.

- You have to pay a fee of ₹50 for every cash against statement redemption request you make.

Exclusion on Rewards Points/Cashback

The following spending categories are not eligible to earn Cashpoints –

- Fuel

- Rent

- Govt Related Transactions

- EMI Transactions

- Wallet Loading

- Cash Advance

- Payment of Card Fees

- Smart EMI/Dial an EMI Transactions

Who Should Sign Up for an HDFC Millennia Card?

As the name suggests, The HDFC Millennia card should be the card of choice for young professionals who plan to begin their credit journey and build a strong credit profile. HDFC Bank, keeping its target customers in mind, offers extra shopping benefits from partner websites, including Amazon, Swiggy, Zomato, Uber, and Flipkart. Whether you are a travel enthusiast, a movie buff, a foodie, or a shopaholic, this card has something for you. Unlock your savings journey with the HDFC Millennia Card.

Eligibility Criteria for HDFC Millennia Credit Card

The following table illustrates the income-based and age-based eligibility criteria for HDFC Bank Millennia Credit Card-

| Criteria | Salaried Employees | Self-Employed Individuals |

|---|---|---|

| Age | 21 – 40 Years | 21 – 40 Years |

| Income | Minimum ₹35,000 Per Month | Minimum ₹6,00,000 Per Annum (As Per ITR) |

Compare HDFC Millennia Credit Card With Other Popular Cards

The following table compares HDFC Bank’s Millennia credit card with similar credit cards.

| HDFC Millennia Credit Card | IDFC Millennia Credit Card | SBI SimplyCLICK Credit Card | Axis Bank Ace Credit Card | |

|---|---|---|---|---|

| Reward Structure | Cashback (earned as CashPoints) | Reward Points | Reward Points | Cashback |

| Reward Rate at Partner Merchants | –5% cashback (earned as CashPoints) at partner merchants, including Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber, and Zomato.-1% cashback on all other online/offline spends.-1CP = ₹1 | -3 Reward Points per ₹150 spent offline and online up to spends of ₹20,000 -10 Reward Points per ₹150 on spends above ₹20,000. -1 Reward Point = ₹0.25 | -10 Reward Points per ₹100 spent at partner merchants, including Cleartrip, BookMyShow, Dominos, Apollo24x7, and Netmeds. -5 Reward Points per ₹100 on all other online spends. -1 Reward Point = ₹0.25, reward rate of 2.5% at partner merchants and 1.5% on all other online spends | -5% cashback on utility bill payments and mobile, and DTH recharges. -4% cashback on Zomato, Swiggy, and Ola. -1.5% cashback on all other spends with the card. |

| Cap on Rewards | Max 1,000 CashPoints per month at the 5X rate and 1,000 CashPoints per month at the regular 1X rate- a total of 2,000 Reward Points in a given statement cycle | No max cap applicable | Max 10,000 Reward Points can be earned in a month at an accelerated (5X or 10X) rate | Cashback is Capped at ₹500 Each Statement Cycle |

| Additional Benefits | -20% discount on dining at partner restaurants. | -4 complimentary railway lounge access per quarter. -25% discount on movie tickets (up to ₹100) -Up to 20% discount at over 1,500 restaurants across the country | N/A | -4 complimentary domestic airport lounge access. -20% discount at partner restaurants with Axis Bank’s Dining Delights program. |

| Annual Fee | ₹1,000 per annum, waived off on a minimum annual expenditure of ₹1 lakh | Nil | ₹499 per annum, waived off on a minimum annual expenditure of ₹1 lakh | ₹499 per annum, waived off on an annual expenditure of a minimum of ₹2 lakh |

Latest News (August 2024)

- If you use payment services such as CRED, PayTM, Cheq, MobiKwik, or Freecharge to pay rent, a 1% fee will be applied to the transaction amount, capped at ₹3,000 per transaction.

- From 1st September 2024, no Reward Points shall be provided for EMI transactions and wallet loading.

- If your fuel transaction is under ₹15,000, no extra fee will be charged. However, if your fuel transaction exceeds ₹15,000, a 1% fee will be charged on the entire amount, capped at ₹3,000 per transaction.

- For utility transactions of less than ₹50,000, no additional fee will be charged. However, for transactions exceeding ₹50,000, a 1% fee will be applied to the entire amount, capped at ₹3,000 per transaction.

- Beginning August 1st, 2024, a redemption fee of ₹50 will be charged if you choose to redeem your rewards for statement credit (CashBack). The redemption rate for the statement balance will be 1 CashPoint = ₹1, and you can complete the redemption process through Net Banking login, Phone Banking, or physical redemption form.

HDFC Millennia Credit Card Review

HDFC Bank’s Millennia Credit Card, one can say, is the ideal card for someone who has just started working and loves to shop online. Not only that, it gives you 5% CashBack on India’s most popular online shopping websites, Amazon and Flipkart. On non-partner brands, you get 1% cashback on offline and online spends. It is also one of the cards to vouch for building a solid credit profile.

Like any other credit card, this card also requires you to maintain financial punctuality; otherwise, a debt trap at an early age can be really troublesome. Before you make up your mind, however, you may also have a look at some other similar credit cards like the Swiggy HDFC which also offers cashback on Swiggy and other popular platforms.

This was our review of the HDFC Bank Millennia Credit Card. Do share your reviews on this card with us in the comment section below!

FAQs:

Follow these simple steps to apply for an HDFC Millenia Credit Card. Click on the Apply Now button on this page. You will be redirected to HDFC’s credit card application page, where you will need to fill out a form so that your application may be submitted.

The CashPoints earned on the HDFC Millennia Credit Card can be redeemed for cashback (adjustment against the card's statement balance), purchasing products from the HDFC product catalog, or for flight/hotel booking.

Your credit limit is decided based on your income and a number of other factors, including your credit score.

Yes, you can withdraw cash from an ATM with HDFC Millennia Credit Card. You will be charged a cash withdrawal fee of 2.5% of the withdrawn amount, subject to a minimum charge of Rs. 500.

You can place a call on HDFC's 24x7 toll-free helpline number, 1800 266 4332, or you can also dial 1800 258 3838 on all days from 8 AM to 8 PM. Alternatively, you can also send an email to [email protected] mentioning your query/complaint.