What are EFT payments? And when should you use them? (2025) (original) (raw)

If you’ve ever used a debit card or set up a direct deposit transaction, then you’ve made or received an electronic funds transfer (EFT). These transactions move money between bank accounts without paperwork or a bank employee's help.

EFTs are handy, but types differ in speed, cost, and security, especially for B2B payments.

Here’s what you need to know about EFT payments, including how they work, when to use them, and how to set up EFT payments for your business.

Key takeaways

- EFT payments transfer funds electronically between banks, reducing the need for checks and cash.

- These payments can be processed through many methods, including direct deposits, online bill pays, and peer-to-peer platforms.

- EFTs are widely secure, using encryption and tokenization, but users should still watch for fraud.

- You can make international EFTs, but they may have higher fees and must follow international regulations.

- For businesses, EFT payments offer significant advantages like improved cash flow, reduced processing costs, and seamless integration with accounting systems.

What is an electronic funds transfer (EFT)?

An electronic funds transfer (EFT) is a way of transferring money directly between bank accounts without the need for paper checks or other physical paperwork. EFT payments have been around for decades but are becoming increasingly popular — non-cash payments have been increasing by 9.5% per year.

EFTs transfer money between accounts within the same or different banks, even internationally.

Various EFT types exist, each with its own pros and cons, but all have the same basic parts:

- Electronic devices: An electronic funds transfer needs to be initiated from an electronic device, such as a computer, automated teller machine (ATM), or a point-of-sale (POS) terminal.

- End users: An EFT requires a sender and receiver, and either party can initiate the transaction with appropriate authorization and account details.

- Financial institutions: Financial institutions process electronic transfers, often through a third-party clearinghouse or payment network.

EFTs can be used to withdraw cash, pay bills, send money to a friend or family member, receive payment from an employer, or make a purchase using a debit or credit card. An EFT transfer can take anywhere from a few seconds to a few days to process.

What is an EFT payment?

EFT is an umbrella term that encompasses several different types of payment methods. An electronic transfer used to pay for goods or services is called an EFT payment.

Some of the most common types of EFT payments include:

- Online bill pay

- Online tax payments

- Direct deposit (payroll)

- Automated clearing house (ACH) transfers

- Peer-to-peer payments, like Cash App or Venmo

EFTs are usually faster, more convenient, and cheaper than traditional payments. EFTs can start anytime, even outside bank hours, but transfers can indeed take days.

How EFT payments work

EFT processing mostly happens behind the scenes. When you send or receive an EFT payment, it goes through the following steps:

- Initiation: First, the sender initiates a transfer by providing the recipient’s bank account information and routing number. Sometimes, the recipient may initiate the transaction, as in the case of a pre-authorized debit (PAD) payment.

- Verification: Next, the sender’s financial institution verifies that the funds are available and that the payment was authorized.

- Settlement: The sender’s bank contacts the recipient’s bank with the details of the transaction and initiates a transfer of funds.

- Crediting: The recipient’s bank credits the money to the correct bank account, and may send out a confirmation message to the recipient.

The EFT process varies by transaction type. ACH transfers go through a third-party ACH network, and are usually processed in batches.

Credit and debit card payments go through a card network like Visa or Mastercard, and may also involve a payment processor like Stripe, PayPal, or Plooto.

7 common types of EFT payments

There are different types of EFT payments for different use cases. Let’s take a look at some of the most common examples:

Electronic checks

Electronic checks, or eChecks, are the digital equivalent of a paper check. They use your bank account and routing number to transfer money to the recipient. If you’re a business, then accepting check payments online means you don’t have to wait for a check to arrive in the mail or go through the hassle of depositing it.

Direct deposit

A direct deposit is a type of EFT transfer in which a paycheck is deposited directly into an employee’s bank account, usually on a recurring basis. Direct deposits cut down on administrative work, and allow the employee to receive their paycheck faster.

ATM withdrawals

Automated teller machines (ATMs) allow customers to access their funds or make a deposit outside of banking hours. ATM transactions are a type of EFT transfer.

Credit card transactions

Credit and debit card transactions are electronic transfers processed by a credit card network. The payment processor draws funds from the recipient’s bank account or line of credit and credits it to the recipients’ bank account. This is one of the most secure forms of EFT due to the rise of virtual credit cards and chip technology.

Internet transactions

With more online banking, customers can pay without credit or debit cards. Customers can store money in a mobile wallet, initiate peer-to-peer transfers, and schedule online bill payments.

Phone payments

Phone payments are less common with the rise of online payments, but they’re still an option for consumers who don’t have access to a computer. Some pay-by-phone systems use interactive voice response, or IVR, to guide customers through the process.

Wire transfers

Wire transfers are primarily used for B2B payments because they can transfer large sums of money more quickly than other types of EFT payments. However, they also tend to have higher fees than other payment methods.

Are EFT payments safe?

EFT payments are a relatively safe form of payment, and are usually more secure than traditional payment methods like cash or check. But as with any payment method, EFT transfers do have some risks. Fraudsters could make an unauthorized purchase, or a sender could provide the wrong details and send the money to the wrong place.

Here are some of the security practices that keep your money safe:

- Encryption: Banks and payment processors use high-level encryption when they send and receive information related to a money transfer. That means your bank account and personal details are digitally scrambled, so hackers couldn’t make use of them even if they did get hold of the encrypted data.

- Tokenization: Tokenization stores sensitive information in a secure location, and only transfers nonsensitive “tokens”. This is how payment processors can store your credit card information without making it vulnerable to thieves.

- Two-factor authentication: 2FA is used to verify an account holder’s identity by sending a security code to a user’s phone or another trusted device.

Financial institutions do most of the work when it comes to security. But there are still steps that businesses and consumers can take to keep their EFT payments safe:

- Avoid public WiFi networks. Don’t pay bills or make purchases on a shared device or a public WiFi network. If you offer WiFi at your business, maintain a network for guests that’s separate from your point-of-sale system.

- Be on the lookout for phishing attempts. Fraudsters can gain access to your accounts by sending emails or 2FA notifications that look legitimate, but aren’t. Don’t click suspicious links or give out your password to third parties.

- Only send money to trusted recipients. Be careful when sending money to an unfamiliar recipient. Always confirm that the name on the bank account matches the person or entity you’re doing business with.

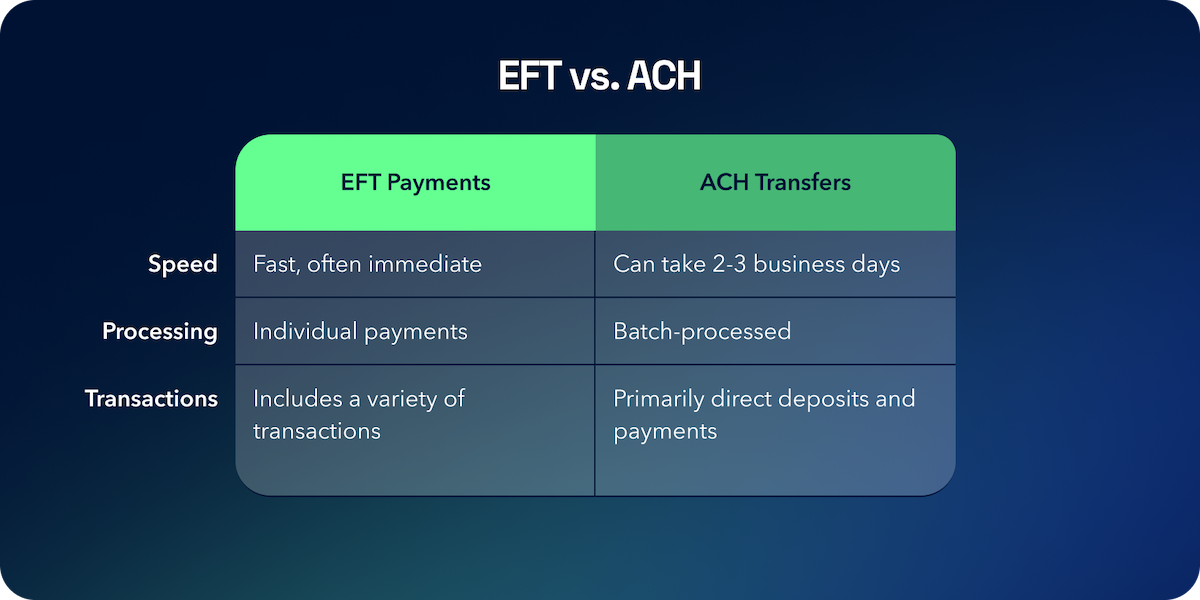

EFT vs. ACH

ACH transfers are a type of EFT payment processed by an automated clearing house, or ACH network. ACH payments are processed in batches, usually overnight, so they take longer to clear than other types of EFT payments.

ACH transactions are best for recurring payments, such as payroll. For large sums or one-time transfers, other payment methods provide more speed and flexibility.

Pros and cons of EFT payments

EFT payments are here to stay. According to the Federal Reserve, ACH transactions alone accounted for $91.85 trillion in non-cash payments in 2021. But EFT payments have their pros and cons. Here are just a few of them:

Pros of EFT payments

- Efficient: Electronic payments are processed more quickly than paper checks and other payment methods, so the recipient gets their money faster.

- Cost-effective: EFT payments, especially ACH transfers, have lower fees than traditional payment methods and involve fewer administrative costs.

- Convenient: EFT payments can be initiated at any time of day, and don’t require the sender or recipient to be physically present.

Cons of EFT payments

- Potential security risks: EFTs can be vulnerable to fraud and data breaches — but new technologies and smart security practices can reduce the risk.

- Technological dependence: If the WiFi goes out or if a point-of-sale system is down, it can be difficult for businesses to accept customer payments.

Pros and cons of different EFT payment types

Automated Clearing House (ACH)

Pros

- Cost-effective: Typically lower fees than wire transfers.

- Widely accepted: Commonly used for payroll, direct deposit, and bill payments.

Cons

- Slower transaction times: Payments are processed in batches, which can delay fund availability.

- Limited international scope: Primarily used within the United States.

Plooto

Pros

- Easily integrates with major accounting software to streamline financial tasks.

- Handles both domestic and international payments with clear and competitive pricing.

- Uses strong encryption and follows strict compliance standards to secure different types of transactions.

Cons

- Internet-dependent: Needs a stable internet connection to function, which can be a drawback in areas with poor connectivity.

PayPal

Pros

- Global recognition: Widely recognized and used across various countries.

- User-friendly interface: Easy to use for both sending and receiving funds.

Cons

- Higher fees: Can incur substantial fees, especially for business transactions and currency conversions.

- Account limitations: PayPal has been known to freeze accounts with little warning, disrupting business operations.

Venmo

Pros

- Social features: Includes social elements that make sending money to friends and contacts easy and fun.

- Instant transfer options: Offers an option for instant transfers to linked bank accounts.

Cons

- Primarily for personal use: Not widely accepted for business transactions.

- Privacy concerns: Transactions are publicly visible by default, raising privacy issues.

Stripe

Pros

- Comprehensive developer tools: Offers extensive APIs that allow businesses to customize their payment processing.

- Strong security measures: Implements advanced security protocols to protect transaction data.

Cons

- Can be expensive for smaller businesses due to its fee structure that includes a percentage of each transaction.

- To get the most out of its features, a degree of technical knowledge is necessary.

Square

Pros

- Offers point-of-sale hardware that integrates directly with its service.

- Suitable for both online and in-person transactions.

Cons

- Charges per transaction, which can accumulate, especially for businesses with small ticket sizes.

- Most effective when used with Square's hardware, which represents an additional cost.

EFTs and international payments

EFT payments can be used for international payments, but the process can vary depending on which EFT payment is used.

Making an international payment is a lot like making an ACH payment, but it may take longer to process. Instead of going through the ACH network, your payment may need to go through an international banking system like the SWIFT or IBAN network.

In the U.S., EFT payments are regulated by the Electronic Fund Transfer Act (EFTA), which sets out compliance and record-keeping requirements. Electronic transfers may not be available to all countries, and you may need to pay higher transaction fees.

Some payment providers, like Plooto, allow you to make international payments with borderless payment processing. You can make cross-border payments (in the same currency), as well as FX transactions with no foreign transaction fee.

Using EFTs to improve cash flow: A real life example

One notable example of the benefits of EFT payments is The Influence Agency, a leading digital marketing firm that leverages Plooto to automate their accounts receivable process. Before adopting Plooto, The Influence Agency faced significant challenges with manual payment processing, such as time-consuming reconciliation tasks and high processing fees for international transactions.

Benefits experienced by The Influence Agency:

- By automating their payment collection process with Plooto, The Influence Agency eliminated the inefficiencies of manual check payments. This streamlined process ensured timely and accurate receipt of funds, drastically reducing the time spent on administrative tasks.

- The agency saved over $1,000 per month by reducing credit card processing fees and avoiding high international transaction costs. Plooto's flat-rate international payments and competitive exchange rates provided substantial financial benefits.

- The automated system allowed The Influence Agency to manage payments to hundreds of recipients effortlessly. This newfound efficiency freed up valuable time, enabling the team to focus on creative projects and client campaigns.

By implementing Plooto's EFT solutions, The Influence Agency not only optimized their financial operations but also significantly improved their overall business efficiency and cost-effectiveness.

What are B2B EFT payments?

Business-to-business (B2B) EFT payments are money transfers between businesses that are handled electronically. These might include recurring payments to a vendor or supplier, or one-time payments to a contractor or freelancer.

As with B2C payments, you can make B2B EFT payments with an electronic check, a debit or credit card, an ACH transfer, or another EFT payment method.

B2B EFT payments are ideal for modern businesses because they allow you to send and receive money faster and maintain a digital paper trail.

B2B EFT transfers allow for:

- Greater efficiency in transactions: Reduce payment delays by eliminating paper checks and incentivizing on-time digital payments.

- Lower transaction costs: Replace the fees associated with checks and wire transfers with transparent ACH and credit card processing fees.

- Improved cash flow: Achieve better cash flow management by streamlining your accounts receivable process and facilitating cash flow projections. This also helps with important KPI like accounts receivable turnover.

- Increased security: Modern security measures make EFT payments safer than cash or check, especially when transferring large sums of money.

- Integrations: Integrate your payment platform with your ERP and accounting software to support automatic reconciliation and accurate record-keeping.

- Compliance: EFTs help you handle the complexities of international payment systems and ensure compliance with a digital audit trail.

FAQs

What are EFT payments? ›

What is an EFT payment? An electronic funds transfer (EFT), or direct deposit, is a digital money movement from one bank account to another. These transfers take place independently from bank employees. As a digital transaction, there is no need for paper documents.

Electronic fund transfers (EFTs) include several types of payment methods, including ACH and global ACH, wire transfer, credit cards and debit cards, peer-to-peer, phone payment transactions, point of sale, eCommerce, and ATM transactions.

Electronic Funds Transfer (EFT) payments are quick, easy, and reliable. They require minimal effort from either the sender or recipient, making them an attractive solution for businesses and individuals alike.

To make an EFT payment, the sender must know the recipient's bank account information. If you're making an EFT payment, you must authorize the funds transfer. Then, the money is taken from your account and deposited into the recipient's account. There might be a fee for some EFT transactions.

What is the purpose of the EFT? ›

Emotional freedom technique (EFT) is a method some people use to help manage emotions and troubling thoughts. They may also use it to lower their stress and anxiety. For example, EFT may help calm you if you're feeling angry.

But due to the Electronic Fund Transfer Act (EFTA), EFT payments are generally considered safe. Under the EFTA, you'll have some legal protection if something goes wrong.

What is required for an EFT payment? ›

You can set up one-time or recurring EFT transactions and allow up to three layers of approval for sending or receiving money. To set up a payment to another account, you need their bank account number, their institution number, branch number and account number, and their transit number.

What is the maximum amount you can send through EFT? ›

There are also hourly and daily limits: For any 24-hour period, you can send up to 3,000∗∗.Forany7−dayperiod,youcansendupto3,000. For any 7-day period, you can send up to 3,000∗∗.Forany7−dayperiod,youcansendupto10,000. For any 30-day period, you can send up to $30,000.

Is EFT the same as direct deposit? ›

31 U.S.C. 3332 generally requires all federal payments, other than payments under the Internal Revenue Code, be delivered by Direct Deposit also known as Electronic Funds Transfer (EFT), unless a waiver is available.

What are 2 disadvantages of an EFT? ›

However, like any other system, EFT has its drawbacks:

- Risk of Fraud: Despite security measures, cybercriminals may attempt to intercept sensitive data during transmission.

- Technical Issues: Server crashes or network issues can delay transactions or lead to processing errors.

Why should I use EFT? ›

Pros of EFT payments

Efficient: Electronic payments are processed more quickly than paper checks and other payment methods, so the recipient gets their money faster. Cost-effective: EFT payments, especially ACH transfers, have lower fees than traditional payment methods and involve fewer administrative costs.

The main difference between EFT and ACH payments is that EFT is an umbrella term for all digital payments, whereas ACH is only a specific type of digital payment. But they are both digital payments, and in fact, ACH is a type of EFT payment.

For example, you could say, "Even though I feel anxious about work tomorrow, I deeply and completely accept myself." Or you could say, "Even though my partner broke up with me, I deeply and completely accept myself." Tap repeatedly on the edge of your palm, below your little finger.

EFT tapping is easy to use as a self-help technique because you can do it any time you feel the need. A practitioner can provide in-depth help if needed. EFT tapping sessions follow a set sequence: Begin by stating what is on your mind and rating your distress on a scale of 0 to 10.

What are the side effects of EFT tapping? ›

“There are no known side effects or negatives of EFT tapping, and it really is a safe, effective and accessible therapy that can be used by children and adults,” says Capanna-Hodge. While EFT tapping is widely considered safe, some people may start feeling emotional during an EFT tapping session, according to Ewing.

What's the difference between EFT and ACH? ›

EFT includes any money transfers between banks, while also including things like digital wallets and ATM cash withdrawals. The big ACH and EFT difference is that ACH specifically refers to payments sent via Automated Clearing House. Another ACH and EFT difference involves timing and cost.

What is EFT form of payment? ›

EFT meaning

Essentially, EFT (electronic fund transfer) is used to move money from one account to another. The transaction is completed electronically, and the two accounts can be at the same financial institution or different financial institutions. However, the term “EFT” doesn't refer to a specific type of payment.

Which of the following are examples of EFT payments? ›

Here are some popular types of EFTs that move funds around the world through a variety of use cases:

- ACH direct deposit. ...

- ACH direct payments. ...

- ACH direct debits. ...

- Wire transfer. ...

- ATM transactions. ...

- Debit cards. ...

- Peer-to-peer payments. ...

- Any electronic payment sent using bank account information.

Author information

Name: Terence Hammes MD

Birthday: 1992-04-11

Address: Suite 408 9446 Mercy Mews, West Roxie, CT 04904

Phone: +50312511349175

Job: Product Consulting Liaison

Hobby: Jogging, Motor sports, Nordic skating, Jigsaw puzzles, Bird watching, Nordic skating, Sculpting

Introduction: My name is Terence Hammes MD, I am a inexpensive, energetic, jolly, faithful, cheerful, proud, rich person who loves writing and wants to share my knowledge and understanding with you.