Expected Present and Final Value of an Annuity when some Non-Central Moments of the Capitalization Factor are Unknown: Theory and an Application using R (original) (raw)

Abstract

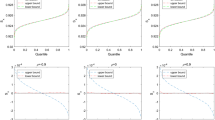

The aim of this chapter is the development of three approaches for obtaining the value of an _n_-payment annuity, with payments of 1 unit each, when the interest rate is random. To calculate the value of these annuities, we are going to assume that only some non-central moments of the capitalization factor are known. The first technique consists in using a tetraparametric function which depends on the arctangent function. The second expression is derived from the so-called quadratic discounting whereas the third approach is based on the approximation of the mathematical expectation of the ratio of two random variables by Mood et al. (1974). A comparison of these methodologies through an application, using the R statistical software, shows that all of them lead to different results.

Similar content being viewed by others

Present Value

Chapter © 2018

References

- Calot, G., 1974. Curso de Estadística Descriptiva. Ed. Paraninfo, Madrid.

Google Scholar - Cruz Rambaud, S., Maturo, F., Sánchez Pérez, A.M., 2015. Approach of the value of an annuity when non-central moments of the capitalization factor are known: an R application with interest rates following normal and beta distributions. Ratio Mathematica 28, 15–30.

Google Scholar - Cruz Rambaud, S., Sánchez Pérez, A.M., 2016. Una aproximación del valor de una renta cuando el tipo de interés es aleatorio. XXIV Jornadas de Asepuma y XII Encuentro Internacional Granada (Spain), July 7–8.

Google Scholar - Cruz Rambaud, S., Valls Martínez, M.C., 2002. La determinación de la tasa de actualización para la valoración de empresas. Análisis Financiero 87-2, 72–85.

Google Scholar - Fisz, M., 1963. Probability Theory and Mathematical Statistics. John Wiley and Sons, Inc, New York.

MATH Google Scholar - Mira Navarro, J.C., 2014. Introducción a las Operaciones Financieras. Creative Commons, http://www.miramegias.com/emodulos/fileadmin/pdfs/mof.pdf.

- Mood, A.M., Graybill, F.A., Boes, D.C., 1974. Introduction to the Theory of Statistics. 3rd Ed. Boston: McGraw Hill.

Google Scholar - Rice, J.A., 2006. Mathematical Statistics and Data Analysis. 2nd Ed. California: Duxbury Press.

Google Scholar - Suárez Suárez, A.S., 2005. Decisiones Óptimas de Inversión y Financiación en la Empresa. 2nd Ed. Madrid, Ed. Pirámide.

Google Scholar - Villalón, J.G., Martínez Barbeito, J., Seijas Macías, J.A., 2009. Sobre la evolución de los tantos de interés. XVII Jornadas de Asepuma y V Encuentro Internacional 17, 1–502.

Google Scholar

Author information

Authors and Affiliations

- Department of Economics and Business, University of Almería, Almería, Spain

Salvador Cruz Rambaud & Ana María Sánchez Pérez - Department of Management and Business Administration, University of Chieti-Pescara, Chieti, Italy

Fabrizio Maturo

Authors

- Salvador Cruz Rambaud

You can also search for this author inPubMed Google Scholar - Fabrizio Maturo

You can also search for this author inPubMed Google Scholar - Ana María Sánchez Pérez

You can also search for this author inPubMed Google Scholar

Corresponding author

Correspondence toSalvador Cruz Rambaud .

Editor information

Editors and Affiliations

- Department of Mathematics and Physics, Faculty of Military Technology, University of Defence, Brno, Czech Republic

Šárka Hošková-Mayerová - Department of Business Administration, University “G. d’Annunzio” of Chieti-Pescara, Pescara, Italy

Fabrizio Maturo - Systems Research Institute, Polish Academy of Sciences, Warsaw, Poland

Janusz Kacprzyk

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Cruz Rambaud, S., Maturo, F., Sánchez Pérez, A.M. (2017). Expected Present and Final Value of an Annuity when some Non-Central Moments of the Capitalization Factor are Unknown: Theory and an Application using R. In: Hošková-Mayerová, Š., Maturo, F., Kacprzyk, J. (eds) Mathematical-Statistical Models and Qualitative Theories for Economic and Social Sciences. Studies in Systems, Decision and Control, vol 104. Springer, Cham. https://doi.org/10.1007/978-3-319-54819-7\_16

Download citation

- .RIS

- .ENW

- .BIB

- DOI: https://doi.org/10.1007/978-3-319-54819-7\_16

- Published: 23 June 2017

- Publisher Name: Springer, Cham

- Print ISBN: 978-3-319-54818-0

- Online ISBN: 978-3-319-54819-7

- eBook Packages: EngineeringEngineering (R0)