Specialised property valuation: Multiple criteria decision analysis (original) (raw)

To carry out the MCDA of the specialised property, the decision-making matrix must be prepared in the following stages: (1) all information about specialised property to be valued is collected; (2) the criteria defining the aims of the multiple criteria analysis are determined; (3) values, levels of significance and units of measurement of criteria of comparable alternatives are defined; (4) criteria, their value and levels of significance make up the grouped decision-making matrix (Zavadskas et al., 1997; Maliene, 2001).

One of the most important stages in multiple criteria analysis of property is the determination of the values and levels of significance of the criteria describing the properties. Levels of significance of the criteria defining the quality and quantity of the properties to be valued and values of the qualitative criteria for the alternatives are estimated through the application of expert, social, normative, calculation and analogue methods.

When the calculation is carried out in accordance with the expert method, the qualitative values of criteria can be expressed in a certain number of points. Criteria can be estimated according to the increasing or decreasing valuation scale.

To estimate the proportional values of the quantitative criteria, the expert valuation is based on comparison. In this case, the values of the qualitative criteria are estimated as follows: (1) the best suitable value of the criterion x best is selected; (2) the value of the best selected criterion is set equal to the magnitude of one point (x best =1); (3) the ratio between the best criterion's value (x best = 1) and the remaining values (x i ) of the same criterion is estimated and expressed in percentage (p i ); (4) the relative values are attributed to the remaining values of the criterion (x i =(1−p i )÷100); (5) relative values of all the criteria are set equal to the magnitude of one point (Table 1).

Table 1 The grouped decision-making matrix of the MCDA of properties to be valued

Initial significance of the criteria is determined in a similar way. The market price of specialised property reflects quality and quantity, as well as supply and demand for the property; therefore, the significance of the market price criterion for the given specialised property is equal to the total sum of significance of all the remaining criteria, that is, to one point or 100 per cent. The levels of significance of other criteria are determined by the expert method.

The decision-making matrix must be prepared in order to carry out the multiple criteria analysis of specialised property. The matrix is prepared through the analysis of the quantitative and conceptual information of the specialised properties to be valued, as well as by estimation of the criteria values and levels of significance of the properties.

The value of the property under valuation is determined by means of reiteration through several repetitive cycles of refinement until the mean deviation k x of the degree of utility N j of the property a x under valuation satisfies the condition k ax < ±1%. The initial price of the property under valuation is estimated according to the purchase prices of the comparable properties and is equal to the mean of purchase prices of the comparable properties.

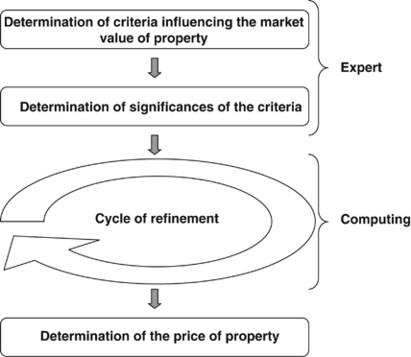

The essence of the method of multiple criteria analysis in estimating property price is presented in Figure 1. The method is composed of a total of four stages, of which two are stages concerned with the preparation of initial data.

Figure 1

MCDA method overview

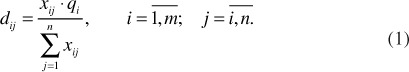

Stage three is a reiteration of refinement cycles, which results in stage four, at which the specialised property price is determined. A normalised decision-making matrix D is formed. The purpose of this stage is to obtain dimensionless weighted values from comparative indexes. When the dimensionless weighted values are known, it is possible to compare all the indexes of different units of measurement. The following formula is used for that purpose:

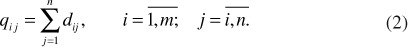

The sum of the dimensionless weighted values d ij of each criterion x i always equals the significance q i of this criterion.

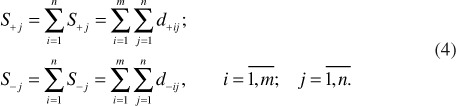

The sums of the minimising indexes S_−_j and maximising indexes S −j characterising the j variant are calculated. They are calculated according to the following formula:

In this case, the values of S +j and S −j express the degree to which the property being compared achieves its purposes.

In any case, the sums of all the pluses S +j and minuses S −j of the properties being compared are always equal to all the sums of significance of the maximising and minimising criteria:

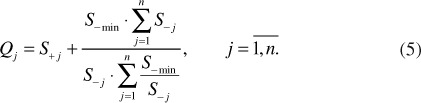

The relative significance (effectiveness) of properties being compared is determined in accordance with the positive (pluses) S +j and negative (minuses) S −j qualities that characterise these properties. The relative significance Q j of each alternative a j is determined according to the following formula:

The prioritisation of the properties is determined. The larger the Q j , the larger the effectiveness (prioritisation) of that alternative. The summarised criterion Q j directly and proportionately depends on the relative influence of the value and the initial significance of the criteria under comparison on the final result.

The degree of utility N j of the property a j is determined according to the following formula:

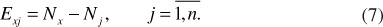

The degree of effectiveness E xj of all the alternatives a j is determined. It shows by what percentage a property a x is better or worse in comparison with another property a j :

The mean deviation k x of the degree of utility N j of the property a x is determined:

If the mean deviation k x of the degree of utility N j of the property a x under valuation does not satisfy the condition:

then proceed to formula 10.

The value V xp of the property under valuation is refined according to the following formula:

V xp is the refined value of the property under valuation. C x is the refined value of the property under valuation after the _n_th iteration. k x is the mean deviation of the degree of utility N j of the property under valuation.

The price of the specialised property under valuation is refined by means of reiteration through several repetitive cycles of refinement until the mean deviation k x of the degree of utility of the property under valuation satisfies condition (9). After condition (9) is satisfied at stage 10 by the method of multiple criteria analysis in estimating the property price, proceed to stage 12.

The value V x of the property being valued is determined according to the following formula:

V x is the value of the property under valuation, C x is the refined value of the property under valuation after nth iteration, k x is the mean deviation of the degree of utility N j of the property under valuation.