AmaraRaja Batteries Share Price Today, AmaraRaja Batteries Stock Price Live NSE/BSE, Share Price Insights (original) (raw)

AmaraRaja Batteries - Amara Raja Energy & Mobility Share Price

- Overview

- News

- Analysis

- Recos

- Financials

- Forecast

- Technicals

- Peers

- Shareholdings

- MF

- F&O

- Corp Actions

- About

View All

- Board Meeting was held on Feb 8, 2025

Meeting Agenda: Quarterly Results. Please add to watchlist to track closely. - Employee & Interest Expense

Company has spent less than 1% of its operating revenues towards interest expenses and 6.28% towards employee cost in the year ending Mar 31, 2024. (Source: Consolidated Financials) - Sell Signal: Bear gaining steam

10 day moving crossover appeared on Feb 10, 2025. Average price decline of -2.5% within 7 days of this signal in last 5 years. - Stock Returns vs Nifty Midcap 100

Stock gave a 3 year return of 64.89% as compared to Nifty Midcap 100 which gave a return of 76.5%. (as of last trading session) - AmaraRaja Batteries Share Price Update

Amara Raja Energy & Mobility Ltd. share price moved down by -0.25% from its previous close of Rs 1,001.85. Amara Raja Energy & Mobility Ltd. stock last traded price is 999.35Share Price Value Today/Current/Last 999.351,001.20 Previous Day 1,001.851,000.80

InsightsAmaraRaja Batteries

Do you find these insights useful?

- hate it

- meh

- love it

Key Metrics

| (x) | 18.06 |

|---|---|

| (₹) | 55.34 |

| (₹ Cr.) | 18,290.64 |

| 12 | |

| (x) | 2.70 |

| (%) | 0.99 |

| (₹) | 1.00 |

| 0.24 | |

| (₹) | 992.50 |

| 52W H/LBV/ShareMCap/Sales |

| (x) | 18.09 |

|---|---|

| (₹) | 55.34 |

| (₹ Cr.) | 18,324.50 |

| 12 | |

| (x) | 2.69 |

| (%) | 0.99 |

| (₹) | 1.00 |

| 0.24 | |

| (₹) | 989.49 |

| 52W H/LBV/ShareMCap/Sales |

Key Metrics

| (x) | 18.06 |

|---|---|

| (₹) | 55.34 |

| (%) | 0.99 |

| (₹) | 992.50 |

| (x) | 2.70 |

| (₹ Cr.) | 18,290.64 |

| (₹) | 1.00 |

| (₹) | 371.46 |

| 12 | |

| (₹) | 1,775.95 / 737.70 |

| 0.24 | |

| 1.19 |

| (x) | 18.09 |

|---|---|

| (₹) | 55.34 |

| (%) | 0.99 |

| (₹) | 989.49 |

| (x) | 2.69 |

| (₹ Cr.) | 18,324.50 |

| (₹) | 1.00 |

| (₹) | 371.46 |

| 12 | |

| (₹) | 1,774.90 / 737.65 |

| 0.24 | |

| 1.19 |

AmaraRaja Batteries Share Price Returns

| 1 Day | -0.25% |

|---|---|

| 1 Week | -8.76% |

| 1 Month | -7.41% |

| 3 Months | -21.29% |

| 1 Year | 18.2% |

| 3 Years | 64.48% |

| 5 Years | 30.42% |

| 1 Day | 0.03% |

|---|---|

| 1 Week | -8.57% |

| 1 Month | -7.25% |

| 3 Months | -21.09% |

| 1 Year | 18.35% |

| 3 Years | 64.71% |

| 5 Years | 30.82% |

AmaraRaja Batteries News & Analysis

Budget 2025: Green energy stocks soar up to 15% after FM announces plans for clean tech manufacturing

Budget 2025: Green energy stocks soar up to 15% after FM announces plans for clean tech manufacturing

News- Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

Announcements - Announcement under Regulation 30 (LODR)-Investor Presentation

Announcements - Announcement under Regulation 30 (LODR)-Newspaper Publication

Announcements

AmaraRaja Batteries Share Recommendations

Recent Recos

HOLD

Current

Mean Recos by 14 Analysts

Strong

SellSellHoldBuyStrong

Buy

Target₹1395

OrganizationHem Securities

BUY

Target₹1390

OrganizationMotilal Oswal Financial Services

NEUTRAL

Analyst Trends

| Ratings | Current | 1 Week Ago | 1 Month Ago | 3 Months Ago |

|---|---|---|---|---|

| Strong Buy | 2 | 2 | 2 | 2 |

| Buy | 5 | 5 | 5 | 5 |

| Hold | 5 | 5 | 5 | 4 |

| Sell | 1 | 1 | 1 | 1 |

| Strong Sell | 1 | 1 | 1 | 2 |

| # Analysts | 14 | 14 | 14 | 14 |

AmaraRaja Batteries Financials

Insights

- Employee & Interest Expense

Company has spent less than 1% of its operating revenues towards interest expenses and 6.28% towards employee cost in the year ending Mar 31, 2024. (Source: Consolidated Financials)Quarterly | Annual Dec 2024 Sep 2024 Jun 2024 Mar 2024 Dec 2023 Total Income 3,307.17 3,276.20 3,292.64 2,941.19 3,067.99 Total Income Growth (%) 0.95 -0.50 11.95 -4.13 2.64 Total Expenses 2,887.15 2,945.52 2,948.49 2,620.90 2,729.80 Total Expenses Growth (%) -1.98 -0.10 12.50 -3.99 2.78 EBIT 420.02 330.68 344.15 320.29 338.19 EBIT Growth (%) 27.02 -3.91 7.45 -5.29 1.49 Profit after Tax (PAT) 298.37 235.61 249.12 229.78 254.75 PAT Growth (%) 26.64 -5.42 8.42 -9.80 6.86 EBIT Margin (%) 12.70 10.09 10.45 10.89 11.02 Net Profit Margin (%) 9.02 7.19 7.57 7.81 8.30 Basic EPS (₹) 16.30 12.87 13.61 12.55 14.91 Quarterly | Annual Dec 2024 Sep 2024 Jun 2024 Mar 2024 Dec 2023 ------------------------- -------- -------- -------- -------- -------- Total Income 3,193.27 3,154.30 3,156.74 2,825.07 2,904.77 Total Income Growth (%) 1.24 -0.08 11.74 -2.74 2.32 Total Expenses 2,760.46 2,817.20 2,819.11 2,510.00 2,585.57 Total Expenses Growth (%) -2.01 -0.07 12.32 -2.92 2.52 EBIT 432.81 337.10 337.63 315.07 319.20 EBIT Growth (%) 28.39 -0.16 7.16 -1.29 0.74 Profit after Tax (PAT) 311.83 240.71 244.55 228.03 239.64 PAT Growth (%) 29.55 -1.57 7.24 -4.84 5.85 EBIT Margin (%) 13.55 10.69 10.70 11.15 10.99 Net Profit Margin (%) 9.77 7.63 7.75 8.07 8.25 Basic EPS (₹) 17.04 13.15 13.36 12.46 14.03 Quarterly | Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 --------------------------- --------- --------- -------- -------- -------- Total Revenue 11,818.85 10,480.24 8,775.13 7,237.14 6,894.22 Total Revenue Growth (%) 12.77 19.43 21.25 4.97 0.79 Total Expenses 10,568.63 9,485.41 8,084.01 6,363.79 6,053.56 Total Expenses Growth (%) 11.42 17.34 27.03 5.12 -0.92 Profit after Tax (PAT) 934.38 694.53 512.57 646.83 660.80 PAT Growth (%) 34.53 35.50 -20.76 -2.11 36.75 Operating Profit Margin (%) 10.97 9.78 8.12 12.36 12.47 Net Profit Margin (%) 7.98 6.68 5.89 9.04 9.66 Basic EPS (₹) 51.05 40.66 30.01 37.87 38.69 Quarterly | Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 --------------------------- --------- --------- -------- -------- -------- Total Revenue 11,361.84 10,475.24 8,773.80 7,237.04 6,894.51 Total Revenue Growth (%) 8.46 19.39 21.23 4.97 0.80 Total Expenses 10,150.81 9,480.02 8,084.00 6,363.71 6,053.83 Total Expenses Growth (%) 7.08 17.27 27.03 5.12 -0.91 Profit after Tax (PAT) 905.86 694.41 511.25 646.81 660.82 PAT Growth (%) 30.45 35.83 -20.96 -2.12 36.68 Operating Profit Margin (%) 11.04 9.79 8.10 12.36 12.46 Net Profit Margin (%) 8.04 6.68 5.87 9.04 9.66 Basic EPS (₹) 49.49 40.65 29.93 37.87 38.69 All figures in Rs Cr, unless mentioned otherwise

- Employee & Interest Expense

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Total Assets 8,977.76 7,123.85 6,376.10 5,796.89 5,000.40 Total Assets Growth (%) 26.02 11.73 9.99 15.93 11.23 Total Liabilities 2,179.03 1,824.61 1,823.62 1,586.90 1,345.09 Total Liabilities Growth (%) 19.42 0.05 14.92 17.98 15.89 Total Equity 6,798.73 5,299.24 4,552.48 4,209.99 3,655.31 Total Equity Growth (%) 28.30 16.40 8.14 15.17 9.60 Current Ratio (x) 2.24 2.35 1.85 2.12 2.02 Total Debt to Equity (x) 0.01 0.00 0.01 0.01 0.01 Contingent Liabilities 1,121.72 625.00 487.54 858.02 367.49 Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 ---------------------------- -------- -------- -------- -------- -------- Total Assets 8,834.31 7,099.08 6,375.85 5,797.08 5,000.59 Total Assets Growth (%) 24.44 11.34 9.98 15.93 11.22 Total Liabilities 2,065.66 1,801.24 1,824.46 1,586.82 1,344.98 Total Liabilities Growth (%) 14.68 -1.27 14.98 17.98 15.88 Total Equity 6,768.65 5,297.84 4,551.39 4,210.26 3,655.61 Total Equity Growth (%) 27.76 16.40 8.10 15.17 9.60 Current Ratio (x) 2.14 2.25 1.85 2.12 2.02 Total Debt to Equity (x) 0.01 0.00 0.01 0.01 0.01 Contingent Liabilities 769.43 377.06 487.54 858.02 367.49 All figures in Rs Cr, unless mentioned otherwise Insights

- Increase in Cash from Investing

Company has used Rs 1020.12 cr for investing activities which is an YoY increase of 35.27%. (Source: Consolidated Financials)Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Net Cash flow from Operating Activities 1,266.02 914.37 633.26 802.21 1,176.56 Net Cash used in Investing Activities -1,020.12 -754.15 -481.89 -634.97 -849.36 Net Cash flow from Financing Activities -242.49 -100.40 -213.48 -121.50 -363.79 Net Cash Flow 3.47 60.01 -62.07 64.31 -17.61 Closing Cash & Cash Equivalent 98.34 94.87 34.86 96.93 32.62 Closing Cash & Cash Equivalent Growth (%) 3.66 172.15 -64.04 197.15 -35.06 Total Debt/ CFO (x) 0.04 0.02 0.04 0.03 0.03 Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 ----------------------------------------- ---------- -------- -------- -------- -------- Net Cash flow from Operating Activities 1,314.20 925.94 632.95 802.03 1,176.91 Net Cash used in Investing Activities -1,071.96 -770.41 -481.89 -634.97 -849.65 Net Cash flow from Financing Activities -242.46 -100.40 -213.48 -121.50 -363.79 Net Cash Flow -0.22 55.13 -62.42 64.13 -17.55 Closing Cash & Cash Equivalent 89.22 89.44 34.31 96.73 32.60 Closing Cash & Cash Equivalent Growth (%) -0.25 160.68 -64.53 196.72 -35.00 Total Debt/ CFO (x) 0.04 0.02 0.04 0.03 0.03 All figures in Rs Cr, unless mentioned otherwise

- Increase in Cash from Investing

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Return on Equity (%) 13.74 13.10 11.25 15.36 18.07 Return on Capital Employed (%) 17.71 17.92 14.56 19.78 21.87 Return on Assets (%) 10.40 9.74 8.03 11.15 13.21 Interest Coverage Ratio (x) 51.47 65.40 72.98 83.94 69.96 Asset Turnover Ratio (x) 1.45 1.54 1.43 123.33 136.77 Price to Earnings (x) 14.90 14.25 17.89 22.57 12.36 Price to Book (x) 2.05 1.87 2.01 3.46 2.23 EV/EBITDA (x) 7.83 6.79 8.28 11.99 7.04 EBITDA Margin (%) 15.10 13.90 12.67 16.82 16.86 Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 ------------------------------ ------- ------- ------- ------- ------- Return on Equity (%) 13.38 13.10 11.23 15.36 18.07 Return on Capital Employed (%) 17.33 18.04 14.53 19.78 21.87 Return on Assets (%) 10.25 9.78 8.01 11.15 13.21 Interest Coverage Ratio (x) 51.94 65.42 72.89 83.94 69.96 Asset Turnover Ratio (x) 1.41 1.54 1.43 123.33 136.77 Price to Earnings (x) 15.38 14.27 17.92 22.57 12.36 Price to Book (x) 2.06 1.87 2.01 3.46 2.23 EV/EBITDA (x) 8.05 6.79 8.29 11.99 7.04 EBITDA Margin (%) 15.30 13.90 12.65 16.82 16.86

Financial InsightsAmaraRaja Batteries

Income (P&L)

Cash Flow

- Employee & Interest Expense

Company has spent less than 1% of its operating revenues towards interest expenses and 6.28% towards employee cost in the year ending Mar 31, 2024. (Source: Consolidated Financials)

- Employee & Interest Expense

- Increase in Cash from Investing

Company has used Rs 1020.12 cr for investing activities which is an YoY increase of 35.27%. (Source: Consolidated Financials)

- Increase in Cash from Investing

Do you find these insights useful?

- hate it

- meh

- love it

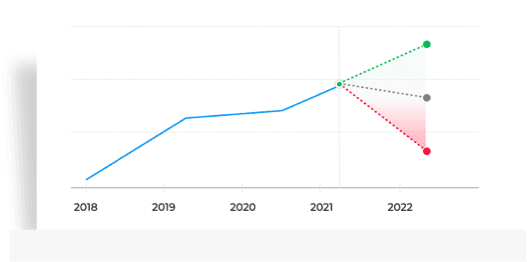

AmaraRaja Batteries Share Price Forecast

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

START FREE TRIAL Get multiple analysts’ prediction on AmaraRaja Batteries

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

START FREE TRIAL Get multiple analysts’ prediction on AmaraRaja Batteries

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

START FREE TRIAL

AmaraRaja Batteries Technicals

Bullish / Bearish signals for AmaraRaja Batteries basis selected technical indicators and moving average crossovers.

10 Day EMA Crossover

Bearish signal on daily chart

Appeared on: 10 Feb 2025

10D EMA: 1062.35

Last 4 Sell Signals_:_21 Jan 2025

Average price decline of -2.50% within 7 days of Bearish signal in last 5 years44%

Positive Movement since

1st Jan 2005 on basis

56%

Negative Movement since

1st Jan 2005 on basis

Exclude

Global Meltdown - 1st Jan 2008 to 10th Nov 2008

Covid Crisis - 1st Feb 2020 to 31st Mar 2020Pivot Levels

| R1 | R2 | R3 | PIVOT | S1 | S2 | S3 | |

|---|---|---|---|---|---|---|---|

| Classic | 1017.90 | 1036.45 | 1078.55 | 994.35 | 975.80 | 952.25 | 910.15 |

Average True Range

| 5 DAYS | 14 DAYS | 28 DAYS | |

|---|---|---|---|

| ATR | 37.91 | 38.79 | 40.01 |

AmaraRaja Batteries Peer Comparison

Insights

- Stock Returns vs Nifty Midcap 100

Stock gave a 3 year return of 64.89% as compared to Nifty Midcap 100 which gave a return of 76.5%. (as of last trading session) - Stock Returns vs Nifty Auto

Stock generated 64.89% return as compared to Nifty Auto which gave investors 100.06% return over 3 year time period. (as of last trading session) - 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

Insights

- Stock Returns vs Nifty Midcap 100

Stock gave a 3 year return of 64.89% as compared to Nifty Midcap 100 which gave a return of 76.5%. (as of last trading session) - Stock Returns vs Nifty Auto

Stock generated 64.89% return as compared to Nifty Auto which gave investors 100.06% return over 3 year time period. (as of last trading session)

- Stock Returns vs Nifty Midcap 100

Ratio Performance

| NAME | P/E (x) | P/B (x) | ROE % | ROCE % | ROA % | Rev CAGR [3Yr] | OPM | NPM | Basic EPS | Current Ratio | Total Debt/ Equity (x) | Total Debt/ CFO (x) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AmaraRaja Batteries | 18.06 | 2.69 | 13.74 | 17.71 | 10.40 | 17.57 | 10.97 | 7.98 | 51.05 | 2.24 | 0.01 | 0.04 |

| Exide Inds. | 39.20 | 2.41 | 6.80 | 9.82 | 4.83 | 3.11 | 8.03 | 5.26 | 10.31 | 1.41 | 0.05 | 0.46 |

| Add More | ||||||||||||

| Annual Ratios (%) | ||||||||||||

| See All Parameters |

Peers InsightsAmaraRaja Batteries

- Stock Returns vs Nifty Midcap 100

Stock gave a 3 year return of 64.89% as compared to Nifty Midcap 100 which gave a return of 76.5%. (as of last trading session) - Stock Returns vs Nifty Auto

Stock generated 64.89% return as compared to Nifty Auto which gave investors 100.06% return over 3 year time period. (as of last trading session)

Do you find these insights useful?

- hate it

- meh

- love it

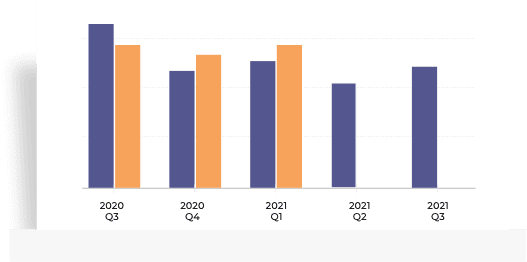

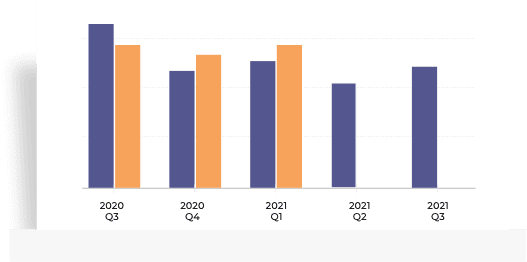

AmaraRaja Batteries Shareholding Pattern

Showing AmaraRaja Batteries Shareholding as on Dec 2024

Category Dec 2024 Sep 2024 Jun 2024 Mar 2024 Promoters 32.86 32.86 32.86 32.86 Pledge 0.00 0.00 0.00 0.00 FII 21.82 22.33 23.84 24.46 DII 14.47 15.24 14.49 15.36 Mutual Funds 5.93 6.25 4.95 4.45 Others 30.84 29.57 28.81 27.31 Showing Shareholding as on Dec 2024

Category No. of Shares Percentage % Change QoQ Promoters 6,01,45,316 32.86 % 0.00 Pledge 0 0.00 % 0.00 FII 3,99,27,345 21.82 % -0.51 DII 2,64,98,740 14.47 % -0.76 MF 1,08,47,689 5.93 % -0.32 Others 5,64,53,963 30.84 % 1.27

AmaraRaja Batteries MF Ownership

- 218.37

Amount Invested (in Cr.) - 1.55%

% of AUM - 0.00

% Change (MoM basis)

- 218.37

- 182.98

Amount Invested (in Cr.) - 0.46%

% of AUM - 0.00

% Change (MoM basis)

- 182.98

- 134.96

Amount Invested (in Cr.) - 0.75%

% of AUM - 0.00

% Change (MoM basis)

- 134.96

MF Ownership as on 31 December 2024

AmaraRaja Batteries F&O Quote

- ExpiryPlease select expiry month:

Open High Low Prev Close Contracts Traded Turnover (₹ Lakhs) - - - - - - Open Interest as of

- ExpiryPlease select expiry month:

AmaraRaja Batteries Corporate Actions

Meeting Date Announced on Purpose Details Feb 08, 2025 Dec 26, 2024 Board Meeting Quarterly Results Nov 04, 2024 Sep 26, 2024 Board Meeting Quarterly Results & Interim Dividend Aug 03, 2024 Jun 27, 2024 Board Meeting Quarterly Results Aug 03, 2024 May 29, 2024 AGM Book closure from Jul 19, 2024 to Jul 25, 2024 May 28, 2024 Mar 27, 2024 Board Meeting Audited Results & Final Dividend Type Dividend Dividend per Share Ex-Dividend Date Announced on Interim 530% 5.3 Nov 14, 2024 Nov 04, 2024 Final 510% 5.1 Jul 18, 2024 May 28, 2024 Interim 480% 4.8 Nov 10, 2023 Oct 31, 2023 Final 320% 3.2 Jul 28, 2023 May 23, 2023 Interim 290% 2.9 Nov 15, 2022 Nov 03, 2022 All Types Ex-Date Record Date Announced on Details Splits Sep 25, 2012 Sep 26, 2012 May 28, 2012 Split: Old FV2.0| New FV:1.0 Bonus Oct 14, 2008 Oct 15, 2008 Jun 24, 2008 Bonus Ratio: 1 share(s) for every 2 shares held Splits Sep 19, 2007 Sep 26, 2007 Jun 22, 2007 Split: Old FV10.0| New FV:2.0

About AmaraRaja Batteries

Amara Raja Energy & Mobility Ltd., incorporated in the year 1985, is a Mid Cap company (having a market cap of Rs 18,290.64 Crore) operating in Auto Ancillaries sector. Amara Raja Energy & Mobility Ltd. key Products/Revenue Segments include Batteries (Storage), UPS/Uninterruptible Power Supply Systems, Export Incentives, Sale of services and Scrap for the year ending 31-Mar-2024.For the quarter ended 31-12-2024, the company has reported a Consolidated Total Income of Rs 3,307.17 Crore, up .95 % from last quarter Total Income of Rs 3,276.20 Crore and up 7.80 % from last year same quarter Total Income of Rs 3,067.99 Crore. Company has reported net profit after tax of Rs 298.37 Crore in latest quarter.The company’s top management includes Mr.Jayadev Galla, Mr.Harshavardhana Gourineni, Mr.Vikramadithya Gourineni, Mr.Amar Patnaik, Mr.Annush Ramasamy, Ms.Bhairavi Tushar Jani, Mr.N Sri Vishnu Raju, Mr.T R Narayanaswamy, Mr.Y Delli Babu, Mr.C Narasimhulu Naidu, Mr.Vikas Sabharwal. Company has Deloitte Haskins & Sells LLP as its auditors. As on 31-12-2024, the company has a total of 18.30 Crore shares outstanding.AmaraRaja Batteries Share Price Today is Rs. 999.35. On previous day, the AmaraRaja Batteries Share Price (NSE) closed at Rs. 1032.25, featuring among the most traded securities on the National Stock Exchange.

Shareholdings:

As of 31st Dec, 2024, the promoter held 32.86% of the stake in AmaraRaja Batteries shares, out of which 0.0% was pledged. On the same date, foreign institutional investors' (FII) holdings of AmaraRaja Batteries stocks was 21.82% as compared to 22.33% in Sep 2024 with decrease of 0.51%. The domestic institutional investors (DII) holdings on 31st Dec, 2024 was 14.48% as compared to 15.24% in Sep 2024 with decrease of 0.76%. Out of the total DII holdings in AmaraRaja Batteries shares 5.93% was held by mutual funds. The rest including public held is 30.84%. AmaraRaja Batteries stock price is reflected on both the exchanges - BSE and NSE.

Dividend, Bonus & Split Information:

AmaraRaja Batteries Dividend: Ever since 1985, AmaraRaja Batteries dividends has been paid out around 36 times. As on 12 Feb, 2025, 03:59 PM IST, The overall dividend yield for AmaraRaja Batteries stands at 0.99%. The last dividend paid was on November 14, 2024 (Rs. 5.3). The Earnings Per Share (EPS) for quarter ending 31st Dec 2024 is Rs. 55.34.

AmaraRaja Batteries Bonus: The most recent bonus issue had been in year October 14, 2008 around 16 years ago at 2 : 1 ratio. The first bonus issue was announced in Jun 2008.

Stock Forecast:

After showing 3307.17 Cr. of sales and 0.95% of quarterly net profit, there have been multiple ups and downs in the AmaraRaja Batteries stock prices in the past few weeks. For example, AmaraRaja Batteries stock price on 4th of February 2025 was around Rs. 1068.2. AmaraRaja Batteries share price now stands at an average of Rs. 999.35. Judging by last week's performance, stock is in down trend.

AmaraRaja Batteries has a median target price of Rs. 1461.0 in 12 months by 13 analysts. They have provided a high estimate of Rs. 2000.0 and low estimate of Rs. 1050.0 for AmaraRaja Batteries share.

Historical Prices and Performance:

AmaraRaja Batteries, incorporated in 1985 is a Mid Cap company (with a market cap of Rs. 18336.4) operating in Auto Ancillaries sector.

The Return of Equity (ROE) in last five financial years given by AmaraRaja Batteries stock was 13.74%, 13.1%, 11.25%, 15.36% and 18.07% respectively.

The AmaraRaja Batteries share gave a 3 year return of 64.89% as compared to Nifty 50 which gave a return of 32.79%.

AmaraRaja Batteries announced 530.0% final dividend on November 14, 2024.

Key Metrics:

PE Ratio of AmaraRaja Batteries is 18.08

Prices/Sales Ratio of AmaraRaja Batteries is 1.19

Price/Book Ratio of AmaraRaja Batteries is 2.69

Peer Insights:

Peers are businesses with comparable activities, buisness objectives and affiliation with a particular industry area. For AmaraRaja Batteries, major competitors and peers include Exide Inds.. As of Sep 2024, the dividend yield of AmaraRaja Batteries stands at 0.99% while Exide Inds. stand at 0.55% respectively. The PE ratio and PB Ratio of the company are among its competitors stand at 18.08 and 2.69 respectively.

Recommendations:

The current total number of analysts covering the stock stands at 14, Three months ago this number stood at 14. Out of total, 2 analyst have a'Strong Buy' reco, 5 analyst have a'Buy' reco, 5 analyst have a'Hold' reco, 1 analyst have a'Sell' reco.

Mean recommendations by 14 analyst stand at'Buy'.

Leadership of AmaraRaja Batteries :

Vikas Sabharwal is Co. Secretary & Compl. Officer

Y Delli Babu is Chief Financial Officer

C Narasimhulu Naidu is Chief Operating Officer

M Jagadish is Chief Technology Officer

S Vijayanand is President

Indeevar Govardhanagiri is Chief Marketing Officer

Rajesh Jindal is Chief Marketing Officer

M M Venkata Krishna is Chief Marketing Officer

P Muralimohan Reddy is Business Head

VVS Sridhar is Head

C Murali is Associate Vice President

G Balaji is Head

Ramamurthy Ryali is Head

Jayadev Galla is Chairman & M.D & CEO

Harshavardhana Gourineni is Executive Director

Vikramadithya Gourineni is Executive Director

N Sri Vishnu Raju is Ind. Non-Executive Director

T R Narayanaswamy is Ind. Non-Executive Director

Bhairavi Tushar Jani is Ind. Non-Executive Director

Annush Ramasamy is Ind. Non-Executive Director

Amar Patnaik is Ind. Non-Executive Director

Show More

Executives

Auditors

JG

Jayadev Galla

Chairman & M.D & CEO

HG

Harshavardhana Gourineni

Executive Director

VG

Vikramadithya Gourineni

Executive Director

AP

Amar Patnaik

Ind. Non-Executive Director

AR

Annush Ramasamy

Ind. Non-Executive Director

BT

Bhairavi Tushar Jani

Ind. Non-Executive Director

NS

N Sri Vishnu Raju

Ind. Non-Executive Director

TR

T R Narayanaswamy

Ind. Non-Executive Director

YD

Y Delli Babu

Chief Financial Officer

CN

C Narasimhulu Naidu

Chief Operating Officer

VS

Vikas Sabharwal

Co. Secretary & Compl. Officer

Show MoreDeloitte Haskins & Sells LLP

Brahmayya & Co.

Key Indices Listed on

Nifty Smallcap 100, Nifty 500, BSE 500, + 20 more

Address

Renigunta-Cuddapah Road,Karakambadi,Tirupati, Andhra Pradesh - 517520

More Details

FAQs about AmaraRaja Batteries share

- 1. What's AmaraRaja Batteries share price today and what are AmaraRaja Batteries share returns ?

AmaraRaja Batteries share price is Rs 999.35 as of today. AmaraRaja Batteries share price is down by 0.25% based on previous share price of Rs 1,032.25. AmaraRaja Batteries share price trend:- Last 3 Months: AmaraRaja Batteries share price moved down by 21.29%

- Last 3 Years: AmaraRaja Batteries Share price moved up by 64.48%

- 2. What are the key metrics to analyse AmaraRaja Batteries Share Price?

Key Metrics for AmaraRaja Batteries are:- PE Ratio of AmaraRaja Batteries is 18.06

- Price/Sales ratio of AmaraRaja Batteries is 1.19

- Price to Book ratio of AmaraRaja Batteries is 2.70

- 3. What are the returns for AmaraRaja Batteries share?

Return Performance of AmaraRaja Batteries Shares:- 1 Week: AmaraRaja Batteries share price moved down by 8.76%

- 3 Month: AmaraRaja Batteries share price moved down by 21.29%

- 4. Who are peers to compare AmaraRaja Batteries share price?

Exide Industries Ltd. is the key peer to compare AmaraRaja Batteries. - 5. What is the market cap of AmaraRaja Batteries?

AmaraRaja Batteries share has a market capitalization of Rs 18,290.64 Cr. Within Auto Ancillaries sector, it's market cap rank is 12. - 6. What has been highest price of AmaraRaja Batteries share in last 52 weeks?

AmaraRaja Batteries share price saw a 52 week high of Rs 1,775.95 and 52 week low of Rs 737.70. - 7. Who's the chairman of AmaraRaja Batteries?

Jayadev Galla is the Chairman & M.D & CEO of AmaraRaja Batteries - 8. What is the PE & PB ratio of AmaraRaja Batteries?

The PE ratio of AmaraRaja Batteries stands at 18.1, while the PB ratio is 2.7. - 9. What are the AmaraRaja Batteries quarterly results?

Total Revenue and Earning for AmaraRaja Batteries for the year ending 2024-03-31 was Rs 11818.85 Cr and Rs 934.38 Cr on Consolidated basis. Last Quarter 2024-12-31, AmaraRaja Batteries reported an income of Rs 3307.17 Cr and profit of Rs 298.37 Cr. - 10. Is AmaraRaja Batteries giving dividend?

An equity Interim dividend of Rs 5.3 per share was declared by Amara Raja Energy & Mobility Ltd. on 04 Nov 2024. So, company has declared a dividend of 530% on face value of Rs 1 per share. The ex dividend date was 14 Nov 2024. - 11. Who are the key owners of AmaraRaja Batteries stock?

* Promoter holding has not changed in last 9 months and holds 32.86 stake as on 31 Dec 2024

* Domestic Institutional Investors holding have gone down from 15.36 (31 Mar 2024) to 14.47 (31 Dec 2024)

* Foreign Institutional Investors holding have gone down from 24.46 (31 Mar 2024) to 21.82 (31 Dec 2024)

* Other investor holding has gone up from 27.31 (31 Mar 2024) to 30.84 (31 Dec 2024) - 12. Who is the CEO of AmaraRaja Batteries?

Jayadev Galla is the Chairman & M.D & CEO of AmaraRaja Batteries - 13. What is the CAGR of AmaraRaja Batteries?

The CAGR of AmaraRaja Batteries is 13.12.

Trending in Markets

Top Gainers As on 03:58 PM | 12 Feb 2025

Top Losers As on 03:58 PM | 12 Feb 2025

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.