Kansas Bill of Sale Form (original) (raw)

Kansas bill of sale is a document that follows a transaction between private parties regarding transferring ownership of a particular item. Some of the most common things private parties trade for money are motor vehicles, boats, equipment, animals, furniture, and artwork. Thus, there are many types of the form, from a Kansas bill of sale for a motor vehicle to a Kansas horse bill of sale form.

Regardless of what is purchased and sold, documenting the details of a deal in the form of a bill of sale will help the parties involved get legal protection in case either of the sides has any claims in the future.

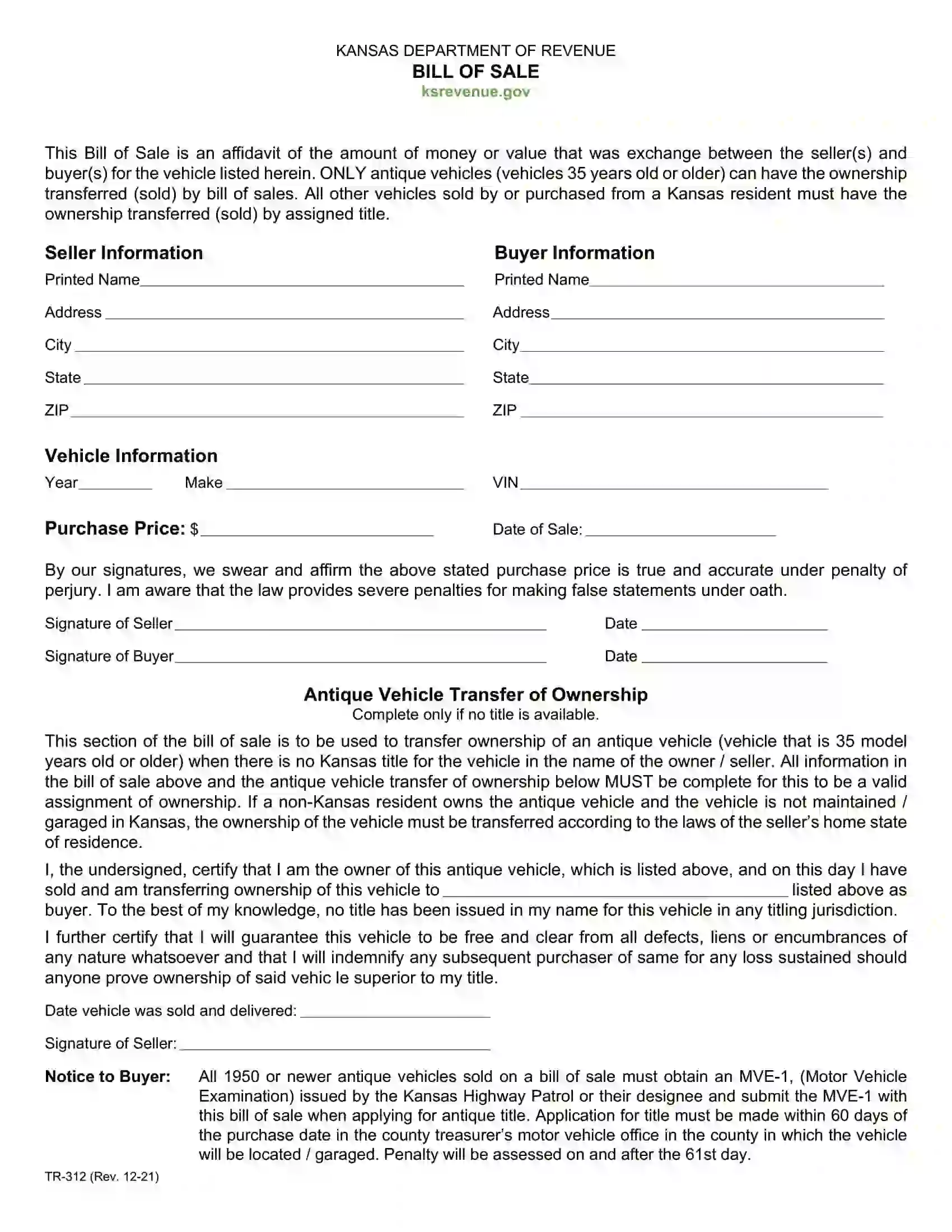

Kansas requires sellers and purchasers to use specific forms when it comes to deals involving vehicles and boats. The Form TR-312 by the Kansas Department of Revenue’s Division of Vehicles should be used for vehicle transactions. You can also use the official form released by the Kansas Department of Wildlife, Parks, and Tourism (KDWPT) for boats.

Table of Contents

- Kansas Bill of Sale Forms by Type

- How to Write a KS Vehicle Bill of Sale

- Registering a Vehicle in Kansas

- Relevant Official Forms

- Other Bill of Sale Forms by State

Document Details

| Document Name | Kansas Vehicle Bill of Sale Form |

|---|---|

| Other Names | Kansas Car Bill of Sale, Kansas Automobile Bill of Sale |

| DMV | Kansas Department of Revenue Division of Vehicles |

| Vehicle Registration Fee | $42.50-52.25 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 22 |

Kansas Bill of Sale Forms by Type

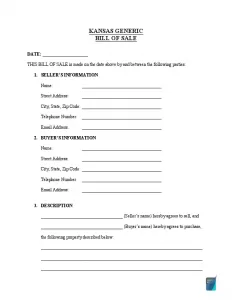

Apart from the official forms for motor vehicles and vessels that we have already mentioned, there are specific bill of sale forms for other types of property that we have prepared with the help of professional attorneys. These forms are also valid in Kansas and often provide more room for custom details.

How to Write a KS Vehicle Bill of Sale

A motor vehicle bill of sale in Kansas is used to prove the legal transfer of the vehicle ownership through the purchase or as a gift. You will need a vehicle bill of sale to register your motor vehicle. If you transfer ownership of an antique vehicle, you may use the bill of sale. However, your document must include the antique vehicle transfer ownership section for you to fill out.

The official TR-312 form can also be prepared if you live in Kansas. After the bill of sale is filled out, previous owners must complete the sale by handing over the motor vehicle title signed on the back. Both previous and new owners will need to print their names on the back of the title, ensuring that the purchase price and vehicle identification number (VIN) are included.

To avoid making mistakes during the completion of the bill of sale, here is a simple guide to help you do it correctly.

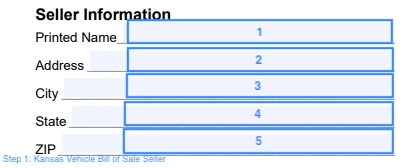

Step 1: Type in the information about the seller in the corresponding boxes:

- Printed name (seller’s name in capital letters)

- Street address

- City

- State

- Zip code

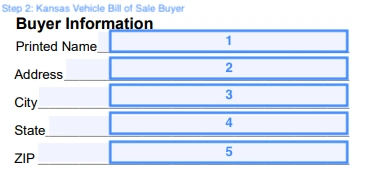

Step 2: Enter the actual information about the purchaser in the Buyer Information section:

- Printed name (buyer’s name in capital letters)

- Street address

- City

- State

- Zip code

Step 3: Next, you need to clarify the details regarding the motor vehicle that is being transferred. Be sure to include all the required pieces of information:

- Year

- Make

- VIN (vehicle identification number)

Step 4: Type in the agreed purchase price and the date when the vehicle transaction happened.

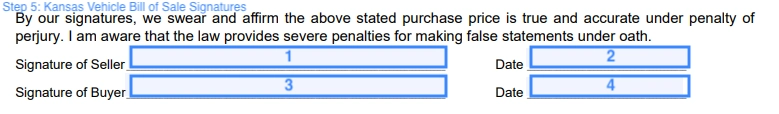

Step 5: After that, it’s necessary to affirm that the price is accurate and agreed upon by both parties by signing the document. Both the Seller and the Buyer must leave their signatures in the corresponding boxes and indicate when the deal occurs.

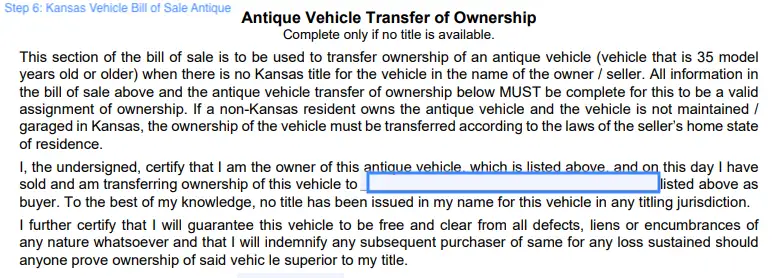

Step 6 (optional): Suppose the purchased vehicle is classified as antique, and the title is not available. In that case, a seller needs to fill out this section, indicating the person they are selling the vehicle to.

Step 7: Lastly, the seller needs to write down when the vehicle is transferred and sign the form.

Although notarization is not mandatory in Kansas state, you’re encouraged to make an extra step for legally protecting your ownership rights.

Create a free Kansas Bill of Sale online in under 5 minutes!

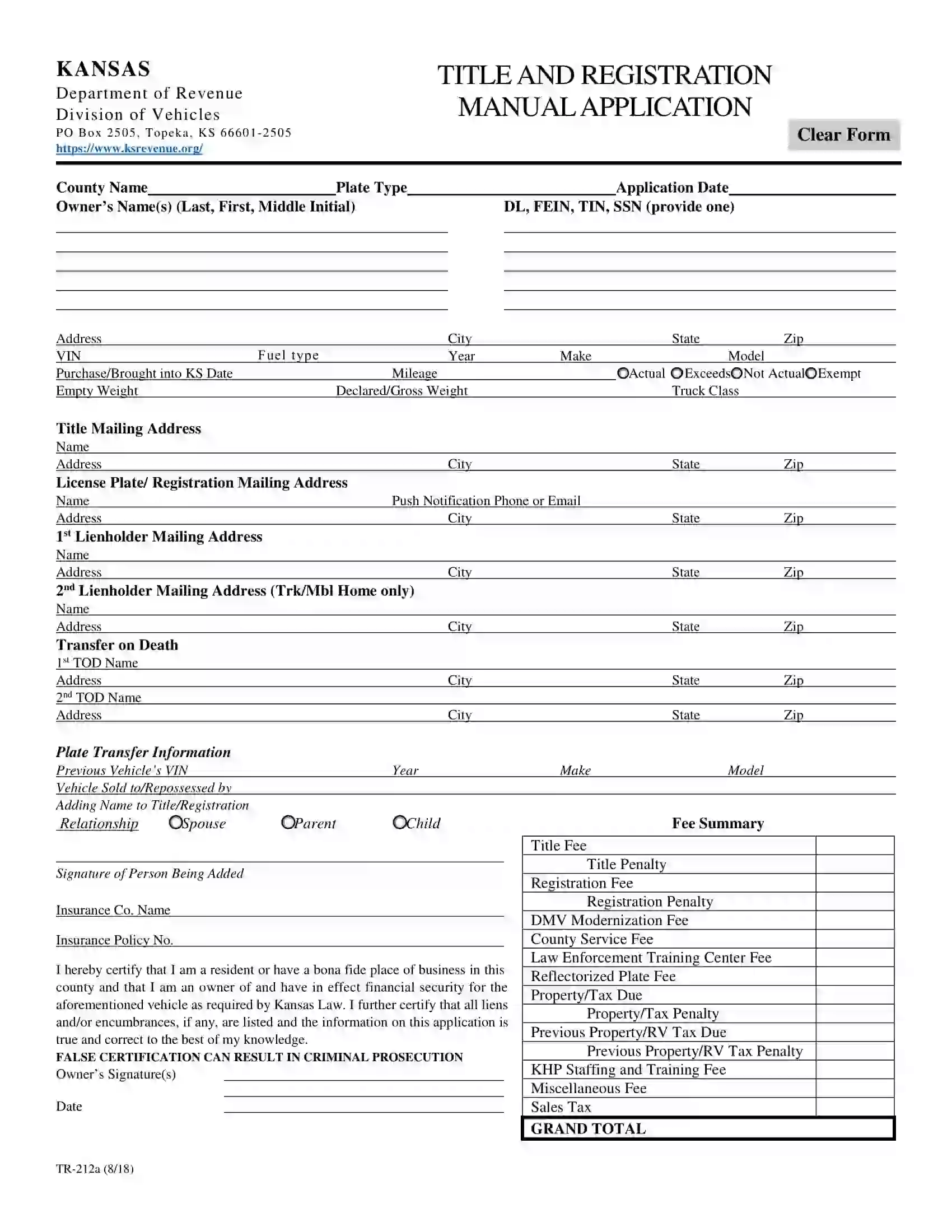

Registering a Vehicle in Kansas

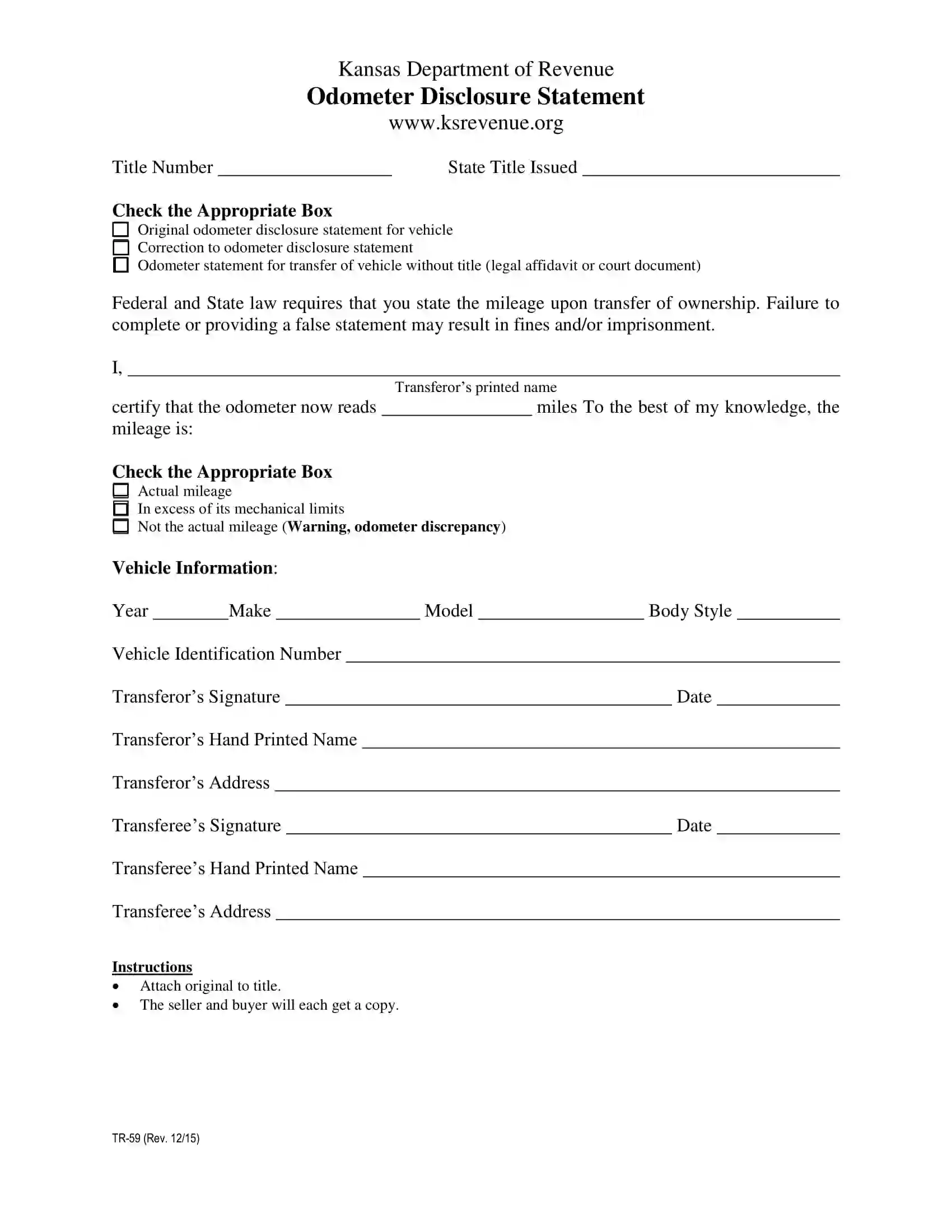

All motor vehicles must be registered at most 60 days after the date of sale to avoid penalties. To complete vehicle registration, the new owner must have a completed bill of sale form, including the date of the sale, purchase price, VIN, signatures, and basic details of both buyer and seller. Kansas also requires an odometer reading at the time of purchase to finalize the registration and vehicle title transfer.

In the case that the title is incomplete or missing necessary details and previous owners cannot be reached, new owners can seek the help of an attorney to obtain a court order granting permission to the Department of Revenue to title the motor vehicle by processing a “quiet title action.” In the case that the bill of sale is out of state, vehicles must undergo inspection via the Kansas motor vehicle inspection station, complete with a motor vehicle examination (MVE-1) before registration. This also stands for antique vehicles from 1950 and forward.

When registering motor vehicles, new owners must visit the County Treasurer’s Office, presenting the title and proof of insurance. Vehicles aged 35 years or older require only a bill of sale and will not need a title to complete a legal sale. A 10applicationfeeand10 application fee and 10applicationfeeand3 processing fee are included, along with any sales or property taxes that were left unpaid at the time of purchase. Title fees are $8.00, and tag fees vary by the make and model of a motor vehicle. Other price variations take the weight of a vehicle into account, where anything over 16,000 pounds requires a call to the Kansas County Treasurer’s Office.

- A complete vehicle bill of sale form with the buyer and seller details, motor vehicle details, and purchase price

- The buyer’s valid driver license

- Proof of the insurance

- Title (exempt on vehicles 35 years and older)

- The results of VIN inspection (if necessary)

- An Odometer Disclosure Statement (according to Kansas Department of Revenue’s Administrative Code, Chapter 36-Sec. 1 on odometer disclosure).

Regarding taxes, the state of Kansas requires proof of payment. In the case of the vehicle title transfer between two parties, if sales tax was not included at the time of purchase, new owners must pay sales tax ranging from 7.3% to 8.775% depending on the type and age of vehicles, plus a 1% local tax in some counties.

Relevant Official Forms

(Vehicle) Form TR-312

(Vehicle) Form TR-212a

(Vehicle) Form TR-59

Motor Vehicle POA

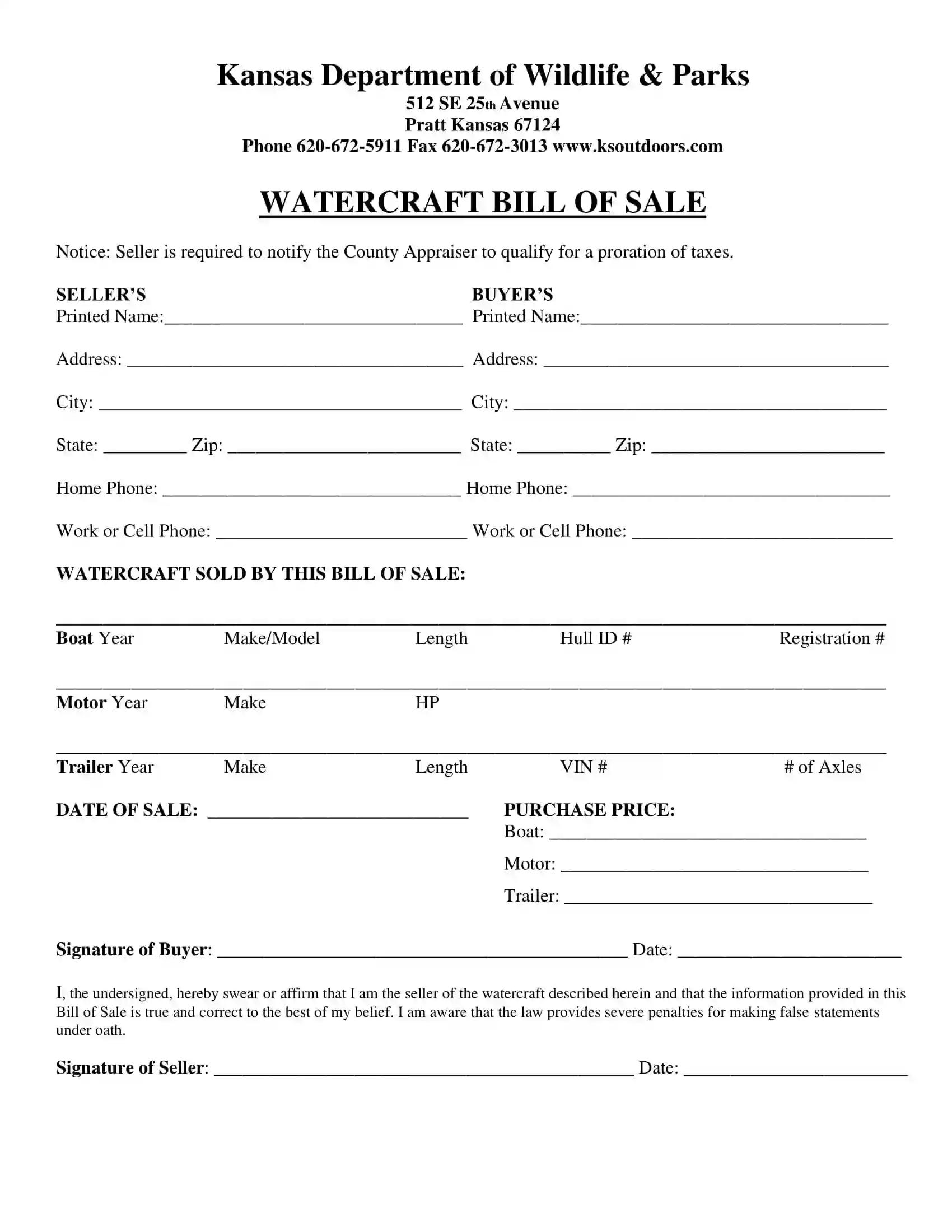

(Vessel) Bill of Sale

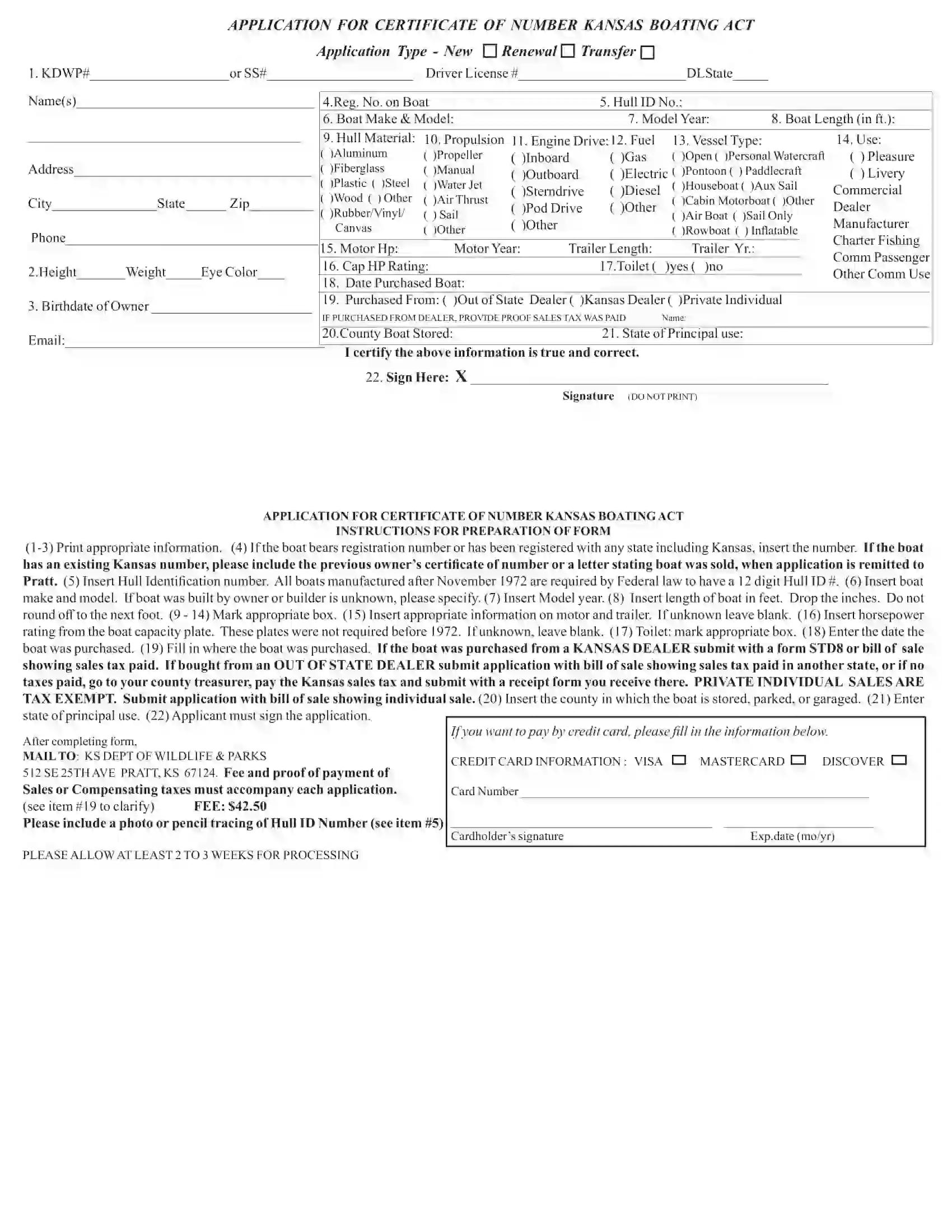

(Vessel) Application for Certificate of Number

Official Vehicle Bill of Sale in Kansas

Form TR-212a or Title and Registration Application is used to proceed with the vehicle titling or registration process.

Odometer Disclosure Statement (Form TR-59) is usually attached to a bill of sale to confirm the actual mileage.

Official vessel bill of sale provided by the Kansas Department of Wildlife and Parks

Application for Certificate of Number is designed for new owners to register their vessels.

Short Kansas Bill of Sale Video Guide

Published: Jun 21, 2022

Mara has been practicing estate planning and trust law in California since 2003, taking pride in helping clients of all backgrounds and asset profiles form a complete and customized estate plan. Her specialties are: estate planning, wills and trusts, trust and probate administration.