Johnna Montgomerie - Profile on Academia.edu (original) (raw)

Papers by Johnna Montgomerie

The politics of austerity dominate contemporary discussions of the British economy. Every new set... more The politics of austerity dominate contemporary discussions of the British economy. Every new set of economic figures published sparks another debate on whether the United Kingdom has finally recovered (Hutton, 2014; Parker, 2014). The sheer variety of opinions demonstrates the inability to discern whether the UK is moving out of—or into—a prolonged stagnation (Crouch, 2011; Hay, 2013; Sum and Jessop 2013). It is problematic to ‘spin’ new sets of economic growth figures in order to support or oppose austerity as a policy agenda. Yet, it is even more problematic to accept that the policy-elite are locked into a politics of uneven reform that targets households as objects and subjects of ‘reform’ in order to continue not ‘reforming’ the structural problems of financialised growth. ‘Economic growth’ acts as a framing device in which highly stylised figures reporting positive economic performance serves to silence alternative voices for whom economic priorities mean something else entirely (Young, Bakker & Elson, 2011; Ferber & Nelson, 2003; Hoskyns & Rai, 2007; Stiglitz, Sen and Fitoussi, 2009).

Gender, indebtedness and social reproduction: another politics of the subprime crisis

Cresc Working Paper Series Http Www Cresc Ac Uk Publications Gender Indebtedness and Social Reproduction Another Politics of the Subprime Crisis 2011 Working Paper No 91, Feb 1, 2011

The rise of mental health problems such as depression cannot be understood in narrowly medical te... more The rise of mental health problems such as depression cannot be understood in narrowly medical terms, but instead needs to be understood in its political-economic context. An economy driven by debt (and prone to problem debt at the level of households) will have a predisposition towards rising rates of depression.

Financial Melancholia: Mental Health and Indebtedness

The rise of mental health problems such as depression cannot be understood in narrowly medical te... more The rise of mental health problems such as depression cannot be understood in narrowly medical terms, but instead needs to be understood in its political-economic context. An economy driven by debt (and prone to problem debt at the level of households) will have a predisposition towards rising rates of depression.

This eBook speaks to the groundswell of interest in wrestling ‘the economy’ away from the orthodo... more This eBook speaks to the groundswell of interest in wrestling ‘the economy’ away from the orthodox economics expertise that dominates elite policy circles that treats the economy as an abstract series of models of markets built on assumptions about individuals’ rational choice or inferences about individual behaviour preferences. This type of orthodox economic analysis is not about ‘the economy’ at all – it’s about testing the validity of causal claims. We combat this framework by offering new ways of understanding the deep-seated problems in the UK economy that manifest as entrenched stagnation and perpetual crises.

This paper highlights the uneven politics of reform is Austerity Britain. We explore how reform i... more This paper highlights the uneven politics of reform is Austerity Britain. We explore how reform is underwritten by policy-making that uses the language of ‘improving literacy’ to inscribe a lack of education or skills -not a stagnant economy-as a fundamental cause of poverty in the UK. Thereby, we seek to shift the terrain of debate away from a focus on economic performance to grasping the deeply moral and uneven way in which policy-making seeks to manage and control households’ everyday social reproduction under the auspices of ‘Austerity’. Specifically we critically interrogate how morality permits at the same time as it cloaks a re-imaging of poverty as an inherently moral condition; therefore, a person is not poor because of the material conditions they encounter in a depressed economy, rather poverty is the outcome of lack moral virtues of hard work, prudence and temperance, with the added neoliberal virtue of responsibility for self. In policy terms these moral virtues become actionable as educational deficiencies; therefore the poor require (re)education – further literacy – in these key moral virtues because they lack these fundamental skills. Policy makers mobilised morality to question, discipline and potentially even criminalise the everyday practices of social reproduction in poor families. We provide the evidence to support this claim using two case studies: promoting financial literacy to solve indebtedness of the poor and parental literacy to turn around ‘troubled’ families. The two studies demonstrate how the cultural morality of austerity is shaped through deeply gendered practices of the everyday in which women’s morality is ultimately what needs reforming. We show how poor women, especially those with dependent children, are the main objects/subjects of Austerity-led reforms that seek to transform their undesirable (moral) behaviours with new forms of literacy, i.e. financial literacy and parental literacy programmes.

This paper introduces a theme section on knowledge limits in and after the financial crisis. It e... more This paper introduces a theme section on knowledge limits in and after the financial crisis. It explores how and why practitioners have generally responded less conservatively to crisis than academics, and argues that academics within a variety of problematics could do more by reflecting critically on the heroic ideas about the role of knowledge which were current across the social sciences in the decade before the crisis. It then turns to introduce the section's papers before finally raising the possibility of a more explicitly political approach to understanding finance.

This paper introduces a theme section on knowledge limits in and after the financial crisis. It e... more This paper introduces a theme section on knowledge limits in and after the financial crisis. It explores how and why practitioners have generally responded less conservatively to crisis than academics, and argues that academics within a variety of problematics could do more by reflecting critically on the heroic ideas about the role of knowledge which were current across the social sciences in the decade before the crisis. It then turns to introduce the section's papers before finally raising the possibility of a more explicitly political approach to understanding finance.

This article evaluates the rapid escalation of American household debt in relation to the changin... more This article evaluates the rapid escalation of American household debt in relation to the changing dynamics of liberal welfare capitalism. Starting with the outcome of rising household debt levels during the credit and asset bubble of 2001–7 it argues that the failure of asset-based welfare and the inability of households to move beyond their historical dependence on earned income made indebtedness essential to household social participation and protection. It examines the unique relationship of young adults (households headed by persons under age 35) and senior citizens (households headed by persons over age 65) to the liberal welfare regime, in particular the ways in which these relationships were shaped by the 2001–7 credit and asset bubble. By using a framework in which debt is analyzed as a claim against income, alongside other costs of social participation and daily living, we see the impact of the credit and asset boom on both young adults and senior citizens: growing indebtedness and financial insecurity.

The dominant account of rising household indebtedness in the United States, the United Kingdom an... more The dominant account of rising household indebtedness in the United States, the United Kingdom and Canada claims that current economic stimuli, namely low nominal interest rates and rising property markets, are the key reasons debt has grown so rapidly since the mid-1990s. By drawing on key theoretical assumptions from neoclassical economics, policy makers have argued that rising debt levels since the mid-1990s shows that households are rational agents taking advantage of cheaper credit to purchase assets; thus, the equilibrating effect of market society translates into a balance between rising debt and rising assets. This article puts forward an alternative framework for evaluating potential contributing factors of rising household indebtedness in the United States, the United Kingdom and Canada by evaluating the long-term impacts of policies implemented to achieve non-inflationary growth. Using a neo-Gramscian method of analysing historical structures, it is argued that growing household indebtedness was not an inevitable outcome of the policy of non-inflationary growth. Instead, it was most likely a product of a confluence of forces as rising demand for credit by households (due to downward pressure on wages) combined with increased supply of credit (as banks sought profitable returns in a liberalised market) to generate indebtedness. By locating the specific policy processes that contributed to mass household indebtedness this article tries to more accurately understand the origins and effects of politically-led structural change.

Competition and Change, 2006

This paper asks, what can account for the rapid expansion and growing profitability of the US cre... more This paper asks, what can account for the rapid expansion and growing profitability of the US credit card industry since the mid-1980s? And, what does this mean to the study of global finance within IPE? It is argued that the advent of asset-backed securities, a financial innovation known as securitization, was the key to the enormous expansion of credit card profits and the continued proliferation and growth of the credit card market in the US. This is because securitization moved credit card receivables off-balance sheet, allowing loan pools to be re-capitalized, lowering the cost of borrowing and increasing revenues from payments on securities issued. This financial innovation attracted non-banks, mostly large MNCs, into the credit card market, facilitating greater integration between finance and the ‘real’ economy. The deepening integration facilitated mounting competition and lower costs of borrowing and was the catalyst for the rapid expansion of the credit card market and its unsurpassed profitability.

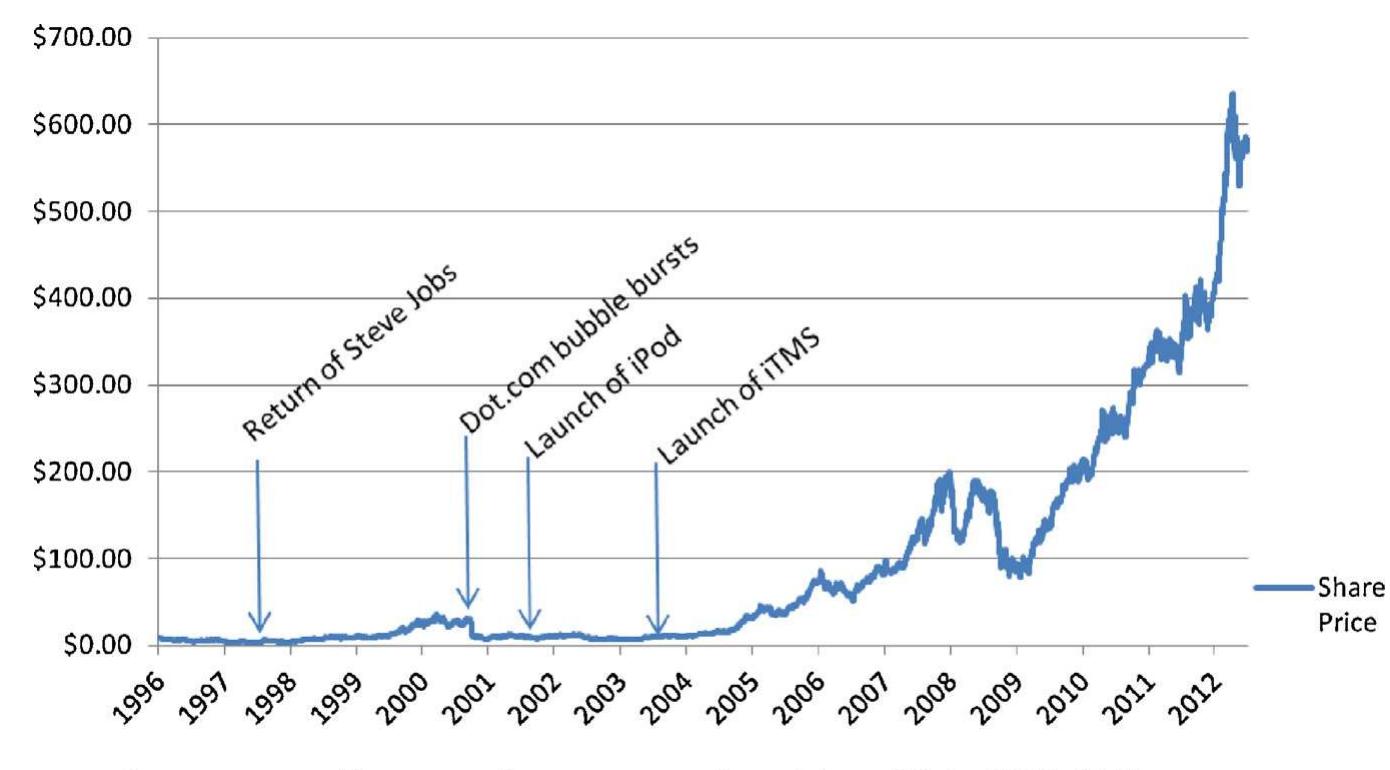

This paper uses a business model framework to analyze the main limitations of Apple Inc. post-200... more This paper uses a business model framework to analyze the main limitations of Apple Inc. post-2003, a significant turning point in the company's history. As such, we move beyond an exclusive focus on what makes Apple unique or different by evaluating the mundane and out-dated elements of its business model. To do so, we examine the end-to-end supply chain, from source to store, to present a more holistic evaluation of the Apple business model. Drawing on the existing literature, we argue that the quintessential element of the Apple business model is its ability to ‘own the consumer’. In short, the Apple business model is designed to drive consumers into its ecosystem and then hold them there, which has been hugely successful to date and has allowed Apple to wield enormous power in the end-to-end supply chain. We demonstrate this through a detailed evaluation of Apple's physical and content supply chains and its retailing strategy. Moreover, we find that the very business processes that enable unparalleled corporate control bring with them new problems that Apple has thus far been unable, or unwilling, to adequately address.

This paper serves as an introduction to a special issue which explores many new questions, intell... more This paper serves as an introduction to a special issue which explores many new questions, intellectual and political, posed by the current global financial crisis. The aim is to get beyond the convention asking the well-rehearsed questions about what caused the crisis, or why the established theories could not predict it. For we can safely predict that many critical thinkers in political and cultural economy already know, or think they know, the answer to what caused the crisis. This is because they will construct the origins and causes of the within the problematic which they endorsed before the crisis began. Namely, that neoliberalism demarcates the period since 1970 as one of privatisation, liberalisation and support for free markets which essentially takes ideological propositions at their own word and, consequently, fail to distinguish between rhetoric and practice. This special issue explores some new ways of fundamentally reconsidering or challenging established ideas about neoliberalism and finance. For financialisation researchers, the intellectual struggle against organising concepts of neoliberalism and disembedded finance is unfinished business.

This article is about two distinct frameworks that evaluate why finance matters in contemporary c... more This article is about two distinct frameworks that evaluate why finance matters in contemporary capitalism. The International Political Economy (IPE) literature on global finance analyses the geopolitical dynamics of financial markets where finance matters because it is an integral element of power in the global political economy. The newer literature on financialisation offers an account of present day capitalist dynamics where individuals, firms and the macroeconomy are increasingly mediated by new relationships with financial markets. These two frameworks share a common ground: both reject the mainstream orthodoxy of neo-classical economics and positivist methodology. Essentially, the global finance and financialisation frameworks are different sides of the same critical coin. This article offers a sympathetic critique of both the global finance and financialisation bodies of literature. I argue that greater engagement between the literatures would provide new fruitful avenues of research.

Financialization and consumption: an alternative account of rising consumer debt levels in Anglo-America

A diversity of opinions exists on the cause and consequences of rising debt levels in the United ... more A diversity of opinions exists on the cause and consequences of rising debt levels in the United States and United Kingdom. Economists and government policy makers see rising debt levels as a natural outcome of lower inflation and nominal interest rates. In fact, growing debt levels are seen as contributing to a wealth effect in these economies, as borrowing more as induced asset price appreciation contributing to new avenues of wealth creation. Conversely, some see rising debt levels as a symptom of eroding of self-control and evidence of the intensification of consumerism in Anglo-American society, as people are now considered to consume without consideration for the limits of income. Increasing indebtedness has also been associated with the deepening disciplinary power of global finance

in everyday life. This article addresses previous unexplored socio-cultural variables alongside significant market transformations that, together, contributed to escalating levels of consumer debt levels in Anglo-America. In doing so, it asks: what factors contributed to rising consumer debt levels in Anglo-America since the mid-1990s? Rather than putting forward a single causal relationship, rising debt levels are analyzed as a product of the cumulative

effects of economic changes and socio-cultural factors. In particular, how widespread use of asset-backed securitization (ABS) in consumer credit industry created an increase supply of credit available for lending and a dependence on a growing pool of revolving debtors.

Moreover, how stagnant incomes for wage-earners created a new form demand for consumer credit. Finally, how the centrality of consumerism in Anglo-American society provided sufficient cultural justification for consumption despite lower incomes for most wage-earners.

"The subprime borrower has achieved a celebrity status as of late. In this evolving tale of finan... more "The subprime borrower has achieved a celebrity status as of late. In this evolving tale of financial woe, the subprime borrower has delivered a fatal blow to the global financial markets. Two distinct personalities have emerged from this unfolding saga: the incredulous and financially illiterate subprime borrower pit against the greedy and often predatory lender. In retrospect lending to this group of low-income/ high-risk individuals is now considered indicative of the foot-loose tendencies of financial actors and complacent nature of the financial regulatory environment. Yet, the availability of credit to subprime borrowers was, not to long ago, heralded as a major achievement of newly liberalized financial markets. Risk calculation and balance sheet management techniques showed that markets, without the interference government, were able to democratize access to finance. Up until the summer of 2007, little attention had been paid to the subprime borrower and their experience of the ‘roaring 90s’ and past seven years of financialized expansion. The term ‘subprime’ refers to credit status that encompasses a wide range of socio-economic grouping. Using existing qualitative accounts of the causes of rising consumer debt, coupled with the limited quantitative data available on subprime borrowers, this article moves away from the linear (and coherent) account of credit as a transaction between borrower and lender. The attempt is

to engage with the lived experience of these groups of the past seven years to understand the role that consumer credit plays in their everyday life. By drawing together the outcomes presented in existing literatures on labour market reform, rising education costs and declining state subsidies these trends are contextualized as factors contributing to the broader consumer credit boom. In particular, how these groups have lived on the frontier of receding state subsidies and advancing credit products."

Before the crisis which started in 2007, the mass marketing of retail financial products in high ... more Before the crisis which started in 2007, the mass marketing of retail financial products in high income countries since the early 1980s was understood through rhetorics about individual emancipation as the ‘democratisation of finance’ and ‘ownership society’, where supporters and critics debated in a shared framework. From a post 2007 perspective, it is time to revalue these developments. This paper changes the frame around the debate and constructs the

extension of credit and ownership as a major social innovation led by profit seeking retail banks. It then presents empirical evidence from the United States, which suggests that the extension of credit and asset ownership in an unequal society is self defeating because it does not abolish the tyranny of earned income and, indeed, it tightens the vice insofar as low income individuals and households accumulate debt but not assets. The implication is that

finance as privately led social innovation has failed and it is time for fundamental rethinking of much that has been taken for granted.

Losing the battles but winning the war: the case of UK Private Equity Industry and mediated scandal of summer 2007

Private equity was heavily criticised by the media and trade unions during the Spring/Summer 200... more Private equity was heavily criticised by the media and trade unions during the Spring/Summer 2007, when the Treasury summoned a Selected Committee to quiz its top executives about the business’ practices. Despite losing the public argument, the Private Equity industry did not suffer any consequences, escaping with no significant policy changes affecting its modus operandi. Its remarkable lack of sophistication in gathering allies and dealing with politicians

and journalists alike diverges from part of the literature on business representation and its assumption that results are directly proportional to lobbying/public relations efforts, be it collectively or individually organised. The argument put forward here is that Private Equity’s victory was a consequence of its successful mobilization of existing ideological and structural conditions, leaving to the government the task of justifying any regulatory or tax changes.

(Re)Politicizing inflation policy: A global political economy perspective

This article investigates the political and social outcomes of low-inflation policy as it relates... more This article investigates the political and social outcomes of low-inflation policy as it relates to labour market policy and wages. Current policy orthodoxy assumes there are indomitable negative costs associated with inflation; as such, Central Banks are tasked with maintain price stability to ensure economic growth and global competitiveness. Critical political economists challenge in these assumptions tend to focus almost exclusively on the ambiguous relationships between low inflation, monetary policy and real economic growth. Examining the politics of low-inflation policy and labour market reform adds a new dimension to this critical research agenda. Using the United States and the United Kingdom as case studies, two policies designed to control inflation and adopted as part of labour market reform are examined: promoting increased product market competition and indexing wage increases to price levels using the consumer price index (CPI). These two policies reveal how controlling wage-led inflation, and all the related distributional outcomes, at the heart of low inflation policy. Finally, with inflation rates rising quickly across the US and the UK the politics of inflation have again entered the public domain. Again, we see that policy makers are looking to labour markets, not monetary policy, to quell inflationary pressures. Wage-earners must take real wage cuts to ensure a rebounding of economic growth. For all intense and purposes, it appears the politics and vigilance against wage-led inflation is paramount in Anglo-America, whether the actual inflation rate is low or high.

Home is Where The Hardship is. Gender and Wealth (Dis)Accumulation in the Subprime Boom

Subprime lending has become the penultimate case study for critics of the recent period of financ... more Subprime lending has become the penultimate case study for critics of the recent period of financialization, or neo-liberalism more broadly, because it exposes the most profligate tendencies of predatory lending and the pernicious social costs visited on society's most vulnerable groups. This article builds on the social stratification and wealth accumulation literature. We assess how mounting debt levels and crippling costs of servicing these debts compared to relatively flat income growth for female-headed households have resulted in wealth (dis)accumulation. We use the Survey of Consumer Finances (SCF) to analyze how single female-headed households, and in particular how African American single mothers were affected by the subprime boom in different, arguably more pernicious, ways. There is already considerable evidence showing that subprime lending was disproportionally sold to women, particularly minority women. Focusing on single mothers reveals important gender and racial dimensions of the lending techniques, but it also shows how marginalized families increasingly relied on housing wealth (equity) to adjust to shrinking purchasing power. Thus, contrary to the lofty expectations of the ownership society, the high mortgage debts of many low-income women suggest they own a lesser share of their homes – (dis)accumulation of wealth – than at any previous time.