e-Rupee: Here’s a Quixplained on India’s first official digital currency (original) (raw)

The e-Rupee will be primarily meant for retail transactions.

The e-Rupee will be primarily meant for retail transactions.

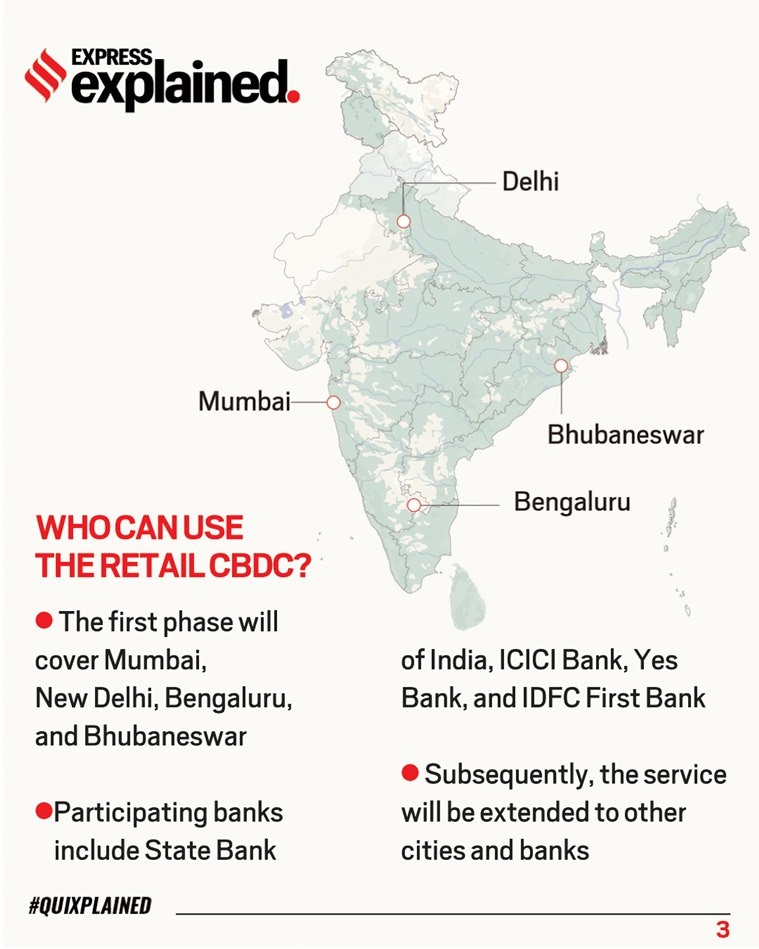

India launched its e-Rupee on Thursday (December 1). The Reserve Bank of India’s Central Bank Digital Currency (CBDC) is an electronic version of cash, and will be primarily meant for retail transactions. The pilot will initially cover the four cities of Mumbai, New Delhi, Bengaluru, and Bhubaneswar. Four banks will be involved in the controlled launch of the digital currency in these four cities: State Bank of India, ICICI Bank, Yes Bank, and IDFC First Bank.

What exactly is it, and how will it work? What is the need for it? Take a look.

The Reserve Bank of India launches the Central Bank Digital Currency today.

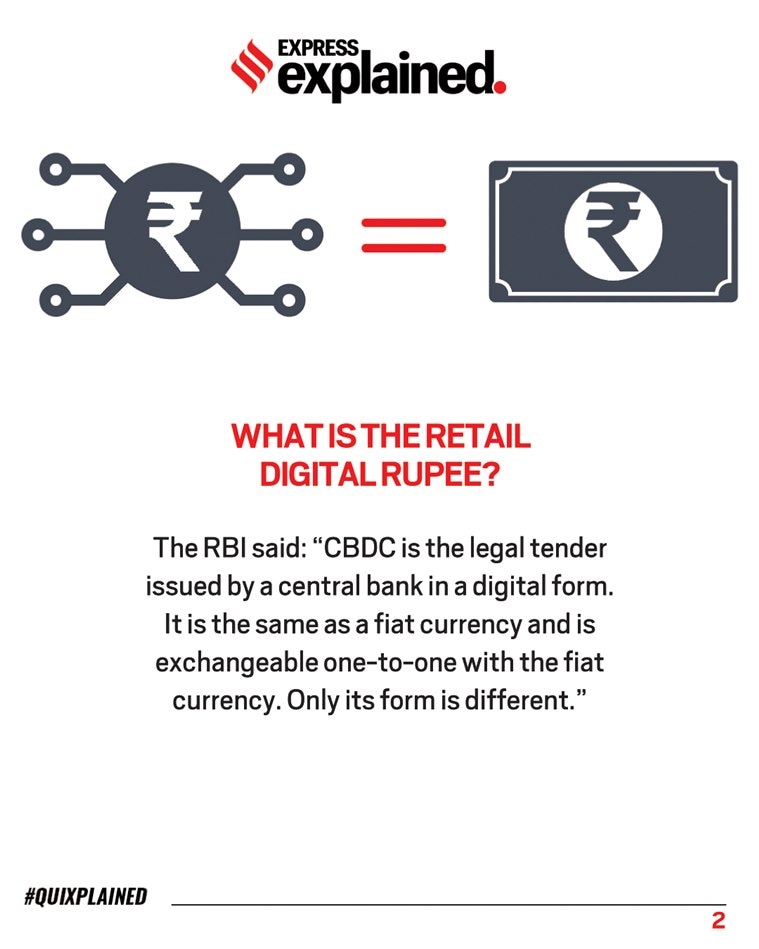

The Reserve Bank of India launches the Central Bank Digital Currency today.  What is the Central Bank Digital Currency?

What is the Central Bank Digital Currency?  The first phase of the CBDC will cover Mumbai, New Delhi, Bengaluru and Bhubaneswar.

The first phase of the CBDC will cover Mumbai, New Delhi, Bengaluru and Bhubaneswar.  Users will be able to transact with the e-Rupee through a digital wallet.

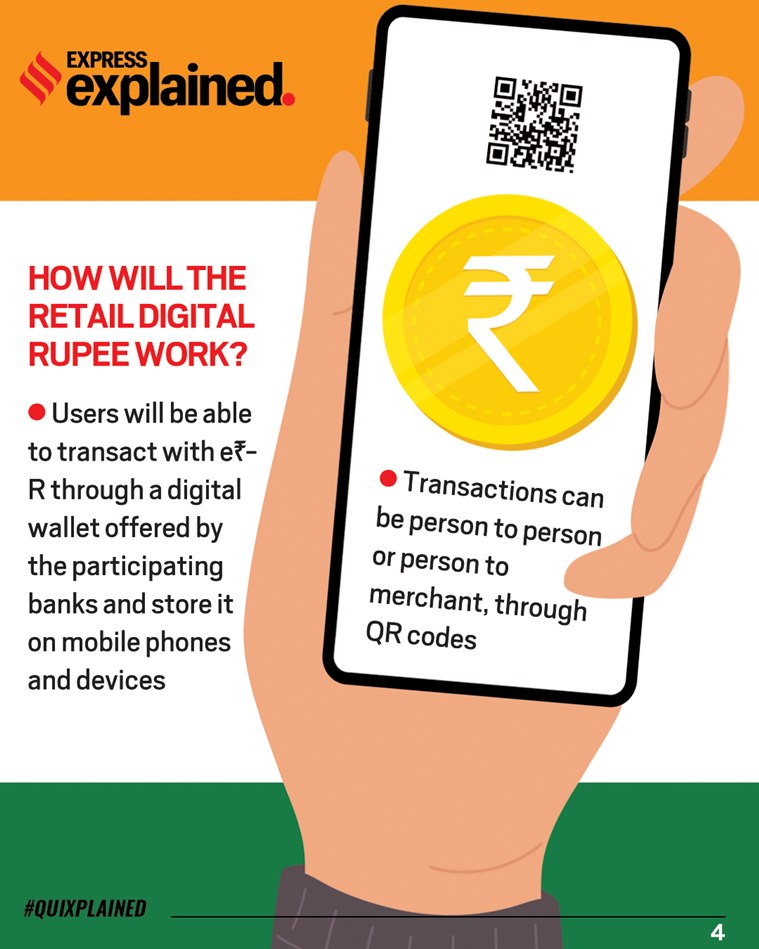

Users will be able to transact with the e-Rupee through a digital wallet.  What is the need for a Digital Rupee?

What is the need for a Digital Rupee?

According to the central bank, the pilot will test the robustness of the entire process of digital rupee creation, distribution and retail usage in real time “Different features and applications of the e?-R token and architecture will be tested in future pilots, based on the learnings from this pilot,” it said.