Are Physical Games Dead? It’s More Complicated Than You Might Think (original) (raw)

In 2007, console gaming got its first day-and-date digital release. The sci-fi war shooter Warhawk for the PlayStation 3 was sold as a Blu-ray disc in stores but was also available to buy digitally on PSN. The game is mostly forgotten now, but it was the first domino to fall in digital’s slow but relentless takeover of console gaming.

Suggested Reading

The Best Reveals From The Game Awards 2023

- Off

- English

Suggested Reading

Seventeen years later, the way big video game companies make money has become completely inverted. While it used to be revenue from sales of boxed copies at GameStop and Walmart, it’s now overwhelmingly from sales of digital downloads on console storefronts. Publishers like Electronic Arts don’t even make most of their money from game sales at all, but rather from “recurring revenue,” AKA microtransactions in online multiplayer and free-to-play games like Madden and Apex Legends.

“Back then before the PlayStation 4 was released, you’d be lucky to get five to 10 percent of digital sales for a AAA game,” Daniel Ahmad, director of research and insights at Niko Partners, told Kotaku in an interview. “Today, depending on the title, you know, it can be as high as 80 percent but it could also be as low as 40 percent.” He noted that while the average breakdowns overwhelmingly favor digital downloads (with platforms like PlayStation reporting annual digital revenue splits over 70 percent), it can still vary a lot on a case-by-case basis.

In its annual report this year, Capcom revealed that roughly 89 percent of the games it sells are digital copies. It expects that number to reach close to 94 percent in 2024. The report also emphasized how much more profitable these sales are. Kunitsu-Gami: Path of the Goddess, a new $50 Capcom game with no physical version, exemplifies that move. As a result, the company was effectively asked if it will continue making physical games during its latest annual shareholder meeting this week.

Screenshot: Capcom / Kotaku

“Given that a significant number of end users demand physical games we currently do not expect to eliminate physical products,” the company said. The statement echoed a view expressed by Ubisoft SVP Chris Early last year. “Some people will always want to own the physical disk,” he said in a Q&A on the French publisher’s Activision Blizzard cloud gaming deal. “I just don’t think it’s going away. Do I think physical sales might get lower over time? Sure, but will it ever completely go away? I don’t think so.”

Aggregate data can sometimes obscure small but substantial wrinkles in popular trends. While it’s true that physical games have become a niche market in the broader gaming landscape, a shift accelerated by the pandemic, Early also pointed out that even a small slice of a big pie can mean a lot of money. According to a GamesIndustry.biz infographic using Newzoo data, only 17 percent of console gaming revenue in 2023 was from boxed games, but that still came out to $9.5 billion. Put another way, that’s still more than the top 10 worldwide box offices last year, including Barbie, Oppenheimer, and The Super Mario Bros. Movie, combined.

“When you actually look at the absolute values Sony still sold 286 million total games last year,” Ahmad told Kotaku. “Even with a 70 percent ratio, that still means 85 or 86 million of that is physical, right? So, yes, it’s a small part, but it’s not tiny by any means.”

Games like God of War Ragnarök buck digital trends

The market for physical copies of some first-party games, for example, remains surprisingly strong. One of the pieces of data that seemingly leaked as part of the malicious Insomniac Games hack was the total digital downloads for PlayStation Studios games through June 2023. 2018's Spider-Man and 2020's Miles Morales were downloaded a combined 13.6 million times, less than half the 33 million sales reported in 2022. God of War Ragnarök had seemingly only been downloaded 4.2 million times compared to 11 million sales reported in January 2023.

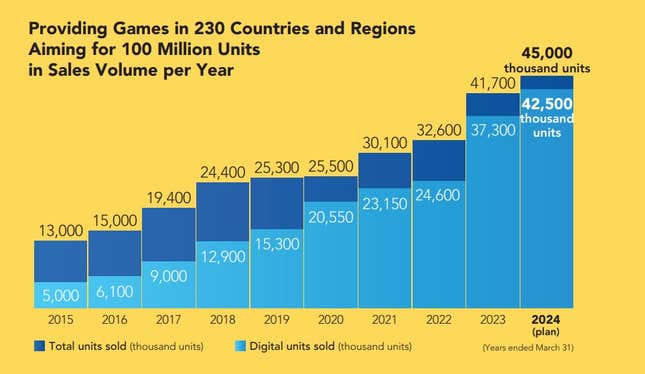

According to Ahmad, physical sales on the Nintendo Switch are even stronger despite the overall trend toward digital. Nintendo still reports that roughly half of its software revenue comes from physical releases vs. digital spending, which includes digital-only games and add-on content. But the difference is even more stark when you compare breakdowns of physical sales to digital sales for games that have retail copies. Based on his estimates, Switch owners bought physical copies over digital 60 percent of the time in the first quarter of 2024.

“When it comes to digital sales as a whole it’s absolutely massive,” Ahmad said more generally. “But if we look at just the physical versus digital split for games that are released physically, then yes, it’s lower than that 70 percent number and two, it definitely skews higher for AAA and first-party games, especially during the holiday season, where gifting is a notable part of it.”

And even as some big games like Baldur’s Gate 3 and Alan Wake II have initially skipped physical copies at launch, smaller games and indie releases that were previously digital-only are partnering with companies like Limited Run Games to get physical editions printed and into the hands of their hardcore fans. “I think there’s always going to be a demand for physical media,” Limited Run CEO Josh Fairhurst told Kotaku in a recent interview. “We see that with music, things were starting to feel like it was going to go all digital, and then vinyl kind of exploded, because people were starting to see kind of the downsides of digital purchasing not actually owning the music.”

He said the audience for that is definitely the biggest on Switch and smallest on Xbox, estimating that for every Xbox version of a physical game Limited Run sells, two are purchased on PlayStation and 10 are bought on Nintendo’s platform. In addition to the physical connection fans feel to the products going back to the NES and PS1 days, he thinks fears about the lack of digital preservation also drive physical collecting.

“I think that’s kind of going to happen more and more as time marches on and more services end up shutting down for whatever reason, because there’s always going to be something newer, bigger, better coming out that will eventually out mode, whatever the current popular model of distribution is,” Fairhurst said. “I think people are going to get frustrated when they see their digital purchases evaporate.”

That’s not necessarily the case as much for Xbox, where a majority of console sales this generation have already been for the disc-less Series S and millions are subscribed to the Netflix-style rental service Game Pass. Fans now routinely share photos online of almost all-digital Xbox sections at stores like Target and Best Buy where cards with download codes have replaced plastic game cases. Big first-party releases like Senua’s Saga: Hellblade II have skipped physical editions, and earlier this year a number of physical editions of small games by third-party publishers appeared to be canceled. Meanwhile, leaked plans pointed to Microsoft at one point working on a discless mid-gen refresh for the Series X.

Earlier this year, Microsoft Gaming CEO Phil Spencer told Game File the company wasn’t planning to abandon physical media. “I will say our strategy does not hinge on people moving all-digital,” he said. “And getting rid of physical, that’s not a strategic thing for us.” But analysts all think Xbox will be the first console to ditch discs entirely. Circana analyst Mat Piscatella tweeted earlier this year that he expected Microsoft to go all-digital soon, with Sony following the one after that, and Nintendo having at least two more hardware generations with physical media.

“Physical, as long as there’s disk drives on the console, is never going to go fully away, there’ll always be demand for it, as long as it’s part of the console package,” Ahmad said. “But if, for example, Xbox decides to exclude a disc drive next generation, like we saw with the all digital Series X, they’re unlikely to see a negative material impact on earnings given how niche physical sales are on the platform today.”

And even when companies continue to support physical formats, the advantages of them are continuing to erode. Where discs and cartridges used to be plug-and-play, they now need to install on the console and often require massive day-one updates. It might be weeks or months before important bugs are fixed or highly requested gameplay features get added in post-launch patches. “With that in mind, a lot of people will say ‘I’ll just get the digital version’,” Ahmad said. “It’s just the same thing, but more convenient.”