How to File BOI Report in Missouri – Ultimate Guide (2024) (original) (raw)

How to file a BOI Report in Missouri: Since the Corporate Transparency Act, the Beneficial Ownership Information (BOI) principle has become an important aspect of the regulatory framework for Limited Liability Companies, Corporations, and all types of business structures. This act aims to increase transparency and fight against illegal financial activities by requiring businesses to disclose information about beneficial owners. In Missouri, companies must comply with these BOI reporting obligations, and this guide will give a comprehensive overview of the processes involved, entities affected, and compliance actions that must be put in place.

Missouri, also known as The Show-Me State, has a population of 6,204,710. That makes the state small business friendly. According to the act, small and medium-sized businesses have to file BOI reports. In this article, LLCBuddy editors shared the latest update and mandate on filing BOI reports in Missouri.

What is Beneficial Ownership in Missouri?

Beneficial ownership in Missouri entails individuals who own or control an entity ultimately even though legal ownership rests with some other person. These persons may have significant influence over it or hold substantial interest therein as owners. Identifying who qualifies as a beneficial owner is a critical first step in complying with BOI reporting requirements. To be a beneficial owner, one must meet at least one of the following:

- Has direct or indirect ownership of 25% or more of the entity’s equity interests

- Directly or indirectly exercises significant control over the entity

It should be noted that beneficial ownership can involve complicated ownership structures; therefore entities should conduct thorough assessments of their organizational structure and holdings.

Beneficial Ownership Information Reporting

The BOI (Beneficial Ownership Information) Report is a memo or document that every small and medium-sized business (exemption applicable) has to file with the Financial Crimes Enforcement Network (FinCEN). In Missouri, any LLC that is eligible to enlist under the reporting company must file the BOI Report within the given period.

It is not only mandatory for all businesses in Missouri but also can lead to heavy monetary penalties along with imprisonment. There are many reasons why the Corporate Transparency Act was started and BOI Report filing becomes mandatory for all businesses in Missouri.

BOI Reporting Companies (Entities) in Missouri

Not every company, located in Missouri, is required to file BOI reports with FinCEN. Only the eligible companies (Reporting Companies) are liable to file the BOI report. Following are the requirements for BOI reporting,

Entities Required to Report

There are certain entities that are considered “Reporting Companies” as per the Corporate Transparency Act and must report beneficial ownership information. Normally, these include:

- Corporations

- Limited Liability Companies (LLCs)

- Professional Limited Liability Companies (PLLCs)

- Other similar entities are formed by filing a document with Missouri Secretary of State or its equivalent.

Exempted Entities

However, it is important to note that there are certain entities in Missouri that do not have BOI reporting requirements such as;

![]()

- Sole proprietorships or any business structure that does not require registration under Missouri SOS.

- Large entities (more than 20 employees with $5M revenue)

- Tax-exempt organizations

- Inactive entities meeting specific criteria

- Subsidiaries of exempt entities

- Complex ownership that is not publicly known

For PLLCs, selected types of companies get to file BOI reports. Small PLLCs that do not meet the eligibility of reporting companies are exempted from filing BOIR. Besides, PLLCs that are already under stringent regulatory authority like the medical or law field, might get an exemption too.

List of Entities Exempted from BOI Reporting According to FinCEN

Securities reporting issuer

Governmental authority

Bank

Credit union

Depository institution holding company

Money services business

Broker or dealer in securities

Securities exchange or clearing agency

Other Exchange Act registered entity

Investment companies or investment advisers

Venture capital fund adviser

Insurance company

State-licensed insurance producer

Commodity Exchange Act registered entity

Accounting firm

Public utility

Financial market utility

Pooled investment vehicle

Tax-exempt entity

Entity assisting a tax-exempt entity

Large operating company

Subsidiary of certain exempt entities

Inactive entity

Entities should review their classification carefully in order to ascertain if they fall under the requirement for reporting or qualify for an exemption. It is recommended to consult an expert before you start filing your BOI Report. Also, not only the above-mentioned sectors but also the size and structure of the business matters when it comes to filing the report. Hence, it is important to consult an expert beforehand.

How to File a BOI Report in Missouri?

In Missouri, you can file your BOI report in two ways. The report can be filed online or offline. The process is pretty simple. There is an online and offline (PDF) form available. The reporting company in Missouri has to fill up the form and submit it within the given time. Here are the steps to file the BOIR in Missouri

Recommended: You can fill up and file the BOI forms easily and without hassle by hiring a professional service. We recommend using –

#1 TOP PICK

TailorBrands – (BOI Report Filing)

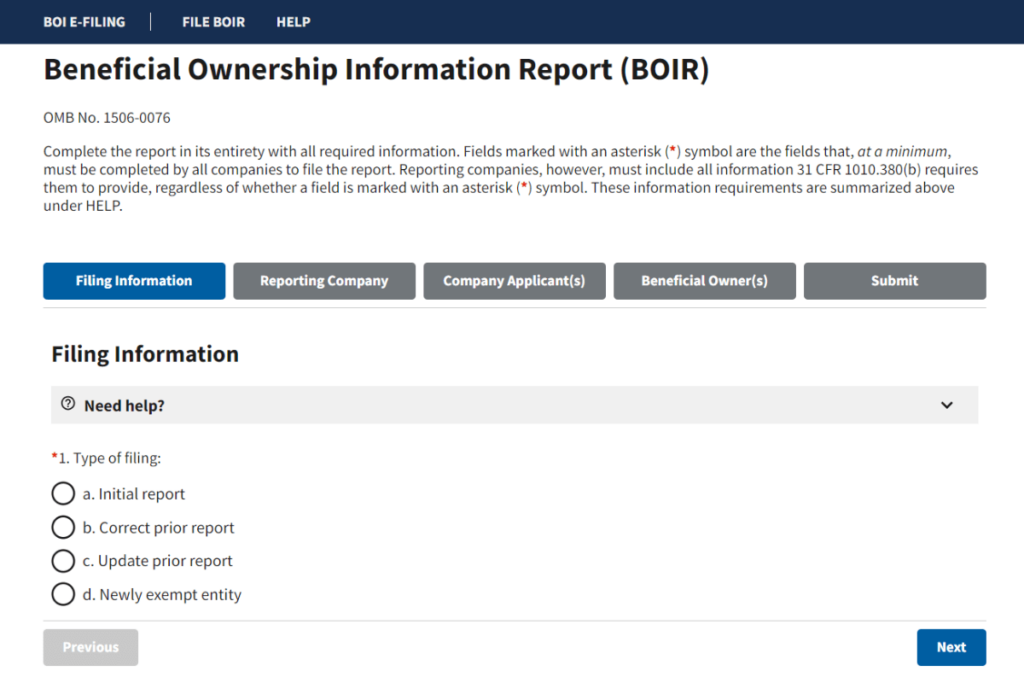

Online BOI Report Filing in Missouri

- Step 1: For online filing, reporting companies in Missouri are required to visit the FinCEN BOIR e-filing page.

- Step 2: The first page shows 4 options, Initial Report, Correct Prior Report, Update Prior Report, and Newly Exempt Entity.

- Step 3: For the fresh filing, select Initial Report and click NEXT.

- Step 4: On the next page, fill out the form for Reporting Company and ask for FinCEN ID.

- Step 5: The ‘Company Applicant’ page comes up next. Add the details wherever is required.

- Step 6: The next page shows the details of the Beneficial Owner(s). Also, mention if there is an exemption.

- Step 7: Submit the online form after sharing your name and email on the final page.

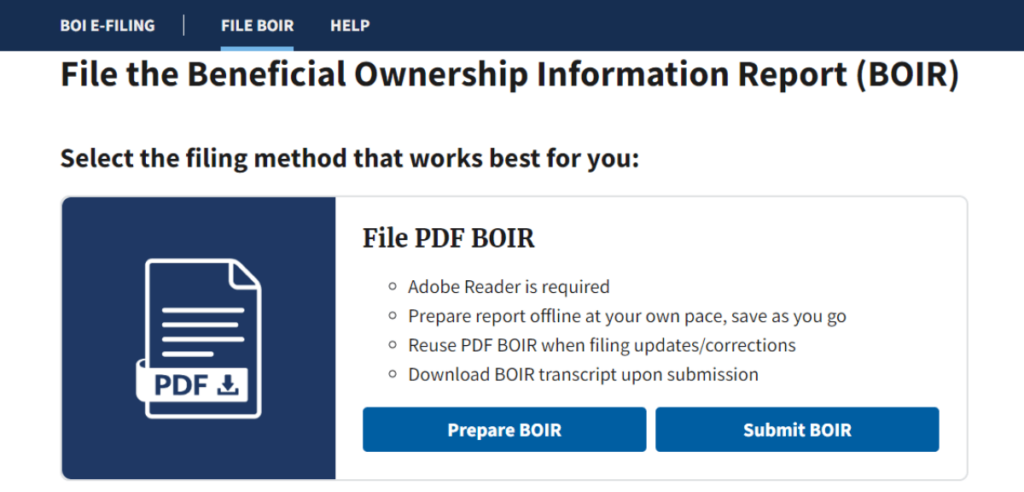

Offline BOI Report Filing in Missouri

- Step 1: For offline filing, visit the FinCEN BOI Report filing page

- Step 2: Download the PDF form from the ‘Prepare BOIR’ option

- Step 3: The PDF form requires Adobe Reader 8 or higher, make sure you have this version installed on your device.

- Step 4: Save the form on your device.

- Step 5: Fill it up with the correct information. Make sure to select the ‘Initial Report’ if you’re filing it afresh. For correction or updating the previous form, select the other options.

- Step 6: Once filled up, upload the form on the site by clicking on ‘Submit BOIR’.

- Step 7: On the Submit page, you will have to provide your name and email. Click on the ‘upload document’ section to upload the PDF form and submit it.

Reporting Process and Timeline

BOI Reporting effectively becomes mandatory from January 1, 2024, in Missouri and the rest of the United States. All the LLCs in Missouri, Corporations, and other types of businesses registered under Missouri Secretary of State will have to file the report within the given time.

- Entities in Missouri incorporated or registered before January 1, 2024, will have to file their BOI report before January 1, 2025.

- Entities in Missouri incorporated or registered on or after January 1, 2024, will have to file their BOI report within 90 working days from the date of completion of company registration with Missouri SOS or similar authority.

- Entities in Missouri incorporated or registered on or after January 1, 2025, will have to file their BOI report within 30 working days from the date of completion of company registration with Missouri SOS or similar authority.

Penalties for Non-Compliance with CTA (BOI Report Filing)

The authority decides to make it more difficult for the companies that fail to comply with the Corporate Transparency Act or BOI report filing. Following are the monetary and other penalties for non-compliance,

- The Civil Penalty for missing the deadline in Missouri is $500 a day for the company

- The Criminal Penalty for not filing the BOI Report in Missouri is $10,000

- Continuing violating rules and non-compliance in Missouri can lead to 2 years imprisonment

The FinCEN makes sure that every reporting company must file the BOI report as soon as they meet the eligibility criteria. The penalty is heavy, especially for small businesses in Missouri.

BOI Reporting Required Information in Missouri

The Beneficiary Ownership Information consists of some confidential information about the LLC owners in Missouri. The compulsory information to be given in respect of each beneficial owner includes:

- Reporting Company legal name

- Alternative or DBA Name (if any)

- Tax Identification type

- Country/Jurisdiction of Formation

- Address (number, street, and apt. or suite no.)

- Individual’s Full Legal Name

- Date of birth

- Current Address

- Identifying document (Type, Number, Issuing Jurisdiction, Image)

- Beneficial Owner Details (Legal Name, FinCEN ID, Address, DOB)

Entitles should confirm that the information given is correct and up-to-date as any inconsistencies or inaccuracies may attract penalties.

Ensuring their BOI reports are accurate and updated is a responsibility that these bodies have. Disputes or concealed information, therefore, need to be attended to quickly and openly as this is essential in compliance maintenance. Should organizations fail to do this, they may invite increased scrutiny with possible penalties imposed against them.

Privacy and Data Security

While the requirements for BOI reporting in Missouri aim at increasing transparency levels, there are practical challenges faced by entities regarding the identification and disclosure of beneficial ownership information. These may include:

- Complexity in identifying beneficial ownership for entities with intricate ownership structures or multi-layered holding companies.

- Difficulties in obtaining accurate and up-to-date information from beneficial owners, particularly where ownership interests are held indirectly or via intermediaries.

- This places an additional burden on small businesses which will find it hard to deploy enough resources and personnel to deal with compliance matters.

Entities can overcome these hurdles through engagement of professionals’ advice; and having internal mechanisms that strengthen their capacity to communicate with their beneficiaries.

Regulatory and Legal Considerations

In addition to the issues above, entities in Missouri must also navigate numerous regulatory and legal considerations when reporting BOI. These include:

- Balancing transparency with legitimate privacy concerns, especially for individuals who may be exposed to personal safety risks or other sensitive situations.

- Addressing international implications and cross-border ownership structures since BOI reporting requirements can vary across jurisdictions.

- Compliance with other relevant legislations such as anti-money laundering (AML) laws and know-your-customer (KYC) regulations is necessary as well.

What helps entities address these concerns is consulting the legal fraternity on changes occurring within the regulatory space.

Anticipated Changes and Updates

With time, FinCEN together with other relevant agencies will provide further guidance on complying with these reporting requirements as financial crime evolves. For instance, new changes could affect how they comply with these requirements. Additionally, in the future, there is a possibility of expanding or modifying the reporting requirements to deal with emerging issues or any possible loopholes.

Impact on Businesses and Financial Sector in Missouri

The introduction of BOI reporting requirements will have profound effects on both corporate entities and the financial sector as a whole. Likely consequences could include:

- Increased administrative burdens and compliance costs for firms, especially at the early stages of implementation.

- Enhanced due diligence procedures by financial institutions to verify the accuracy of BOI reports and identify potential red flags.

- Business practices may change leading to ownership structures that are more flexible to fit into new transparency needs.

- Entities that have complex ownership arrangements or those operating internationally may face some difficulties.

Nonetheless, in the long run, it can be expected that this law would go towards creating an environment where business is transparent and accountable thus enhancing trust and integrity within the financial system.

Significance of Reporting Beneficial Ownership Information

Reporting BOI is essential for several reasons. We have come up with three main reasons that CTA pointed out for having BOI reporting.

![]()

- Preventing Illegal Activities: Identifying true owners helps to combat money laundering, terrorist financing, and other financial crimes in Missouri since bad actors cannot hide behind complex corporate structures.

- Enhancing Transparency: It ensures corporate transparency and accountability so that entities cannot operate under cover but are required to reveal who their beneficial owner(s) are.

- Facilitating Law Enforcement: Accurate data on BOI allows law enforcement authorities to investigate and prosecute fraudulent activities better thus protecting a fair business environment.

Starting an LLC in Missouri or forming a corporation in Missouri can be an eyewash of hiding other shady activities or illegal businesses. Companies often create shell companies to money launder. This reporting was started to prevent such activities in Missouri.

State Specific Data: Missouri

Capital and Incorporation

- The capital of Missouri is Jefferson City.

- The population of Missouri: 6,204,710

- The Annual GDP of Missouri: 392,935

- Incorporation in Missouri can be done through various methods including online and offline. For more details, visit Missouri Secretary of State.

- Incorporation Method in Missouri (Online): Create an account/Log in to the SOS site, get the online form, fill it, and submit online

- Incorporation Method in Missouri (Offline): Send the form by mail or drop it off in person to Corporations Unit, James C. Kirkpatrick State Information Center, P.O. Box 778, Jefferson City, MO 65102

Filing Fees

- LLC Initial Filing Fee: 105(bymailand105 (by mail and 105(bymailand50 online)

- LLC Amendment Fees: $25

- Annual Fee: $7

- DBA Filing Fee: $7

- Incorporation Fee: 50fofilingonline,50 fo filing online, 50fofilingonline,105 for filing by mail

- Registered Agent Change Fee: $10

- Corporate Amendment Fee: $25

Important Offices

- State Tax Office: Missouri Department of Revenue

- State Insurance Office: Missouri Department of Insurance, Financial Institutions and Professional Registration

- Secretary of State Address: Corporations Unit, James C. Kirkpatrick State Information Center, P.O. Box 778, Jefferson City, MO 65102

- Department of Treasury: Department of the Treasury Internal Revenue Service Center – Kansas City, MO 64999 Fax: 855-887-7734

Key Contacts

- Form 2335 Mailing Address: Department of the Treasury Internal Revenue Service Center – Kansas City, MO 64999 Fax: 855-887-7734

- Filing Method for DBA: three methods, online, by mail, and in person filing.

- Filing Fee for DBA: $7

- Online Filing for DBA: For online filing, check the Missouri Corporations Online Portal. There, look for the “Assumed Names” section. You will get the registration form.

- Offline Filing for DBA: For filing offline, you must send the downloaded PDF form to the Corporations Division, P.O. Box 778, Jefferson City, MO 65102 or drop it off in person at the Corporations Division, 600 W. Main St., Rm. 322, Jefferson City, MO 65102

By staying compliant with the BOI reporting requirements and leveraging the resources available in Missouri, businesses can ensure they meet all regulatory obligations efficiently.

FAQs

How do I file a boi report in Missouri?

To file a boi report in Missouri, you must submit a written report to the Missouri Department of Revenue.

What information is required in a boi report in Missouri?

The boi report in Missouri must include detailed information about all business activities conducted in the state.

When is the deadline for filing a boi report in Missouri?

The deadline for filing a boi report in Missouri is typically by the 15th day of the fourth month after the close of the entity’s tax year.

Can I file a boi report online in Missouri?

Yes, you can file a boi report online through the Missouri Department of Revenue’s website.

What happens if I don’t file a boi report in Missouri?

Failure to file a boi report in Missouri can result in penalties, fines, and even loss of business privileges in the state.

Can I file a boi report for multiple entities in Missouri?

Yes, you can file a single boi report for multiple entities in Missouri if they are under common control.

Is there a filing fee for a boi report in Missouri?

No, there is no filing fee required to submit a boi report in Missouri.

How can I get help with filing a boi report in Missouri?

You can contact the Missouri Department of Revenue directly for assistance with filing your boi report.

What documentation should I include with my boi report in Missouri?

You should include all relevant financial statements, tax returns, and supporting documentation with your boi report in Missouri.

Are there any resources available to help me understand the requirements for filing a boi report in Missouri?

Yes, you can access the Missouri Department of Revenue’s website for detailed instructions and guidelines on filing a boi report in Missouri.

Can I request an extension for filing my boi report in Missouri?

Yes, you can request an extension for filing your boi report in Missouri, but you must do so before the original due date.

What are some common mistakes to avoid when filing a boi report in Missouri?

Some common mistakes to avoid when filing a boi report in Missouri include inaccuracies in reporting business activities and missing deadlines.

Do I need to file a boi report in Missouri every year?

Yes, you must file a boi report in Missouri every year to report your business activities conducted in the state.

Can I file a boi report in Missouri if my business is no longer operating?

Yes, you are still required to file a final boi report in Missouri to officially close out your business activities in the state.

How long does it typically take to process a boi report in Missouri?

The processing time for a boi report in Missouri can vary depending on the volume of reports being filed, but typically takes a few weeks.

Can I file a boi report for a foreign entity operating in Missouri?

Yes, foreign entities conducting business in Missouri are also required to file a boi report with the Missouri Department of Revenue.

What are the consequences of filing a late boi report in Missouri?

Filing a late boi report in Missouri can result in penalties and fines being assessed by the state.

Can I file an amended boi report in Missouri?

Yes, you can file an amended boi report in Missouri if you discover errors or omissions in your original report.

Are boi reports in Missouri subject to audit?

Yes, boi reports in Missouri are subject to audit by the Missouri Department of Revenue to ensure compliance with state tax laws.

How can I check the status of my boi report in Missouri?

You can typically check the status of your boi report by contacting the Missouri Department of Revenue or checking online through their website.

Is there a helpline I can call for assistance with filing a boi report in Missouri?

Yes, you can contact the Missouri Department of Revenue’s helpline for assistance with filing your boi report.

Can I file a boi report for a non-profit organization in Missouri?

Yes, non-profit organizations conducting business activities in Missouri are also required to file a boi report with the state.

Can I file a boi report for a partnership in Missouri?

Yes, partnerships operating in Missouri are also required to file a boi report with the Missouri Department of Revenue.

What should I do if I receive a notice from the Missouri Department of Revenue regarding my boi report?

If you receive a notice from the Missouri Department of Revenue regarding your boi report, promptly respond and address any issues raised.

Can I file a boi report for a sole proprietorship in Missouri?

Yes, sole proprietorships conducting business activities in Missouri are also required to file a boi report with the state.

What information is confidential in a boi report in Missouri?

The information contained in a boi report in Missouri is considered confidential and protected from public disclosure under state law.

Can I file a boi report for a corporation in Missouri?

Yes, corporations operating in Missouri are required to file a boi report with the Missouri Department of Revenue.

Can I file a boi report in Missouri on behalf of someone else?

Yes, you can file a boi report on behalf of someone else, such as a tax professional or attorney, with their authorization.

Can I file a boi report in Missouri if my business has no activities in the state?

Yes, even if your business has no activities in Missouri, you may still be required to file a boi report with the state.

Can I file a boi report in person in Missouri?

Yes, you can file a boi report in person at a Missouri Department of Revenue office.

Is there a deadline for filing a boi report in Missouri?

Yes, boi reports in Missouri are due by March 1st each year.

What information do I need to provide when filing a boi report in Missouri?

You will need to provide information about your business’s assets, income, and expenses when filing a boi report in Missouri.

Are there any penalties for filing a boi report late in Missouri?

Yes, there are penalties for late filing in Missouri, so make sure to submit your report by the deadline.

How long does it take to file a boi report in Missouri?

The time it takes to file a boi report in Missouri will vary depending on the complexity of your business and the accuracy of your records.

Do I need to file a boi report every year in Missouri?

Yes, boi reports are required to be filed annually in Missouri.

What are the consequences of not filing a boi report in Missouri?

Failing to file a boi report in Missouri can result in serious penalties, so it is important to comply with the requirements.

Can I get an extension to file my boi report in Missouri?

Yes, you can request an extension to file your boi report in Missouri, but it must be done before the deadline.

How can I make corrections to a boi report that I have already filed in Missouri?

If you need to make corrections to a boi report in Missouri, you should contact the Missouri Department of Revenue for guidance on how to proceed.

Do I need to pay a fee to file a boi report in Missouri?

There is no fee to file a boi report in Missouri, but failing to file by the deadline may result in fines.

Can I file a boi report for multiple businesses in Missouri?

Yes, you can file boi reports for multiple businesses in Missouri, but you will need to submit a separate report for each business.

Are there specific instructions for filing a boi report for a nonprofit organization in Missouri?

Nonprofit organizations may have different requirements for filing boi reports in Missouri, so it is important to review the guidelines provided by the Department of Revenue.

Can I request an adjustment to my boi report in Missouri if I made an error?

Yes, you can request an adjustment to your boi report in Missouri if you discover an error, but it is important to do so as soon as possible.

Is there a phone number I can call for assistance with filing a boi report in Missouri?

You can contact the Missouri Department of Revenue at their toll-free number for assistance with filing a boi report.

What should I do if I am unsure about how to properly file a boi report in Missouri?

If you are unsure about how to file a boi report in Missouri, you may want to consult with a tax professional or contact the Department of Revenue for guidance.

Can I file a boi report for a business that has closed in Missouri?

Yes, you are still required to file a boi report for a business that has closed in Missouri, as long as it was operational during the reporting period.

What documentation should I retain after filing a boi report in Missouri?

You should keep copies of all documents related to your boi report in Missouri for at least three years in case of an audit.

What is the purpose of filing a boi report in Missouri?

The purpose of filing a boi report in Missouri is to report your business’s financial information for tax assessment purposes.

Can I file a boi report on behalf of someone else in Missouri?

If you are authorized to do so, you may file a boi report on behalf of someone else in Missouri, such as a business owner or authorized representative.

What is the best way to ensure accuracy when filing a boi report in Missouri?

To ensure accuracy when filing a boi report in Missouri, it is important to maintain detailed and well-organized records throughout the year.

Should I consult with a tax professional before filing a boi report in Missouri?

Consulting with a tax professional can be helpful to ensure that you are filing your boi report correctly in Missouri and taking advantage of any available deductions or credits.

Can I file a boi report for a business that is located outside of Missouri?

No, boi reports are specific to businesses located within Missouri, so if your business is located outside of the state, you will need to follow the reporting requirements in that jurisdiction.

Are there any workshops or resources available to help me understand how to file a boi report in Missouri?

The Missouri Department of Revenue may offer workshops or provide online resources to help you better understand the process of filing a boi report.

What steps should I take if I receive a notice from the Department of Revenue regarding my boi report in Missouri?

If you receive a notice regarding your boi report in Missouri, it is important to review the information carefully and respond promptly as instructed.

Can I file a boi report for a business that operates on a seasonal basis in Missouri?

Yes, businesses that operate seasonally in Missouri are still required to file a boi report based on their financial activities during the reporting period.

How can I determine if my business is subject to boi reporting in Missouri?

The Missouri Department of Revenue provides guidelines to determine whether your business is subject to boi reporting based on its assets, income, and other factors.

Is there a specific form I need to use to file a boi report in Missouri?

Yes, the Missouri Department of Revenue provides specific forms for filing a boi report, which can be accessed on their website or obtained by contacting their office.

Also Read

- Alabama BOI Report

- Alaska BOI Report

- Arizona BOI Report

- Arkansas BOI Report

- California BOI Report

- Colorado BOI Report

- Connecticut BOI Report

- Delaware BOI Report

- DC BOI Report

- Florida BOI Report

- Georgia BOI Report

- Hawaii BOI Report

- Idaho BOI Report

- Illinois BOI Report

- Indiana BOI Report

- Iowa BOI Report

- Kansas BOI Report

- Kentucky BOI Report

- Louisiana BOI Report

- Maine BOI Report

- Maryland BOI Report

- Massachusetts BOI Report

- Michigan BOI Report

- Minnesota BOI Report

- Mississippi BOI Report

- Missouri BOI Report

- Montana BOI Report

- Nebraska BOI Report

- Nevada BOI Report

- New Hampshire BOI Report

- New Jersey BOI Report

- New Mexico BOI Report

- New York BOI Report

- North Carolina BOI Report

- North Dakota BOI Report

- Ohio BOI Report

- Oklahoma BOI Report

- Oregon BOI Report

- Pennsylvania BOI Report

- Rhode Island BOI Report

- South Carolina BOI Report

- South Dakota BOI Report

- Tennessee BOI Report

- Texas BOI Report

- Utah BOI Report

- Vermont BOI Report

- Virginia BOI Report

- Washington BOI Report

- West Virginia BOI Report

- Wisconsin BOI Report

- Wyoming BOI Report

In Conclusion

In the world of business, conducting illicit monetary transactions is not a new thing. To prevent that the Corporate Transparency Act came into the picture. Businesses in Missouri, especially, small and medium businesses must file the Business Ownership Information Report to combat growing financial crimes. In Missouri, the companies must understand the obligations to comply with the rules.

In Missouri, before you start filing the BOI Report, there are a few important points to note. Important points worth noting are:

- Identifying beneficial owners from their control or ownership interests over the entity.

- Reporting accurate information at all times including names, dates of birth, addresses, and identification details about beneficiaries.

- Timely filing of the initial reports and updating the reports in case of changes.

- When required, involve reputable third-party service providers to assist in the filing process.

- Ensure compliance with relevant penalties for non –compliance.

- Deal with practical challenges and legal issues related to BOI reporting.

- Keep abreast of future developments and advice from relevant bodies.

Filing the BOI Report does not require complicated steps, however, it definitely requires an expert to proceed. We recommend TailorBrands, one of the best LLC formation services that not only offers free LLC formation but also offers BOI Reporting at a very reasonable cost.