3 Diverse Companies With Recent Insider Buying in Common (original) (raw)

Chatham Lodging Trust, Summit Materials and Vistra Corp. all have seen their CEOs add to their holdings in these companies.

I still am finding little value in the market as we start a new trading week. I also expect sporadic selloffs in mega-cap names such as Tesla Motors (TSLA) and Amazon (AMZN) that have led the rally. Let's hope as the economic restart gains more traction and we continue to see progress on the Covid-19 front that breadth will improve for equities.

I continue to sort through the market for special situations and pockets of undervaluation. One thing I find helpful in identifying new opportunities is insider buying. Today I will highlight three names with recent and significant insider purchases.

The first is Chatham Lodging Trust (CLDT) , a hotel REIT I highlighted recently as a beneficiary of the slow return to economic normality. Since that piece ran on Aug. 26, CEO Jeffrey Fisher has added almost $1 million in stock to his stake in Chatham through three separate purchases so far in September. That's a nice vote of confidence in our investment thesis in this name.

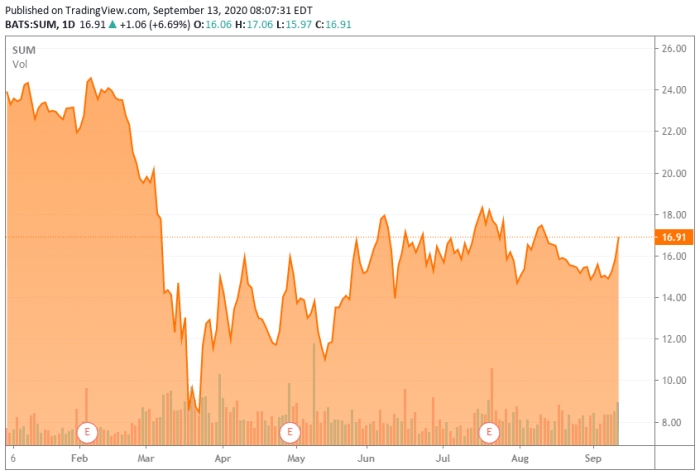

Next up is Summit Materials (SUM) , a new name that just popped onto my radar. Summit Materials is a Denver-based producer of construction materials and related downstream products. These shares just saw their first insider purchase in more than a year and a half as Summit Materials' CEO Anne Noonan added just over $1 million in new shares to her holdings in the company.

Summit Materials would seem to fit into the robust housing market investment theme I have been pounding the table on in these columns for a couple quarters now. The company reaps more than 50% of its overall revenue from the states of Texas, Utah, Missouri and Kansas, which are not experiencing some of myriad problems right now on the coasts.

Summit Materials also could benefit from any post-election scenario where an infrastructure bill is part of early 2021 legislation as 38% of its revenue is from public infrastructure projects. The stock has come back nicely from the March meltdown lows, but the shares are still down 30% for the year. The CEO seems to be signaling that better times lie ahead.

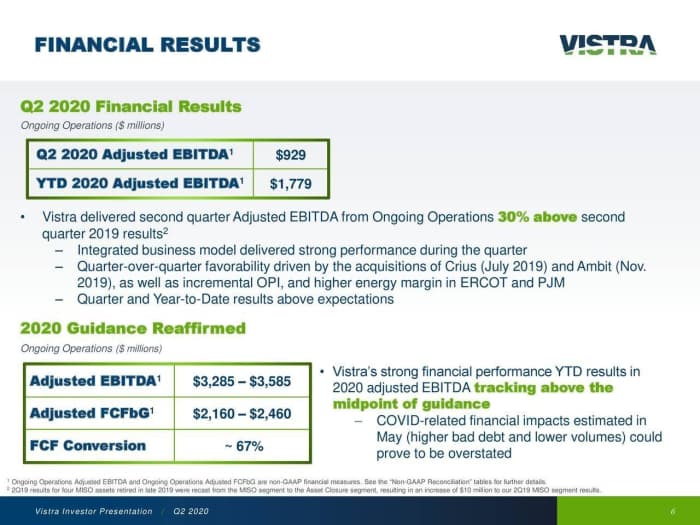

We end with Vistra Corp. (VST) , which is based in Irving, Texas, and sells electricity to residential, commercial and industrial customers across 20 states. Vistra CEO Curtis Morgan recently added almost 750,000tohisstakeinthecompanywhileadirectorpurchasedmorethan750,000 to his stake in the company while a director purchased more than 750,000tohisstakeinthecompanywhileadirectorpurchasedmorethan360,000 of shares the same day.

Vistra has delivered above expectations so far in 2020 thanks to solid business performance as well as integrating a couple acquisitions it made in the second half of 2019. Nonetheless, its shares are down nearly 20% for the year to date. The stock is selling around 18ashareandyieldsnearly318 a share and yields nearly 3%. Analyst price targets proffered since May have been in the mid 18ashareandyieldsnearly320s to mid $30s range.

At the time of publication, Jensen was long CLDT.