Analysts Advise Contrarian Plays in Retail Stocks (original) (raw)

Some Wall Street voices advise there could be some key contrarian retail names to select while anxiety emanates from the sector.

Shares of prominent retailers such as Nike (NKE) , Under Armour (UA) , and VF Corp. (VFC) all slid sharply following a crescendo in the trade war as further tariffs are expected to impact the sector straight into back-to-school buying.

However, the strong reaction to the overall sector could lead to some attractive buying opportunities amidst the panic.

Charting China Exposure

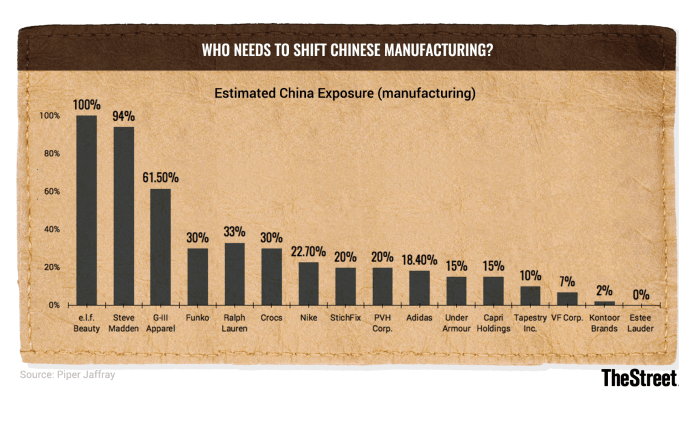

The first step is to quantify the direct impact of new tariffs on each retailer in terms of their supply lines.

The high exposure of companies such as Ralph Lauren (RL) and Steve Madden (SHOO) might make them far more difficult plays in the near term, while companies like Capri Holdings (CPRI) might have been unduly punished along with their peer group and may be more nimble in terms of tariff mitigation.

"While retail stocks reacted aggressively on Thursday afternoon, and in some cases over-reacted, we do see some opportunities," Piper Jaffray analyst Erinn Murphy advised. "We would be buyers of UAA, NKE & VFC. These names have diversified global footprints and lower-than-average exposure in China."

She added that each company has solid pricing power and should be able to navigate a shifting environment without impacting demand to too large a degree.

Additionally, she advised non-American names like Adidas (ADDYY) and Puma (PUMSY) are likely oversold based on their lessened risk of patriotic buying backlash in China and ability to avoid U.S. imposition.

The impact on the sales side is more likely to impact travel reliant names that are often buoyed by Chinese tourism.

PVH Corp. (PVH) , Tapestry (TPR) , Capri Holdings and G-III Apparel (GIII) were cited by Murphy as most at risk in this trend. Of course, this also applies to upscale and luxury retailers such as Tiffany (TIF) and Canada Goose (GOOS) .

Prior Planning

While charting overall exposure is helpful, a changing landscape will ultimately come down to management's ability to execute under the new pressure.

The easiest way to analyze the ability of each company to continue momentum is to observe how each retailer has reacted to the tariffs so far.

While department stores including Macy's (M) , J.C. Penney (JCP) , and Nordstrom (JWN) have been hit hard by the recent news, many of these names had built in the potentiality for a tariff hike into guidance.

"This is a dynamic situation but let me give you a high-level view," Macy's CEO Jeff Gennette said in May. "The increase of the third tranche from 10% to 25% on does have some impact particularly on our furniture business. However, the team anticipates that this can be mitigated. If the potential fourth tranche of tariffs is placed on all Chinese imports that will have an impact on both our private and our national brands."

Accordingly, the look ahead may be tempered, but not be as extremely as the market initially registered.

According to Credit Suisse research, specialty retailers such as Home Depot (HD) and Dick's Sporting Goods (DKS) will be also able to avoid the latest tranche of tariffs based on the impact being considered in guidance and the differentiation in their supply lines. Their research delineates these names from other retailers like Lowe's (LOW) and Best Buy (BBY) which are indeed in the cross hairs of the latest tariff tranches with little room for quick solutions.

Additionally, larger retailers with more hands on control on supplier relationships and diversified supply bases such as Walmart (WMT) and Target (TGT) are strongly positioned to counteract trade impacts per the report.

Credit Suisse analyst Michael Binetti added that higher-end brands like Revolve (RVLV) will be able to mitigate some effects based upon pricing power in the long term, despite the near-term EPS hit.

Off-Price Opportunity

Possibly overlooked are the dynamics of off-price retail as well, as a weakened consumer could be pushed toward lower-cost options.

Many lower-cost retailers that can maintain margins through lower exposure to China could therefore become contrarian defensive options for an investor's portfolio.

"We have stated before that if anything, off-price retailers could benefit from tariff disruption, which can free-up buying opportunity from the full-price channel due to inventory disruptions," D.A. Davidson analyst John Morris pointed out. "Given the indiscriminate sector sell-off, we would be buyers of the off-pricers Burlington Store (BURL) and TJX Companies (TJX) as well as Boot Barn (BOOT) , in the wake of the company's upside earnings surprise."

That very analysis is indeed driving Jim Cramer's Action Alerts PLUS team to buy Burlington Stores as the stock fell sharply on the recent news.

"Over the long run, Burlington's off-price model should provide a degree of insulation to this tranche of tariffs," the team advised. "Therefore, we view BURL as a buying opportunity on this tariff announcement, and we'll continue to scale into this name as the market gets hit on incremental tariff news because it would not be a surprise to see this selloff spread across multiple days."

For more on what they're buying amid the noise and what names they are advising investors to avoid, click here for their full report.

Employees of TheStreet are restricted from trading individual securities.

Action Alerts PLUS, which Cramer manages as a charitable trust, is long BURL and HD.