Bearish Bets: 3 Stocks You Really Should Consider Shorting This Week (original) (raw)

These recently downgraded names are displaying both quantitative and technical deterioration.

Each week we identify names that look bearish and may present interesting investing opportunities on the short side.

Using technical analysis of the charts of those stocks, and, when appropriate, recent actions and grades from TheStreet's Quant Ratings, we zero in on three names.

While we will not be weighing in with fundamental analysis, we hope this piece will give investors interested in stocks on the way down a good starting point to do further homework on the names.

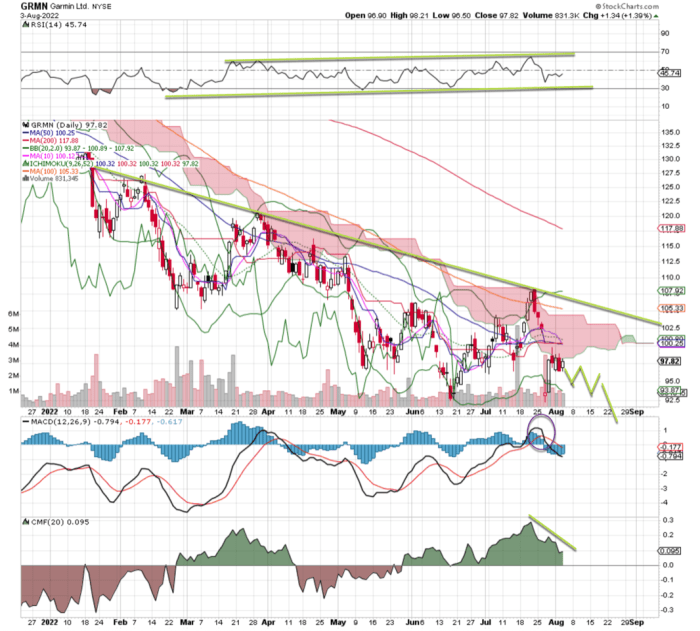

Garmin Looks Lost

Garmin Ltd. (GRMN) recently was downgraded to Hold with a C+ rating by TheStreet's Quant Ratings.

The producer of GPS navigation technology has fallen hard since the start of the year. Garmin has a defined downtrend channel with lower highs and lower lows and its moving average convergence divergence (MACD) now is on a sell signal.

Money flow is pointing lower and volume trends are weak; notice the elevated volume on the down sessions. If short, target the low 80s,putinastopat80s, put in a stop at 80s,putinastopat107 just in case.

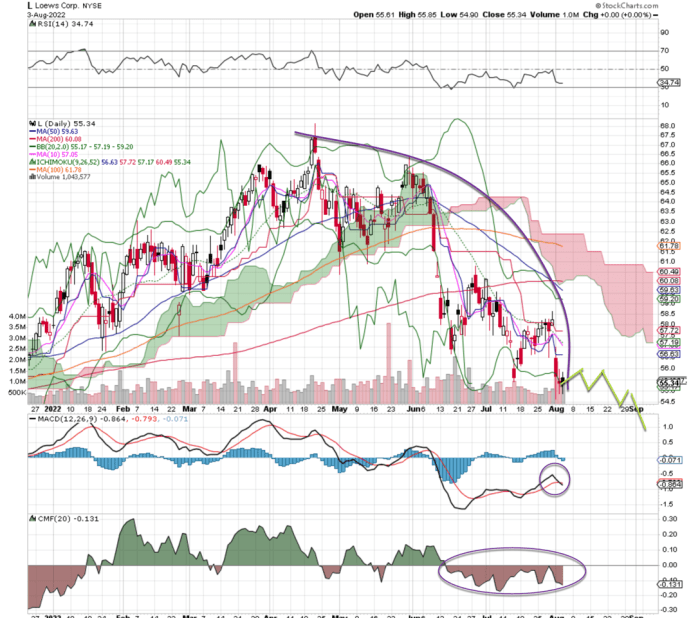

Loews Could Go Lower

Loews Corp. (L) recently was downgraded to Hold with a C rating by TheStreet's Quant Ratings.

The commercial property and casualty insurer has shown plenty of volatility this year and it doesn't appear that is over. Money flow is weak and the cloud is red; relative strength is very poor, too.

Loews has a massive downtrend line with lower highs and lower lows. There is plenty more downside to go here. We could see this stock make a run to 40beforetoolong,butputastopinatthegaparound40 before too long, but put a stop in at the gap around 40beforetoolong,butputastopinatthegaparound58 just in case.

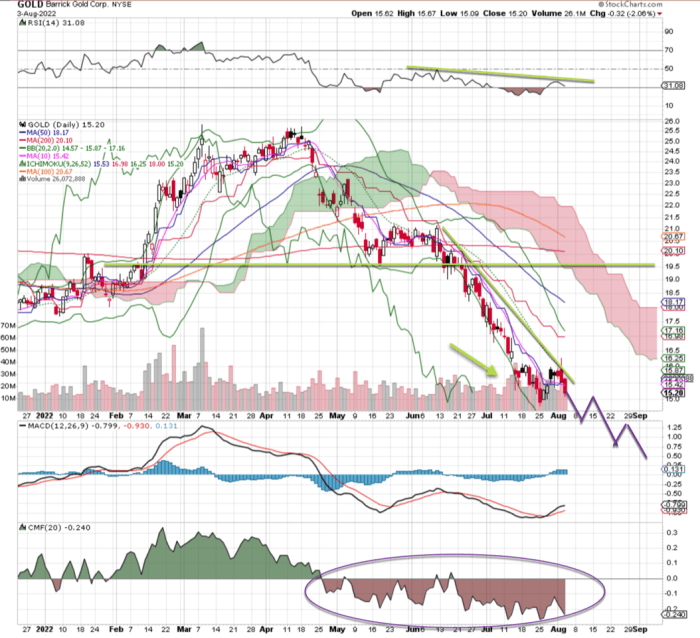

Barrick Gold Isn't Glistening

Barrick Gold Corp. (GOLD) recently was downgraded to Hold with a C+ rating by TheStreet's Quant Ratings.

The gold and copper miner has been clobbered this year on very strong volume, poor indicators and just very weak price action. The resistance is clear around $20. The downtrend line is quite severe, too.

There is nothing to hold this stock up here, but any rally could be shorted. Even at this current price, a move down to 11orsocouldbeagoodtarget.Putinastopat11 or so could be a good target. Put in a stop at 11orsocouldbeagoodtarget.Putinastopat17.50 just in case.

(Real Money contributor Bob Lang is co-portfolio manager of TheStreet's Action Alerts PLUS. Want to be alerted before AAP buys or sells stocks? Learn more now. )

At the time of publication, Lang had no positions in the stocks mentioned.