Building the Case for 3 Infrastructure Plays (original) (raw)

Jacobs Engineering, Summit Materials and Great Lakes Dredge & Dock appear attractive, especially if infrastructure spending picks up.

The federal government has allocated $5 trillion over the past year for Covid-19 relief, which greatly has boosted consumer spending, albeit much of the "relief" could have been avoided if the nation had not kept restrictions in place for so long in so many regions. My home state of Florida is proof of that.

In addition, this "relief" spending along with largess of the Federal Reserve has been a primary driver of the huge uptick in inflation we have experienced in recent months. Whether the increase in cost inputs is "temporary" and "transitory" as central bankers keep assuring the market will be a $64,000 question for investors in the months ahead.

Now the Biden administration is pushing a 6trillionannualbudgetthatisabout506 trillion annual budget that is about 50% larger than pre-pandemic levels. A good portion of the spending is targeted at what is loosely defined as "infrastructure." Whether these proposals pass in their current form is anybody's guess given the lack of bipartisan support and the very narrow margins that exist in the House and Senate. A good portion of the actual infrastructure spending, if passed, also might be tied up for years in bureaucratic red tape and environmental reviews, much as what happened with the 6trillionannualbudgetthatisabout50809 billion recovery bill enacted in 2009 that saw little in "shovel ready" job generation.

However, infrastructure might be a key buzzword for the markets in coming weeks. In that vein, here are several infrastructure names that might get a temporary boost in sentiment.

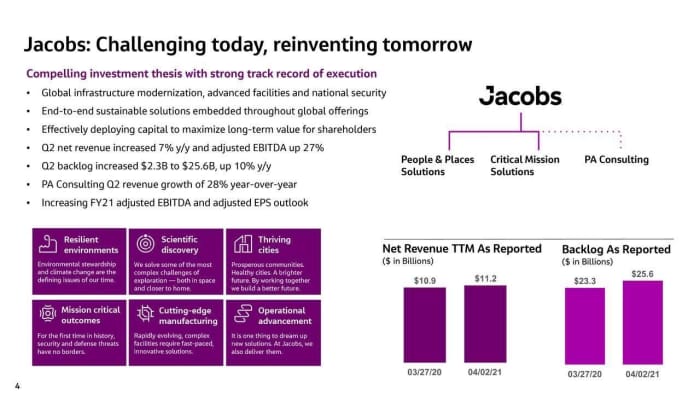

Let's start with Jacobs Engineering (J) , which has transitioned nicely in recent years from being dependent on the energy sector. Jacobs Engineering recently won a huge, 10-year, $6.4 billion environmental cleanup project in Idaho. Additional infrastructure spending could enable other such opportunities. The company's business is already in good shape at it is.

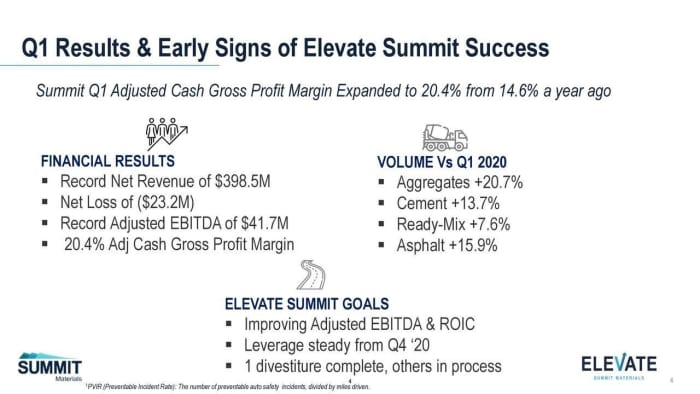

Summit Materials (SUM) had a big earnings and revenue beat when it reported first-quarter results three weeks ago. Summit Materials' aggregates, ready-mix concrete, cement, asphalt and paving businesses already are humming thanks to the pandemic-inspired migration that is happening from big cities to more rural and exurban areas. Any legislation that boosts transportation infrastructure and highway spending would just be another tailwind for Summit Materials. The company's efforts to boost margins also are bearing fruit as well.

Finally, we have Great Lakes Dredge & Dock (GLDD) , the largest dredging company in North America. Any money that goes to expanding ports or improving river/lake navigation should benefit Great Lakes Dredge.

i

As it is, Great Lakes Dredge already has announced a slew of new contract wins here in May. New or additional money from the federal government for port deepening, port expansion, coastal restoration, land reclamation, underwater trenches and/or coastal protection will just add to the company's backlog and future prospects.

At the time of publication, Jensen was long GLDD and SUM.