Delek US Holdings Should Continue to Go With the Upside Flow (original) (raw)

A breakout should come soon based on the downstream energy company's charts.

Delek US Holdings (DK) is a downstream energy company with assets in petroleum refining, logistics, convenience stores, asphalt and renewables. The charts and indicators of Delek look poised for further gains, so let's look for a strategy to do some buying.

In this daily bar chart of DK, below, we can see a bullish trend in price the past 12 months. Prices have rallied from lows in December and January and doubled into June. DK corrected in a sideways to lower move before steading in July and moving higher again. DK is trading above the rising 50-day moving average line and above the rising 200-day line. The trading volume increased up into June and then remained fairly active. The On-Balance-Volume (OBV) line has been steady since July. The Moving Average Convergence Divergence (MACD) oscillator is in a bullish alignment above the zero line.

In this weekly Japanese candlestick chart of DK, below, we can see the past three years of price history. Prices have moved higher from early 2020 and have formed a rising triangle formation since May. An upside breakout should come soon if I am reading the chart right. Prices are above the rising 40-week moving average line. The weekly OBV line has confirmed the price gains the past three years and is on the rise again and close to making its own new high. The trend-following MACD oscillator is above the zero line and poised for a new outright buy signal.

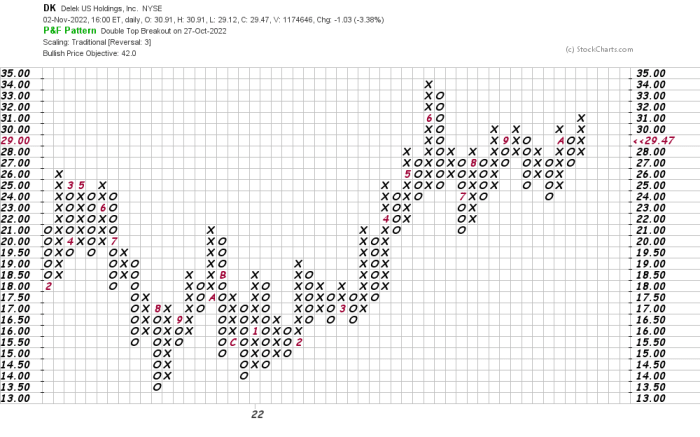

In this first Point and Figure chart of DK, below, we used daily price data. Here the charting software projects a price target in the $42 area.

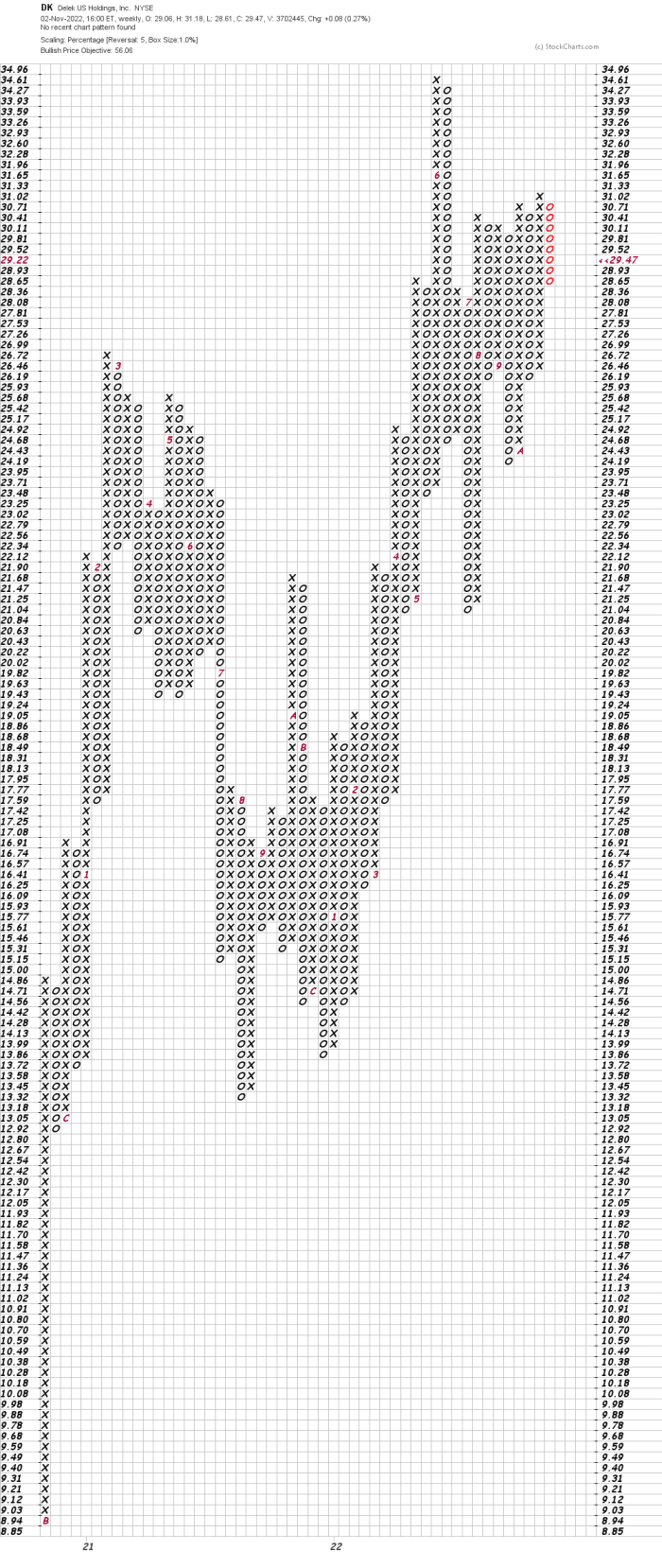

In this second Point and Figure chart of DK, below, we used weekly price data with a five-box reversal filter. Here the software yields a target in the $56 area.

Bottom line strategy: Traders looking for another energy play could go long DK at current levels. Risk to 25fornow.Ourfirstpriceobjectives25 for now. Our first price objective s 25fornow.Ourfirstpriceobjectives42.

Employees of TheStreet are prohibited from trading individual securities.