Eye-Catching Quarterly Results From a Trio of Companies (original) (raw)

The first-quarter reports from Camping World, Esperion Therapeutics and BioDelivery Sciences were impressive amid coronavirus disruption.

The market continues to hold up quite well given the horrific and historic headlines that keep coming. More than 20 million Americans lost their jobs in April and more than 30 million have filed for unemployment claims thanks to the shutdown of the country due to coronavirus.

While Covid-19 is not nearly contained, there has been some encouraging progress. After some initial bungling by local and state officials, the situation in New York has improved markedly in recent weeks as the daily death toll has dropped by three quarters from its peak and the state's hospital system never became overwhelmed as so many predicted.

Given the unprecedented period we are living through, it is easy to forget about the things we usually scrutinize so intently as investors. During normal times most market conversation right now would be on first-quarter results amid another earnings season. So, I'll highlight three of the better reports I've seen across my portfolio this week. These quarterly results have given me additional confidence to add to my stakes in these stocks via covered calls during the next decline in the overall market.

Let's start with Camping World Holdings (CWH) , a name I have talked about occasionally. Life in recreational vehicle land appears to be much better than the market feared.

Camping World's first-quarter numbers easily beat top- and bottom-line expectations as revenue was down around 2% from a year ago. Management sounded upbeat about the future and has done a good job adjusting its cost structure, which resulted in a big jump in EBITDA. Camping World will look to take market share in this uncertain environment. One would think many families will be canceling trips to Disneyland and other crowded tourist meccas in favor of more secluded locales, such as the mountains, especially as most summer camps will be canceled this year. If so, the RV sector should benefit.

Esperion Therapeutics (ESPR) is another name that had a good earnings call on Thursday. The initial rollout of recently approved Nexletol seems to be gaining traction despite the impact of the pandemic.

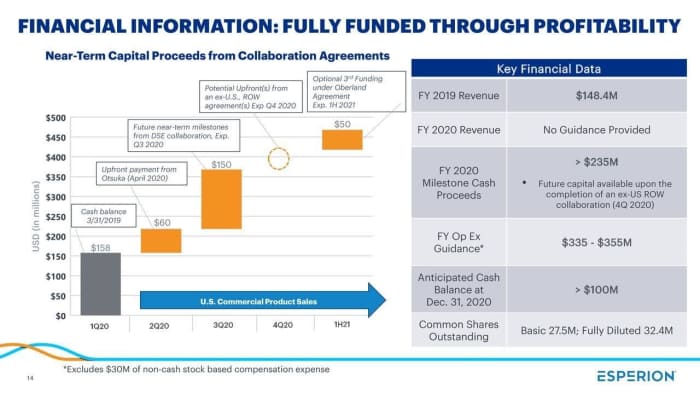

Esperion should benefit from the large marketing partnerships it has with a couple big players in Asia and Europe, where the compound was approved last month. This should result in a growing stream of revenue from royalties and sales milestones in the months and years ahead.

Esperion is not providing 2020 guidance at the moment due to the uncertainty caused by the coronavirus. However, Nexletol already has achieved 50% commercial coverage in the U.S. and the company's balance sheet is in good shape.

Finally, we have BioDelivery Sciences International (BDSI) , which also reported quarterly results on Thursday. I touched briefly on this small biopharma earlier this week as a possible logical buyout target if merger-and-acquisition activity picks up across the industry. BioDelivery Sciences reported another stellar quarter after the bell.

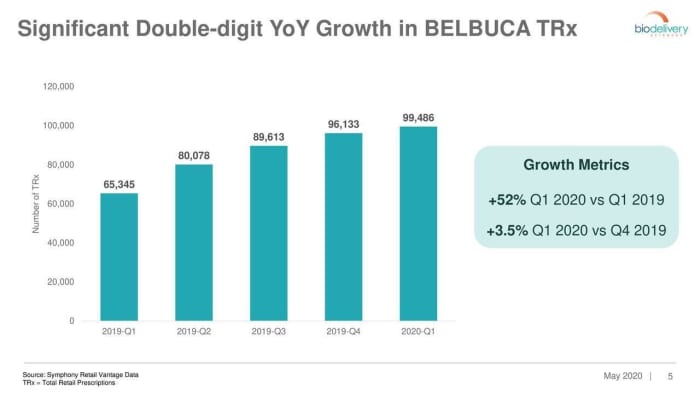

Despite a very challenging environment as most of the nation was in lockdown throughout March, BioDelivery Sciences still saw a small sequential pickup in Belbuca prescriptions, which were up better than 50% from a year earlier.

BioDelivery Sciences also is marching toward profitability and posted earnings of five cents a share last quarter, up from a loss of 18 cents a share in the fourth quarter of last year.

While most of the economy and companies will continue to suffer during the second quarter thanks to a huge economic contraction, these three names are executing well is difficult environment and should do even better whenever normality returns.

At the time of publication, Jensen was long BDSI, CWH and ESPR.