For This REIT It's All About That Base (original) (raw)

We're checking the charts and indicators on Ventas, owner of senior housing and medical facilities.

Shares of Ventas (VTR) were upgraded to "buy" from "hold" by a sell-side firm Thursday. Ventas is a real estate investment trust that owns senior housing communities, skilled nursing facilities, hospitals, and medical office buildings.

Let's check the charts and indicators, something that never gets old.

In the daily bar chart of VTR, below, we can see that prices have moved sideways in a wide range this past year. Prices are currently below the declining 50-day moving average line and below the 200-day moving average line.

The On-Balance-Volume (OBV) line is back to its December low and suggests that sellers of VTR have been more aggressive the past three months. The Moving Average Convergence Divergence (MACD) oscillator is below the zero line but has crossed to the upside for a cover shorts buy signal.

In the weekly Japanese candlestick chart of VTR, below, we can see that the shares are holding just above a support zone in the 50−50-50−45 area. Prices are not all that far below the declining 40-week moving average line.

The weekly OBV line shows strength from late January. The weekly MACD oscillator is declining below the zero line.

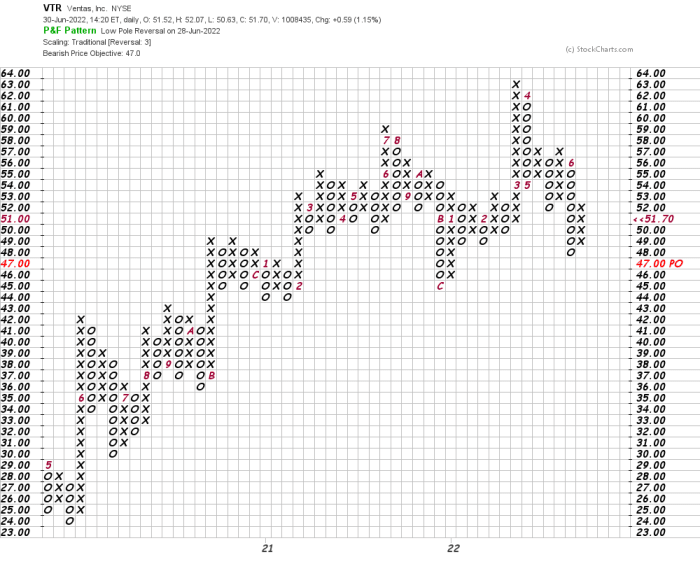

In this daily Point and Figure chart of VTR, below, we can see a downside price target in the $47 area.

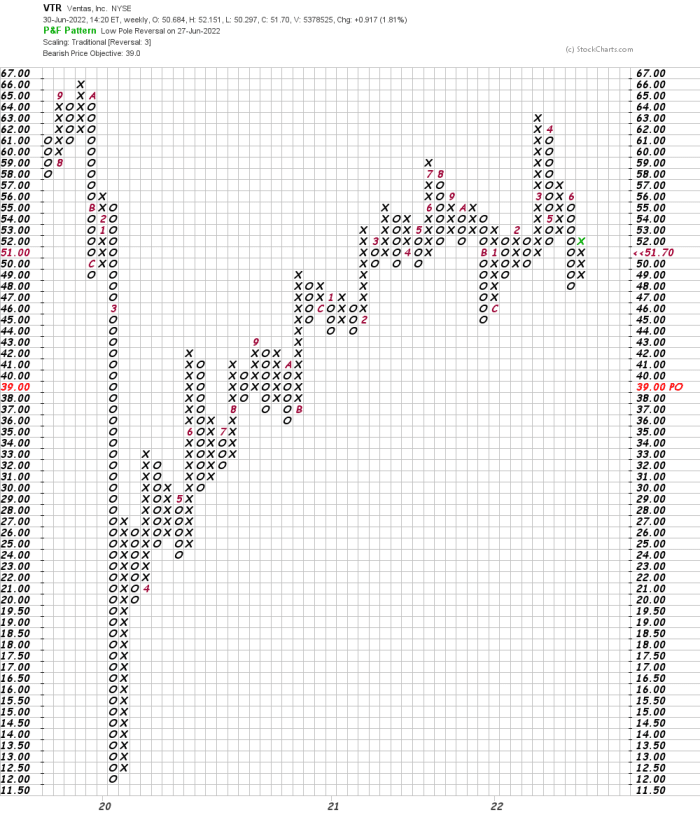

In this weekly Point and Figure chart of VTR, below, we can see a downside price target in the $39 area.

Bottom-line strategy: VTR may be looking attractive to a fundamental analyst but this technical analyst wants to see a better and more bullish base pattern before recommending purchase.

Employees of TheStreet are prohibited from trading individual securities.