I'm Unapologetically Overweight in These 2 Sectors (original) (raw)

The two are homebuilding and biotech, and there are stocks within those sectors where I've parked my money.

In my last column I wrote about some of the sectors I am underweight in my personal portfolio during the current uncertain market environment. Now let's look at some areas where I am overweight.

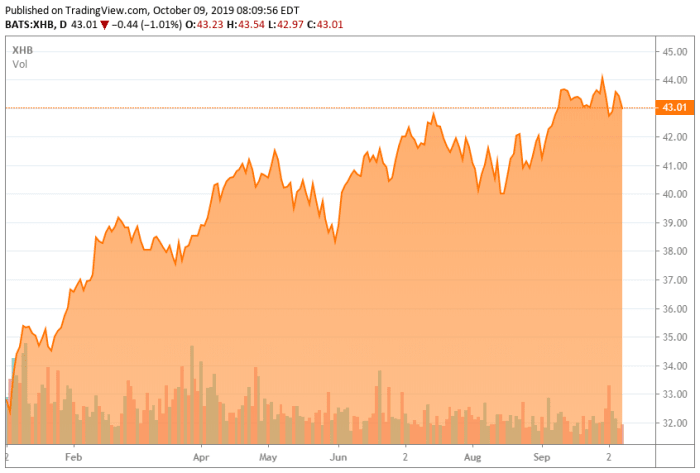

In my columns to begin 2019 I wrote often that I saw good value from two parts of the market. One was in home builders, as I believed a solid job market with strong wage growth and low unemployment as well as receding mortgage rates would lead to an improved picture for housing. While housing activity has ebbed and flowed throughout the year, it has picked up recently.

More importantly, home builders have been a pocket of strength for investors so far in 2019, as seen in the SPDR S&P Homebuilders ETF (XHB) .

I still hold home builders such as William Lyons Homes (WLH) , LGI Homes Inc. (LGIH) , Beazer Homes USA Inc. (BZH) and Taylor Morrison Home Corp. (TMHC) that I have profiled on these pages. However, I am not adding to this sector at the moment given the sector's run-up in 2019.

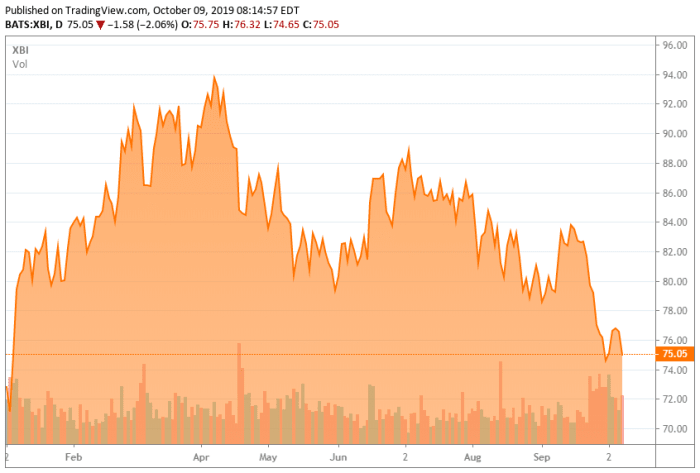

I also liked the biotech sector at the start of 2019. This sector had suffered a deep sell-off in the fourth quarter of last year and was significantly below its last peak in the summer of 2015. I also thought after a couple down years that merger-and-acquisition (M&A) activity would pick up markedly this year in the industry. And, indeed, a couple big deals did happen in early January to kick off the New Year. Unfortunately, other than a couple notable purchases earlier this summer, deal volume has continued to lag. After a nice spike in the first quarter the sector is back down to near when it began the year, as seen in the SPDR S&P Biotech ETF (XBI) .

I think I may have just been early with my conviction on this sector. I have highlighted numerous covered call ideas in the mid- and large-cap parts of this sector in recent months, such as with Alexion Pharmaceuticals Inc. (ALXN) . I also still like some of the small-caps that have borne the brunt of the recent pullback in this high-beta space as investors have gone into risk-off mode amid escalating trade tension, rising worries about global growth and Brexit fast approaching (again).

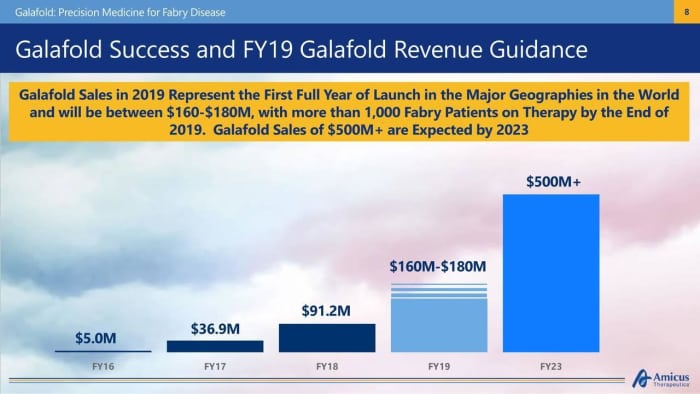

I have added some additional exposure to Amicus Therapeutics Inc. (FOLD) in recent trading sessions via buy-write orders. Amicus' one approved compound, Galafold, is seeing a solid sales ramp-up as it addresses the rare affliction known as Fabry Disease across the globe. That compound has $500 million peak sales potential.

Amicus also has a couple other drug candidates in development, including one targeting Pompe Disease that just posted mid-stage trial results.

Amicus has plenty of cash on the balance sheet after recently doing a secondary offering. The stock trades under 8ashareafterarecentpullback,reducingitsmarketcapto8 a share after a recent pullback, reducing its market cap to 8ashareafterarecentpullback,reducingitsmarketcapto2 billion. Most recently analyst buy ratings have bandied about price targets in the mid to high teens, with Cowen & Co. reiterating a Buy rating with a $31 price target last week. Finally, Amicus would make a bite-size acquisition for a larger player and is in the rare disease area, which has seen its share of M&A activity in recent years.

At the time of publication Jensen was long ALXN, BZH, FOLD, LGIH, TMHC and WLH.