Non-Essential Goods Mean Non-Essential Stocks: Avoid These Three (original) (raw)

Here's why these consumer discretionary stocks like Starbucks should be avoided right now.

Analysts have been predicting a recession for over a year now. Since mid-October, yields on Treasury instruments have declined, as markets prepare for the lower interest rates that accompany an economic downturn.

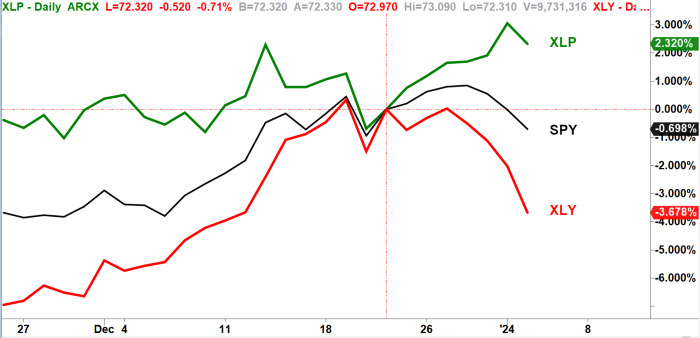

While the bond market has been signaling a recession for months, the stock market has now joined the chorus. A sharp divergence is now visible between consumer staples and consumer discretionary products.

Staples, represented below by the S&P Select Consumer Staples SPDR exchange-traded fund (XLP) , are those items that will be purchased regardless of economic conditions, like food and personal grooming products.

Discretionary items, by definition, are not necessities. These products are represented below by the S&P Select Consumer Discretionary SPDR (XLY) .

The divergence between these two ETFs over the past two weeks is startling. Discretionary stocks (red) are getting pounded, while staples (green) are stronger than the broader market, represented here by the S&P 500 ETF (SPY) , (black).

Chart Source: TradeStation

Which consumer discretionary stocks could see significant declines in the coming weeks and months? Let's go to the charts to find out.

How Lowe's?

Lowe's (LOW) on Wednesday closed at its lowest level in three weeks. The stock has formed an island reversal pattern, a bearish formation that contains two gaps (points A and B).

Chart Source: TradeStation

Traders and investors who went long Lowe's from Dec. 14 through Jan. 2 are now "trapped on the island" (shaded yellow). Those trapped longs are losing money, and the result could be additional selling as investors cut their losses.

'Bucks the Trend

Seattle-based coffee giant Starbucks (SBUX) has been trending lower for months. This is particularly negative because the just-ended November/December period was extremely bullish for stocks.

Chart Source: TradeStation

In addition, the stock is trading below its 50-day (blue) and 200-day (red) moving averages.

The good news for Starbucks is that support, in the form of a gap fill, is nearby. The stock could receive a boost if it slips to the $89.25 area (green dotted line).

The bad news is, if 89.25breaks,thenextlevelofsupportisat89.25 breaks, the next level of support is at 89.25breaks,thenextlevelofsupportisat82.50 (black dotted line).

Don't Be Held Captive to Aptiv

Aptiv (APTV) , a Dublin-based vehicle component manufacturer fell by 6.3% on Wednesday. In doing so, the stock gave back all the gains from its eleven previous sessions (shaded yellow).

Chart Source: TradeStation

APTIV has formed a symmetrical triangle pattern (converging lines). The stock is currently supported by its 50-day moving average (blue) and its bullish trendline (green). A decline of just $2 would put APTIV below both of those supports. Shares of APTIV declined 43.5% last year in a bull market.

At the time of publication, Ponsi had no position in any security mentioned.