Pulte Group Is on a Tear Higher, and Here Is Why I Am a Buyer (original) (raw)

This homebuilder has roared past resistance.

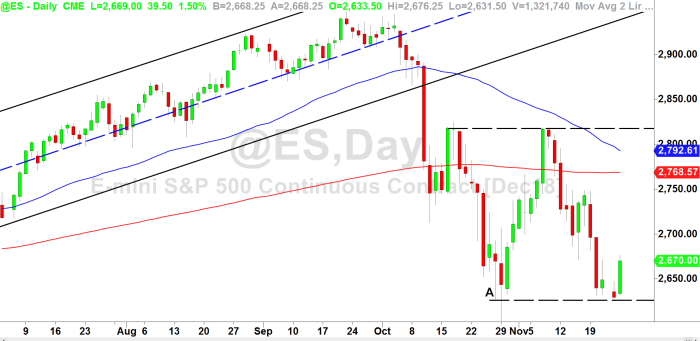

The bulls needed a big day coming out of the Thanksgiving holiday, and they got it. Monday's rally was important because it retested and confirmed the S&P 500's October lows (point A, below). It launched the index firmly away from support in the 2625 area, and provided it with an area to defend.

Unfortunately, one strong day won't repair the damage created by the recent selloff. The S&P 500 remains below its 50-day (blue) and 200-day (red) moving averages, which are now tilting lower and threatening to cross.

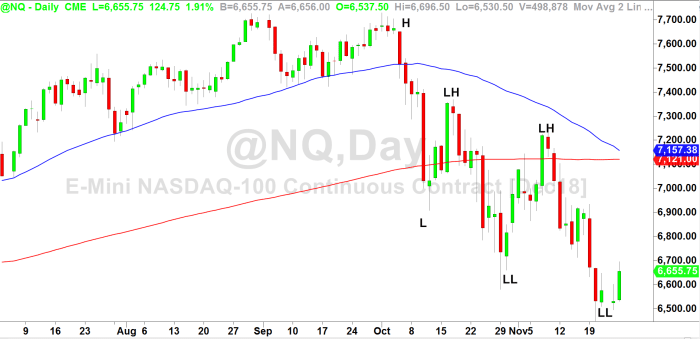

Is there reason to believe that the S&P 500 is doing more than just postponing the inevitable? Or is it about to break down and form a fresh low, like the Nasdaq 100? That tech-heavy index has formed a series of lower highs (LH) and lower lows (LL) over the past two months.

I believe the disarray in the indices is due to an overzealous Fed, which has raised rates seven times in less than two years. Contrast the Fed's activity with that of the European Central Bank, which last raised rates in July of 2008. The ECB is still executing its version of quantitative easing.

Perhaps realizing that its actions have been detrimental, the Fed has softened its tone in recent weeks. On November 14, Fed Chairman Powell admitted that there's been a "gradual chipping away" at global growth, indicating a less-hawkish outlook. On Monday, ECB chief Mario Draghi confirmed that growth in Europe is slowing.

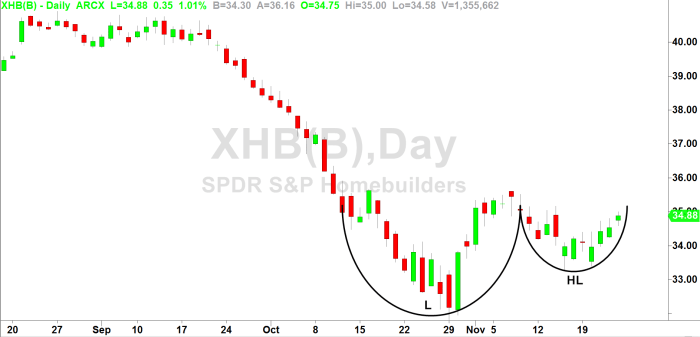

That's good news for the indices, and even better news for the homebuilders, which have been routed. The S&P SPDR Homebuilders ETF (XHB) , which acts as a bellwether for the sector, is down 21% year-to-date. However, after a fierce selloff, the ETF has formed both a double bottom and a higher low.

XHB hasn't broken out yet. Within the group, Lennar Corp. (LEN) , Toll Brothers (TOL) , D.R. Horton (DHI) , Beazer Homes (BZH) , and Meritage Homes (MTH) all remain below resistance.

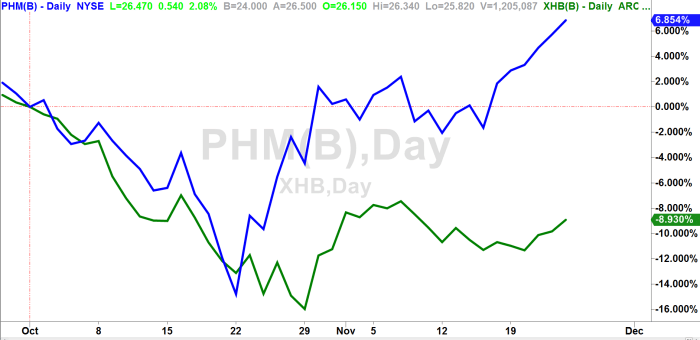

However, Pulte Group (PHM) has roared past resistance. On Monday, the homebuilder closed at a two-month high. The stock is down 21% for the year, so there is plenty of room for upside.

Take a look at the relative performance of Pulte (blue) vs. its sector, represented by XHB (green), over the past two months:

Needless to say, I'm buying Pulte here. I think the entire housing sector is about to turn around, and Pulte has the best chart in the sector.

At the time of publication, Ponsi was long PHM.