I'm Not Convinced About Altimeter Growth (original) (raw)

Let's look at the charts of this SPAC.

One caller during Wednesday's Lightning Round segment of Mad Moneyasked Jim Cramer about Altimeter Growth (AGC) . "I think this one is a good one," said Jim Cramer about the blank check company that is bringing Grab public. Grab through its subsidiaries, provides software application ride-hailing transport, food delivery, and payment solutions.

Let's take a look at the charts of AGC.

In the daily Japanese candlestick chart of AGC, below, we can see that prices have made a number of up and down swings in the past six months or so. The $11 area seems to be a magnet for prices as they keep returning to that level. The slopes of our short-term 20-day and 50-day moving averages are negative.

The On-Balance-Volume (OBV) line is flat to lower and not showing us signs of aggressive buying. The Moving Average Convergence Divergence (MACD) oscillator is bearish.

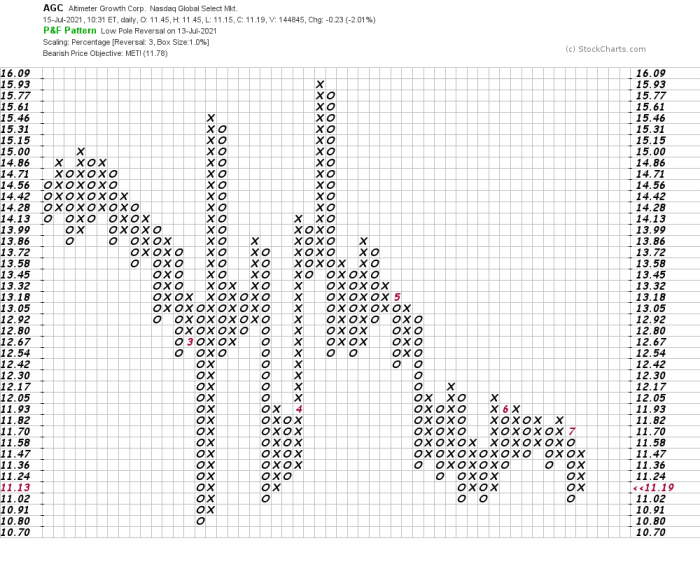

In this daily Point and Figure chart of AGC, below, we can see that prices have reached a downside price target. This does not make it a buy, however.

Bottom-line strategy: Things could change tomorrow but at this point in time I do not find the charts of AGC attractive for purchase.

Employees of TheStreet are prohibited from trading individual securities.