When Headlines Deceive Investors (original) (raw)

When looked at from the perspective of market history, the facts inside a recent bearish Wall Street Journal story tell a far more interesting story on buying opportunities.

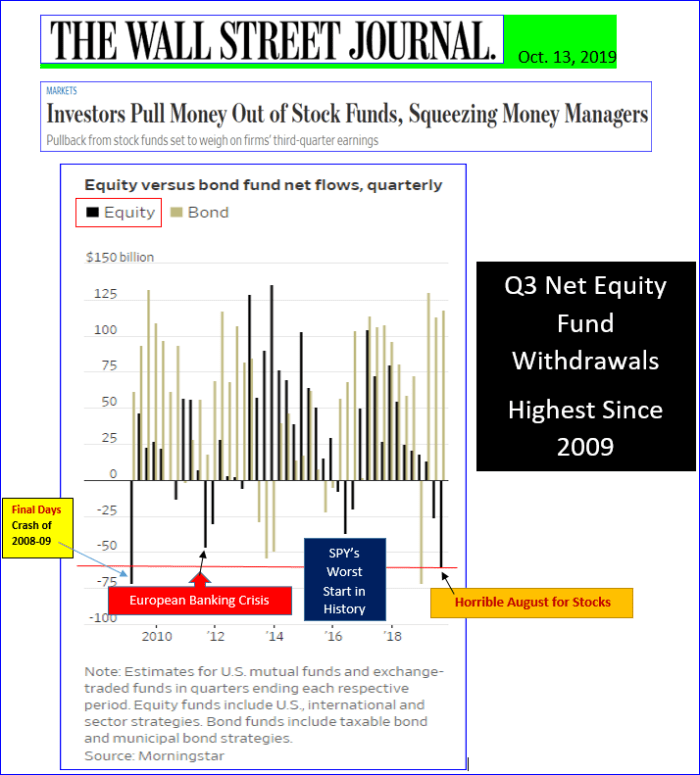

A recent Wall Street Journal article noted that investors had pulled more money out of equity mutual funds during the third quarter of 2019, than at any other time since the very darkest days of early 2009.

The story noted the negative consequences for money managers and asset-management stocks. The tone of the column was unequivocally bearish.

The Journal pulled out a Morningstar chart that shows quarterly stock and bond mutual fund flows over the most recent decade. This year's Q3 did, indeed, see the second-largest net equity fund outflows.

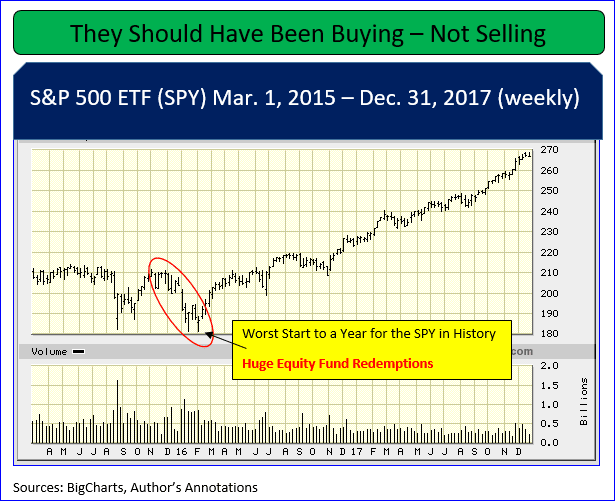

The next two largest quarterly redemptions occurred in the heat of the European banking crisis of 2011, and during the first 45 days of 2016, when the S&P 500 got off to its worst start to a calendar year in history.

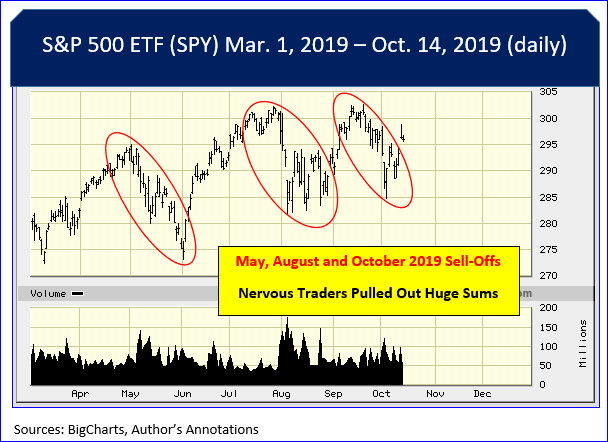

What made investors so crazy to get out of stocks in the quarter ended Sep. 30, 2019?

A nasty sell-off in May set the stage, but a sharp rebound in June and July gave traders hope. August gapped down, however, and after churning wildly, it finished near the monthly nadir.

The early September rally tantalized once again before dashing us on the rocks. Patterns like that, when each advance ends in despair, had many people saying, "No mas." They cashed out of their mutual funds in a big way.

Negative headlines like the WSJ's only serve to reinforce those sell decisions.

What obvious question should come to mind of all the readers whenever selling is "the most in 10-years"?

The question should be: "Were those good, or bad, times to be buying stocks?"

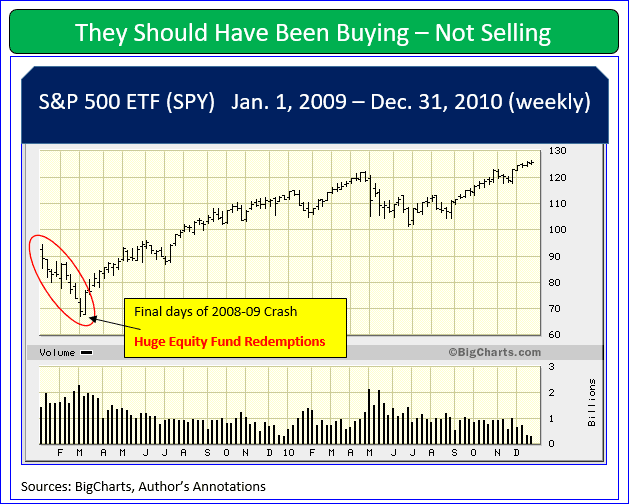

Let's take a look at the three prior largest redemption periods. Excuse me for my headlines, which act as spoiler alerts.

We all know now that March 9, 2009, was the turning point between bear and bull runs. Cashing out mutual funds in Q1 of 2009 was about the worst possible thing you could have done.

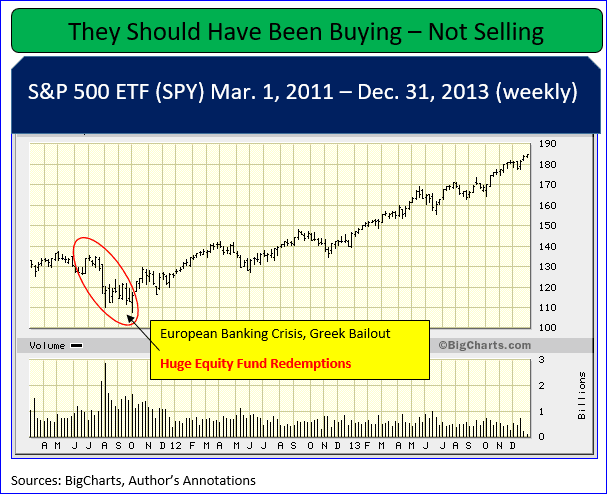

There was a plethora of bad news in late summer and the fall of 2011. Greece needed a bailout. European banks were dangling by a thread. The U.S. markets plunged badly from July through October.

It was bad enough to make people want out. Had they hung in there just a bit longer, though, they would have been much better off.

How about selling during "the worst start to a calendar year" in history? By now you know the story. Watching your money shrink in value is never fun. Selling at the bottom then watching it rebound without you feels even worse.

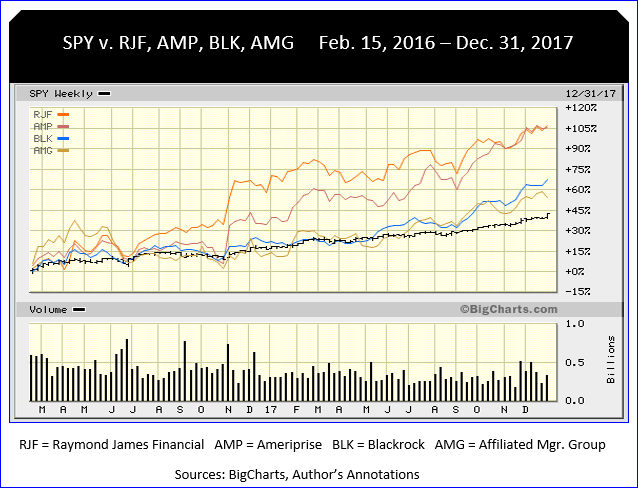

From mid-February of 2016 through Dec. 31, 2017 was a fantastic time to be fully invested.

It was an even better time to be holding shares of asset management companies like Raymond James (RJF) , Ameriprise (AMP) , BlackRock (BLK) and Affiliated Managers Group (AMG) .

Those market-sensitive stocks get trashed when the mood is negative, but rebound sharply once the psychology shifts from fear to greed.

If the author of that Wall Street Journal article was a market historian, rather than a journalist, the same facts might have been used to explain to investors why they should be buying.

At the time of publication, Price was long on AMG, short puts on BLK and AMG.