3 Key Fed Takeaways, the Rally, Deciphering Price Discovery, Less Than Convinced (original) (raw)

Straight forward. Just the way we like it.

Honest assessment. Telling it like he sees it. Directly answering questions that might make most other folks uncomfortable.

Equities and debt securities alike rallied and rallied hard on Wednesday. The FOMC increased their target for the fed funds rate by 50 basis points to a range spanning 0.75% to 1%. As expected. This was the first hike of 50 basis points for the U.S. central bank since the year 2000, and 2022 is the first year that the Fed raised rates at back-to-back policy meetings since 2006.

The Fed also finally got on their horse in regards to reducing the "slosh" of an oversized balance sheet. In an attempt to wring out the excess liquidity that an enlarged monetary base has lent the U.S. economy, the Fed will start allowing a limited level of maturing securities to roll off of the books, while still reinvesting the balance. To start on June 1, this limit or cap will be initiated at 30BpermonthinTreasurysecuritiesand30B per month in Treasury securities and 30BpermonthinTreasurysecuritiesand17.5B per month in mortgage-backed securities.

These caps should stand at 60BpermonthforTreasuriesand60B per month for Treasuries and 60BpermonthforTreasuriesand35B per month for MBS after three months, and that is where, according to plan, they'll stay somewhat indefinitely -- or at least until the central bank's holdings reach a level where risk has been reduced, but still sufficient enough to satisfy the needs of the bank to effectively implement monetary policy.

The Fed Statement

There were a number of distinct changes made to the May 4 FOMC policy statement away from just editing for numerical values. For one, in the first paragraph, the FOMC sets up the regime change in the trajectory of forward-looking policy. The statement points out that during the first quarter, "household spending and business fixed investment remains strong" and that "Job gains have been robust."

The second paragraph illustrates all that is inflationary, but has been beyond the control of ordinary monetary policy. On Russia's invasion of Ukraine, the statement reads, "The invasion and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity." On China: "In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions." Then finally, the most powerful sentence in the statement: "The committee is highly attentive to inflation risks."

This justifies doing what must be done. The rest of the changes have to do with the mechanics of implementing more aggressive policy, which is certainly important in terms of impacting monetary conditions over time, but not part of clearing the deck in a way that justifies the taking of action.

Interestingly, the vote on these policy changes was a unanimous 9-0, which means that St. Louis Fed President James Bullard, who had publicly shown an interest in even more aggressive policy, ultimately supported this statement.

Boring (But You Need to Read It)

On top of taking the fed funds rate to 0.75%-1%, and announcing the launch of the central bank's quantitative tightening program (that kicks off June 1), the Fed made a number of less publicized policy decisions on Wednesday.

Effective May 5 (today), interest paid on reserve balances moves up to 0.9%, the Fed will conduct overnight repurchase agreement operations with a minimum bid of 1%, and with an aggregate operation limit of 500B,astheFedwillconductreverserepurchaseagreementoperationsatanofferingrateof0.8500B, as the Fed will conduct reverse repurchase agreement operations at an offering rate of 0.8% and with a per-counterparty limit of 500B,astheFedwillconductreverserepurchaseagreementoperationsatanofferingrateof0.8160B per day. These limits can be temporarily increased at the discretion of the Fed Chair. The Board of Governors also decided to increase the primary credit rate by 50 basis points to 1%, also effective May 5.

Markets Rally

The were three key takeaways from the press conference.

One, Fed Chair Jerome Powell came off as confident, whether or not everyone believes it, that the committee can drain labor markets of excess demand without negatively impacting the unemployment rate. Personally, I find that this "threading of the needle" will likely prove to be a difficult trick to turn, as the probability that the tightening of policy either drains too much or not enough demand for labor from the economy far exceeds getting policy precisely correct.

Second, the Chair sounded confident in the U.S. economy itself, in consumers, and in business despite the recent quarterly contraction in GDP. That's not what pushed markets though.

What pushed markets (that in turn are driven by keyword-reading algorithms) was the statement by Powell that the central bank was likely to carry on with 50 basis point moves at the next couple of meetings, but that the committee was not "actively considering" the more aggressive stance of a 75 basis point hike (at any point). Powell did add, "If higher rates are required then we won't hesitate to deliver them", and he reiterated that position more than once, ensuring that he would not be cornered moving forward.

The algos that control price discovery in the high-speed electronic execution era had heard what they needed to hear. The rally was on. Overshoot, this time to the upside, would likely be forced.

Probabilities

To put it mildly, futures markets trading in Chicago have dramatically reined in what is seen as currently "priced in" as far as the trajectory of the fed funds rate is concerned. Twenty four hours ago, I told you that these markets were pricing in an FFR of 3.5% to 3.75% by May 2023 (one year). This morning, those markets are pricing an FFR of 2.75% to 3% one year out. That's a huge difference.

As far as June 15 is concerned futures are pricing in an 83% likelihood of just a 25 basis point hike, with an 81% probability for a 50 basis point hike in July. That puts the FFR 50 basis points lower by summer's end than we thought it would be Wednesday at this time.

I have been a vocal proponent of the FOMC being less aggressive on the short end of the curve. I have been almost a lone voice in the wilderness on that front. Has the FOMC heeded Market Recon's advice? Probably not.

Readers know that I have also pushed for more aggression on the balance sheet (on MBS in particular) as a counter to less aggression on rates, and we certainly are not seeing that. That said, I am pleased. Jerome Powell and this Fed did well Wednesday.

Marketplace

The fact that markets rallied on Wednesday afternoon did not surprise me. I had added exposure to my bank stocks {Wells Fargo (WFC) and Bank of America (BAC) ) going into the announcement, but I did not add as broadly across my "long" book as apparently I could have.

The magnitude of that rally did surprise me. That said, I am not shocked to see equity index futures trading lower Thursday morning. That's a combination of profit-taking and hedging and may or may not have little to do with regular session trading on Thursday.

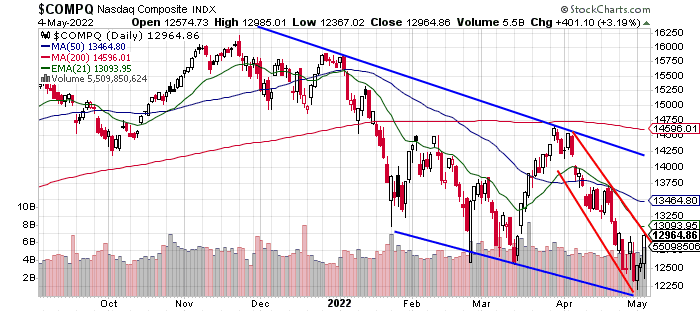

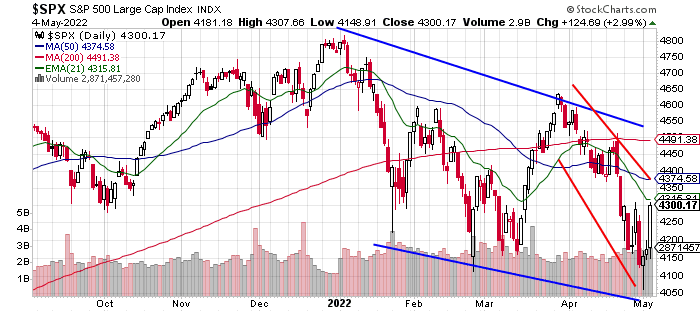

The late Wednesday rally was broad, exceptionally broad. The Nasdaq siblings (Composite & 100) led the way, up 3.19% and 3.41%, respectively, as the Dow Transports and S&P 500 followed closely at +3.08% and +2.99%. Yes, large-caps led, but that does not mean at all that less than large-caps suffered. The S&P MidCap 400 gained 2.79% for the day, while the Russell 2000 tacked on 2.69%. This all while bond traders bought Treasuries.

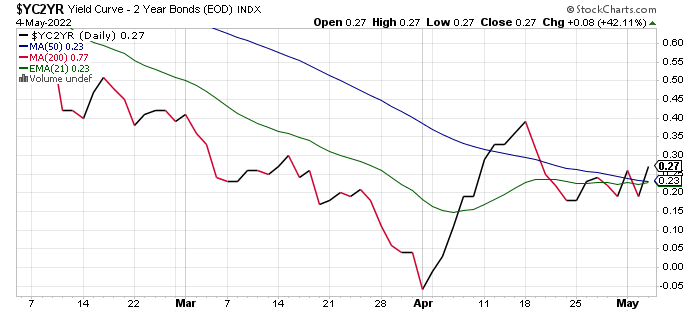

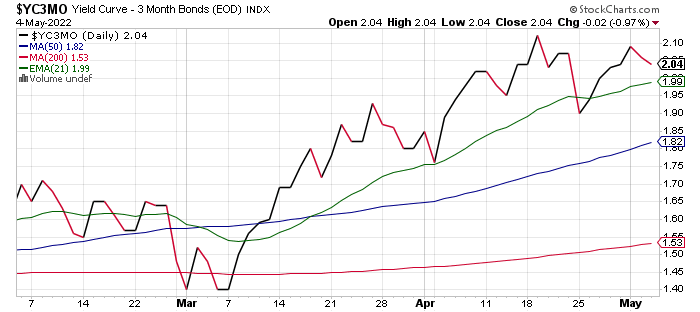

The U.S. 10-Year Note paid 2.94% by day's end, and 2.91% overnight, down from 2.96% earlier. The U.S. 2-Year Year Note paid 2.64% late Wednesday, and 2.62% overnight, down from an earlier 2.77%. That was some move on the shorter end... and did manage to steepen the 10/2 spread.

Despite the flattening of the curve from top to bottom:

Key to note as the wee hours pass, would be that while traders have pressured U.S. equity index futures, they have also pressured Treasuries. At zero dark-thirty, U.S. 10-Year paper once again pays 2.96%, while 2-Year paper yields 2.68%.

Turning back to equities, all 11 S&P sector-select SPDR ETFs shaded green for the day, with all 11 up at least 1.18%. In fact, 10 of 11 SPDRs gained at least 2%, and five of 11 gained at least 3%, with Energy (XLE) on top at +4.15%. That was EU-news related.

Away from energy, tech and growth were cool again, at least in the moment. The Technology sector SPDR (XLK) gained 3.51% as the Communication Services sector SPDR packed on 3.43%. Within those sectors, the Philadelphia Semiconductor Index rallied 3.9% ( All hail Lisa Su), the Dow Jones U.S. Software Index gained 3.07%, and the Dow Jones U.S. Internet Index gained 4.08%.

Interpreting Price Discovery

Breadth was solid. Thursday was decisively green on meaningful trading volume. How meaningful? We'll have to decide.

Winners beat losers by roughly 9-2 at the NYSE and by about 5-2 at the Nasdaq Market Site. Advancing volume took an 87.4% share of composite NYSE-listed trading and an 81.6% share of Nasdaq-listed trade. Here's where it gets fun. Aggregate trading volume for NYSE-listed names increased by 12.2% on Wednesday over Tuesday. Aggregate trading volume increased an incredible 21.2% for Nasdaq-listed names on Wednesday over Tuesday. In addition, aggregate trading volume increased noticeably across constituent names for both the Nasdaq Composite and S&P 500.

Does Wednesday's market pricing represent confirmation of Monday's equity market bullish reversal? I had said that we needed to see robustly positive price discovery on aggressive trading volume. We certainly have that. Professional Wall Street certainly increased risk exposure on Wednesday, and they were definitely somewhat insensitive to price in doing so. We do, by definition, have a very basic confirmation of a change in trend.

So, why do I feel less than convinced?

Readers will see that while the Nasdaq Composite rallied 3.19% on Wednesday, not only does the last sale remain well inside of the longer November through present downward trend, but even now, still needs more upside to break out of the more severe "trend within the trend" that the index has been mired in since early April. In addition, Wednesday's rally fell short of taking back the 21-day exponential (EMA), and comes nowhere near the 50-day simple moving average (SMA), which has not been kissed since April 21.

Though the trend within the trend is less severe for the S&P 500, every single thing I wrote about the Nasdaq Composite is also true about the S&P 500. Maybe that's why I feel less convinced than I would normally be upon encountering a textbook confirmation of a change in trend -- simply because the two major U.S. equity indexes really have not yet, from a technical perspective, accomplished anything.

So, What Are You Telling Us, Sarge?

I am telling you that while I am hopeful that equity markets might be stabilizing, I am not convinced enough to take my cash levels down to what I consider to be normal levels. I am telling you that while I think this market remains a traders' market, I need more confirmation before I can call it an investors' market.

Consider this.

China is still in shutdown mode.

Russia is still in Ukraine with more of an eye toward expanding and expounding upon their gross error in judgement than they are in correcting for it.

The global economy is almost certainly headed for very rough seas.

The U.S. economy is still half way to an official recession by definition.

There's a lot that has to go right for me to go "all in" on equity markets. For that reason, the safer path for now is trading, as trading requires far less capital commitment than does investment. That said, I am more than willing to be incorrect on my cautious stance.

A Day Game on Fed Day?

What were the Mets and Braves thinking?

Economics (All Times Eastern)

08:30 - Initial Jobless Claims (Weekly):Expecting 181K, Last 180K.

08:30 - Continuing Claims (Weekly):Last 1.408M.

08:30 - Unit Labor Costs (Q1-adv):Expecting 7.6% q/q, Last 0.9% q/q.

08:30 - Non-Farm Productivity (Q1-adv): Expecting -3.6% q/q, Last 6.6% q/q.

10:30 - Natural Gas Inventories (Weekly):Last +40B cf.

The Fed (All Times Eastern)

No public appearances scheduled.

Today's Earnings Highlights (Consensus EPS Expectations)

Before the Open: (BDX) (2.89), (DDOG) (0.11), undefined (0.93), (SHOP) (0.72), (W) (-1.53), (WRK) (1.01), (ZTS) (1.23)

After the Close: (SQ) (0.20), (OLED) (1.02), (VRTX) (3.54)

At the time of publication, Guilfoyle was long WFC, BAC equity.