A Tight Fit on Wall Street (original) (raw)

It seems the selling is now as narrow as the buying. Let's look at breadth, bonds, the transports and FedEx.

The Market

Needless to say today changed nothing in the market. It was just more of the same money flowing into tech stocks and out of everything else.

New highs on the New York Stock Exchange are pathetic. Nasdaq is better, but still pathetic, considering it is back at the 13000 level from which it died in August.

Breadth, though, was not bad. It wasn’t good, but it wasn’t terrible. The S&P 500 was flat and net breadth on the New York Stock Exchange was -160. Seems in line. It’s almost as if even the selling is becoming as narrow as the buying.

The McClellan Summation Index is still heading down. It needs a net differential of +700 advancers minus decliners on the NYSE to halt the decline. It is amazing to me that it has not ticked up in more than a month yet the S&P keeps rising. That is the way the indexes are constructed.

But wait, there is more. Transports traded up for the third straight day. That’s good in my book. Bonds rallied, as they should have. The bond fund (TLT) bounced right off 100andnowisnear100 and now is near 100andnowisnear102. That’s different.

The International Securities and Exchange's equity call/put ratio surged to 1.93, which is the highest since late March 2022. The market peaked about a week or so later. I think the market is in a different place now vs. then, but I also think it shows you folks are getting a bit carried away on options.

Finally, the Daily Sentiment Index for the Volatility Index is back at 11. Nasdaq’s DSI got to 83 on Monday, but has slipped back to 78. That says to me that we get much more rallying in tech; that DSI for Nasdaq is going to get into the danger zone over 85 and the VIX will go to single digits.

I have thought the others could rally. That has been a terrible view to have. Yet energy and banks closed near the highs of the day today. So they keep sucking me in.

New Ideas

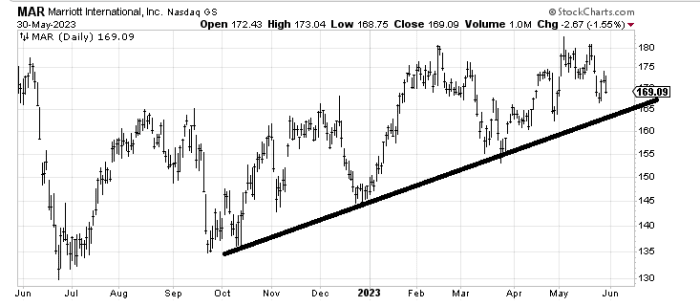

I am cautious on Marriott (MAR) , because it looks to me like it can easily come down and tag that line, maybe even break it.

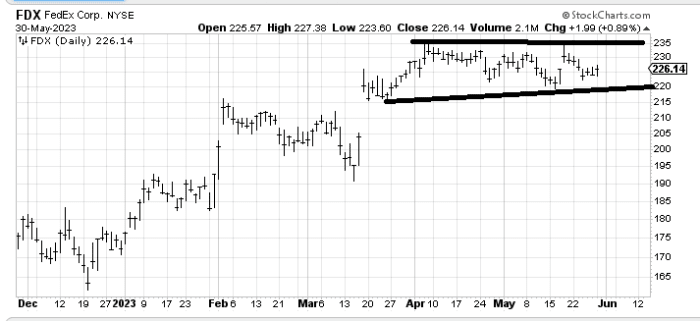

I was asked about FedEx (FDX) , which has gone sideways for two months, so it’s hard to get excited over it, but if it can get going I think it can tag the upper line.

Today’s Indicator

The McClellan Summation Index is discussed in full above.

Q&A/Reader’s Feedback

Helene welcomes your questions about Top Stocks and her charting strategy and techniques. Please send an email directly to Helene with your questions. However, please remember that TheStreet.com Top Stocks is not intended to provide personalized investment advice. Email Helene here.

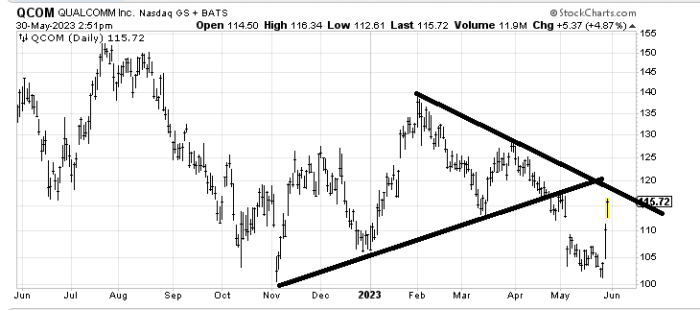

QCOM's Resistance: I was asked to follow up on Qualcomm (QCOM) , which I had a positive bias on a few weeks ago. I had thought it would only fill that gap but it has in its own way jumped over it. It is into some resistance now so some profit taking isn’t a terrible idea but it ought to make its way toward that $118 or so downtrend line.

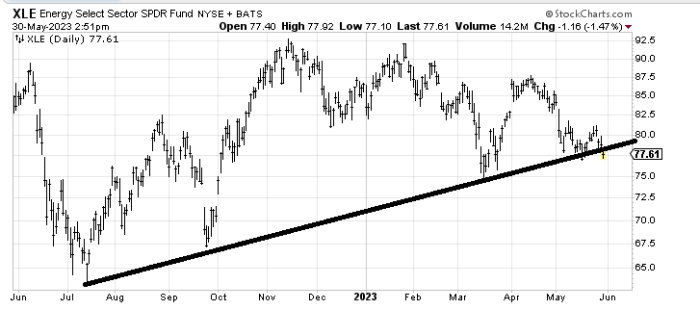

Decision Time for XLE: It is make or break for Energy Select Sector SPDR Fund (XLE) here. This 75−75-75−77 area is where I wanted to be a buyer and it is getting down into that zone.

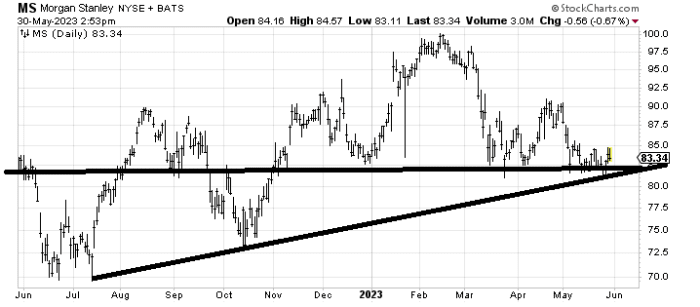

Morgan's Breaking Point: Morgan Stanley (MS) has some good support here, so the risk/reward is pretty good. Here’s the issue: If it breaks that $82 area it will break last week’s low and complete the head-and-shoulders top so that’s a good stop area.