Chip Stocks Beat-Down, Blame the Presidents, Can Small-Caps Keep Going? (original) (raw)

Financial markets were generally positive on Tuesday. Last Thursday's ferocious rotation out of mega-cap and elite-level tech and into most of the rest had returned with a fury. By day's end, though, even those stocks that had been used as piggy banks earlier in the day had found their way closer to the flat line from Monday's close.

The catalyst for a broader market kind of health, or should I say "rally," as health assumes more than I am ready to grant, has been the idea that with consumer-level inflation decelerating, and economic activity apparently slowing, that the FOMC was far more likely to cut short-term interest rates perhaps multiple times this year.

Then there was the attempt on former President Trump's life over the weekend that seemed to solidify his place at the top of the polls, which were already moving his way after President Biden's poor debate performance. Lower rates? Reduced regulation? Sounds like an environment that smaller and perhaps credit-reliant corporations might thrive, or at least do better in. Huzzah!!

However, overnight, it happened. A reason to take profits. A reason to sell stocks. Asia was mixed with both the Nikkei 225 and Shanghai Composite moving lower. Europe opened lower across the board. Big tech still matters as much as anything else, and if there will be an equity bloodletting, it will still be led by tech as most of the bull market over the past couple of years had been.

So, what happened? Why are foreign markets under pressure? Why are U.S. equity index futures, led by Nasdaq futures, getting bloodied overnight.

The story is three-fold. Let's discuss.

The Biden Administration

Bloomberg news reported overnight that the Biden Administration is informing allies that another step in the increased crackdown on technologies made available to China is under consideration. The U.S. is currently weighing whether or not to impose the "foreign direct product rule" or "FDPR," which would restrict foreign-manufactured products that make use of even the smallest amount of American technology. The companies that such a rule would seem to impact the most are Japan's Tokyo Electron (TOELY) and the Netherlands' ASML Holding (ASML) .

Bloomberg reports that the U.S. is already in the process of making officials in Tokyo and the Hague aware that the implementation of this rule is a more than likely outcome if these countries do not tighten their own restrictions against China's acquisition of high-end technology on their own. This would hamper the ability to service and repair equipment already in China.

China, through Foreign Ministry spokesperson Lin Jian, expressed concern that the U.S. has "politicized trade and the concept of national security" while encouraging potentially impacted nations to "resist coercion." There is talk that some U.S. allies are considering trying to outlast the Biden administration.

U.S. chip companies are said to be pushing an alternative to imposing the FDPR, where the criteria for the current "unverified list" would be expanded, requiring firms using American technology to seek licenses in order to ship restricted technologies.

Former President Trump

Shares and ADRs of Taiwan Semiconductor (TSM) are trading in the hole on Wednesday morning, after Donald Trump told Bloomberg News in an interview that Taiwan "stole our chip business" and "should pay for defense." Trump referred to the U.S. as something of an insurance company in its relationship with Taiwan.

Under the Taiwan Relations Act, the U.S. would consider any effort to subjugate Taiwan by other than peaceful means as being of grave concern allowing the U.S. to provide weapons to Taiwan and to maintain the American capacity to resist any attack that jeopardized Taiwan's security.

The U.S. has more or less been the unofficial or sometimes official guarantor of Taiwanese security since Nationalist Chinese forces had retreated to and held the island province after losing mainland China to Communist Chinese forces in 1949. Since the end of the civil war, Beijing has claimed sovereignty over the island province and has threatened the government in Taipei with hostility for as long as it refuses to submit. Conversely, Taipei still claims the mainland as well.

Back to the present, in the Bloomberg interview, former President Trump said... "They took almost 100 percent of our chip industry; I give them credit... Now, we're giving them billions of dollars to build new chips in our country, and then they're going to... bring it back to their country." Trump is referring to the TSMC (Taiwan Semiconductor) plan to invest 65BinArizona,tobuildthreewaferfabplantshere.Inreturn,theU.S.willprovideupto65B in Arizona, to build three wafer fab plants here. In return, the U.S. will provide up to 65BinArizona,tobuildthreewaferfabplantshere.Inreturn,theU.S.willprovideupto6.6B in grants and another $5B in loans from the CHIPs and Science Act.

Taiwan, to be clear, does fill almost all of its defense and security needs through government-negotiated foreign military sales from U.S. defense contractors and is one of the largest markets for these provi

ders. At this early hour, I see TSM down 3.5% followed by many U.S. tech and semiconductors stocks. Lockheed Martin (LMT) is currently sticking out like a "green" thumb on my screen along with my holdings of gold (GLD) and small-cap (IWM) ETFs.

Trump Wasn't Done

In that interview with Bloomberg News (Did any other news agency show up for work on Tuesday?), former President Trump said that he would not replace Jerome Powell as chair of the Federal Reserve Bank. Trump said that he plans to see Powell, who was his choice to ascend to the chair in the first place, serve out his term which ends in 2026.

Very Clever

Anyone else read Philip Grant's brief nightly blog, which is published by Jim Grant's "Interest Rate Observer?" I do. It's easy to read and I have always admired Jim Grant as one of my favorite brains in the business.

Well, last night, Philip Grant referred to the Fed's dual mandate as a "duel" mandate. Will it come down to choosing to fight inflation or save the economy? Hope not but thought that was clever.

On That Note...

June Retail Sales surprised to the upside on Tuesday after what had been back-to-back months of weakness in April and May. On a month-over-month basis, retail sales hit the tape flat (0.0%) from May, down from growth of 0.3% for May from April. Sounds weak, right? Not really though. Consensus had been for -0.3% and once we go to the core (remove autos and auto parts), June looks much better.

Core Retail Sales for June grew 0.4% from May, well above expectations for growth of 0.1%. What was hot? Building materials, non-store (internet) retailing, health & beauty products, and furniture. What was not so hot? Gasoline, food & beverages and fun.

Fun? Yes, that's the line item labeled Sporting Goods, Hobbies, Music, and Books... and this is where we see how willing individuals are willing to spend discretionary income on the things they like. This line item printed at -0.1% month over month and is down 3.4% year over year.

In short, the U.S. consumer is clearly no longer comfortable spending on "wants" when they have to spend on "needs."

The Atlanta Fed did revise their Q2 GDPNow model to growth of 2.5% (q/q, SAAR) from 2.0% on this news as well as on May Business Inventories that printed stronger than expected. Atlanta will revise the model again later today after June Housing Starts and June Industrial Production cross the tape.

Going, Going...

Elon Musk announced on Tuesday that he will be relocating his private businesses X (formerly Twitter) and SpaceX to Texas from California in what appears to be an attempt to distance himself from the politics of running a business on the West Coast.

Earlier this year, Musk moved his business incorporation for Tesla (TSLA) from Delaware to Texas, while moving the public company's headquarters from California to Texas. Tesla maintains a manufacturing hub in Palo Alto, California.

Can the Small-Caps Keep Going?

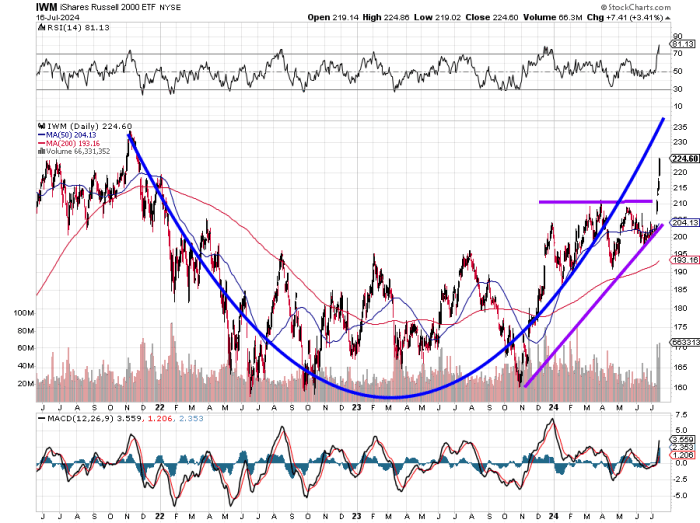

Readers will see in this chart of the iShares Russell 2000 ETF (IWM) that last week into this week there has been a breakout of what had been an ascending triangle dating back to November. That plays into the possibility that the IWM goes on to complete what would be a two-and-a-half-year cup pattern with a pivot of $240.

Relative Strength is currently in technically overbought territory, while the daily Moving Average Convergence Divergence (MACD) is becoming extended, but has shown the ability to further extend in the past. It would not surprise me to see this cup develop a handle in the face of this overbought condition. Doing just that would move the pivot from the left side apex of the cup to the right-side peak, and rest the fund for another upside move.

Currently, my price target is a somewhat conservative $276, which would be an all-time high. That said, adding that handle will impact the target.

Economics (All Times Eastern)

07:00 - MBA 30 Year Mortgage Rate (Weekly): Last 7%.

07:00 - MBA Mortgage Applications (Weekly): Last -0.2% w/w .

08:30 - Housing Starts (June): Expecting 1.31M, Last 1.277M SAAR.

08:30 - Building Permits (June): Expecting 1.393M, Last 1.399M SAAR.

09:15 - Industrial Production (June): Expecting 0.3% m/m, Last 0.7% m/m.

09:15 - Capacity Utilization (June): Expecting 78.6%, Last 78.2%.

10:30 - Oil Inventories (Weekly): Last -3.444M.

10:30 - Gasoline Stocks (Weekly): Last -2.006M.

13:00 - Twenty-Year Bond Auction: $13B.

The Fed (All Times Eastern)

09:00 - Speaker: Richmond Fed Pres. Tom Barkin.

09:00 - Speaker: Reserve Board Gov. Christopher Waller.

14:00 - Beige Book.

Today's Earnings Highlights (Consensus EPS Expectations)

Before the Open: (ASML) (3.70), (JNJ) (2.70), (SYF) (1.37), (USB) (0.95)

After the Close: (DFS) (3.08), (EFX) (1.73), (UAL) (3.98)

At the time of publication, Guilfoyle was long LMT, GLD and IWM.