Lessons From a Wild Week (original) (raw)

Rarely do I feel that being right or wrong is as random as it was last week.

While all of us at TheStreet Pro do our best to help you invest, trade and maximize your portfolio’s potential, we do so while ready to admit that we are not always right. Instead, we use our backgrounds, unique experiences and skills and extensive contacts to make the best decisions and give the best advice possible.

But, last week, whew.

There was no shortage of opportunities to be right or wrong last week.

Markets seemed to gyrate rapidly, not just in response to news, but to price action itself. That does not feel particularly helpful.

But as I digest what happened and look forward, I must take stock of the most important things we learned. And I want to share them with you. Here goes:

The Lessons of the Week

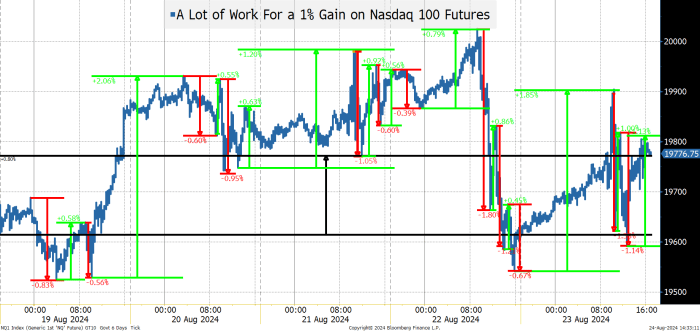

Liquidity is abysmal. Every reasonably large flow -- program trade -- seemed to move the market disproportionately more than one would expect. Add to that the fact that “the rebalancing of leveraged exchange-traded funds” has become a common discussion as traders try to push markets creating larger “sell at the close” orders on down days, or “buy at the close” orders on up days. I suspect that zero-day to expiration options were also a factor in the swings, especially into the close.

We can now talk about the terminal rate on Fed Funds and the path to getting there. While Powell was the big driver on Friday, I put“Fed Clarity” below liquidity in the biggest things I learned last week. As you know, I think the Fed should have cut in July, so I should be in the half-percentage point camp, but I am not there (not unless jobs data is very weak). I think we get one-percentage point by the end of the January meeting (meaning a quarter point per meeting, or half a percentage point at one meeting, with a pause at another). That is slightly less dovish than the market is now pricing in. I differ further as the market gets to two-percentage points, with quarter point or more at each of the next eight meetings. I think we need a lot more data, to be a lot weaker (on jobs) or a lot calmer (on inflation) to get that. It could happen, but not without some pain, and it is far from certain that the Fed will get such a smooth case for easing so consistently (looks for bonds to give up some gains).

There are a few other things that I’m thinking about as we enter this week and next:

NVDA comes out after the close on Wednesday. Nvidia (NVDA) could be very important to markets. I’m told options are pricing in a volatile response. At this stage I’m convinced that the downside move could be larger than the upside, but we will find out. I do like that companies, such as Walmart (WMT) have been giving credit to artificial intelligence, which is something we had not seen enough of – though at some point that AI success should translate into better overall valuations and not accrue just to the AI providers.

Jobs Data. After the much larger than normal annual revision to the non-farm payrolls (beyond the already-large monthly downward revisions), will anyone ever trust this job report? I think everyone is going to have to look more closely at initial claims (a number I don’t tend to fixate on), the Job Openings and Labor Turnover Survey (not just the headline, but the hires and quits rate) and even the ADP survey (which after all the revisions may have told the true story). We now know the Fed has shifted its focus to jobs (understandable) but we don’t know how accurate the jobs data is (tricky), so think there will be a lot more attention paid to overall jobs data, and not just the headline number published on Sept. 6.

Is the “round trip” from bullish, to bearish, to bullish complete? The American Association of Individual Investors Investment Sentiment Survey is just below the July 17 reading (which I think was the highest this year). The bearish side is almost as low as it has been. Those are typically contrarian signals. I believe that positioning has become aggressively long risk again.

No one cares about the big bad Japanese yen carry trade. The yen closed Friday at 144.37, just above the low of 144.18 on Aug. 5, when people still cared about that trade. While we thought it was overdone and would be shocked if anyone reloaded on that trade, it seems like we should pay some attention, because the Bank of Japan cannot tie their monetary policy, which points to needing to be restricted, to the Fed’s (which is clearly heading in the other direction).

We can start buying the beneficiaries of lower rates. The Russell 2000 did very well this week (up 3.6%), but the KBW Regional Bank Index was up even more (5%). Commercial real estate should be stable and could once again be a big opportunity for investors. The last “bounce in small caps and value stocks” felt like a massive unwind of the PowerShares QQQ Trust (QQQ) vs. iShares Russell 2000 fund (IWM) (Nasdaq 100 vs. Russell 2000) but this seemed more calm, orderly, and rational.

Trim Nasdaq 100, but start buying more of the “laggards” with a focus on banks, commercial real estate, and “value” as the case builds.

Now is not the time to extend duration – yes the Fed is cutting, so money market yields will come down, but the long end, with tens trading at 3.8% have already captured this and the market is pricing in a very optimistic path of cuts!

If liquidity doesn't return in September, it could be a very hectic month.