Markets Near Overbought, Inflation Analysis, Trading Cisco, Palo Alto and More (original) (raw)

Financial markets appeared to show at least some exhaustion on Wednesday. Don't get me wrong. The fact that markets, along with breadth, were both positive on balance after Tuesday's charge was, on its own merits, impressive. Though the major U.S. equity indexes closed well off of their highs, they did all rebound from a midday trip into the red only to re-enter green for the day.

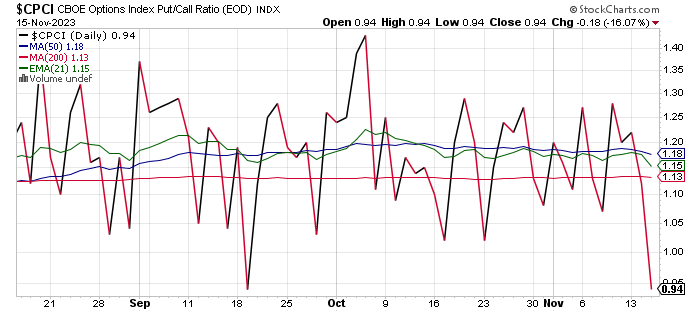

Technically, the equity breakout was indeed extended. That said, there's always a "but." One the one hand, these markets are approaching short-term technically overbought territory. On the other hand, on Wednesday, the CBOE Put/Call Ratio practically fell off of the map.

Take a look at this:

The day started out with Target's (TGT) less-than-awful earnings release ( see my analysis here) and a bevy of highly focused upon macroeconomic data points that all surprised in one way or another.

By day's end, markets would have to deal with a couple of negative reactions to earnings from the tech sector, from Cisco Systems (CSCO) and Palo Alto Networks (PANW) and then finally the results of hours of meetings behind closed doors between Presidents Biden and Xi of the US and China respectively.

Inflation

Perhaps most importantly, though I was able to poke holes in the October CPI that put this rally in overdrive on Tuesday, the data for October Producer Prices released on Wednesday morning reinforced the idea that inflation is decelerating. Headline PPI printed at -0.5% month over month and +1.3% year over year, both of these results well below expectations. Core October PPI crossed the tape flat on the monthly number and up 2.4% on the annual print, again... both below consensus view.

The really good news is that October 2023 was the weakest month in terms of wholesale/producer-level inflation since April 2020. What this did by extension, was price out any probability as expressed by futures markets trading in Chicago for any potential increase in the target for the Fed Funds Rate at the FOMC policy meeting on December 13. According to that market, there is now a 0% likelihood that the Fed raises short-term rates at any point from now through the end of 2024. The markets are also pricing in a 61% chance for a 25 basis point rate cut on May 1. This would be the first of four 2024 rate cuts the market currently expects.

I would be really careful about placing too much trust in these markets right now. While the evidence does support continued disinflation and the FOMC very well may be done raising rates for this cycle, I do not think the FOMC sees their job as done, or any victory in what they have accomplished.

Without the provocation of a recessionary economic environment, FOMC membership might very well resist pressure to cut short-term rates until well into the second half of next year. Maybe longer than that. In other words: "We'll see."

Retail Sales

October Retail Sales were also released Wednesday morning. They were weak, but less weak than expected, and that had investors thinking about their "Goldilocks" soft-landing scenario.

At the headline level, Retail Sales printed at -0.1% month over month. Ex-autos, retail sales printed at +0.1% m/m. Consensus had been for prints of -0.3% and -0.1% for those two lines, respectively.

What's interesting here is that there was visible contraction in sales for motor vehicles, furniture, and what I call the "fun index," which is the line item that contains sales for sporting goods, hobbies, music and books. These are all things that people like. For most consumers, purchases of these goods are purely discretionary. Well, if we're doing so well, how come sales of these "wants" that aren't "needs" are -0.8% m/m and -3.8% y/y? Groceries were the hottest sales item in October (+0.7% m/m) for those that were wondering.

Clearly, the consumer has been put in a position where purchases are not only being made through the use of revolving credit, but necessary purchases are being prioritized.

New York, New York

The New York Fed released its Empire Manufacturing Survey for November on Wednesday. The headline number landed in positive territory, at +9.1, up from -4.6 in October and surprising economists. This is actually New York's fourth positive headline print for this survey in the past seven months, so this was not some outlier result. The thing that bothers me about this survey is that the really important components are still in decline, making, in my opinion, the 9.1 print somewhat deceptively optimistic.

The most important component in any manufacturing-based survey is New Orders. The second most important is Unfilled Orders. These are the two lines that produce revenue for manufacturers as the other components mostly have to do with overhead or logistics. Well, November New Orders hit the tape at -4.9, while Unfilled Orders hit the tape at -23.2. In both cases, contraction accelerated from October.

Look at it this way: If manufacturing activity was picking up, manufacturers wouldn't be pulling back on labor. Yet they are. Number of Employees hit the tape at -4.5, another contraction that accelerated from October, while Average Employee Workweek printed at -3.8 after having expanded (+2.2) in October. So manufacturers are both cutting back on employees and on the hours worked for remaining employees.

Yeah, New York sounds red hot. Where did the headline print come from? Prices Paid, Prices Received, and Inventory Building.

Hotlanta

In response to the data released, the Atlanta Fed revised its GDPNow model for the fourth quarter from growth of 2.1% to 2.2% q/q, SAAR. The model's inputs for personal consumption expenditures and private domestic investment were both tweaked ever so slightly in an upward direction.

Thursday brings another batch of high-level economic data, including October Industrial Production and the November Philly Fed. Philly, by the way, is more important than New York as far as manufacturing is concerned. Atlanta will not revise its model again until tomorrow (Friday) after October Housing Starts are reported by the Census Bureau.

The Rally

On Wednesday, Treasury yields worked their way higher from Tuesday's levels, but still well below where they were late last week. The yield for the U.S. 10-Year Note gave back nine basis points on Wednesday, going out at 4.53%. I see that yield at 4.5% as the zero-dark hours pass on Thursday morning, so there has been some overnight support.

Winners beat losers at the NYSE on Wednesday by a 5-to-4 margin and at the Nasdaq by roughly 4 to 3. Nine of the 11 S&P sector-select SPDR ETFs closed in the green with the Staples (XLP) in the lead showing a gain of just 0.8%. Nine of these 11 funds closed the session less than half of one percent from their Tuesday closing prices.

Advancing volume took a 68.8% share of composite NYSE-listed trade and a 63.6% share of composite Nasdaq-listed volume. Aggregate trading volume, while still elevated, came well off from Tuesday's levels for names domiciled at both of New York's primary equity exchanges as well as across the memberships of both the S&P 500 and Nasdaq Composite.

Trading/Investing

-- I welcomed the news out of Microsoft's (MSFT) "Ignite" conference that the firm will start producing its own processors for AI as well as for data center purposes, while still trying to play nice with Nvidia (NVDA) and Advanced Micro Devices (AMD) . I remain to some degree long all three. Microsoft, as it has been all year, remains my portfolio's most heavily weighted long position.

-- I welcomed the news of a new activist investor (ValueAct) taking a stake in The Walt Disney Company (DIS) in addition to Trian Fund Management. I think CEO Bob Iger has Disney on the right track, but I never complain when activist investors initiate or increase their involvement in names that I am long.

-- I have started to cover my Netflix (NFLX) short over the past two days after having added to it and getting run over. This one has certainly not worked in my favor. I have been day-trading the shares for small profits over this time, so the exit has been slow-going. Having covered a rough 3/8 of my position, I remain short more shares than I would prefer. I am down 4.1% so far on this misadventure.

-- I was very disappointed in the guidance provided by Cisco Systems (CSCO) . I worked toward exiting the name overnight. Fortunately, I did not lose any money on this one, but did see a solid double/triple turn into a hit by pitch.

-- My opinion is that Palo Alto Network's (PANW) earnings release was misinterpreted by overnight traders and that the billings miss is something that can be explained as sales and profitability continue to impress. I added to this long on weakness overnight despite the last sale still seriously violating my net basis.

Economics (All Times Eastern)

08:30 - Philadelphia Fed Manufacturing Index (Nov):Expecting -10.7, Last -9.

08:30 - Initial Jobless Claims (Weekly):Expecting 221K, Last 217K.

08:30 - Continuing Claims (Weekly):Last 1.834M.

08:30 - Export Prices (Oct):Expecting 0.5% m/m, Last 0.7% m/m.

08:30 - Import Prices (Oct): Expecting -0.3% m/m, Last 0.1% m/m.

09:15 - Industrial Production (Oct):Expecting -0.4% m/m, Last 0.3% m/m.

09:15 - Capacity Utilization (Oct):Expecting 79.4%, Last 79.7%.

10:00 - NAHB Housing Market Index (Nov):Expecting 40, Last 40.

10:30 - Natural Gas Inventories (Weekly)... for the past two weeks:Last +79B cf.

11:00 - Kansas City Fed Manufacturing Index (Nov): Expecting -9 Last -8.

16:00 - Net Long-Term TIC Flows (Sep): Last $63.5B.

The Fed (All Times Eastern)

06:00 - Speaker:Reserve Board Gov. Lisa Cook.

07:10 - Speaker:Reserve Board Gov. Michael Barr.

08:30 - Speaker:Cleveland Fed Pres. Loretta Mester.

09:25 - Speaker: New York Fed Pres. John Williams.

10:30 - Speaker:Reserve Board Gov. Christopher Waller.

10:35 - Speaker:Reserve Board Gov. Michael Barr.

12:00 - Speaker: Cleveland Fed Pres. Loretta Mester.

Today's Earnings Highlights (Consensus EPS Expectations)

Before the Open: (M) (0.01), (WMT) (1.52), (WSM) (3.33)

After the Close: (AMAT) (1.99), (GPS) (0.20)

(AMAT and MSFT are holdings in TheStreet's Action Alerts PLUS portfolio. Want to be alerted before the portfolio buys or sells these stocks? Learn more now.)

At the time of publication, Guilfoyle was long PANW, MSFT, NVDA, AMD, DIS equity; short TGT, NFLX equity.