Rally Reality Check, Hiding Out in Fixed Income, Charting 3 Key Tech Stocks (original) (raw)

Party on, dudes.

Equity markets rallied on Wednesday. Hurrah. Only because Treasuries rallied off of multiyear lows, and crude sold off a little more.

Stocks have always been the tail wagged by the dog during times of either crisis or heightened uncertainty. I am not sure that what this economy or these markets are in now qualifies for a labeling as "crisis" but I don't think I can remember a time plagued by more uncertainty.

Does that mean that even if "this" is no crisis, that we can see what might be an actual "crisis" from here? The headline maker has been the removal of Kevin McCarthy as Speaker of the House by the party of the left aligned with a handful of reps from the party of (ironically those furthest to) the right. Not getting political, because that's not what I do, but does this make a government shutdown more or less likely on or about November 17?

I would think the fact that McCarthy was largely fired by that core group on the hard right for having compromised with the left, that his likely successor will not be elected easily. House Speaker pro tempore (Interim Speaker) Patrick McHenry of North Carolina will oversee the election process, but should a solution not come to light quickly, may have to actually oversee the legislative process in order to avoid that shutdown and get on with the business of government.

A Speaker pro tempore is not prohibited by law from assuming the powers of a lawfully elected Speaker, but one would have to think that it would be difficult to assume those powers given that he was on board with the deal that McCarthy had brokered with the left and been fired for. One has to wonder, why the left, in the minority by just a smidge, would have sided with the extreme right to remove a leader who had already shown himself to be quite the moderate. While that will force division on the right and I guess that could help their cause down the road, McCarthy's successor will likely not be as willing to play ball as this grants that handful further out on the right the ability to punch well above their weight class within their own party.

Another short-term continuing resolution will likely be the best this nation can do, especially as Congress (not known in the aggregate for their Herculean work ethic) moves toward the holiday season. This could potentially tamp down any expectations for positive seasonal equity market activity going into year's end.

Extra! Extra!

Read all about it! Headlines? You want headlines?

From Bloomberg News overnight: "Only an Equities Crash Can Rescue the Bond Market, Barclays Says." From Barron's: "8% Mortgage Rates Are on the Horizon - and May Stay Around." From the Wall Street Journal: "Rising Interest Rates Mean Deficits Finally Matter."

What to make of all of the "gloom and doom" I see in print overnight into Thursday morning? Bloomberg News quoted a Barclays' piece written by analysts led by Ajay Rajadhyaksha, "In the short term, we can think of one scenario where bonds rally materially. If risk assets fall sharply in the coming weeks." Of course, TINA or "There is no alternative" has turned into "what exactly is the risk premium" of any investment and am I really receiving that premium or any premium for taking on elevated risk?

Of late, it would seem the answer would be a flat "no." U.S. 30-Day paper yields 5.4%. If one is willing to tie their money up in Treasuries for 90 days, that yield currently moves up to 5.51%. That's the question now. With the S&P 500 was down 1.77% in August, down 4.87% in September and down 0.57% month to date as traders rip their heads away from their warm pillows on October 5. That puts the S&P 500 down 7.5% from its July high. The end of the world? Probably not. At least not yet.

A correction of note? Already there. Investors do what investors do. Traders like to remain liquid. Investors typically see less of a necessity to be fully liquid at all times. This used to require tying up one's investable capital if one were to stay within the kingdom of fixed income, for years, or at least six months if one went the CD route at their local bank.

Now, suddenly (not really all that sudden) investors are getting paid as bonds and notes provide (what we think of as) risk-free income. Now, traders who see an uncertain future and have had trouble proving that there actually has been any "equity" risk premium for much of 2023, can hide out in short-term government paper and not get punched in the teeth for it.

Macro

The first headlines of the day on Wednesday were sobering. According to the Mortgage Bankers Association, the contract rate for a 30-year mortgage printed at 7.53% for the week ending September 29. This put U.S. 30-year mortgage rates above 7.5% for the first time since the year 2000.

How long ago was 2000? Doesn't feel like so long ago, but our nation fought a war that lasted almost two decades since. Equities were still priced in fractions, not decimals, and trading equities still required wearing noticeable jackets, opening one's mouth and waving one's arms. Been a while.

A short while later, equity index futures got a lift from a less-than-strong monthly report for September private sector employment from ADP. According to ADP, the private sector created only 89K jobs in September, down from 180K in August and well short of the 155K or so that economists were looking for.

Interestingly, when sliced and diced and then broken down, there was outright job destruction (not creation) across New England and the desert Southwest. There was also outright job destruction in the aggregate for larger firms. Those firms employing 500 or more individuals across the country produced job "creation" of -83K positions for the month of September. The largest increases (+67K) were made by employers with less than 20 employees.

While small employers have historically been, in the aggregate, an engine for economic growth in this country, such a disparity in payroll management between the largest and smallest employers can be reflective of policy lag effects working their way through the economy. As larger firms can tend to lay off numbers, small employers will be slower to shed payroll-related overhead as there is a greater fear of being unable to meet customer demand. Then as more talent becomes available to smaller employers, there is an instinct to bring on this talent for what is at the time perceived as a discount.

Marketplace

Relief rally? Short-covering? Or rally rally? I'd love to be wrong, but I have my doubts about what's behind door number three.

As Treasuries bottomed on the ADP news, yields charged toward lower levels as Wednesday wore on. Crude prices came in sharply as well. This put some life in U.S. equities. Wednesday's equity market rally did not recover all of Tuesday's losses. The S&P 500 gained 0.81% as the Nasdaq Composite gained 1.35%. The "Magnificent Seven" did well as Tesla (TSLA) ran 5.99% and all seven names finished in the green.

Small-caps struggled to gain any traction, as the Russell 2000 scored a gain of just 0.11%. The Dow Transports also underperformed, at +0.29%. Remember that transports and small-caps are heavily reliant upon economic growth. It is possibly quite significant that these two groups lagged broader markets, especially in the case of the transports as crude prices were slapped around.

Of the 11 sector SPDR ETFs, nine closed in the green, with Discretionaries (XLY) on top thanks to Tesla and Energy (XLE) on the bottom, taking a horrific (-3.14%) beating. Technology (XLK) , as implied above, had a nice day, up 1.25% for the session. Within that group, the Dow Jones U.S. Software Index ran 1.76% led by Stocks Under $10 portfolio holding Palantir Technologies (PLTR) at +5.57%. The Philadelphia Semiconductor Index gained 1.43% led by Advanced Micro Devices (AMD) and ASML Holding (ASML) .

Winners beat losers at the NYSE by roughly 3 to 2, and at the Nasdaq by about 5 to 4. Advancing volume took a 53.6% share of composite NYSE-listed trade and a 64% share of composite Nasdaq-listed action.

Here's where it gets less fun. Aggregate trade decreased on a day-over-day basis across the realms of both NYSE and Nasdaq listings as well as across the constituencies of both the S&P 500 and Nasdaq Composite.

In short, professional money was hesitant to get on board with Wednesday's rally and held their collective fire to see if this rally has any legs or not.

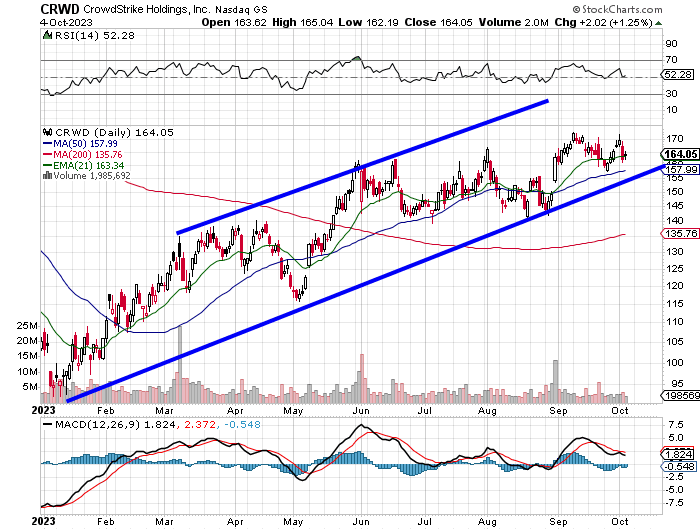

CrowdStrike: Still Unbroken

At least for now with CrowdStrike Holdings (CRWD) :

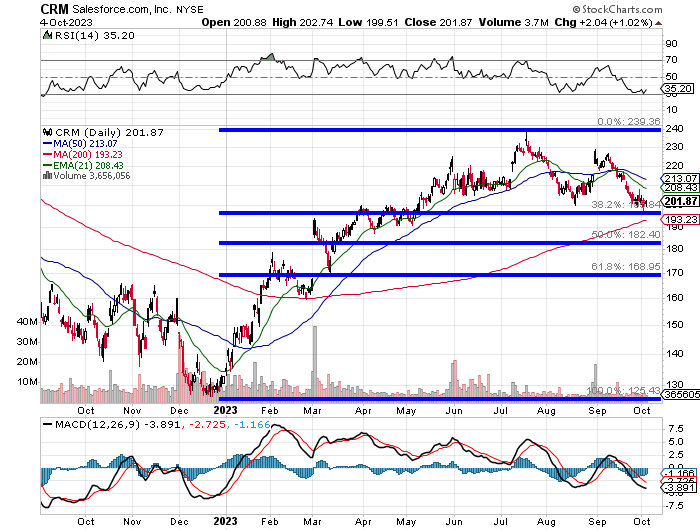

Salesforce: Double Top or Fibonacci Support?

You be the judge on Salesforce (CRM) :

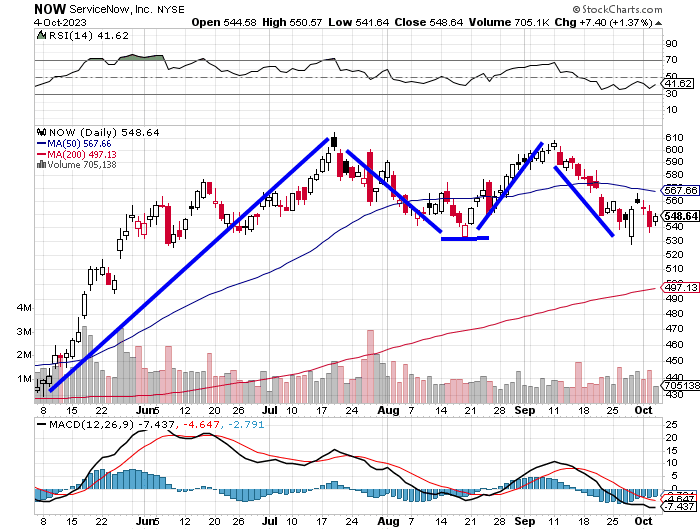

ServiceNow: Pivot Under Pressure

A clear double top reversal pattern with ServiceNow (NOW) . So far, the downside pivot has held for almost two weeks under pressure.

Economics (All Times Eastern)

08:30 - Initial Jobless Claims (Weekly):Expecting 210K, Last 204K.

08:30 - Continuing Claims (Weekly):Last 1.67M.

08:30 - Balance of Trade (Aug):Last -$65B.

10:30 - Natural Gas Inventories (Weekly):Last +90B cf.

The Fed (All Times Eastern)

09:00 - Speaker: Cleveland Fed Pres. Loretta Mester.

11:30 - Speaker: Richmond Fed Pres. Tom Barkin.

12:00 - Speaker: San Francisco Fed Pres. Mary Daly.

12:15 - Speaker: Reserve Board Gov. Micahel Barr.

Today's Earnings Highlights (Consensus EPS Expectations)

Before the Open: (CAG) (0.60), (STZ) (3.37), (LW) (1.08)

After the Close: (LEVI) (0.28)

At the time of publication, Guilfoyle was long AMD, CRWD, CRM and NOW equity.