The 'Other' Side of Outperformance (original) (raw)

The Market

Finally the "others" outperformed the big-caps. But gosh, why doesn’t it feel that way? And why does it feel as if it was such a chore to do so?

I still think we can see the others rally for a few more days. But know that by Thursday we’ll be back to an overbought reading. That doesn’t mean the market will have to pull back on that particular day, but it means that the window for upside, which has been open for just over two weeks, now will close. In other words, it ought to get harder to rally after that.

The good news is breadth was good, but not quite as good as it was last Thursday. Last Thursday the S&P 500 was up 25 points with net breadth at +1,580. Today the S&P was up 37 points with net breadth at +1,275.

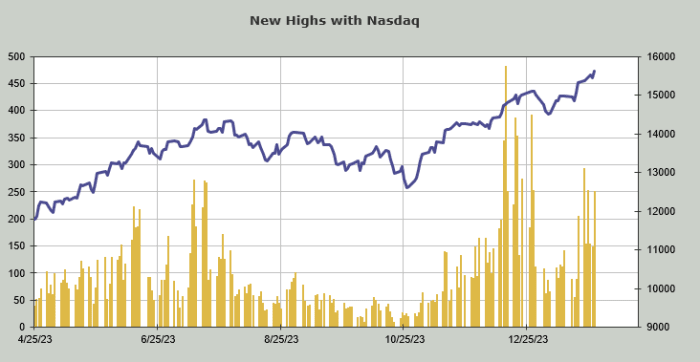

The McClellan Summation Index did tick back up, although as I noted yesterday I’m not sure how long it can go even if I do think the 490-ish stocks should rally. The number of stocks making new highs is still below the reading from two weeks ago and well below the mid-December reading.

You know what the best part of the rally was? Bonds rallied. It has taken forever for them to lift and they have. The iShares 20+ Year Treasury Bond ETF (TLT) runs into some resistance in the $96-97 area now.

As I’m sure you know, we have some of the Magnificent Seven (or whatever the number is now), reporting this week and that will surely have an effect on the indexes. I have, over the last month or so, recommended some of them and I can report that so far none have hit their target prices except Nvidia (NVDA) , which we discussed a week or so ago.

Then there is the FOMC meeting. I have no idea what will happen at the meeting but I do know that the daily Sentiment Indicator (DSI) for the Nasdaq is 81 and the S&P's is 82 so if we rally into the overbought reading midweek and these DSIs lift over 85, that will be a sign this short-term rally has run its course.

New Ideas

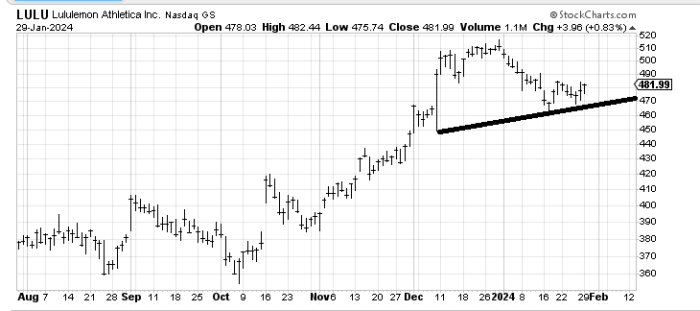

I was asked if Lululemon (LULU) has corrected enough to rally. It does have that pattern I prefer (a "W") so as long as it stays over $470-ish, yes, it seems to have corrected enough for now.

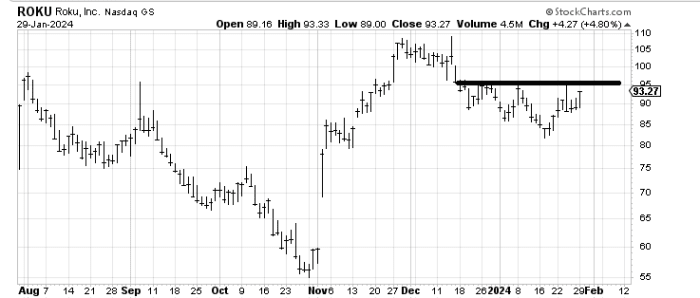

A few weeks ago I recommended Roku (ROKU) and the stock has worked its way up, but if it can’t get itself up and over $95 in the next few days I would give up on it.

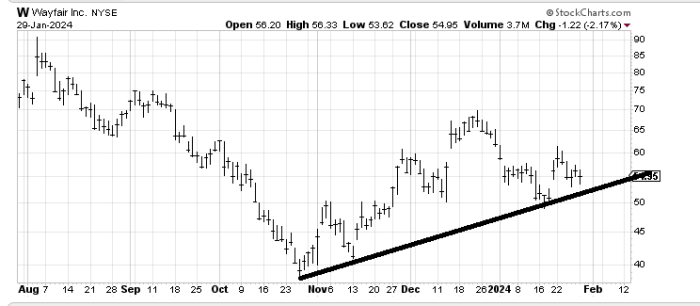

A few weeks ago I was also asked about Wayfair (W) and I was nonplussed with the chart. It did drop about 10% from then but it is now right back where it was when I was first asked ($55). So for the person who inquired, if it stays over $50, it gets a chance to rally.

Today’s Indicator

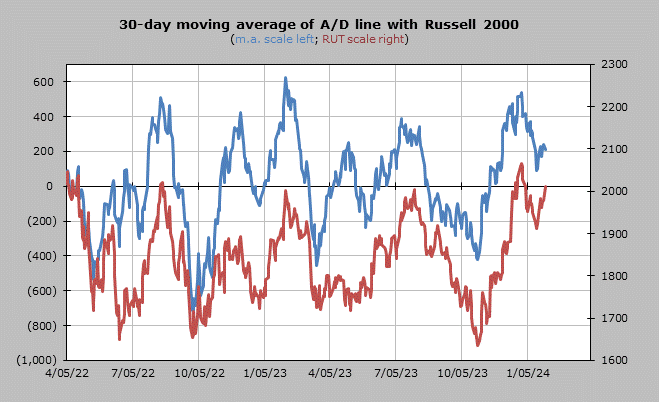

The 30-day moving average of the advance/decline line is overbought.

Q&A/Reader’s Feedback

Helene welcomes your questions about Top Stocks and her charting strategy and techniques. Please send an email directly to Helene with your questions. However, please remember that TheStreet.com Top Stocks is not intended to provide personalized investment advice. Email Helene above.

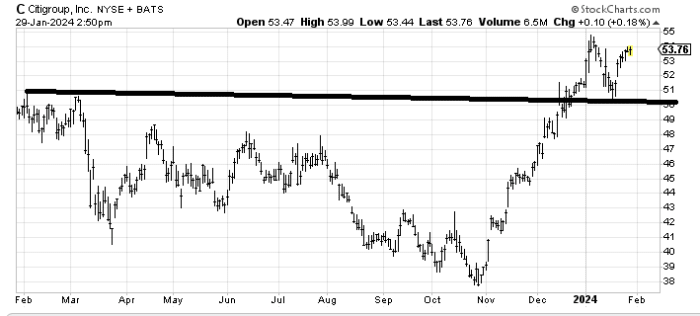

I have a longer-term measured target in the low-$60s for Citigroup (C) but I would prefer if the stock pulled back toward $51-52 first because as you can see it is struggling to make a higher high. A pullback would give a "W" pattern, which to me tends to be sturdier than a "V."

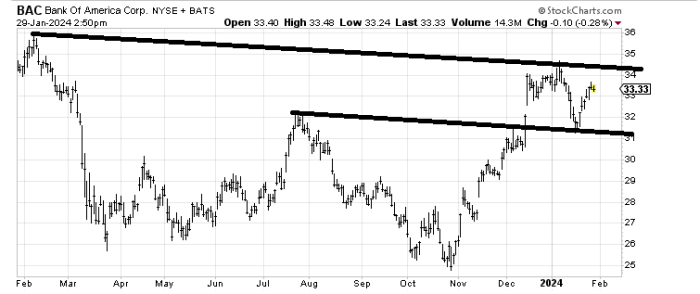

Bank of America (BAC) , I thought, was a buy on that gap fill at 32butitwentabitlower.Nowitisstrugglingtomakeahigherhigh.IfBACpulledbackintothat32 but it went a bit lower. Now it is struggling to make a higher high. If BAC pulled back into that 32butitwentabitlower.Nowitisstrugglingtomakeahigherhigh.IfBACpulledbackintothat31-32 area I’d buy it again. It just needs more time and "work" to overcome the highs.

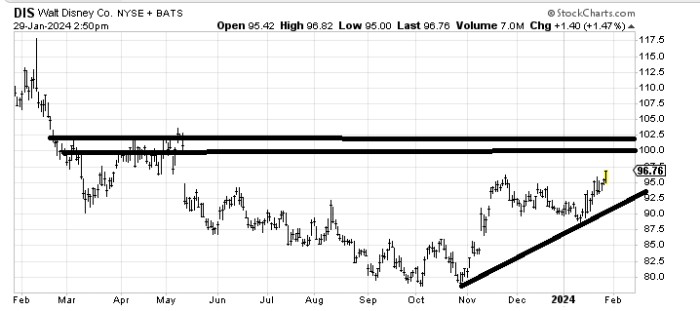

I continue to like Disney (DIS) and think it will fill that gap to $100 in the near term. It is a base.

Hershey’s (HSY) looks like it’s trying to form a head-and-shoulders bottom. I believe we looked at this stock in the last month and I drew in that exact pattern (a pullback for the right shoulder). Maybe it’s a seasonal trade with Valentine’s Day coming soon (this is a joke; I have no idea if there is a seasonal trade!)

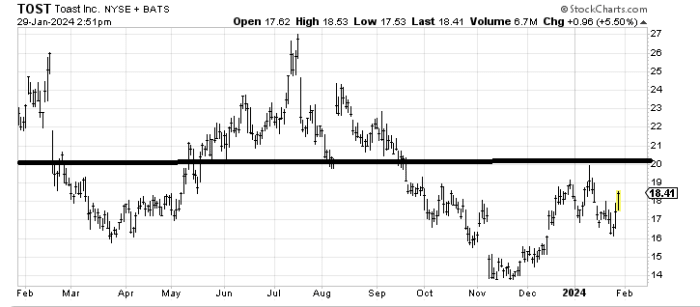

Toast (TOST) will run into some resistance in that $20-21 area so I’d lean on profit-taking there.