Tom Lee: Stocks Are Caught in a Buyers Strike, But Markets Bottom on Bad News (original) (raw)

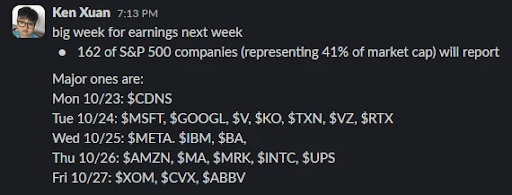

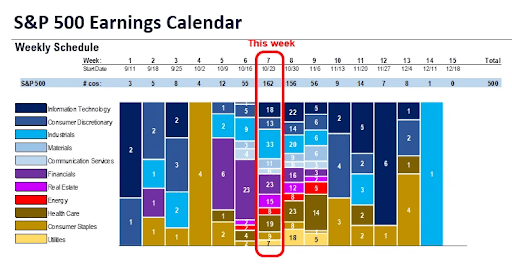

In today's FS Insight First Word note we discuss: There are widening uncertainties around Israel-Gaza, Washington, rates and earnings season. This explains why investors are sidelined but we need to be mindful that markets bottom on bad news. This is the day to watch for. This week is the biggest week for 3Q23 EPS with 162 companies reporting.

Please click here to view our Macro Minute (Duration: 7:06).

----------

Equities fell 1.4% last week, a relatively modest loss but the downturn felt much greater because of the persistence of selling in the final days of last week. If I had to summarize the prevailing issue, it is the growing uncertainty around some key variables:

* The litany of "uncertainties" is large but the key items are:

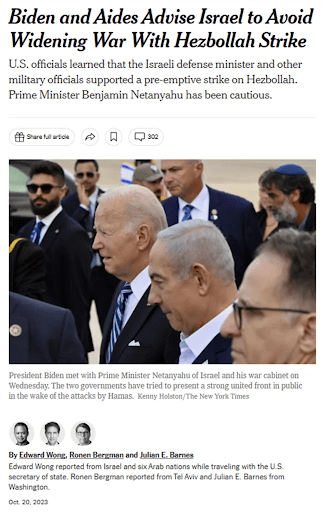

-- Israel-Gaza war and risks of a widening conflict

-- Rise in long-term yields that even Fed views with "humility"

-- Washington political circus (House Speaker) at a time when deficits worry markets

-- Earnings visibility given hits to consumer from student loan debt resumption

-- General negative price momentum on risk assets (sentiment)

* Last year, in the fall, almost every investor we spoke with told us "stocks will get hit because the recession is here" -- and a year later, many have not shifted from that view. And in fact, many are now more convinced that recession risks are even more elevated given the rise in long-term rates. We know this is adding to the downward reflexivity of negativity. As risk assets fall, this is reinforcing those negative perceptions.

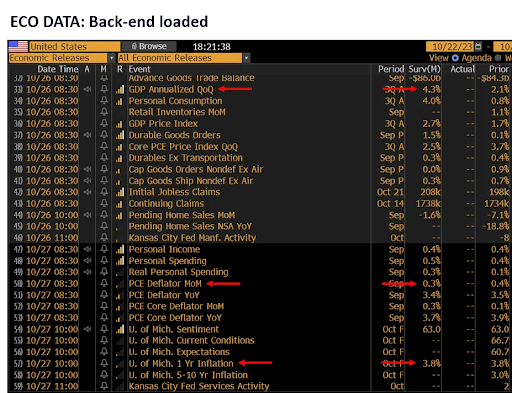

* The key economic data this week are back-end loaded:

-- 10/26 Thu 8:30 am ET: 3Q23 GDP released, Street +4.3%

-- 10/26 Thu: ECB rate decision, consensus expecting a "pause"

-- 10/27 Fri 8:30am ET: Sept PCE deflator, core PCE +0.3% MoM

-- 10/27 Fri 10:00am ET: Oct final U Mich inflation, 1-yr +3.8% YoY

* Will the incoming economic data sway markets this week? Given the cumulative uncertainties above, the bar is high for markets to be persuaded from the sidelines. But we think this data will help, to the extent this will provide some economic clarity.

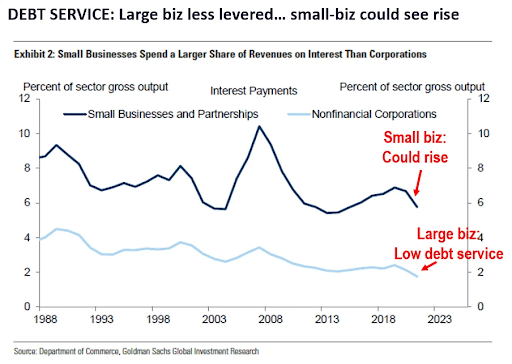

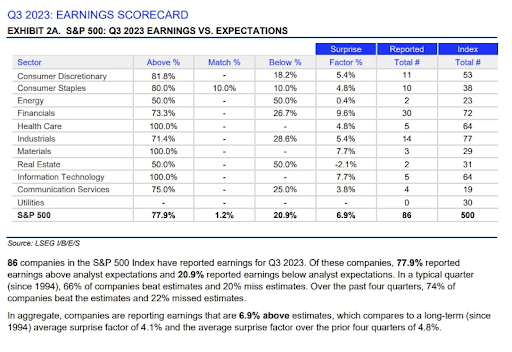

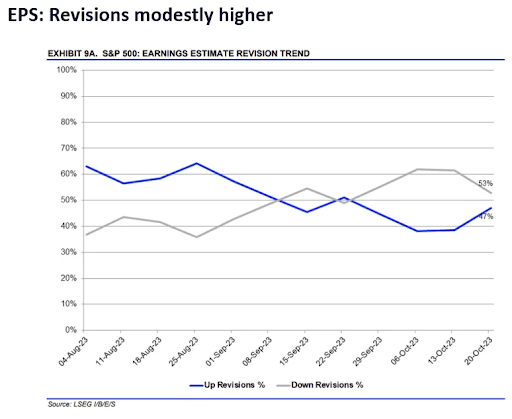

* Earnings season is underway and 162 companies report this week. The largest share is Industrials with 33 reporting. To an extent, a recession is not likely to come from large corporates since they have operated with caution since early 2023. And as the chart below highlights, large businesses have low debt service ratios and less exposure to floating rate debt. Thus, the risk to corporates is a sudden change in conditions that are unexpected. And this would have to be from consumers suddenly slowing. Earnings season 3Q23 is being viewed as mixed as beat ratios at 78% are solid, but many companies cite weaker guidance. Companies do not have a crystal ball and the above constellation of concerns means CEOs have to be somewhat cautious as well.

* Among some of the major earnings report this week:

-- Mon 10/23: (CDNS) -2.62%

-- Tue 10/24: (MSFT) -1.33%, (GOOGL) -1.74%, (V) -0.18%, (KO) 0.42%, (TXN) -2.07%, (VZ) -0.03%, (RTX) -1.81%

-- Wed 10/25: (META) -1.48%, (IBM) -0.62%, (BA) -1.50%

-- Thu 10/26: (AMZN) -2.76%, (MA) -0.89%, (MRK) 2.23%, (INTC) -2.38%, (UPS) -0.07%

-- Fri 10/27: (XOM) -1.72%, (CVX) -1.48%, (ABBV) 0.49%

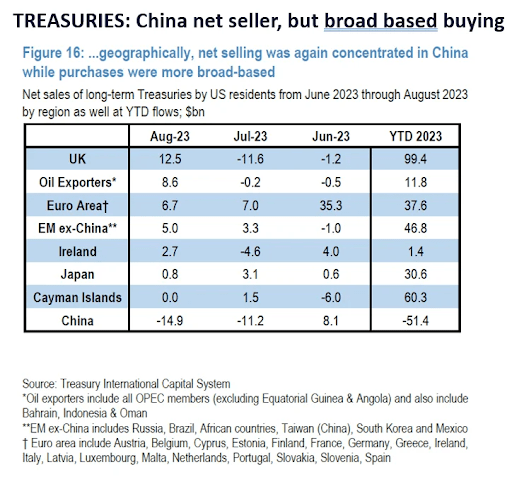

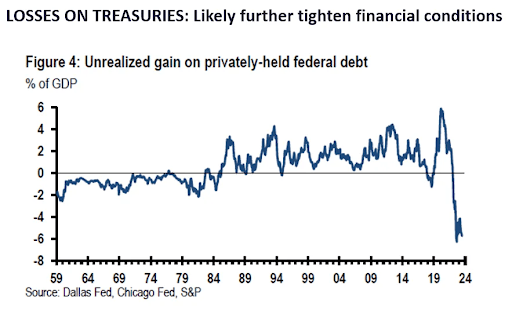

* Several reports by US economists caught our eye this weekend. JPMorgan economists noted that US consumer debt service ratios remain at 40-year lows. And this does mean US households are in a somewhat better position to absorb higher interest rates. On the margin, though, delinquencies are picking up on subprime autos and other floating rate debt.

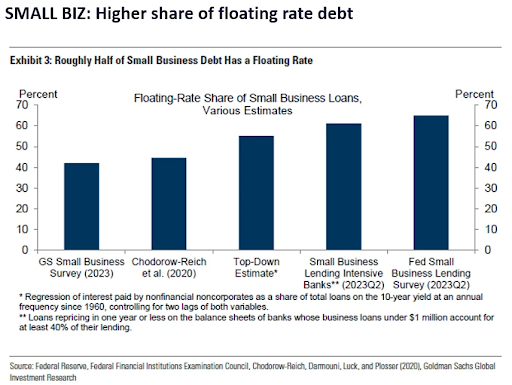

* And Goldman Sachs Economics show that small biz have a higher share of floating rate debt. The estimates range from 50% to 70% depending upon the survey, but the message is that small-biz is where we should see the effects of higher interest rates. And generally, small biz have higher leverage already. This is something to monitor, but also a reason to doubt those who claim the economy is so strong the Fed needs to keep raising interest rates. If anything, one has to wonder if small-biz caution is being properly captured by the broader economic statistics.

Bottom line: Investors are cautious, and at some point, markets will bottom on "bad news."

Unfortunately, equities are caught in a buyers strike. That is, investors are sidelined as the above uncertainties are cumulatively preventing investors from adding risk. And at the moment, these risks have crept higher. However, one needs to be mindful that this loop could reach a turning point. We do not have an idea when this will come:

* But markets bottom on bad news. That is, there will be a day when equity markets reverse on what appears to be bad news. That is when many will become more confident some sustainable low is in place.

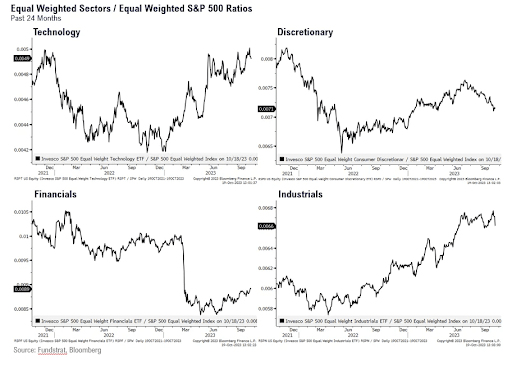

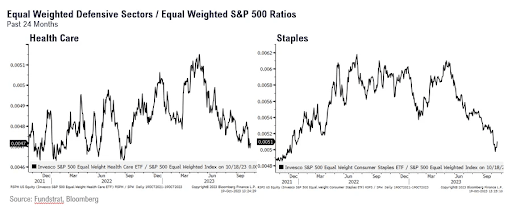

* As the sector relative performance charts show (equal weight sector vs equal weight S&P 500), Cyclicals are relatively outperforming, despite this uncertainty.

* The best relative performance has been Technology and Financials. Both looking very strong in the last few months. Financials is a surprise but reflects the relative resilience of bank earnings.

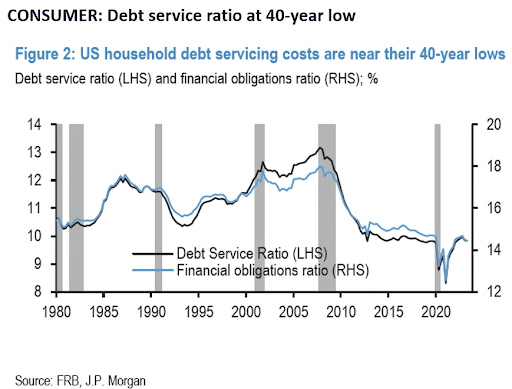

* Industrials is overall strong but recently weakened on the multiple geopolitical risks above. Moreover, financial conditions have tightened and this is a headwind short-term for Industrials.

* The rise in the 10-year yield remains a problem for stocks. That is, until markets either adjust to higher rates or interest rates turn lower. Mark Newton, Head of Technical Strategy, believes such a turning point could come in the near future. But the upside momentum in interest rates is hard to fight.

Source: NY Times

Source: Bloomberg

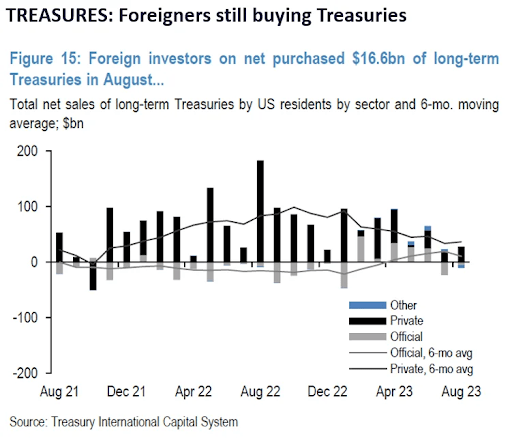

Source: JPMorgan Fixed Income Research

Source: JPMorgan Fixed Income Research

Source: JPMorgan Economic Research

Source: JPMorgan Economic Research

Source: Goldman Sachs Economics Research

Source: Goldman Sachs Economic Research

Source: Fundstrat

Source: Refinitiv

Source: Refinitiv