We're Adding to This Cybersecurity and IoT Firm (original) (raw)

| Symbol | Action | # Shares Traded | Recent Price | % of Portfolio* | Shares Owned* |

|---|---|---|---|---|---|

| BB | BUY | 3240 | $8.9 | 1.8% | 8350 |

Blackberry/TheStreet

After you receive this alert, we will buy 3,240 shares of BlackBerry (BB) at or near $8.90. Following the trade the portfolio will own 8,350 BB shares, roughly 1.8% of the active portfolio.

We are using the additional move lower in BlackBerry shares following the company's better than expected November quarter results to build out the portfolio's position while also improving our cost basis ahead of the pending patent portfolio sale. Over the last several weeks, BB shares have traded off along with many other cybersecurity stocks as evidenced by the near 10% pullback in the ETFMG Prime Cybersecurity ETF (HACK) , but today's added move lower reflects weaker than expected revenue guidance for the current February quarter.

Before we get to the likely "why" behind that, let's first review the positives that emerged during the company's November quarter.

To begin with, BlackBerry bested both revenue and EPS expectations for the quarter, with revenue rising 8% vs. the August quarter. That confirms the company continues to win new business and service existing customers across its cybersecurity and IoT businesses. Cybersecurity revenue rose modestly quarter over quarter but on the earnings conference call management confirmed new customer wins with the U.S. Navy, the Department of Homeland Security, the U.S. Department of Education, the FAA, and the U.S. Central Command, among others. We see that largely as a positive but given the nature of government contracts, we must acknowledge those wins are likely to make quarterly results lumpy from time to time. That said, we view those wins as a ringing endorsement for BlackBerry's offering, and they round out its already stellar customer base that spans 18/20 of the G20 governments, 9/10 of the largest global banks and 9/10 of the top auto OEMs.

Picking up on the auto sector, BlackBerry's IoT business grew 34% year over year (high single digits on a sequential basis) and won 11 new design wins. As this business continues to grow, it should have a positive influence on BlackBerry's overall margin profile and bottom line given the gross margins of 81% vs. 59% for the cybersecurity business. Even though automotive supply chains are easing, BlackBerry's IoT revenue guidance of 50−50-50−55 million, up 22% quarter over quarter, confirms design wins over the last few quarters are ramping. We welcome that positive influence it will have on the company's business mix.

Exiting the quarter, its average recurring revenue was pegged at 449million−449 million-449million−358 for cybersecurity and $91 million for IoT - but what we like even more is that roughly 80% of its software revenue is recurring in nature.

So, what's weighing on BB shares today? The company guided overall revenue for the current quarter in the range of 185−185-185−200 million, which missed the consensus forecast of $208 million. Granted some of how revenue for the quarter shakes out will hinge on the timing of government customer contracts for the cybersecurity business and the speed at which auto OEMs get production back on track. Looking back over the last year, BlackBerry has either met or exceeded expectations, which suggests there could be an air of conservatism surrounding management's top line guidance. From our perspective, when we look at the company's end markets, there is little question that cyberattacks will continue and the IoT market will not only continue to grow but expand into new areas, all of which will drive incremental demand for cybersecurity. In short, we see a very good ying-yang pull through between the company's two businesses, which makes it rather unique among cybersecurity companies.

Patent Portfolio Sale

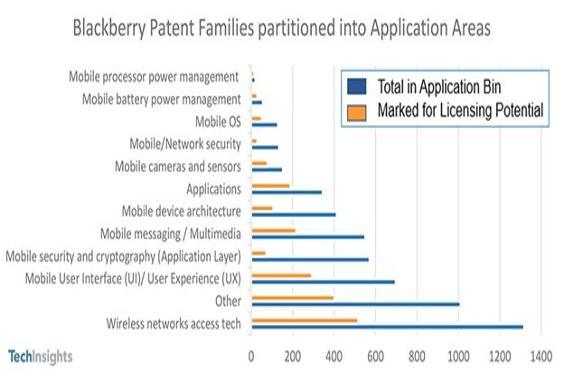

Aside from the guidance, the other item that we were somewhat disappointed on was the pending mobile patent sale. Management shared, "Negotiations are very close to a conclusion, and we are literally down to the last few important items now" before adding it expects an update in January. While we are admittedly frustrated by how long this is taking, we also understand the company's patent portfolio is rather large (more than 8,500 patents) that fall into 12 buckets:

It's rare that a patent portfolio of this size is up for sale and given that Apple (AAPL) is suing Ericsson (ERIC) amid an ongoing dispute over pricing for patent licensing in regards to technology "critical" for mobile telecommunications, the timing for this sale is likely to receive a hefty offer. We've said before the sale of that portfolio will remove the final vestiges of the legacy smartphone business, and we hope the company opts to rename itself as part of completing the sale. The other positive to be had when the sale is completed is it will alter the company's balance sheet. It's hard to say by how much, but we're looking at it this way - Blackberry has $673 million in long-term debentures and the ability to "clean up" the balance sheet means reducing if not wiping out the corresponding interest expense, which is a drag on profits falling to the bottom line.

We look forward to the positives associated with the pending transaction and would argue the current share price has yet to bake in those positives. To be clear, we aren't either, but we acknowledge that when the transaction is concluded there will be a re-think on the company's balance sheet as well as its EPS expectations. We look forward to that.

Our price target of 14remainsintact,andallthingsbeingequal,wewouldlooktorevisitthecurrentOneratingonthesharesnear14 remains intact, and all things being equal, we would look to revisit the current One rating on the shares near 14remainsintact,andallthingsbeingequal,wewouldlooktorevisitthecurrentOneratingonthesharesnear12. At that level, the shares would have ~165 upside to our current price target.

(Please note that we are looking to execute these trades at or near the share price mentioned above. Once the trade is completed, subscribers can see the trade's executed price here. Be sure to toggle the chart to sort by Purchase Date.)

Action Alerts PLUS is Long BB, AAPL.