Bearish Bets: 3 Stocks You Seriously Should Think About Shorting This Week (original) (raw)

These recently downgraded names are displaying both quantitative and technical deterioration.

Each week we identify names that look bearish and may present interesting investing opportunities on the short side.

Using technical analysis of the charts of those stocks, and, when appropriate, recent actions and grades from TheStreet's Quant Ratings, we zero in on three names.

While we will not be weighing in with fundamental analysis, we hope this piece will give investors interested in stocks on the way down a good starting point to do further homework on the names.

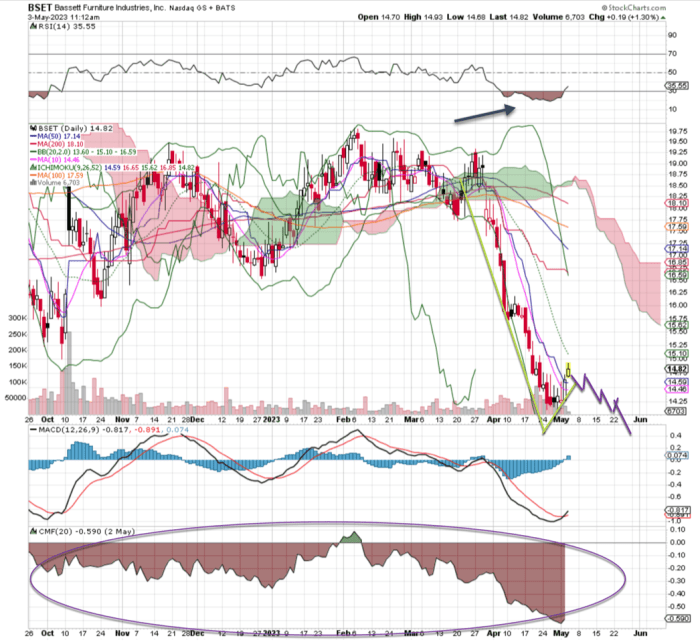

Bassett Furniture Is Marked Down

Bassett Furniture Industries Inc. (BSET) recently was downgraded to Hold with a C+ rating by TheStreet's Quant Ratings.

This furniture maker is a disaster. The trend has been down since the stock (RPM) in early February, but the really bad price action did not start up until late March. This stock has been on a slope downward for more than six weeks, and the recent pull-up in price is an excellent spot to add a short play.

The cloud is red, and check out the money flow at the bottom --all bearish all the time. Any move back up would be an opportunity to get a short position working; we'll say now is the time. Target the 9area,putinastopat9 area, put in a stop at 9area,putinastopat17 just in case.

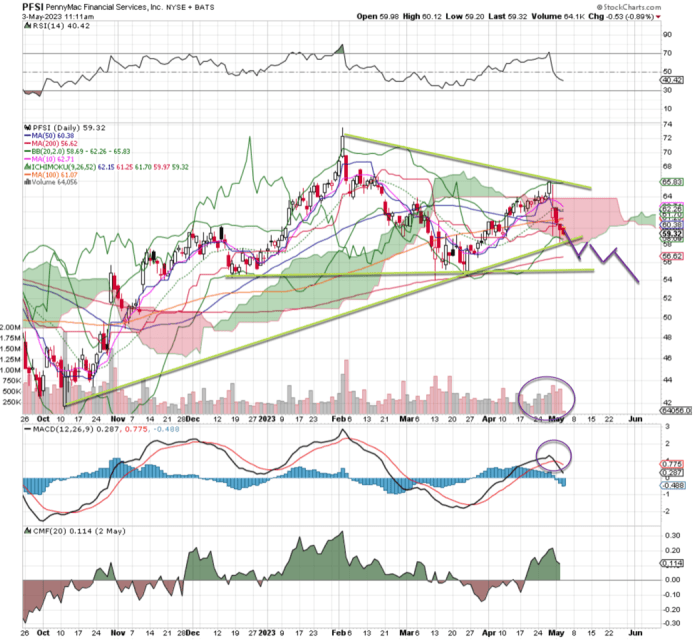

PennyMac Financial Suddenly Sags

PennyMac Financial Services Inc. (PFSI) recently was downgraded to Hold with a C rating by TheStreet's Quant Ratings.

PennyMac is a mortgage banking and investment company that seems to be holding up well in a high interest rate environment. However, its chart is starting to break down here, with lower highs and lower lows, which means a downtrend has been established.

Moving average convergence divergence (MACD) has turned and confirmed a sell signal, and the 50-day moving average recently was crossed under some heavy volume. That spells trouble. Notice that the recent highs in the Relative Strength Index (RSI) put the stock at overbought, but the price action was not equal to the highs in February. We call that a negative divergence. Whatever the case, there is more downside to go here. Target the low 50sforanice2050s for a nice 20% gain or more, put in a stop at 50sforanice2065.

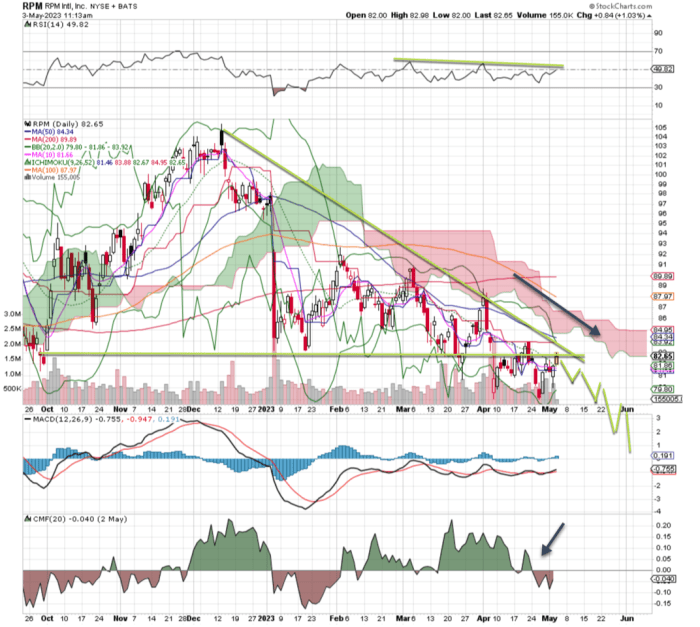

RPM International Steadily Slides

RPM International Inc. (RPM) recently was downgraded to Hold with a C+ rating by TheStreet's Quant Ratings.

The stock of this maker of specialty coatings has been pounded mercilessly since breaking down in December. However, the big move was at the start of 2023, when a huge down bar on heavy turnover changed the complexion of the stock.

RPM is clearly bearish with lower highs and lower lows and heavy volume on the downs sessions. Money flow just turned bearish, and the RSI is stymied at the 50 level. The recent rally into the low$ 80s is a good low-risk entry point. Target the low 70sherefirst,putinastopat70s here first, put in a stop at 70sherefirst,putinastopat89 just in case.

At the time of publication, Lang had no positions in the stocks mentioned.