Kass: 3 Spots of Vulnerability I Would Avoid in This Market (original) (raw)

I will briefly highlight the vulnerability of one stock and two market sub-sectors in the current market.

I would avoid all three over the next few months and over the remainder of the year.

Semiconductors

The U.S. has rolled back some of last Sunday's restrictions on Huawei, giving the company a temporary reprieve.

Stock futures rallied vibrantly in response.

Regardless, I have learned from my industry sources that Huawei has likely increased (hoarded?) their component inventory levels substantially.

Nobody is looking at Huawei's balance sheet and even if they did they probably couldn't find the inventory line as there are so many off balance sheet items that the Chinese typically use.

If correct, semiconductor demand has been massively overinflated over the last six to 12 months (depending on the degree of the actual stockpile levels) as Huawei might have anticipated the restrictions by the U.S. could have happened.

My contacts suspect Huawei has been stockpiling for awhile - this means that most semiconductor companies have "over earned" in the last 12 months.

Estimates for Intel (INTC) , Micron (MU) and the other semis are likely to be revised downward in the months ahead.

Apple

The greatest risk facing Apple (AAPL) has been the possibility that a competing product, delivered at a much less expensive price which incorporates most of the features of the iPhone, could upend the company's throne in the high end smart phone market.

Finally, Alphabet's (GOOGL) $400 Pixel 3a may provide the innovation that dethrones Apple.

Meet Pixel 3a: Premium. For Less.

And, so simple.

Just more than good enough and cheap!

For Apple there may be nothing left to keep average selling prices up and to stay differentiated.

If I am correct about the legitimacy of this competitive threat, over time Apple's installed base will be threatened and, with that, so will the stream (and vibrant rate of growth) of the high-margined service business.

Asset Managers

Bottom Line

Investment managers may be the next group to feel disruption... and may be headed for large share price falls.

I think I am ahead of the curve on this idea.

About a month and a half ago, Tobias Levkovich hosted a _Bull/Bear d_ebate at Citigroup's (C) headquarters in New York City.

I represented The Bear Case.

One of the questions Tobias asked was:

"Technology is seen as generating growth but often at the expense of some others, such as online sales versus brick/mortar stores - is there a new area that you envision as being prone to major disruption?"

That was a great question from Tobias - though it is hard to predict areas that may be the next sector subject to disruption (because almost every area is subject disruptive change these days)!

Tobias' query renewed a project I was working on late last year - shorting the investment managers (e.g., T. Rowe Price (TROW) and Franklin Resources (BEN) ) - and I have moved on my analysis recently and shorted several stocks in the space.

Here is my short thesis on the investment managers:

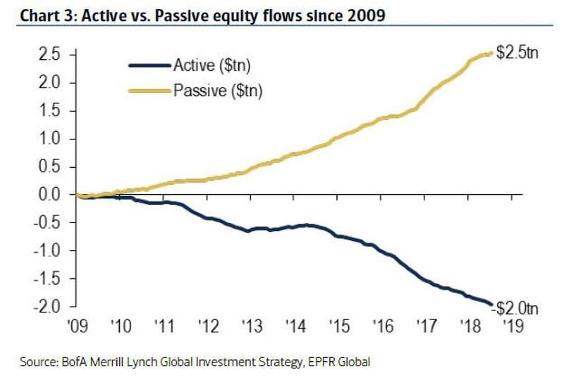

More and more money is going to passive products and strategies and away from active managers (who have failed to meet the returns of the Indices). Passive products are by definition not as energetic (it is a strategy that trades less actively) compared to active managers. More importantly, the fee differential between active and passive managers is wide - with passive providing an attractive low-cost (fee) alternative to active.

In summary, a toxic cocktail may loom ahead for investment managers:

* Lower stock market prices

* Less volume and activity (as low cost passive strategies continue to replace high cost active strategies)

* Lower transaction pricing (commissions) provided by on line services (like E Trade and Fidelity)

* Reduced investment management fees reflecting the continued share gains of passive products and strategies over the active ones

I don't believe investors are aware of how commoditized the money management business has become. As an example, a year ago, a boutique fund manager, Salt Financial, began to pay clients five basis points a year to manage their money!

Even many of the larger money management firms (including Fidelity and Vanguard) are offering some no-fee based ETFs.

I expect the competitive challenges to active managers like T Rowe and Franklin to intensify in the coming years.

Finally, those larger brokerages (e.g., Morgan Stanley (MS) and Goldman Sachs (GS) ) who are moving their business mix towards the retail investor) who have very high cost fee-based (wrap) products are particularly vulnerable to the trends discussed in the body of this column.

(This commentary originally appeared on Real Money Pro on May 21. Click here to learn about this dynamic market information service for active traders and to receive Doug Kass's Daily Diary and columns from Paul Price, Bret Jensen and others.)

(Apple, Alphabet, Citigroup and Goldman Sachs are holdings in Jim Cramer's Action Alerts PLUS member club. Want to be alerted before Jim Cramer buys or sells AAPL, GOOGL, C or GS? Learn more now.)

At the time of publication, Doug Kass was Short AAPL (small), TROW (large), BEN (large).