Looking at Semis, The What Ifs: Brexit, China, USMCA with the UK: Market Recon (original) (raw)

Zero Dark Thirty

Doing some chart-work at 2 am on Friday morning, I ran into a train of thought. I would like to try to explain this to you, my loyal readers. Is rising in silence in a effort to get a jump start on the wonders of numbers based pattern recognition a sign of madness? I'll let others judge. I'm just trying to make a living.

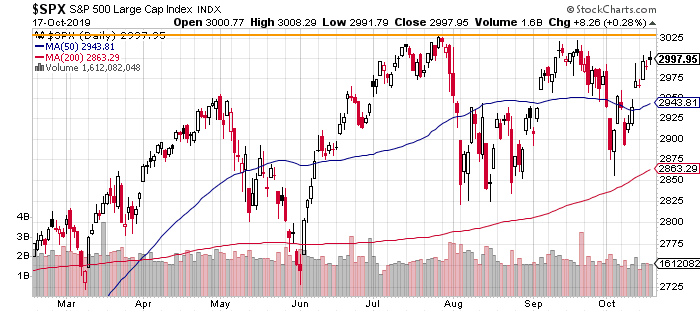

The Little Engine. I think I can. I think I can. I know you feel it too. There has been some rotation. Certainly some churn. Yet, our broadest large cap equity index, the S&P 500 moves ever so slowly, ever so methodically toward a retest of what already was a double top. The fact that trading volume has been not tremendously light, but certainly cautious in nature, I think is illustrative of a "hopeful" trepidation if you will. Take a look at what I am trying to communicate here.

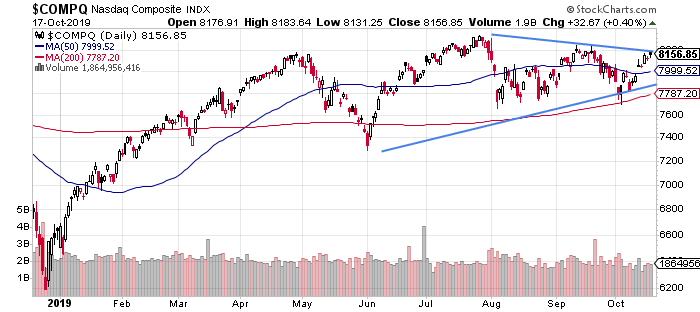

As for the Nasdaq Composite, you'll also see an upward looking test of trend, but not really that of a double top, more like that of a closing pennant flying atop a flagpole.

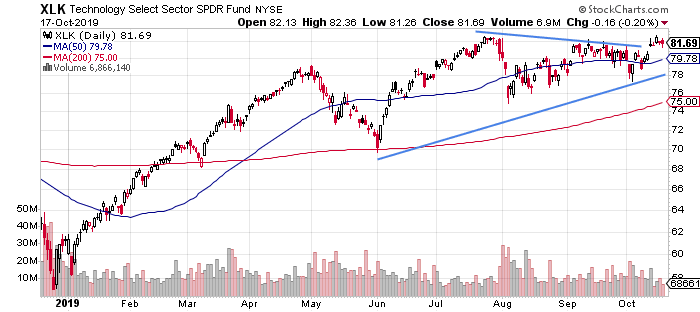

Think that's crazy? No, it's actually a thing, and what it signals is continuation of direction after a period of consolidation. In this case that direction would be higher. Does that mean better things are ahead for the tech sector? The sector has been the victim of the recent "on again, off again" rotation. That may really just mean that the group has been victimized by it's own success. Chart the technology Sector SPDR ETF (XLK) ? Kind of looks just like the chart above, just already well into the testing phase.

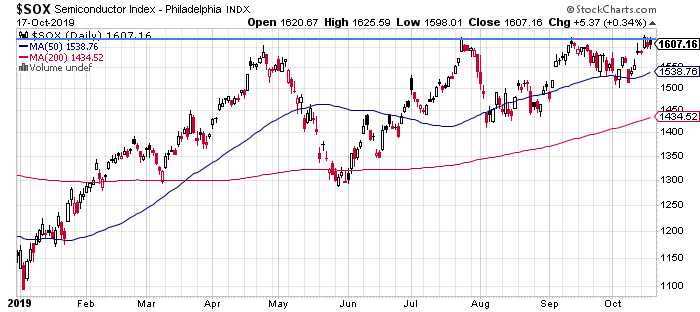

Within the sector, the semiconductors are ready to rock. I know that you saw the robust guidance that Taiwan Semiconductor (TSM) laid out for full year 2019 and for 2020. These guys sound like it's "go time."

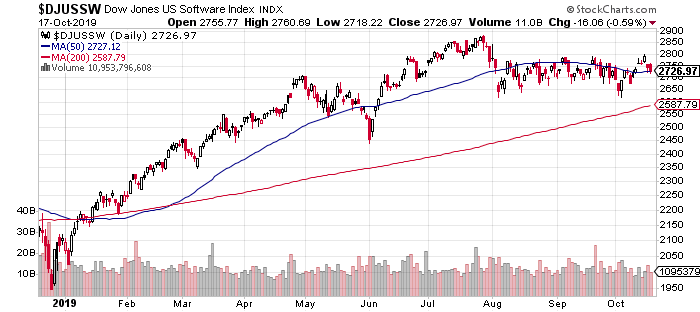

The group stands at the precipice of what is now a quadruple top. You know what happens when somebody knocks on a door four times. It either opens peacefully or there is violence. Do you need Lam Research (LRCX) , KLA Corp. (KLAC) , Applied Materials (AMAT) , or Brooks Automation (BRKS) ? Well, some exposure to the semiconductor equipment space might not be the worst idea. Those high growth, highly valued software names are where capital has been created of late. That's where managers have taken profits and put them to use elsewhere. So, let's take a look.

Now, suddenly we see a chart not facing an upward test, but a downward test. See that 50 day SMA? Just taken in mid-October, the index now rests right on the line. Ever see those swinging doors that saloons have in the old cowboy movies? Hmm. I'm not going to lie. I don't have a crystal ball. This group has not kissed it's 200 day SMA since January. That would be ugly. Then again, there are a few cards on the table, and there is a visible path toward optimism. This group finds support in here, and voila! Both the sector as well as the Nasdaq Composite likely make new highs. So, why should we believe?

The What Ifs

What if the UK Parliament actually finds a way toward consenting to the just reached Brexit deal?

What if China actually plays ball, and not only takes steps to alleviate the trade imbalance, but makes some structural changes that allow, as Larry Kudlow mentioned on TV on Thursday, foreign businesses take more control over their own operations in that country?

What if such progress is made and the administration in Washington finds reason to delay the next deadline for the implementation of new tariffs on mostly Chinese made consumer goods?

What if, also as Larry Kudlow mentioned, Congress actually moves toward the ratification of the crucial USMCA (new NAFTA) trade deal? Going out a little further... what if the initials UK can eventually be added to this acronym?

What I Think

I think that if all of these chips fall the right way, or at least seem to, that not only does the outlook for corporate profit improve greatly, in particular for the S&P 500, but that dollar valuations relax and the yield curve continues to normalize.

What you may already expect to hear from me, is that now that the Fed is discreetly pressuring the short end of the curve with a fairly aggressive (not QE) plan, they do need to reduce the Fed Funds Rate at least one more time in two weeks, and then take another look. What I do not want to see is lower yields at the longer end of the curve. You see, I am not a dove, I recognize the need for the yield curve to present as a slope that portrays to purchasing managers a normalized environment for credit. The effect on the entire U.S. economy of a positive spread for the 3 month/10 year comparison and the ability of that spread to expand can not be overstated.

The danger will come from Europe. We really know how the ECB proceeds form here. Yes, Mario Draghi plans an aggressive quantitative easing program. That said, there is a serious level of dissent in Europe over the implementation of this policy. Now, as Mario Drgahi passes that baton to Christine Lagarde, who is not an economist, but a politician... and whose greatest strength is considered to be that of a consensus builder, where does this talent lead her? and Europe?

Should Europe move ahead with Mario Draghi's QE program, the long end of the curve in the U.S. will come under pressure from net long-term TIC flows out of Europe. That would also place upward pressure on the U.S. dollar. So, yes... there is risk. There is also a path.

Why, Yes I Do

Apparently on Thursday the SEC (Securities and Exchange Commission) asked for help. The regulator is looking for help from stock exchanges and from other firms that would have obvious concern as they search for ways to improve market conditions for thinly traded stocks. Many of these thinly traded companies are small caps, and there has been complaint made that modern market models are structured rather poorly and were not tailored to their needs.

Hmm. Why, yes, I do have some ideas. First off, I still doubt the usefulness of high speed, algorithmic control over price discovery even in heavily traded, large cap names. The lack of sentient price discovery becomes glaring in thin markets. You know, I used to know some guys. They were known as floor traders. They worked with some other guys. What were they called? Oh, yeah... specialists. Wait, Sarge, you mean we already had a fairer market model and threw it all away in the name of speed, and that this created a fractured, far more opaque marketplace that served literally nobody's best interest except for high frequency traders? Yeah, you're getting warmer.

Hey, I don't know, commissions are obviously down big time over the long run. Does that justify not knowing if the best bid and best offer were properly represented at the correct point of sale? Here is how I think markets in thinly traded securities can be improved. One, trading in the security must be restricted to a home market, forcing best bid/best offer representation. Secondly, force this market to be a slow market, heck I'll go as far as considering open outcry. Everyone has a fair chance in an open outcry market. If you thought not, you had the wrong broker. These stocks trade thinly, right? how about Spanish pieces of eight? Okay. I'm willing to do sixteenths. You think that maybe with spreads that span between 6.25 cents and 12.5 cents between price points in a slow market might just develop a thicker book of scaled bids and offers? Duh.

C'mon dudes. This isn't rocket science. We already know and had a better way. Should not the bringing together of buyers and sellers actually lead to sentient price discovery? Is that not what brokerage was supposed to be about?

Economics (All Times Eastern)

10:00 - Leading Indicators (Sep):Expecting 0.1% m/m, Last 0.0% m/m.

13:00 - Baker Hughes Oil Rig Count (Weekly):Last 712.

The Fed (All Times Eastern)

10:00 - Speaker:Kansas City Fed Pres. Esther George.

10:00 - Speaker:Dallas Fed Pres. Robert Kaplan.

10:30 - Speaker:Minneapolis Fed Pres. Neel Kashkari.

11:30 - Speaker: Reserve Board Gov. Richard Clarida.

17:10 - Speaker:Dallas Fed Pres. Robert Kaplan.

Today's Earnings Highlights (Consensus EPS Expectations)

Before the Open: (AXP) (2.03), (KO) (.56), (KSU) (1.79), (SLB) (.41), (SYF) (1.14)

After the Close: (MINI) (.49)

(Lam Heracles and Schlumberger are holdings in Jim Cramer's Action Alerts PLUS member club. Want to be alerted before Jim Cramer buys or sells LRCX or SLB? Learn more now.)

At the time of publication, Stephen Guilfoyle was Long SLB equity.