Stimulus Repercussions, Is the Equities Rally Dead? Antitrust Action, Apple 5G (original) (raw)

He Said...

"The expansion is still far from complete. Too little support would lead to a weak recovery, creating unnecessary hardship." ...Fed Chair Jerome Powell, Oct. 6th, 2020

He Tweeted...

"I am rejecting... their request, and looking forward to the future of our Country. I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Businesses." ...President Donald J. Trump, Oct. 6th, 2020

Jacques

Equity markets were up on the day. So was I, but truthfully, I was slightly underperforming the markets. I had to run to the bank. Some quick errands. Only a couple of miles. I drive there. Mask up, Gloves on. In and out. Some woman tries to talk to me in the parking lot. Please don't talk to me. I am in a rush and you are not wearing a mask. Still don't understand those who seem unafraid of Covid. Don't they get it? Can't they see what I look like physically versus what I looked like six months ago? Guess not. How could they? Back in the car. Mask down. Hand sanitizer. Check stocks.

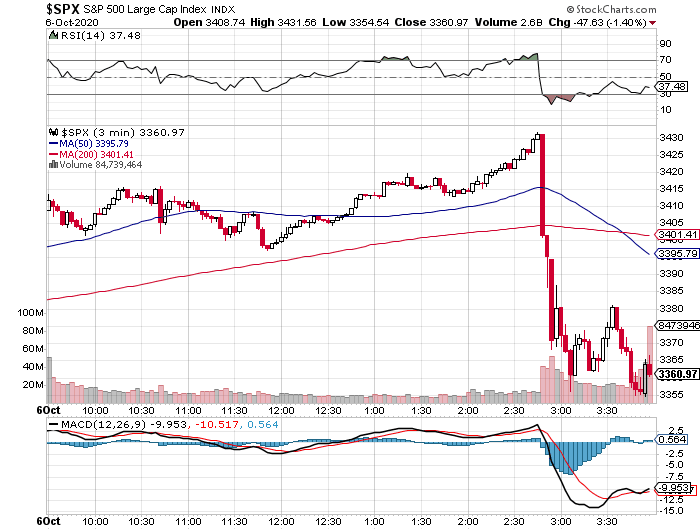

What the? Log in as fast as I can. Make a few sales right there in the parking lot. Radio on. Speechless. Race back, making every light. Thankfully. Markets down big. P/L down? Yes. Even worse? Legendary Van Halen guitarist Eddie Van Halen passes away from throat cancer, the soundtrack of my generation. Gone.

We carried Jacques (no rank, no last name) for miles through jungle terrain. He had been bitten by something. He was dead weight and he was delirious. We had no idea what was wrong with him or even if he was dying. We radioed for a helicopter. There was nothing nearby. Everyone in the squad had some first aid training but we didn't have a corpsman (medic). This is before GPS and before defense spending had gotten to where it was going. We made for it on foot. There was a Navy field hospital about three and a half klicks to our south. That kid somehow, less than half alert... sang the Van Halen song "Panama" the whole way there as if he were drunk, which he was not. That's my Van Halen story. It would also be the one and only time I would ever threaten a senior officer with physical harm. That story is for another time, but a very tired doctor did agree to see one more patient that day.

Keeps Getting Odder

This year just keeps getting stranger and stranger. Not in a good way. I had written on Monday's market rally on Tuesday morning. I was close to declaring these markets to be back in a confirmed uptrend. Just one thing held me back. The fact that trading volume for about a month now had consistently been higher on "down" days than on "up" days. Decisions like this matter, simply because trader behavior, being the result of so much input, is probably more reliant upon trend than anything else. Interpreting one's own outlook for the grand marketplace and understanding how risky or risk averse one should be is the name of the game.

Did he just admit that he's not really that good? In a way, none of us are. Some of us are better at interpreting the size and scope of sustainable capital flow than others. Surfing is easier than swimming, but you'll find out who can't swim in a pressured marketplace. Trust me. I can remember many of their faces, but their names no longer come back to me.

Spot The Tweet

Anyone want to guess what time I was at the bank? The deal is this. A president running for re-election but trailing quite significantly in the polls, who has never seemed particularly bothered by taking on elevated levels of debt, suddenly halts negotiations (at least until after the election) that by all accounts were slow moving but making progress with Speaker Nancy Pelosi on the one side and Treasury Secretary Steven Mnuchin most visibly representing the administration.

The positive could be that at least the president feels better. After receiving both experimental medicines and a level of care unavailable to literally everyone else suffering from this virus. That might mean that therapeutics being used to treat this darned pandemic are reaching a place that could ultimately unlock the economy.

I do have to wonder why a president needing a political win less than a month prior to a national election would end hopes for such a win and do it in such a way where he alone would take the blame publicly. Maybe this is not the end of negotiations, but a negotiating ploy. Who among us has not stormed out of a car dealership in "pretend" anger knowing darned well that we would buy that vehicle and were willing to pay sticker, just to try to get the salesperson to panic. Is this that?

The tweet supposedly came after a call with administration officials and Republican legislators. Can it be that the Republicans in the Senate just do not have the votes to meet the Democrats even half way? Forget the House and their 2.2trillionto2.2 trillion to 2.2trillionto2.4 trillion spending bill. The administration had reportedly come up to $1.6 trillion. What if the votes in the Senate were not even there for that lesser amount. Many of these Senators may not have to defend themselves nationally. They certainly do have to defend themselves locally, or at the state level.

If constituents see their own state in better shape fiscally than what they see nationally, particularly in those states that appear mismanaged by the other side, they may take umbrage should their tax dollars be used to finance what they see as chaos in cities half a continent away. In other words, the administration may not have the legislative ammo to even back up the level of fiscal support proposed on their own end. Of course, this is just me thinking out loud at zero-dark thirty in the morning. I don't know the folks involved and they do not ask for my opinion.

What now? The president will have to take some kind of executive action to at least use funds appropriated but never used by the CARES Act last spring. There is still some 300millionto300 million to 300millionto400 million in that till, and the president may have the authority to put that money to work. While if targeted correctly, this could alleviate some trouble spots, this would not steepen the slope of economic recovery.

Reversal

So... one day after deciding that we still could not confirm the market's uptrend, we are forced to ask the opposite. Is this rally in equities dead? The answer has to be "not yet." traders and investors are left in the "friend zone" Not enough to love, certainly not ready to hate. Volatility must be embraced, and at least mentally adapted to, for to overcome, one must understand that the short to medium term future is uncertain. This is your new certainty. Stinks? Embrace the stink.

We know this move was violent. For equities. The dollar moved around. Yields nearly stayed put. The dollar should have strengthened significantly if fiscal support was dead. The yield curve should have flattened. These things did not happen at least not as aggressively as I might have thought. The US dollar index has returned all the way to Friday's levels. Either equites will pull these assets toward mean, or these assets will drag equities higher. One side here has to give. This is not politics, though upon political outcome markets stand.

Trading volume did increase significantly at both of New York's primary equity exchanges. Only one sector, the Utilities... perceived group of dividend paying safe haven type names closed in the green. Everything else sold off, large caps more aggressively than small to mid-caps. Breadth was not really all that awful, which may surprise. Losers beat winners at the NYSE by little more than 1.6 to 1, and by a rough 4 to 3 at the Nasdaq Market site. In fact, declining volume at the Nasdaq just barely beat advancing volume. This was close to a virtual tie. Take hardware out of tech and the tech sector really just took a powder. There was no rout there, even with the pressure being placed on the FANG names for other reasons.

The challenge remains, and I am sorry for beating you over the head with this, but it matters... moving off of the 50 day simple moving average... for both the S&P 500 and the Nasdaq Composite. This line has really been all that matters to those writing the algorithms that control price discovery since at least late September, but really for almost a month now. You know who reads the charts for these electronic traders? Guys like me. Guys and gals like you.

Notes:

- The House Judiciary subcommittee recommended antitrust action be taken (including potential break-ups) of what we refer to as Mega-Cap tech, or what we refer to as FAANG more specifically (less the N, which is Netflix (NFLX) ). The effort is bi-partisan, which in this environment makes it peculiar.

The short of it all is that this panel believes that Amazon (AMZN) holds monopoly-like power in e-commerce, Apple (AAPL) in the distribution of software application across its own ecosystem, Alphabet's (GOOGL) Google in internet search, and Facebook FB in online advertising and social media. Have we been here before? Have we heard this before? Does this impact what I will hold in my portfolio? I am long Amazon and Apple. Do they face some negative headlines in the short run? Likely. If nothing comes of this more than a fine and some regulation, they'll live, even if those fines mount at the state level. Should they actually break these firms up, do I want to be long or get long ahead of that event? You bet your tail I do.

Speaking of Apple, the firm announced that the "Hi, Speed" event where the new lineup of 5G capable iPhones will likely be revealed will take place this Tuesday, October 13th as "earnings season" launches for the big banks in earnest. What do I think? I point to Wedbush analyst Dan Ives who has a $150 price target on the shares and is considered to be among the most knowledgeable when it comes to this name. Ives notes there are roughly 950 million iPhones currently in use globally, and by his estimates... 350 million (or so) are already in their upgrade windows.

Seemingly to very little fanfare, the Trump administration has agreed to the FDA's guidelines for vetting vaccines under development in the fight against Covid-19. The media had seemingly gone a little over the top when the perception was that the administration would have a problem with the FDA's proposed two month observation period after a patient in a clinical trial had been dosed for the final time. This almost certainly pushes any potential for an Emergency Use Authorization well past the election.

Leadership as in those candidates seen closest to an application for such usage has been seen coming from Moderna (MRNA) and Pfizer (PFE) /BioNTech (BNTX) in the U.S. Moderna dosing patients as recently as September 25th, meaning that for that firm, an application for EMU authorization would not be possible until late November. Pfizer and BioNTech are expected to at least have some kind of available data ready for late October and have started filing for approvals across Europe which can be a drawn out process itself. Still, available data does not make an EMU a snap. I do believe that someone will be vaccinated this year. Just not you, nor I.

Economics (All Times Eastern)

10:30 - Oil Inventories (Weekly):Last -1.98M.

10:30 - Gasoline Stocks (Weekly):Last +683K.

13:00 - Ten Year Treasury Note Auction: $35B.

15:00 - Consumer Credit (Aug): Last $12.25B.

The Fed (All Times Eastern)

14:00 - FOMC Minutes.

14:00 - Speaker:New York Fed Pres. John Williams.

14:15 - Speaker:Minneapolis Fed Pres. Neel Kashkari.

15:00 - Speaker:New York Fed Pres. John Williams.

Today's Earnings Highlights (Consensus EPS Expectations)

Before the Open: (LW) (.30), (RPM) (1.18)

(Amazon, Apple, Alphabet, and Facebook are holdings in Jim Cramer's Action Alerts PLUS member club. Want to be alerted before Jim Cramer buys or sells these stocks? Learn more now.)

At the time of publication, Stephen Guilfoyle was Long AMZN, APPL, MRNA, PFE equity.