Stocks Under $10 Weekly Roundup (original) (raw)

Last Week

It made sense. Right? Last week. I mean, equity markets ended February and started March on weakness as interest rates, or what the U.S. Ten Year Note (for example) yielded, spiked higher. This is something I can understand. Dollar valuations rallied into mid-week as well. All tells a tale that can be retold.

Then, it all changed. Suddenly, from the point where it felt as if someone, somewhere had rung the "all-clear" bell, the "ugly stick" was quickly shoved back inside of its closet and the risk-on machine was back in motion.

What gave? A dovish sounding or should I say, dovish reading essay written by Atlanta Fed Pres. Raphael Bostic? Bostic, who does not vote on policy this year, apparently feels that the Federal Open Market Committee can now move in baby steps (a quarter-percentage point at a time) as policy might now be "sufficiently restrictive." Is it though? Fed Gov. Christopher Waller, who does vote on policy and who is clearly more influential than Bostic, was far more hawkish in his posture. Markets did not care.

What about the macro? I think this strength in the January data that has been landing all month, has surprised a lot of folks? The ISM numbers that printed last week were for February, though. While the manufacturing sector remained mired in weakness, manufacturing prices, without much support from the rest of that survey, somehow refund some footing. As for the services sector, there was strength to be seen up and down the entire survey. New Order were strong as was employment as were of course, prices.

This is an environment that provoked an equity market rally? On dovish Fed speak? This causes a rally in Treasuries on Friday that unwound a lot of mid-week progress on rates? Kind of tough to make all of this make sense.

As of last Friday night's close, the the Stocks Under $10 Portfolio stands up 8.31% year to date.

Our benchmark, the Russell 2000, now stands up 9.48% for 2023. The S&P SmallCap 600, which is somewhat comparable, closed the week up 9.69% for 2023.

The portfolio was moderately active late last week, as I had been sick with a fairly rough bout with Covid earlier in the week. The portfolio did complete its exit from AXT Inc. (AXTI) , as that move had been started the week prior. The portfolio added to 22nd Century on weakness on Thursday. There was news in that name that broke after the closing bell on Friday. It will be interesting to see where the shares open on Monday morning.

The portfolio also executed a nearly perfect in and out trade in Credit Suisseadding on weakness on Thursday and selling on strength on Friday for an overnight "LIFO" profit of 7%. That position ended the week at the same position size as where it had started the week, though the weighting did improve.

The portfolio, as readers can see, had been caught from behind by the two indexes that we see ourselves in competition with. That was three weeks ago. We have stayed close, but have not yet been able to recapture what had been an early 2023 lead.

We still see a dangerous year ahead, and do not fully trust this market. We continue to feel that our net cash position will have to continue to remain higher than we would normally prefer. That said, we must walk the tightrope between patience and aggression.

The Fed

The focus, as far as the Fed is concerned, will move away this week from the ancillary players and squarely into the halls of our legislative bodies. On Tuesday morning, Fed Chair Jerome Powell will testify before the Senate Banking Committee and on Wednesday, he will go through the whole dog and pony show once again before the House Financial Services Committee.

These events will take center stage for the financial media, and while occasionally there will be a pertinent question asked that we really would like to hear some information on, the whole two day episode usually only serves to qualify many members of these committees as to be in way beyond their intellectual depth when discussing economic matters, and largely exposes many as grossly under qualified for the positions in which they serve.

Fed Funds futures trading in Chicago are currently pricing in just a 75% probability for a 25 basis point increase being made the the Fed Funds Rate on March 22nd. This means that these markets also show a 25% chance for a 50 bps rate hike at that time.

Futures now show an 82% likelihood that what would be a terminal rate of 5.25% to 5.5% that will be reached by June and held for at least five meetings. This projected terminal rate is a quarter percentage-point higher than it was when I wrote this column a week ago. Surprisingly, futures now show a 67% chance for a first rate cut late in March of 2024.

Earnings

Earnings season is now, for all intents and purposes, complete. There will still be a few stragglers coming in, and even a headliner or two, but there aren't enough names left out there to seriously impact the "final" score for the S&P 500 for the fourth quarter.

According to FactSet, with 99% of the S&P 500 having already reported, 69% of companies have beaten earnings expectations, while just 65% of companies have reported revenue generation ahead of estimates. Staying with data provided by FactSet, the year-over-earnings decline for the S&P 500 for the fourth quarter of 2022 was -4.6%. Revenue growth is now closed at 5.3%. This was the first year-over-year earnings contraction for the S&P 500 since third-quarter 2020.

Looking out a bit, according to FactSet, the current quarter (Q1 2023) is seen as an earnings contraction by 5.9% on revenue growth of 1.9%. Second quarter 2023 is seen at an earnings loss of 3.8% on revenue shrinking by 0.1%. For the full calendar year of 2023, consensus view is now for earnings growth of 2.1% on revenue growth of 2.0%. The full year numbers keep moving lower.

Markets

As mentioned above, equity markets were really acting weakly last week until a late week surge that came about either due to some dovish Fed speak, which I am sure you can tell that I doubt, some stronger than expected macro regarding employment and inflation, which I also doubt, or something built in ... or technical. This is what I believe mattered more than anything else late last week. That and maybe some shots might have needed covering going into the weekend.

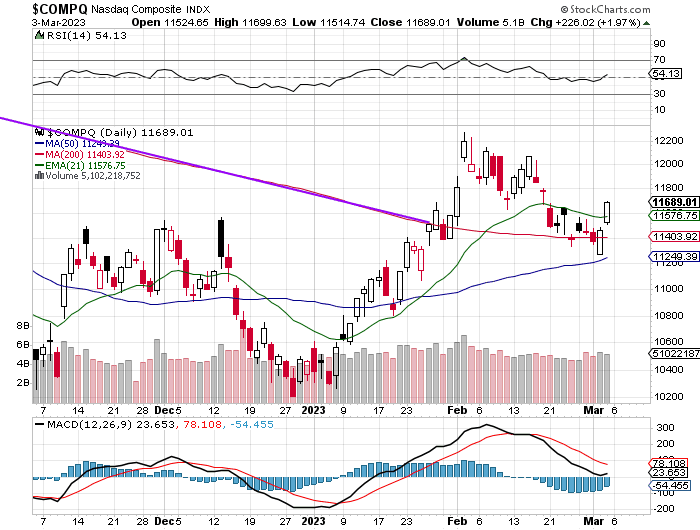

Check out the Nasdaq Composite. The index straddled its own 200-day simple moving average on both Wednesday and Thursday, and then catapulted up through its 21-day exponential moving average on Friday.

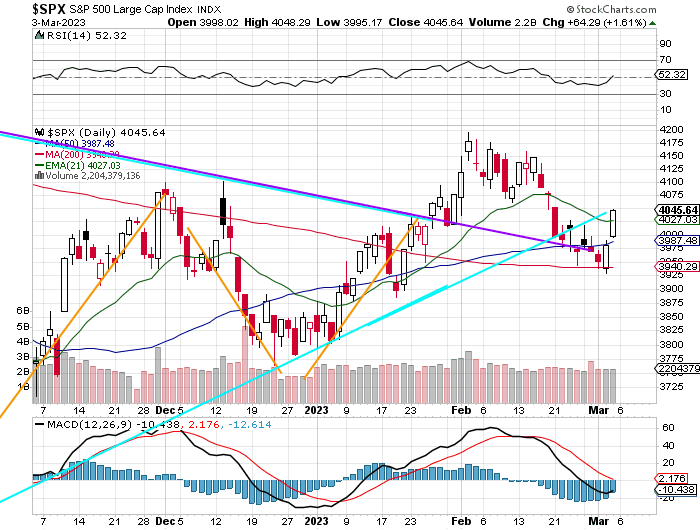

The S&P 500, made a much more precise example of traders (really algorithms) using the key moving averages as trading levels. The S&P 500 tested and bounded off of its 200-day simple moving average three days in five, before soaring right through its 50-day SMA and retaking its 21-day EMA, as well.

For the past five trading days, the S&P 500 rallied 1.9%, after enjoying that 1.61% run on Friday. The Nasdaq Composite ran 1.97% on Friday, to close out the week up 2.58%. The Philadelphia Semiconductor Index, which readers know is something that I always watch closely, and is usually more volatile than most of the other indices we watch, rallied sharply (+1.48%) on Friday to end the week up quite the robust 3.18%. This leaves us with the Russell 2000, which is obviously important to this portfolio, as it is our benchmark. The Russell 2000 rallied 1.35% on Friday to gain an even 2% for the five day period.

Nine of the 11 S&P sector-select SPDR ETFs shaded green for the week past, as all 11 posted gains for Friday. Materials (XLB) led easily, up 4.2% for the week, while the Industrials (XLI) finished the week in second place, up 3.35%. The week's two losers were the staples (XLP) and the utilities (XLU) , as both of those funds finished the week in the red.

According to FactSet, the S&P 500 now trades at 17.5-times forward looking earnings, which is down from where it has been trading recently. This ratio remains well below the S&P 500's five year average of 18.5 times, and just a touch higher than its 10-year average (17.2).

The Week Ahead

Jobs Week. What more needs to be said? First, investors will get hit with a double dose of Jerome Powell testimonies. Then, February jobs data will land squarely upon our doorsteps on Friday. Non-Farm Payrolls are expected to return to the area around 200K for February job creation after that very surprising print of 517K Non-Farm Payrolls hit the tape a month ago. Keep in mind that the ADP Employment Report only posted 106K private sector jobs created in January, so somebody is going to be very wrong once the revisions come in.

This week will be light on the earnings front, but there will be something to look at and potentially trade every single day. Ciena Corp (CIEN) will kick things off on Monday morning, followed by Dick's Sporting Goods (DK) , Thor Industries (THO) , Crowdstike (CRWD) , Campbell's Soup (CPB) , Docusign (DOCU) , Oracle (ORCL) and Ulta Beauty (ULTA) as the week wears on.

Monday: Economics (All Times Eastern)

10:00 - Factory Orders (Jan): Expecting -1.8% m/m, Last +1.8% m/m.

The Fed (All Times Eastern)

No public appearances scheduled.

Earnings Highlights (Consensus EPS Expectations)

Before the Open: CIEN (.36) After the Close: TCOM (-.16)

Tuesday:

Economics (All Times Eastern)

08:55 - Redbook (Weekly): Last 5.3% y/y. 10:00 - Wholesale Inventories (Jan-adv): Expecting -0.4% m/m, Last 0.1% m/m. 3:00 p.m. - Consumer Credit (Jan): Last $11.56B. 4:30 - API Oil Inventories (Weekly): Last +5.203M.

The Fed (All Times Eastern)

10:00 - Speaker: Federal Reserve Chair Jerome Powell.

Earnings Highlights (Consensus EPS Expectations)

Before the Open: DKS (2.89), SE (-.55), THO (1.10) After the Close: CASY (2.00), CRWD (.43)

Wednesday:

Economics (All Times Eastern)

07:00 - MBA 30 Year Mortgage Rate (Weekly): Last 6.71%. 07:00 - MBA Mortgage Applications (Weekly): Last -5.7% y/y. 08:15 - ADP Employment Report (Dec): Expecting 188K, Last 106K. 08:30 - Balance of Trade (Jan): Last $-67.4B. 10:00 - JOLTs Job Openings (Jan): Last 11.012M. 10:00 - JOLTs Job Quits (Jan): Last 4.087M.

10:30 - Oil Inventories (Weekly): Last +1.166M. 10:30 - Gasoline Stocks (Weekly): Last -874K. 1:00 p.m. - Ten Year Note Auction: $32B.

The Fed (All Times Eastern)

10:00 - Speaker: Federal Reserve Chair Jerome Powell. 2:00 p.m. - Beige Book.

Earnings Highlights (Consensus EPS Expectations)

Before the Open: CPB (.74) After the Close: MDB (.07)

Thursday: Economics (All Times Eastern)

08:30 - Initial Jobless Claims (Weekly): Expecting 195K, Last 190K. 08:30 - Continuing Claims (Weekly): Last 1.655M. 10:30 - Natural Gas Inventories (Weekly): Last -81B cf. 1:00 p.m. - Thirty Year Bond Auction: $18B.

The Fed (All Times Eastern)

10:00 - Speaker: Reserve Board Gov. Michael Barr. .

Earnings Highlights (Consensus EPS Expectations)

Before the Open: BJ (.86), TTC (.94) After the Close: DOCU (.52), ORCL (1.20), ULTA (5.54), MTN (6.14)

Friday:

February Employment Situation (08:30 ET)

Non-Farm Payrolls: Expecting 207K, Last 517K.Unemployment Rate: Expecting 3.4%, Last 3.4%.Underemployment Rate: Last 6.6%.Participation Rate: Expecting 62.4%, Last 62.4%.Average Hourly Earnings: Expecting 4.7% y/y, Last 4.4% y/y.Average Weekly Hours: Expecting 34.6, last 34.7 hours.

Other Economics (All Times Eastern)

1:00 p.m. - Baker Hughes Total Rig Count (Weekly): Last 749.1:00 - Baker Hughes Oil Rig Count (Weekly): Last 592.2:00 - Federal Budget Statement (Feb): Last $-39B.

The Fed (All Times Eastern)

No public appearances scheduled.

Today's Earnings Highlights (Consensus EPS Expectations)

Before the Open: BKE (1.62), GENI (-.12)

The Stocks Under $10 Portfolio

Below is a rundown of our current positions. Figures in parentheses are each stock's Friday closing price and percentage weighting in the model portfolio.

ONEs

None

TWOs

22nd Century Group (XXII:NYSE American; $0.91; 6.90%)

1- Wk. Price Change: -1.4%

WEEKLY UPDATE: News broke after the closing bell last Friday that 22nd Century Group had secured access to 21millioninnewseniorsecureddebtfinancing.TheaccesstothesefundswillhelploosenworkingcapitalasthefirmcontinuestoworkonthecommercializationofitsVLNtobaccoandGVBhemp−relatedbusinesses.TheportfoliodidaddtothispositiononweaknessthispastThursday.ThecompanyisexpectedtoreportitsfourthquarterfinancialresultsthisThursdaymorning.Expectationsareforalosspershareof21 million in new senior secured debt financing. The access to these funds will help loosen working capital as the firm continues to work on the commercialization of its VLN tobacco and GVB hemp-related businesses. The portfolio did add to this position on weakness this past Thursday. The company is expected to report its fourth quarter financial results this Thursday morning. Expectations are for a loss per share of 21millioninnewseniorsecureddebtfinancing.TheaccesstothesefundswillhelploosenworkingcapitalasthefirmcontinuestoworkonthecommercializationofitsVLNtobaccoandGVBhemp−relatedbusinesses.TheportfoliodidaddtothispositiononweaknessthispastThursday.ThecompanyisexpectedtoreportitsfourthquarterfinancialresultsthisThursdaymorning.Expectationsareforalosspershareof0.06 on revenue of $20.6 million. These numbers, if realized, would be good for sales growth of 158%.

INVESTMENT THESIS: This stock is basically a play on the idea that the Biden administration moves toward an agenda targeting less dangerous and less addictive forms of tobacco as a replacement for what is currently available to US (and global) consumers. The idea here is for the firm's VLN (very low nicotine) cigarettes to get regulatory approval and move toward commercialization.

Price Target: $5

Credit Suisse Group (CS:NYSE; $3.03; 3.10%)

1-Wk. Price Change: +1.0%

WEEKLY UPDATE: This stock sold off hard last Thursday, provoking a purchase by the portfolio. The stock then rallied on Friday, and the portfolio took quick advantage, swapping out of a 7% overnight "LIFO" profit. The share size of the position closed the week where it started.

INVESTMENT THESIS: This name has come under intense pressure as the firm needs to turnover rocks and sell businesses in order to stabilize the company. That said, the share price has reached a point where there is potential for a short-term rise in the market value of the shares making this position "worth it" to the portfolio in a speculative way and from a risk/reward perspective.

Price Target: $5

Energy Fuels Inc. (UUUU:NYSE American; $6.68; 1.91%)

1-Wk. Price Change: +1.7%

WEEKLY UPDATE: Since the sale of the Alta Mesa property was announced in mid-February, no news has come out on this name. Wall Street is looking to hear something in the way of quarterly earnings some time next week at the earliest.

INVESTMENT THESIS: Energy Fuels earned its place as the uranium-based replacement for the more natural-gas based Southwestern Energy (SWN) as the portfolio tries to pair at least one non-crude based energy name with Transocean as a means of diversification.

Price Target: $9

Pixelworks, Inc. (PXLW:Nasdaq; $1.63; 5.33%)

1- Wk. Price Change: +5.2%

WEEKLY UPDATE: Shares of Pixelworks have alternated "up" weeks with "down" weeks since prior to reporting the firm's quarterly earnings a month ago. There has been no new firm-specific news released of late outside of a planned appearance at the 35th annual ROTH Conference at Dana Point, California one week from today.

INVESTMENT THESIS: Pixelworks is a provider of visual processing solutions, and is a purveyor of both software and semiconductors designed toward those ends. The belief is that Pixelworks will better positioned in 2022 to secure incrementally increased capacity from supplier Taiwan Semiconductor (TSM), which should ease logistics issues and provide for the firm pricing power at home.

Price Target: $5

SoFi Technologies (SOFI:Nasdaq; $6.72; 5.77%)

1-Wk. Price Change: +5.3%

WEEKLY UPDATE: This stock has moved around or late on rumor concerning the future of the Biden administration's plans to forgive a sizable portion of current outstanding student loans for those not meeting a certain income threshold. There has been no hard news concerning this name in recent weeks.

INVESTMENT THESIS: There are a number of reasons to be involved in this troubled name. No, SOFI is not yet profitable, but it is a bank trading under $10 that has plenty of potential as a one-stop financial services shop as interest rates rise and the yield curve normalizes. Ending the moratorium on student loans where SOFI has plenty of exposure would be an upside catalyst.

Price Target: $10

Transocean Ltd. (RIG:NYSE; $7.51; 5.83%)

1-Wk. Price Change: +11.3%

WEEKLY UPDATE: This stock broke a two week losing streak last week. One might also say that these shares have rallied in seven of the past nine weeks. It's all a matter of perspective. While earnings disappointed in late February, that ever-growing order backlog is hard to ignore, as is the stickiness of the underlying commodity at recent market prices.

INVESTMENT THESIS: The portfolio's reason for being in this name is its exposure to deep sea drilling and exploration and the sudden global need for such operations amid a severe shortage in energy commodities. That and the low share price, despite some shaky fundamentals. This helps the portfolio broaden its exposure to the energy sector going forward at limited expense. The plan is to grow the position to something in between a 2% to 3% weighting.

Price Target: $7.50

Vera Bradley Inc. (VRA:Nasdaq; $5.54; 4.53%)

1-Wk. Price Change: +1.5%

WEEKLY UPDATE: Quarterly earnings are expected this Wednesday morning. Wall Street is currently looking for EPS of 0.15onrevenueof0.15 on revenue of 0.15onrevenueof137.5 million. The revenue print, if realized, would come to a year-over-year sales contraction of 8%. Investors will also look to hear more about the semi-recent shake-up in management and where the firm is headed now that these cuts have been made.

INVESTMENT THESIS: This name is a bit of a project for the portfolio. The execution has been poor in terms of assortment, margin, and outright sales. However, the firm runs a tight ship when it comes to the balance sheet, and should be able to withstand the correction now obviously necessary. They may need to burn some of that balance sheet to get there from here, and they have the quality on paper to do it.

Price Target: $7

THREEs

None

Please remember that Stocks Under $10 is not intended

to provide personalized investment advice. DO NOT EMAIL THE SU10 TEAM SEEKING PERSONALIZED INVESTMENT ADVICE, WHICH HE CANNOT PROVIDE.