Stocks Under $10 Weekly Roundup (original) (raw)

Last Week

During the one five-day workweek in a four week stretch, long-dated Treasuries rallied alongside equities as U.S. dollar valuations came in, causing commodities to rally.

How about U.S. equity markets? The S&P 500 rallied on all five days individually last week, as did all of the other major indexes. Most of those major indexes, including the Nasdaq Composite, now have six-day winning streaks intact.

As of last Friday night's close, the Stocks Under $10 portfolio stands up 8.03% year-to-date. Our benchmark, as readers know, and what we shoot against is the Russell 2000. That index now stands up 7.14% for 2023. The S&P SmallCap 600, which is not our benchmark, but is also a small-cap focused equity index ... and is somewhat comparable closed the week up 7.03% for 2023.

The Stocks Under $10 portfolio was extremely active last week. The portfolio downgraded both Southwestern Energy (SWN) and Vision Marine Technologies (VMAR) from "Twos" to "Threes" on Tuesday and spent the rest of the week getting the portfolio flat those two names, and doing so in methodical fashion. The portfolio also added to Credit Suisse (CS) on Tuesday and Friday and added to Energy Fuels (UUUU) on Friday in an effort to create a heavier weighting for those two names. Lastly, the portfolio happily took some SoFi Technologies (SOFI) and 22nd Century Group (XXII) off of the table to prevent those two positions from weighing too heavily on our book as their share prices moved higher.

The portfolio still sees a dangerous year ahead, and will approach traversing the environment provided appropriately. It remains likely that our net cash position will have to continue to remain higher than we would normally prefer. Nine trading days into the year, despite our good start, that has not changed.

From a macroeconomic perspective, the week past was dominated by the December consumer price index report, released by the Bureau of Labor Statistics. Those results showed up as a month-over-month contraction for headline inflation and for the most part, were in line with expectations. Highlighted were two items. One, that the U.S. is almost certainly past peak inflation and two ... that the input for shelter, which accounts for almost a third of the index, is using stale data, is incorrect and thus forcing current results to appear more inflationary than they really are.

Away from the consumer price index, there were key auctions of U.S. three year, 10 year and 30 year paper that went exceedingly well, with increased foreign participation. There was also some Fed speak, and this time it was not all mindlessly hawkish. There was rationale behind the words spoken by Boston Fed Pres. Susan Collins, who suggested such outdated concepts as data-dependency. Collins was seconded by both Philadelphia Fed Pres. Patrick Harker and Richmond Fed Pres. Tom Barkin, who both seemed to tilt toward a quarter percentage-point rate hike on Feb. 1, and then at least listening to the economy from there on out.

Much of the economic talk of late has been around the possibility of a recession, with many seeing a soft landing or a shallow recession ahead. I'm here to tell you that recessions are contagious and once job losses and cost cutting become the norm and not the exception, there is almost no way to tell how deep a recession might get this far ahead of, or early in said recession.

That much said, the Atlanta Fed's GDPNow model, which is a real-time snapshot of data already reported and not a tool of prediction, currently has fourth-quarter 2022 running at growth of 4.1% quarter-over-quarter seasonally adjusted annual rate, though to me, the data feels worse than that. As far as the Federal Open Market Committee policy decision schedules for Feb. 1, Fed Funds futures trading in Chicago are currently pricing in a 92% probability for a quarter percentage-point increase at that time. Futures show that this hike will be followed by an 80% likelihood for another hike of the same rate on March 22 that gets the Fed to 4.75% to 5%, which would be the terminal rate. Futures also show a 52% chance for a rate cut in November.

Markets

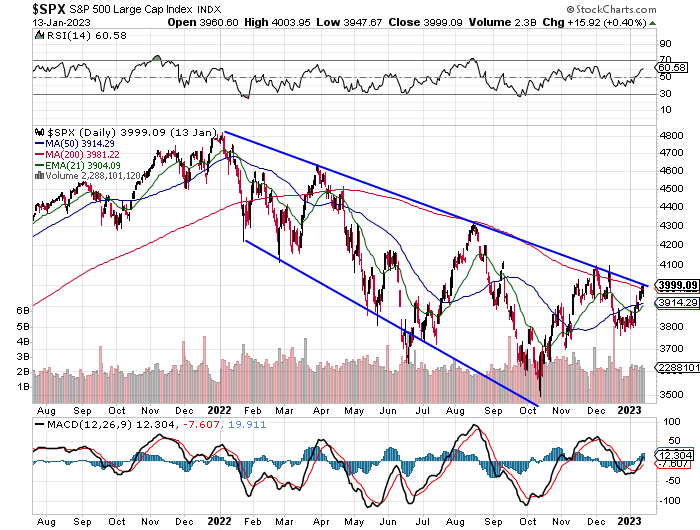

Equity markets, while still looking somewhat range-bound, do appear to be in a place where there either has to be a break out or a rejection. While the Nasdaq Composite still has a ways to go in order to make a run at its 200-day simple moving average, the Russell 2000, Philadelphia Semiconductor Index and most importantly, the S&P 500 all crossed that bridge last week. The S&P 500, as readers can see here, just barely crossed that line on Friday.

Readers will also see that the index now comes up against long-term resistance, which has held, as the upper blue line shows, for just about a year.

For the past five trading days, the S&P 500 gained 2.67%, and now stands up 4.16% year-to- date. The Nasdaq Composite rallied 4.82% last week and is now up 5.85% for 2023. The Philadelphia Semiconductor Index, which is something that I always watch closely, steamed ahead by 6.24% last week and is now 7.14% higher year-to-date. The Russell 2000, which is important to this portfolio, as it is our benchmark, gained 5.26% over the past five days, to open this week up 7.14% for 2023.

Nine of the 11 S&P sector-select SPDR exchange-traded funds shaded green for the week past, led by consumer discretionaries (XLY) , technology (XLK) , the real estate investment trusts (XLRE) and Materials (XLB) , all of which gained at least 4% over the period. Defensive sectors lagged last week for the most part, with staples (XLP) giving up 1.37%.

According to FactSet, the S&P 500 now trades at 17.3-times forward-looking earnings, up from 16.5-times last week. This ratio remains significantly below the S&P 500's five-year average of 18.5-times, and has once again recaptured its 10-year average (17.2). Fourth quarter S&P 500 earnings are now expected to land down 3.9% from the year-ago period on revenue growth of 3.9%. Earnings are also seen in contraction on a year-over-year basis for first quarter and second quarter of 2023.

The Week Ahead

Just a friendly reminder for readers who might run their own businesses or freelance, today (Tuesday, Jan. 17) is your deadline to get your estimated quarterly payments into the IRS and your state tax collector.

For the coming week, traders will have to stay focused on the financials as the big banks kicked off the season. Major names reporting this week include Goldman Sachs (GS) , Morgan Stanley (MS) , United Airlines (UAL) , PNC Financial (PNC) , Discover Financial (DFS) , Kinder Morgan (KMI) , Comerica (CMA) , Procter & Gamble (PG) , Netflix (NFLX) , Ericsson (ERIC) , and SLB (SLB) , which is the former Schlumberger.

Fed speakers will be out in force this week. I am tracking 10 speeches right now over the next four days. The headliner will be Vice Chair Lael Brainard, who is set to speak early Thursday afternoon. Then there will also be the release of the Fed's beige Book on Wednesday afternoon.

As far as the macro goes, there will be a lot to look at in a short period of time. Tuesday brings December retail sales and December industrial production. The housing starts number will land on Thursday, while the December existing home sales will print this Friday.

Concerning surveys, look for the Empire State (New York) Manufacturing Index on Tuesday and the Philly Fed on Thursday. The U.S. Treasury will bring $12 billion worth of 20-year paper to market on Wednesday.

Please remember that Stocks Under $10 is not intended

to provide personalized investment advice. DO NOT EMAIL THE SU10 TEAM SEEKING PERSONALIZED INVESTMENT ADVICE, WHICH HE CANNOT PROVIDE.