Stocks Under $10 Weekly Summary (original) (raw)

The Stock Market Last Week

Last week, U.S. trade tensions expanded past China and potentially the eurozone to include Mexico. Meanwhile, retailer earnings continued to be disappointing and reported economic data reinforced the prevailing narrative of a slowing global economy.

On Friday, China’s manufacturing data for May not only registered in contraction territory but came in weaker than expected, adding to those global growth concerns, while President Trump’s surprise Mexican import tariffs applied yet another of layer uncertainty for investors and the stock market to grapple with.

For the week in full, all the major stock market indices declined, erasing any gains they had on a quarter-to-date basis coming into the shortened trading week.

Over the weekend, China’s retaliatory tariffs kicked in on the $60 billion target list of imported U.S. goods. Ahead of that, on Friday China threatened to unveil an unprecedented hit list of “unreliable” foreign firms, groups and individuals that harm the interests of Chinese companies.

In addition to those tariffs, over the weekend, China released a white paper saying global trade problems were started by the United States, and the U.S. “has been unreliable during talks.” This is looking more and more like that playground drama and finger pointing that we were worried about.

Those developments plus potential tariffs on Mexico, the removal of India from special trade status and potential trade issues with the eurozone has companies from Walmart (WMT) and Costco Wholesale (COST) to Chipotle Mexican Grill (CMG) talking about potentially higher costs. And yes, this is at a time when the latest economic data points to a slowing global and U.S. economy. Exiting May, the Atlanta Fed Now survey pegged current-quarter GDP at 1.2%, while the New York Fed Nowcast is calling for 1.5%. Both forecasts are well below the most recent 3.1% revision for March quarter GDP.

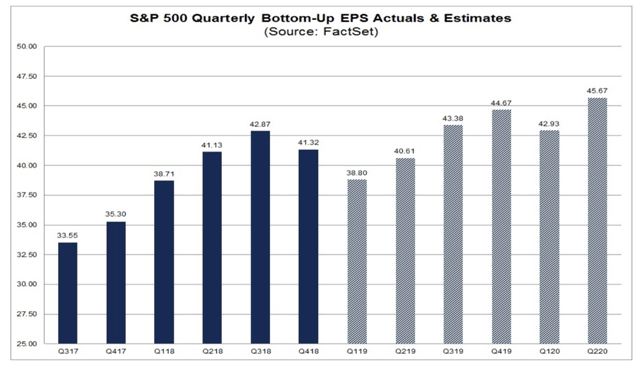

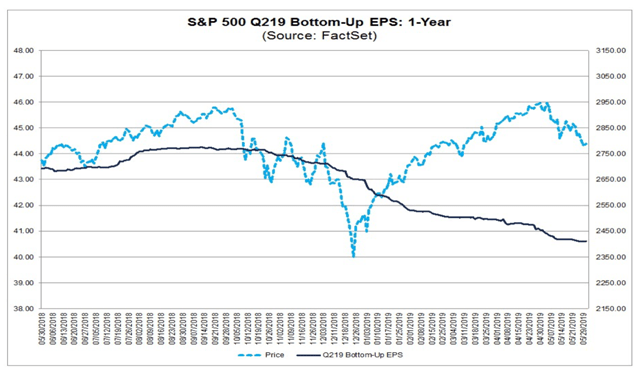

We’ve already seen current quarter EPS estimates for the S&P 500 group of companies fall over the last several weeks, but expectations for the second half of the year are still looking for 11% growth compared to the first half. In our view, these mounting trade and economic concerns have yet to play out on second half expectations, which means they will likely come into greater focus in the coming weeks.

The likely narrative will be tariff-related cost increases that will not only pressure margins and earnings but also stoke inflation as well. Should that come about, it will be a very different story than the one the stock market has been used to and as we know, a change in the expected story is not met with sunshine and candy.

Barring any forward progress on the trade front, given the outlook and increasing uncertainty there is far greater risk, in our opinion, to the downside for those expectations. And while some may hold out hopes for a trade deal at the G20 meeting later this month, both J.P. Morgan and Morgan Stanley say it’s looking likely that there will not be a deal at the summit in Japan this month.

The bottom line is this: We are likely in for a bumpy stock market ride in the coming weeks with the day-to-day movements reflecting the latest trade and tariff comments. In such an environment, we will continue to run the portfolio in a prudent fashion.

The Stocks Under $10 Portfolio Last Week

The heightened trade uncertainty rippled through the portfolio last week, leaving no position untouched. While some names such as Nokia (NOK) and recently added Antares Pharma (ATRS) fared better than the market indices, several holdings, including Pareteum Corp. (TEUM) and Encana Corp. (ECA) , were pounded.

Small-cap stocks in general have been the hardest hit of late as evidenced by the more than 9% drop in the Russell 2000 over the last few weeks through Friday’s market close vs. 6.4%-6.6% declines in the S&P 500 and Dow Jones Industrial Average over the same period.

During the week, we exited our position in KushCo Holdings (KSHB) , and initiated Antares Pharma.

Helping insulate us from the market pressures is our near 50% cash position, which has allowed us to hang onto much of our year-to-date gains in the portfolio. We’ll continue to look for companies whose businesses are defensive, inelastic and U.S.-focused.

The Stock Market This Week

As we enter the final month of the quarter, there are several items coming at us in the next few days even before we get to the usual start-of-the-month economic data and the earnings report stragglers.

In terms of those earnings stragglers, there are just over 120 reports to be had, but from an S&P 500 perspective, only five constituents will be issuing quarterly results next week. The bulk of those reporting will continue to skew toward retail, including Tiffany & Co. (TIF) and GameStop Corp. (GME) , as well as several cloud companies such as Box, Inc. (BOX) and Cloudera, Inc. (CLDR) .

Odds are investors will be paying close attention to results from Salesforce.com, Inc. (CRM) , and we’ll also be watching Guess’, Inc. (GES) and Navistar International Corp. (NAV) .

As we discussed above, China’s manufacturing data report on Friday added to the growing view of a slowing global economy.

This week will bring several pieces of May data that we will assess to determine the velocity tied to that slowing vector. These include the usual monthly PMI reports for China, Japan, the eurozone and the U.S., as well as the May ISM Reports for manufacturing and nonmanufacturing, and several looks at May job creation.

Later this week, we’ll get the April consumer credit report data, and we expect to look through this carefully given our growing concern over this key area. If there is data inside that report which points to climbing consumer debt, we could see further revisions to current quarter GDP expectations.

As we start the week off, the Atlanta Fed Now survey pegs current quarter GDP at 1.2%, while the New York Fed Nowcast is calling for 1.5%. Both forecasts are well below the most recent 3.1% revision for March quarter GDP.

As the number earnings reports dwindles, it will be replaced by a flurry of investor conferences. We will be parsing company comments at these events to determine what, if anything, has changed on the margin and earnings front since they reported their March-quarter results.

The Stocks Under $10 Portfolio

Below is a rundown of our current positions. Figures in parentheses are each stock's Friday closing price and percentage weighting in the model portfolio. (For the most up-to-date portfolio results, please click here.)

As a reminder: -- A “Game Breaker” stock is one that we believe is going to change the landscape of an industry, as Microsoft Corp. (MSFT) and Walmart Inc. (WMT) did in their respective sectors.Investors can make big money in these stocks by getting in before the crowd does.

-- “Inflection Point” stocks have broken business models that are on the mend, but which the market has yet to recognize. Investors who recognize these turnarounds early can pocket strong returns.

-- “Stealth” stocks are often unknown to the general public, but can be hugely profitable investments, especially when they have catalysts to boost their share prices.

-- “One” stocks are those that we would buy at current prices. “Twos” are stocks that we would buy on pullbacks and “Threes” are names that we would sell into strength.

ONES

GSV Capital (GSVC:Nasdaq; 6.29;4.306.29; 4.30%): Shares of this public company that invests in private ones continue fell 3.5% last week as continued stock-market pressure raises questions for the IPO window. GSVC has declined more than 10% over the last few weeks, so we strongly suspect the management team is once again utilizing its buyback program to will help offset near-term declines in its publicly traded holdings. We are watching the IPO market, as successful post-IPO stock price performance could pave the way for other monetization efforts inside of GSV’s investment portfolio. Our price target on GSVC shares remains 6.29;4.3011.

Nokia (NOK:NYSE; 5.05;4.135.05; 4.13%): Shares of this communications-infrastructure and IP-licensing company declined 1.4% last week, outperforming the overall market. We attribute that to competitor Huawei being caught in the U.S.-China trade crosshairs, and the growing negative sentiment for its mobile network and smartphone equipment. We recently nibbled further on NOK given the widespread expectation that 5G deployments from a network and device perspective will accelerate in the coming quarters. We see the 5G market gaining strength in the coming quarters, and that keeps us patient with the shares. Our long-term price target remains 5.05;4.138.50.

TWOS

Antares Pharma (ATRS:Nasdaq; 2.79;1.022.79; 1.02%): Antares is the newest entry to the portfolio after a very short stay in the Bullpen. The company the designs, sells, and licenses needleless pressure-assisted injection devices that patients can administer to themselves. Antares is expected to be profitable by 2020. We have a 2.79;1.024 price target and have identified the $2.50 area as an advantageous spot to add.

AcelRx Pharmaceuticals (ACRX:Nasdaq; 2.59;2.332.59; 2.33%): AcelRx has been moving lower since late April to the point where we think we may have to start being concerned about the stock possibly approaching our 2.59;2.332.31 net basis. There has not been a lot of company-specific news other than a somewhat pitiful, but expected print for first-quarter revenue back in early May. Obviously, in this environment, the broader market is not going to help, nor is the sector. Monday morning there was finally some news that believe should help. The company has announced the closing of a 25millionseniorsecureddebtfacilitywithOxfordFinanceLLC.AcelRxwillusethesefundstofurthertheefforttocommercializetheDSUVIApainmedication.Thisincludesthehiringofhospitalaccountmanagers.Thegoodnewsisthatthisfacilitywillrequiredebt−servicingpaymentsamountingto25 million senior secured debt facility with Oxford Finance LLC. AcelRx will use these funds to further the effort to commercialize the DSUVIA pain medication. This includes the hiring of hospital account managers. The good news is that this facility will require debt-servicing payments amounting to 25millionseniorsecureddebtfacilitywithOxfordFinanceLLC.AcelRxwillusethesefundstofurthertheefforttocommercializetheDSUVIApainmedication.Thisincludesthehiringofhospitalaccountmanagers.Thegoodnewsisthatthisfacilitywillrequiredebt−servicingpaymentsamountingto1.2 million for 2019, which is down from the 4.6millionthattheoldfacilitywouldhaverequired.Westillhaveaa4.6 million that the old facility would have required. We still have a a 4.6millionthattheoldfacilitywouldhaverequired.Westillhaveaa5 price target.

Alkaline Water Co. (WTER:Nasdaq; 1.59;3.261.59; 3.26%): Despite a favorable update showing Alkaline Water continues to expand the reach of its core Alkaline88 product, these shares once again slumped week over week. The recent update showcased the addition of more than 1,100 new convenience stores in Texas and California being added as part of its new relationship with distributor E.A. Berg. To us this is another sign the company continues to execute on its two-pronged growth strategy that centers on geographic and product expansion. This week the company will present at the 9th Annual LD Micro Invitational, to be held on June 4-5 and we suspect its message will reinforce these positive developments. We will remain patient with this U.S.-focused company as the management continues to execute on its strategy. We will look to use the favorable share price relative to our cost basis to add to our position as the overall stock market stabilizes. Our six to 12-month price target is 1.59;3.265.50.

Aurora Cannabis (ACB:NYSE; 7.59;3.417.59; 3.41%): The stock has been under increased pressure for two reasons. One, on Friday FDA Commissioner Ned Sharpless made comments that the agency is still unsure of the safety of CBD for human consumption. Then over the weekend, in Barron's, several Canadian cannabis companies were named in an article that indicated that Colombia could emerge as stiff competition going forward from here due to lower production costs. We are reiterating our 7.59;3.4111 price target. We think it’s a bit early to give up on Aurora, or on Nelson Peltz for that matter. We do have some wiggle room here.

Blue Apron (APRN:NYSE; 0.59;2.150.59; 2.15%): The month of May was a difficult one for our Blue Apron shares, which fell significantly despite the lack of new company-specific news outside of its pending reverse stock split that will allow it to regain compliance with NYSE listing rules. Following the company’s March-quarter results that confirmed a focus on profitability over customer count, we are likely to use the recent pain to our long-term advantage once the reverse stock split takes hold. We have ample room to grow this position, and we’ll look to improve our cost basis should the opportunity present itself. Our price target is 0.59;2.151.50.

Encana Corp. (ECA:NYSE; 5.27;1.025.27; 1.02%): This name sold off hard for a second week in a row last week. Obviously, falling energy prices due to trade conflicts that would exacerbate already slowing economic growth are having an impact across the energy space. The shares are already priced where we would automatically think to add under other circumstances. Instead, we have accepted that we entered this one poorly, and have taken a careful approach toward management in order or to avoid throwing good money after bad. We still have a price target of 5.27;1.029.50, for time being.

Energy Recovery (ERII:Nasdaq; 9.45;1.609.45; 1.60%):The good news would be that this stock has largely traded sideways for more than a week now, even as oil prices have suffered badly. There has been no company-specific news for several weeks now. We think we need to see some kind of confirmation that if need be, the water treatment side of this business can continue to carry the energy side on its back. We remain positive on the name and our target price for the balance of the position stands at 9.45;1.6011.50.

Fitbit Inc. (FIT:Nasdaq; 4.63;2.604.63; 2.60%): This wearables company pulled back more than 5% on renewed U.S.-China trade concerns last week. While we see the company’s portfolio of smartwatches and fitness trackers benefiting from the consumer adoption of healthier lifestyles, the escalating trade environment is likely to weigh on the company’s costs and raise questions over its ability to generate profits. Potentially offsetting that is the company’s Fitbit’s premium subscription service model that should debut later this year. Success of that initiative could alter how Wall Street values FIT shares. Near-term, however, the shares are likely to be range bound. As such we are downgrading them to a Two from One. Our price target of 4.63;2.607 is under review.

LendingClub (LC:NYSE; 3.00;2.603.00; 2.60%): LendingClub’s share price eroded by roughly 3% last week. Despite the share price setback in recent weeks, we see fresh evidence of consumers spending more than they make, which is leading to increasing debt levels that are taking a bit out of disposable income. Later this week, we’ll examine the latest Consumer Credit data for April and what it means for LendingClub’s online lending platform. Our price target on LC shares is 3.00;2.604.50.

Pareteum Corp. (TEUM:Nasdaq; 3.92;4.543.92; 4.54%): This name, even with the recent weakness, remains the portfolio's top performer. There is no change here since we covered the order backlog and the executive level re-shuffling of titles that amounts to not much changing at all, in our view, last week. As a reminder, the company announced 3.92;4.5470 million in deals agreed to in April, and ended the first quarter with a 36-month contractual revenue backlog of 968million;youcanaddthe968 million; you can add the 968million;youcanaddthe70 million to that number. We are comfortable enough to reiterate our Two rating, as well as our price target of $6.25.

USA Technologies (USAT:Nasdaq; 6.71;5.216.71; 5.21%): Last week shares of this mobile payments company fell roughly 6%, but even so its quarter to date increase as of last Friday’s market close was still more than 60%. We think that once USA Technologies has restated its financials, and regained its good listing standing with Nasdaq, investors again will focus on the prospects of the company’s mobile payments business. Our price target remains 6.71;5.2110.

ADDITIONAL INFORMATION

For current insights go to Actions & Analysis.

Don't miss out on the Weekly Roundups.

View the Portfolio

Get the additional market insights with our Bonus Reports.

YOUR ACCOUNT

To manage your account, click here.

GO MOBILE

Get Stocks Under $10 on your smartphone.

For iPhone, click here.

For Android, click here.

Please remember that Stocks Under $10 is not intended to provide personalized investment advice. DO NOT EMAIL THE SU10 TEAM SEEKING PERSONALIZED INVESTMENT ADVICE, WHICH HE CANNOT PROVIDE.