Tuesday's Rally, Island Reversals, 5 Observations, Metaverse, Apple in China (original) (raw)

Rally caps? Or capped rally? On Wednesday morning, European traders sold Tuesday's pop. They sold equities, they sold cryptocurrencies, and they sold commodities. I saw WTI Crude trading with a 103/103/103/104 handle through the wee hours after trading with a 110/110/110/111 handle on Tuesday evening. Capital was, however, flowing back into US Treasuries early this morning. I see the US Ten Year Note paying 3.22% as the creatures of the night go through my garbage cans after yielding as much as 3.3% late Tuesday.

'Twas quite the rally on Tuesday. The S&P 500 gained 2.45%, the Nasdaq Composite 2.51%. Small-caps were hot, but less so... the Russell 2000 gained back 1.7% after last week's obliteration. There was undoubtedly a considerable level of short covering done on Tuesday, as algorithmic traders, sniffing blood in the water, forced something of a squeeze. Profit taking works both ways. mind you.

All 11 S&P sector-select SPDR ETFs gained ground on Tuesday, led by last week's pariah, Energy (XLE) , up 4.01% for the session. Expect a good bit of that run to unwind on Wednesday. Consumer Staples (XLP) , and Technology (XLK) , two sectors not usually thought of as correlated or anything close to it, gained 2.62% and 2.28% for the day. The Semiconductors were a bit hotter than the broader marketplace. The Dow Jones US Semiconductor Index scored a gain of 2.92%, while the Philadelphia Semiconductor Index ran 2.75%, led by fabrication equipment providers Applied Materials (AMAT) and KLA Corp (KLAC) . Those two were up 5.94% and 4.9%, respectively.

As for breadth, winners beat losers by a rough 5 to 2 at the NYSE and by almost 9 to 4 at the Nasdaq Market Site. Advancing volume took a 79.8% share of composite NYSE trade, and 72.3% of the metric for Nasdaq-listed stocks. Aggregate trading volume tailed off on Tuesday from Friday, but this is not an apples to apples comparison as Friday was a "triple witching" expiration event. Aggregate trade across constituent members of both the S&P 500 and Nasdaq Composite was the lightest for any day since last Tuesday, suggesting that not everyone jumped on board Tuesday's rally.

Islands In The Stream

Readers will recall that I have called for a sloppy but potentially upbeat ending to June with twin Jerome Powell appearances before legislative committees set for today (Wednesday) and tomorrow, with the Fed Stress Tests tentatively set for release tomorrow, with the Russell Reconstitution event set for Friday and for the still unknown impact of mandated monthly and quarterly pension fund rebalances next week. After that, markets could resume pricing in the depth and breadth of public pain likely rendered by the current recession (or near-recession, you choose).

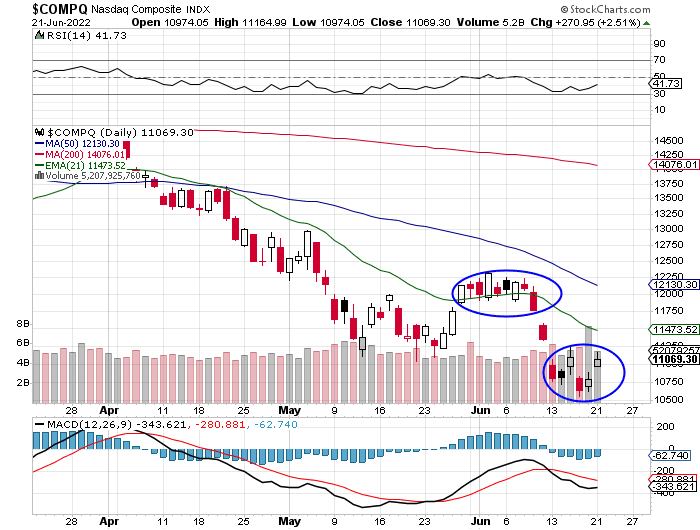

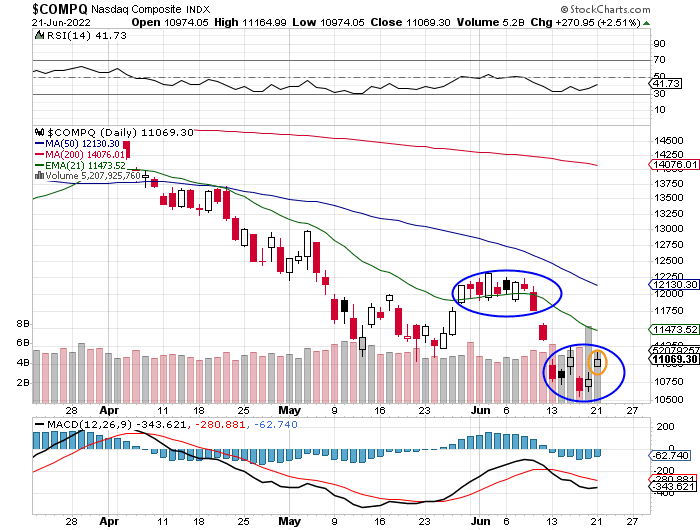

For the short to medium-term, readers will see below, as the Nasdaq Composite has in recent days, experienced a number of gap openings, almost back to back "island reversals"... check this out...

See the gap up on 27 May and the gap down on 10 June? That group of nine candles created what we call a bearish island reversal, and as you can see, it worked quite well. Now, see the gap down on 13 June, that's the start of a sloppy looking island lasting through the present that is or was shaping up like a bullish island reversal. Would have (and still can) signal a market that would make my end of June thesis perform well. Problem?

I am not sure. Of course, island reversals can fly solo, as in containing but one candle. That would be Tuesday (yesterday)...

Tuesday's candle, if equity index futures, which were down sharply this morning, remain lower, will create an island within an island, and in this case, a bearish reversal contained within a potential bullish reversal. Volatility? Yeah, no kidding. Hey, the short covering is over for now.

What Could Have Happened?

Well, a number of things were said, a number of conditions changed since Tuesday's rally. Actually, you probably noticed that the selling actually began with about 45 minutes left in the regular session on Tuesday...

Speaking from the Roosevelt Room in the West Wing of The White House on Tuesday afternoon, President Biden said..."We need more money to plan for the second pandemic. There's going to be another pandemic. We have to think ahead." Absolutely terrifying. Have I mentioned that keyword reading algorithms launch in microseconds because milliseconds are too slow?

Billionaire hedge fund investor Ray Dalio, in a LinkedIn post, wrote... that he believes that it "is both naive and inconsistent with how the economic machine works" (to think that the central bank) "will make things good again once it gets inflation under control." Dalio later adds, "The only way to raise living standards over the long term is to raise productivity and central banks don't do that." I don't always agree with everything Dalio says. On this, he's correct.

Speaking during a webinar hosted by the National Association for Business Economics, Richmond Fed Pres. Tom Barkin said... "We are in a situation where inflation is high, it's broad based, it's persistent, and rates are still well below normal. The spirit is, you want to get back to where you want to go as fast as you can without breaking anything." Well, no spit, Sherlock. Thank you, Captain Obvious. Barkin speaks again later today.

On Tuesday, Bloomberg News ran a story penned by Matthew Boyle citing the recent erosion of labor market health in the US. Boyle reminds us that both Amazon (AMZN) and Walmart (WMT) , the nation's two largest private employers, have recently announced a "thinning" of the herd through attrition, as initial jobless claims have started to move higher on a four week moving average. Boyle also notes that according to the job market website "Indeed", job postings have slowed of late, across several industries.

Geopolitical tensions rose across the Baltic region. In response to Lithuania having announced that it would block the transit of sanctioned goods to the Soviet, I mean isolated Russian province of Kaliningrad, Nikolai Patrushev, Secretary of Russia's Security Council, said that Russia "will certainly respond to such hostile actions. Their consequences will have a serious negative impact on the population of Lithuania." Lithuania is both a member of the EU and NATO. Separately, Estonia, also a member of both the EU and NATO, and in the same neighborhood, accused Russia of simulating missile attacks against that nation, while stating that a Russian border patrol helicopter flew into Estonian air space on June 18th.

Russia, for their part, has announced that part of its Baltic Fleet will shortly carry out "large scale" naval maneuvers in the Gulf of Finland that will include mine-laying, live gunfire, and anti-submarine drills. NATO is scheduled to hold a summit next week in Madrid.

So, We're Going With Metaverse?

Because some of you were calling it the Omniverse.

On Tuesday, the formation of a new group was announced... The Metaverse Standards Forum, where the hope is to establish standards to be used broadly by most or all participants. The internet of tomorrow (or maybe a little further out than that) will be an immersive 3-D virtual world of augmented and/or virtual realities, internet economies, gaming on the next level, and interacting avatars. Man, am I glad I grew up back when you had to look folks in the eye, make a quick assessment and shake hands.

Founding members of the new group include Meta Platforms (META) , Microsoft (MSFT) , Nvidia (NVDA) , Unity Software (U) , Adobe (ADBE) , Alibaba (BABA) , Autodesk (ADSK) , Qualcomm (QCOM) , Sony (SONY) , and Wayfair (W) . A quite notable exception from the group was Roblox (RBLX) . The Forum will meet for the first time in July.

"Red" Delicious

UBS analyst David Vogt pointed out that Apple (AAPL) iPhone shipments significantly outperformed in China in May, gaining market share. Like we all didn't see that one coming. Vogt, rated at four stars at TipRanks, has a "buy" rating on the stock with a $185 target price.

Economics (All Times Eastern)

07:00 - MBA Mortgage Applications (Weekly): Last +6.6%.

08:55 - Redbook (Weekly): Last 11.4% y/y.

13:00 - Twenty Year Bond Auction: $14B.

16:30 - API Oil Inventories (Weekly): Last +736K.

The Fed (All Times Eastern)

09:30 - Speaker: Federal Reserve Chair Jerome Powell.

12:50 - Speaker: Chicago Fed Pres. Charles Evans.

13:30 - Speaker: Philadelphia Fed Pres. Patrick Harker.

13:30 - Speaker: Richmond Fed Pres. Tom Barkin.

Today's Earnings Highlights (Consensus EPS Expectations)

Before the Open: (KFY) (1.55)

After the Close: (FUL) (1.07), (KBH) (2.03), (WOR) (.83)

(XLE, AMAT, AMZN, MSFT, NVDA, and AAPL are holdings in the Action Alerts PLUS member club. Want to be alerted before AAP buys or sells these stocks? Learn more now.)

At the time of publication, Stephen Guilfoyle was Long MSFT, NVDA, AAPL equity.