Watching Nonfarm Payrolls, Trading Roku, Negative Yields (original) (raw)

Up Year-To-Date

Really incredible. The Nasdaq Composite closed Thursday up (ever so slightly) for 2020. There was some afternoon market weakness to be dealt with once again, for a third session in a row, but this time it was different. Broader equity markets peaked around midday and experienced a bit of price erosion as the second half of the regular session wore on, while the tech heavy Nasdaq Composite actually rallied over the final twenty minutes or so into the closing bell. Market internals were rather strong, which I found refreshing ahead of Friday's April employment numbers -- broadly expected to be awful.

With nine of eleven sectors showing positive results for the day, there was still some of the same leadership that we have seen throughout this now six-week rebound in equity pricing. Those names well built to survive -- or even excel -- in an ailing, socially distanced world, have performed. Software, semiconductors, internet types and biotechs have led the Nasdaq higher, but now certain industries far more dependent upon reopening the economy have been stirring. Obviously energy has remained volatile, but in a positive way, as consumption at this point has but one way to go. How the removal of Patriot batteries, as well as jet fighters, by the U.S. military from Saudi Arabian soil impacts these markets remains unknown.

As for trading volume, which is something I look at often, the pace of transaction increased on Thursday from Wednesday at both the New York Stock Exchange and the Nasdaq Market Site, while also increasing across constituent membership for both the S&P 500 and the Nasdaq Composite. Advancing volume beat declining volume as winners beat losers at both of our primary equity exchanges. The most truly notable market action that we saw on Thursday may have happened away from the equity space, however. Let's take a look at that.

That Was Quick

After witnessing yields for U.S. Treasury securities increase for most of the week, as much of the talk around this space had been centered around the sheer size of necessary borrowing that must be taken on by the department in the short term and Treasury's plan to push out average net maturity going forward.

Well, demand was back for U.S. paper on Thursday, big time. Not only did the 10-year note shave nearly 10 basis points off Wednesday's highest yields, the two-year and five-year notes both saw yields reach record lows on Thursday. This happened in response to the awful macro, which in turn creates the perception that the Fed will have to provide easy money and more of it... forever? Maybe. Fed Funds futures dated with expiration dates out into 2021 were quoted at prices on Thursday that implied negative overnight interest rates. We know that the Fed, and especially Chair Jerome Powell, have in the past not looked favorably on the idea of negative interest rates (nor do I), making this very interesting. Will Friday's number have increased impact upon this market? Very possible. In fact, likely.

About Jobs

Yes, the unemployment rate is expected to print in the neighborhood of 16% for April. The number runs with a lag, making real-time assessment very difficult. We already know that millions more have lost their jobs since the mid-April surveys. We also know that others have seen their hours reduced, while still others have already been called back to work as parts of the economy attempt to reopen.

Personally, I think perhaps such standard data as wage "growth" and average work week may be nearly impossible to figure this month. The focus will have to be on the participation rate and the underemployment rate, as these data-points may offer information on just how many small businesses are trying to keep people on board even at reduced workloads, while offering perhaps a glimpse of just how many folks have still had a difficult time in filing for claims at a time where actively looking for work had become impossible through government mandate.

Overnight

Equity index futures received an overnight boost as the call that we expected to happen next week between U.S. and Chinese trade representatives actually happened last night / this morning, depending on where you are while reading this. There is not much detail to report. What we do have has been reported by Chinese news agency Xinhua. What we read is that in a call that involved -- at a minimum -- U.S. Trade Representative Robert Lighthizer, U.S. Treasury Secretary Steven Mnuchin, and Chinese Vice Premier Liu He, the two nations pledged to improve economic and public health cooperation, while creating a favorable environment toward implementing the phase one trade agreement signed back in January. A lot to go on? Of course not. Better than hostility? Yes.

Something To Monitor

I think the news that shook me the most, as a trader, on Thursday was that a Naval valet working in the White House for the president and for the first family had tested positive for this coronavirus after showing symptoms. Both the president as well as the vice president have been tested since, and have continued to test negative. Nothing more needs to be said. Let's hope for a best outcome for that individual and that there is no further spread there -- or anywhere else, for that matter.

A Definite Maybe

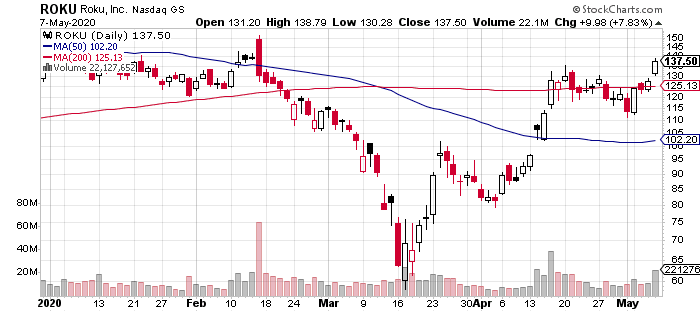

Long-time followers already know how many times I have been in and out of Roku (ROKU) . I have been out of the name for quite some time, for whatever that is worth. Interestingly, the shares ran up nearly 8% on Thursday ahead of Q1 earnings. Just as interestingly, these shares gave back all of that and more in after hours trading after the numbers had been posted.

It's not as if Roku had a poor quarter. Quite the contrary. EPS hit the tape at -$0.45, which hit consensus on the button, Revenue exploded to 321million,growthofmorethan55321 million, growth of more than 55%, and a nice beat at that. The firm performed well across the metrics that need to perform well for a growth stock in this environment. Streaming hours soared 49% to 13.2 billion, Average revenue per user increased 28% to 321million,growthofmorethan5524.35. The firm acknowledged that there had been accelerated activation as well as in hours viewed -- as orders to shelter at home had been implemented across the nation, as well as the planet. I do not believe this growth completely unwinds, even if we all live normally some day in the future.

There are two negatives, I mean aside from increased operating expenses that pressured the firm's headline operating loss. One, due to the uncertainty created around the pandemic, the firm will not provide guidance for the current quarter or for the full year. Two, and this might be one of the root causes for this uncertainty, the instability of the platform advertising business. Roku reports that advertising campaigns had been cancelled by clients that serve the travel, fast food, and entertainment industries. Even though the loss of these campaigns had been offset by increased advertisement provided by other types of businesses as the economy changed on a dime, such activity would certainly be unpredictable moving forward. Understandable.

My Thoughts

Do I need some Roku on my book? No. Do I believe that Roku has a business that will thrive moving forward as an aggregator of all of the streaming services now available -- such as Netflix (NFLX) , Disney + (DIS) , Hulu, Amazon (AMZN) Prime and others? I do. I also still have an elevated cash position, and it is the very reason that this position had been created in the first place... Well okay, the first place was preservation of capital. That said, the second place was to create the flexibility that I might need to go shopping when interesting names go on sale, without having to rob other existing positions in order to do so.

The 200-day simple moving average of $125.13 looks interesting to me. Perhaps a very small entry just about at that spot in case it holds, for a trade. Should the spot break, maybe a little more for an investment. Not enough to hurt, keep that in mind. This is still a money losing operating that cannot effectively predict where it is going. Catch you all down the road, gang. God bless.

April Employment Situation (08:30 a.m. ET)

Nonfarm Payrolls:Expecting -21M, Last -701K.

Average Hourly Earnings:Expecting 3.2% y/y, Last 3.1% y/y.

Average Workweek:Expecting 33.8, Last 34.2 hours.

Unemployment Rate:Expecting 16.1%, Last 4.4%.

Underemployment Rate:Last 8.7%.

Participation Rate:Expecting 61.9%, Last 62.7%.

Other Economics (All Times Eastern)

10:00 - Wholesale Inventories (Mar-F):Flashed -1.0% m/m.

13:00 - Baker Hughes Oil Rig Count (Weekly):Last 325.

The Fed (All Times Eastern)

No public appearances scheduled.

Today's Earnings Highlights (Consensus EPS Expectations)

Before the Open: (LEA) (1.33), (VTR) (0.89)

At the time of publication, Guilfoyle was long AMZN, and DIS equity.