Will AMD's New AI-Capable Processors Break Nvidia's Domination? How to Trade It (original) (raw)

On Wednesday, higher-end semiconductor designer Advanced Micro Devices (AMD) held a launch event for its new AI-capable processors. The firm now sees the total addressable market for AI processors reaching as much as 400Bby2027,upsignificantlyfromapreviousestimateof400B by 2027, up significantly from a previous estimate of 400Bby2027,upsignificantlyfromapreviousestimateof150B. So, it came to pass. AMD had promised generative AI-capable chips by year's end and here they are.

The question remains... Will these new products or any others manage to break Nvidia's (NVDA) near-complete domination of the space to date?

Instinct

AMD rolled out the new Instinct MI300X accelerator and the new Instinct MI300A accelerated processing unit. These products will work to train and run LLMs (Large Language Models). The MI300X comes with a 1.5 times memory capacity upgrade from the older M1250X unit.

AMD CEO Lisa Su, who is a long-time Sarge-fave and quite frankly one of the most effective CEO anywhere in the tech space, during her presentation said that the MI300X "is the highest performing processor in the world" and in reference to Nvidia's H100 called the AMD competitor the "most advanced accelerator in the industry."

According to Su, the MI300X is comparable to the H100 in the training of Large Language Models, but performs better on inference, supposedly 1.4 times better when working with Meta Platform's (META) Llama 2 (a well known 70B parameter LLM). Kevin Scott, who is Chief Technology Officer at Microsoft (MSFT) , made a guest appearance during Su's presentation to announce the launch of the Azure ND MI300X virtual machine (revealed last month), which is available now for preview.

The MI300A is meant for data center use. That total addressable market is now estimated to potentially grow to $45B. Meta Platforms has already announced plans to deploy these processors for use in its data centers. This product is an APU, which combines the best of GPUs and CPUs resulting in a faster process. The MI300A is 30 times more energy efficient than its predecessor and according to AMD, has 1.6 times the memory capacity of Nvidia's H100.

Ryzen

Though the Instinct MI300 series releases made the headlines, AMD also announced the launch of the next generation Ryzen processor, the Ryzen 8040. The firm claims that the Ryzen 8040 will not be limited to AI processing, though it will allow for more native AI type functions in mobile devices and will offer 1.6 times the AI processing capability than the previous Ryzen model. The firm also claims with the use of this chip, video editing will be 65% faster, while gaming speed will improve by 77%, making it faster than Intel's (INTC) lateral offering. AMD has deals in place with IBM (IBM) , Dell (DELL) , Acer, Asus, HP (HPQ) , Lenovo (LNVGY) and Razer. PCs with Ryzen 8040 processors should be available for retail during Q1 2024.

On China

According to the Financial Times, Su acknowledged that her company's $400B estimate for addressable market size for high-end AI processors by 2027 was factored in the US government restrictions on exports to China. Lisa said that her firm "spends a lot of time with the administration (President Biden's Commerce Department). Su commented, "We understand for the most advanced chips (restrictions) are important for us to have - from a national security standpoint." Su said that her firm is "seeking a balance."

Wall Street

The new hardware was more or less well-received by the community of sell-side analysts. I have come across 12 sell-side analysts that are both rated at a minimum of four stars at TipRanks and have opined on AMD since this presentation. Across the 12, there are nine "buy" or buy-equivalent ratings and three "hold" or hold-equivalent ratings. After allowing for changes, we have one "buy" and one "hold' that have not set target prices, leaving us with 10 targets to work with.

The average target price across the remaining 10 analysts is 133.70withahighof133.70 with a high of 133.70withahighof158 (Christian Schwab of Craig-Hallum) and a low of 110(RossSeymoreofDeutscheBank).Onceomittingthesetwoaspossibleoutliers,theaveragetargetacrosstheothereightdropsjustafewpenniesto110 (Ross Seymore of Deutsche Bank). Once omitting these two as possible outliers, the average target across the other eight drops just a few pennies to 110(RossSeymoreofDeutscheBank).Onceomittingthesetwoaspossibleoutliers,theaveragetargetacrosstheothereightdropsjustafewpenniesto133.63. The average buy target came to 136.50andtheaverageofjusttwoholdscameto136.50 and the average of just two holds came to 136.50andtheaverageofjusttwoholdscameto122.50.

My Thoughts

I am guessing that it's quite apparent that I am a fan of both AMD and Nvidia as well as a fan of both Lisa Su and Jensen Huang. These two CEOs and the stocks of these two companies have made for me and many others, sizable (in percentage terms) gains in recent years that have permitted us to camouflage investing mistakes made elsewhere. It becomes very difficult to remain unbiased and objective when it comes to those who, while I don't "know" them, have done something for me.

That said, I have taken profits in both names and while still long, both positions are well below peak size. NVDA has been trading in sideways-moving $110 range since June. That stock is easily tradable. AMD, on the other hand, has not gone back and forth in the way that a child colors neatly within the lines. Let's take a look at the charts.

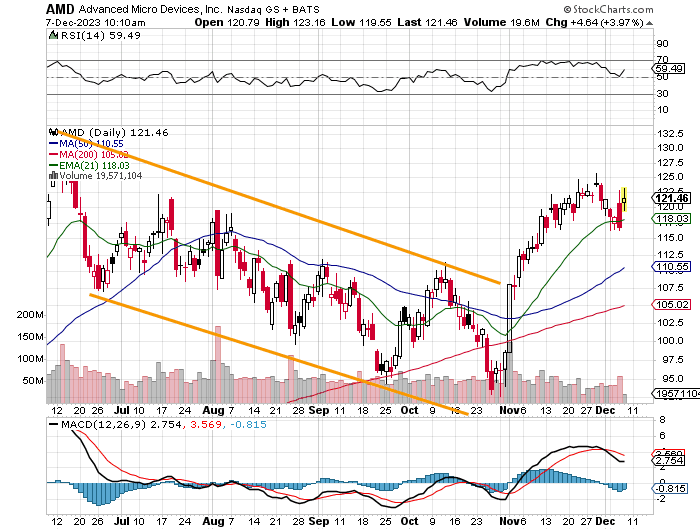

This is the most recent chart (extended into the present) that I've shared with you. It shows the breakout from what I saw at the time as a descending price channel in early November, but also shows a recent rounding as the daily MACD (moving average convergence divergence) has sent a bearish message.

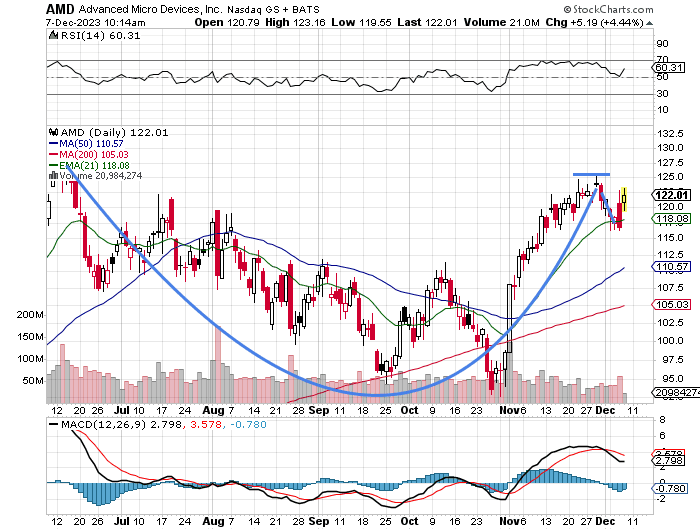

What if that wasn't a price channel at all, but instead the early stages of a cup pattern that has now added a handle?

Suddenly, we're not talking about a 107pivot.Suddenlythatpivotstandsat107 pivot. Suddenly that pivot stands at 107pivot.Suddenlythatpivotstandsat125. Suddenly, we're talking about a $150 target price, technically. What could go wrong? That's simple. If the economy goes into recession, is Lisa Su's addressable market size realistic? Won't there be a downsizing of corporate capital spending? What if Europe and parts of Asia go into a deeper recession than the US? Will that send the US Dollar to levels that would damage cross-border sales in nominal, unadjusted dollars?

I'm still long. I'll probably add if I get another crack at that 21 day EMA (exponential moving average), definitely at that 50 day SMA (simple moving average). That said, I am going to have to shave that target price, because I do believe that the US economy is going to struggle more than many of my colleagues do. My target price is now $143.

(Microsoft is a holding in the Action Alerts PLUS member club. Want to be alerted before AAP buys or sells MSFT? Learn more now.)

At the time of publication, Stephen Guilfoyle was long AMD, NVDA, MSFT equity.