Marketing tactics discouraging price search: Deception and competition (original) (raw)

Abstract

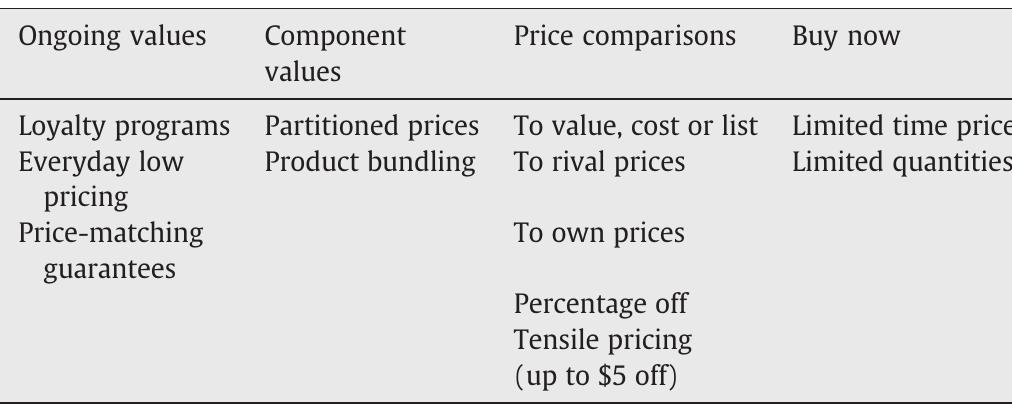

Retailers attempt to assure consumers that their deals are bargains using a variety of marketing tactics. Because consumers continue information and price searches until satisfied with the amount of the information to make a purchase, such bargain assurances (BAs) can change consumers' shopping behavior. This article identifies twelve common BAs and reviews extant marketing literature to derive evidence of how BAs affect consumers' purchasing behavior. It then examines how these practices are regulated to prevent consumer deception or a reduction in competition. This article concludes by offering three policy recommendations: BAs influence consumers and require regulation; the regulation of BAs demands a comprehensive rather than a piecemeal approach; and consumer policy should facilitate and encourage accurate price comparisons.

FAQs

AI

What impact do bargain assurances have on consumer price search behavior?add

The research indicates that bargain assurances may mislead consumers into prematurely terminating their price search, reducing the overall level of competition. Specifically, these tactics can lead to a 30% decrease in consumer price sensitivity according to recent marketing studies.

How do loyalty programs influence consumer purchasing and brand loyalty?add

Loyalty programs increase consumer purchasing by approximately 15% annually when combined with other marketing tactics, according to a study on their long-term effectiveness. They also enhance brand loyalty directly in high-involvement situations, influencing consumer choice across industries.

What regulatory challenges arise from advertising every day low pricing (EDLP)?add

EDLP strategies face scrutiny, with Ohio being the only state regulating such claims by enforcing accuracy in discount characterizations. Despite this, many EDLP claims are often considered puffery by law enforcement agencies, making regulation complex.

How do comparative price advertising strategies affect consumer perceptions of value?add

Comparative price advertisements elevate consumers' internal reference prices, significantly increasing their perceived value of the offering by over 20%. This effect occurs even if the advertised comparisons are misleading, thereby complicating consumer decision-making.

What are the antitrust implications of bundling products at discounted prices?add

Bundling practices can restrict market competition, as demonstrated by the Microsoft case, where bundled products diminished rival sales incentives. Regulatory agencies, including the FTC, often view pure bundling as potentially anti-competitive unless transparently managed.

Figures (1)

Bargain assurances.

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

References (73)

- Anderson ET, Simester DI. The role of sale signs. Mark Sci 1998;17(2):139-55.

- Anderson ET, Simester DI. Are sale signs less effective when more products have them? Mark Sci 2001;20(2):121-42.

- Anderson ET, Simester DI. Mind your pricing cues. Harvard Bus Rev 2003(September) 1-8.

- B. Sanfield, Inc. v. Finlay Fine Jewelry Corp. (1999), 168 F.3d 967 (7th Cir.). Barry v. Arrow Pontiac, Inc. (1985), 100 N.J. 57.

- Bell DE, Feiner JM. Wal-Mart Neighborhood Markets 2002. Harvard Business School Case # 9-503-034.

- Bell DR, Lattin JM. Shopping behavior and consumer preference for store price format: why "large basket" shoppers prefer EDLP. Mark Sci 1998;17(1):66-88.

- Better Business Bureau (2003), "BBB Code of Advertising" available at www.bbb.org/ membership/codeofad.asp, visited November 3, 2007.

- Blair EA, Landon Jr EL. The effects of reference prices in retail advertisements. J Mark 1981;45(Spring):61-9.

- Caldor, Inv. v. Heslin (1990), 215 Conn. 590.

- Compeau LD, Grewal D. Comparative price advertising: an integrative review. Journal of Public Policy & Marketing 1998;17(Fall):257-73.

- Compeau LD, Lindsey-Mullikin J, Grewal D, Petty R. An analysis of consumers' interpretations of the semantic phrases found in reference price advertisements. J Consum Affairs 2003;38(Summer):178-87.

- Cooke, Perkiss and Liehe, Inc. v. Northern California Collection Service, Inc. (1990), 911 F.2d 242 (9th Cir.).

- Coral Telecom, Inc. (2003), NAD Case # 4003 (Jan. 22).

- Dade C. KB Toys offer unexpected discounts. Boston Sunday Globe. October 12. B3.

- Dhar SK, Gonzalez-Vallejo C, Soman D. Modeling the effects of advertised price claims: tensile precise claims? Mark Sci 1999;18(2):154-77.

- Eldin A. Do guaranteed low price policies guarantee high prices, and can antitrust rise to the challenge? Harv Law Rev 1997;111(2):528-75.

- FTC v. Mary Carter Paint Co., (1965), 382 U.S. 46. Gateway, Inc. (2003), NAD Case # 4025 (March 13). Giant Carpet Stores of American Inc v. Retail Kane Carpet, Inc., (1991), New Jersey Super Ct, Bergen Cty, No.C-494-91E, (Nov. 19), reported in Antitrust & Trade Regulation Reports (BNA) 61(Dec. 12), 710.

- Grewal D, Compeau LD. Comparative price advertising: informative or deceptive? J Public Policy Mark 1992;11(Spring):52-62.

- Grewal D, Kavanoor S, Fern EF, Costley C, Barnes J. Comparative versus noncomparative advertising: a meta-analysis. J Mark 1997;61(4):1-15.

- Grewal D, Krishnan R, Lindsey-Mullikin J. Building store loyalty through service strategies. J Relatsh Mark 2008;7(4):341.

- Grewal D, Monroe KB, Krishnan R. The effects of price-comparison advertising on buyers' perceptions of acquisition value, transaction value, and behavioral inten- tions. J Mark 1998;62(April):46-59.

- Hartigan v. Stianos (1985), 475

- N.E.2d 1024 (Ill. App. Ct.).

- Heil OP, Langvardt AW. The interface between competitive market signaling and antitrust law. J Mark 1994;58(July):81-96.

- Hess JD, Gerstner E. Price-matching policies: an empirical case. Manage. Decis. Econ. 1991;12(August):305-15.

- Hoch SJ, Dreze X, Purk ME. EDLP, hi-lo, and margin arithmetic. J Mark 1994;58 (October):16-27.

- The Home Depot (2005), NAD Case # 4342 (June 9).

- Inman JJ, Peter AC, Raghubir P. Framing the deal: the role of restrictions in accentuating deal value. J Consum Res 1997;24(June):68-77.

- Inman JJ, McAlister L, Hoyer WD. Promotion signal: proxy for a price cut? J Consum Res 1990;17(1):74-82.

- Jain S, Srivastava J. An experimental and theoretical analysis of price-matching refund policies. J Mark Res 2000;37(August):351-62.

- J.C. Penney Co. (1999), NAD Case # 3564 (July 1).

- Johnson EJ, Payne JW, Bettman JR. Information displays and preference reversals. Org. Behav. Human Decis. Process 1988;42(1):1-21.

- Joseph Mill Trading (1966), 70

- F.T.C. 1064.

- Kaufman P, Ortmeyer GK, Smith NC. Deception in retailer high-low pricing: a "rule of reason" approach. Journal of Retailing 1994;2(70):115-38.

- Kim BD, Shi M, Srinivasan K. Reward programs and tacit collusion. Mark Sci 2001;20(2):99-120.

- Kivetz R, Simonson I. Earning the right to indulge: effort as a determinant of customer preferences toward frequency program rewards. J Mark Res 2002;39(May):155-70.

- Kmart Corp. (2001), NAD Case # 3775 (June 4).

- Komensky AM, Wegener MD. When is a sale not a sale? State regulation of price comparison advertising. Antitrust 1991(Summer):28-33.

- Kopalle P, Lindsey-Mullikin J. The impact of external reference price on consumer price expectation. J Retail 2003;79:225-36.

- Kroger Co. (1981), 98 F.T.C. 639, ordered modified, 100 F.T.C. 573 (1982).

- Lal R, Rao R. Supermarket competition: the case of every day low pricing. Mark Sci 1997;16(1):60-80.

- Lewis M. The influence of loyalty programs and short-term promotions on customer retention. J Mark Res 2004;3(41):281-92.

- Lichentstein DR, Burton S, Karson EJ. The effect of semantic cues on consumer perceptions of reference price ads. J Consum Res 1991;18(December):380-91.

- Lower Main Street Merchants Ass'n v. Paul Geller & Co. (1961), 67 N.J. Super 514. Market Development (1980), 95 FTC 100. Menard, Inc. (2003), NAD Case # 4017 (Feb. 24).

- Mobley MF, Bearden WO, Teel JE. An investigation of individual responses to tensile price claims. J Consum Res 1988;15(September):273-9.

- Morwitz VG, Greenleaf EA, Johnson EJ. Divide and prosper: consumers' reactions to partitioned prices. J Mark Res 1998;35(November):453-63.

- NBTY, Inc. (2005), NAD Case # 4370 (Aug. 1).

- New York State Attorney General. GM makes restitution for deceptive rebate program. September 25, 2002, available at www.oag.state.ny.us/press/2002/sep/sep25c\_02\. html. New York State Attorney General. Clothing Chair settles misleading ad inquiry. September 14, 2004, available at www.oag.state.ny.us/press/2002/sep/sep25c\_02\. html. New York State Attorney General. Major department store chain agrees to end fake sales. January 24, 2005, available at www.oag.state.ny.us/press/2005/jan/ jan24a_05.html.

- Pechmann C. Do consumers overgeneralize one-sided comparative price claims, and are more stringent regulations needed? J Mark Res 1996;33(May):150-62.

- People v. Federated Dep't Stores, Inc. (1970), 315 N.Y.S.2d 440.

- Petty RD, Lindsey-Mullikin J. The regulation of practices that promote brand interest: a 3Cs guide for brand managers. J Prod Brand Manag 2006;15(1):23-36.

- Petty RD. The impact of advertising law on business and public policy. Westport CT: Quorum Books; 1992.

- Pitofsky R. Beyond Nader: consumer protection and the regulation of advertising. Harv BusLaw Rev 1977;90(4):661-701.

- F.T.C. 344.

- Reichheld FF, Sasser Jr EW. Zero defections: quality comes to service. Harv Bus Rev 1990;5(68):105-12.

- Roehm ML, Pullins EB, Roehm Jr HA. Designing loyalty-building programs for packaged goods brands. J Mark Res 2002;39(May):202-13.

- F.T.C. 762.

- Salop SC. Practices that (credibly) facilitate oligopoly co-ordination in new develop- ments in the analysis of market structure. Cambridge: MIT Press; 1986. Schnall v. Hertz Corp. (2000), 78 Cal. App.4th 1144. Simmonds Upholstery Co. (1953), 49

- F.T.C. 1508.

- Soman D, Gourville JT. Transaction decoupling: how price bundling affects the decision to consume. J Mark Res 2001;38(February):30-44.

- Srivastava J, Lurie N. A consumer perspective on price-matching refund policies: effect on price perceptions and search behavior. J Consum Res 2001;28(September):296-307.

- Stremersch S, Tellis GJ. Strategic bundling of products and prices: a new synthesis for marketing. J Mark 2002;66(January):55-72.

- Tops Markets, LLC (2004), NAD Case # 4245 (Oct. 21).

- U-Haul Int'l, Inc. v. Jartran, Inc. (1984), 601 F. Supp. 1140 (D. Arizona). USB Warburg. Supermarket pricing survey. July 25, 2002.

- Urbany JE, Bearden WO, Weilbaker DC. The effects of plausible and exaggerated reference prices on consumers' perceptions and price search. J Consum Res 1988;15 (June):95-110.

- Wal-Mart v. American Drugs, et al. Supreme Court of Arkansas, No. E-92-1158. Antitrust Trade Reg Report 1995;68(Jan. 26):109-19.

- Wal-Mart Stores, Inc., (1994), NARB Report 77, (April 20). Wal-Mart.com, Inc. (2002), NAD Case # 3987 (Dec. 3).

- Winn-Dixie Stores, Inc. (1996), Report of NARD Panel # 90, (Sept. 26).

- Yadav MS. How buyers evaluate product bundles: a model of anchoring and adjustment. J Consum Res 1994;21(September):342-53.

- Yadav MS, Monroe KB. How buyers perceive savings in a bundle price: an examination of a bundle's transaction value. J Mark Res 1993;30(August):350-8.

- Yi Y, Jeon Hoseong. Effects of loyalty programs on value perception, program loyalty, and brand loyalty. J Acad Mark Sci 2003;31(3):229-40.

- Zale Corp. (2000), NAD Case # 3697 (Sept. 1).